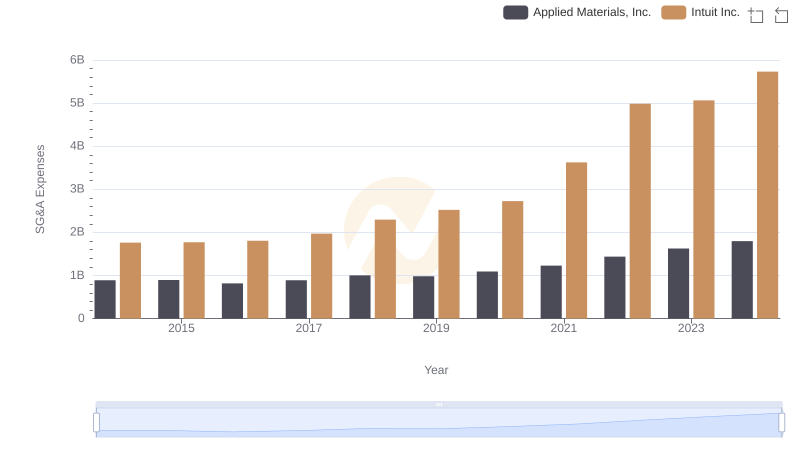

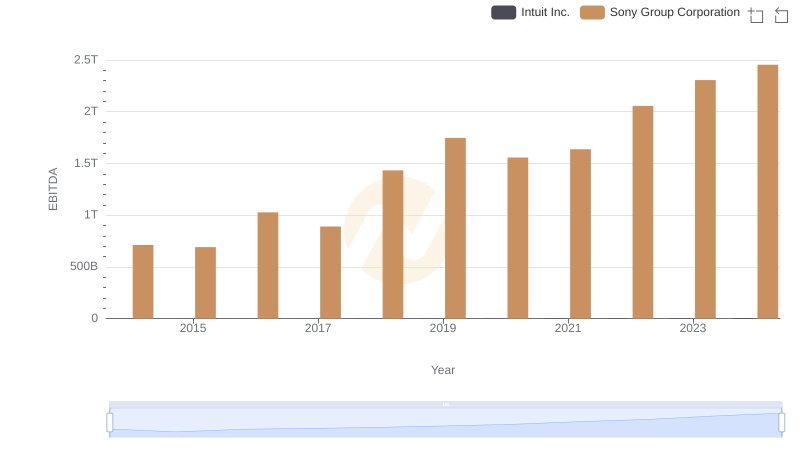

| __timestamp | Intuit Inc. | Sony Group Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1762000000 | 1728520000000 |

| Thursday, January 1, 2015 | 1771000000 | 1811461000000 |

| Friday, January 1, 2016 | 1807000000 | 1691930000000 |

| Sunday, January 1, 2017 | 1973000000 | 1505956000000 |

| Monday, January 1, 2018 | 2298000000 | 1583197000000 |

| Tuesday, January 1, 2019 | 2524000000 | 1576825000000 |

| Wednesday, January 1, 2020 | 2727000000 | 1502625000000 |

| Friday, January 1, 2021 | 3626000000 | 1469955000000 |

| Saturday, January 1, 2022 | 4986000000 | 1588473000000 |

| Sunday, January 1, 2023 | 5062000000 | 1969170000000 |

| Monday, January 1, 2024 | 5730000000 | 2156156000000 |

Data in motion

In the competitive world of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. This analysis compares Intuit Inc. and Sony Group Corporation from 2014 to 2024, revealing intriguing insights into their cost optimization strategies.

Intuit Inc. has seen a consistent increase in SG&A expenses, rising from approximately $1.8 billion in 2014 to $5.7 billion in 2024. This represents a growth of over 200%, reflecting Intuit's expansion and investment in operational capabilities.

Sony's SG&A expenses, on the other hand, are on a different scale, starting at $1.7 trillion in 2014 and reaching $2.2 trillion in 2024. Despite the massive figures, Sony's expenses have grown by only about 25%, indicating a more stable cost management approach.

While Intuit's expenses have surged, Sony's more modest increase suggests a more optimized approach to managing SG&A costs.

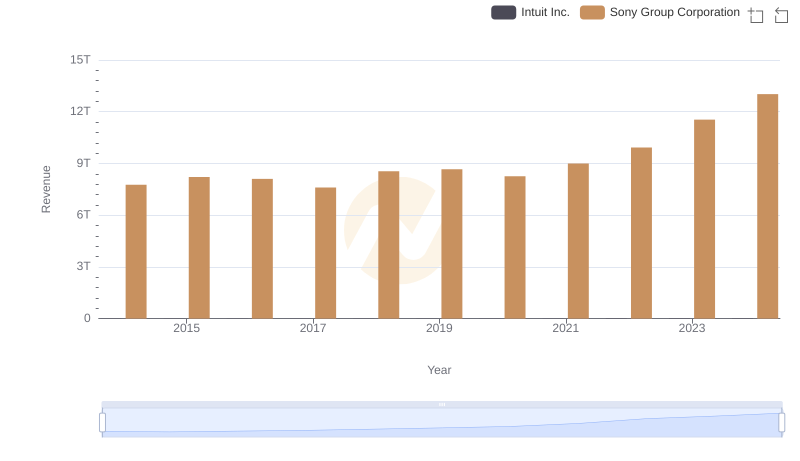

Annual Revenue Comparison: Intuit Inc. vs Sony Group Corporation

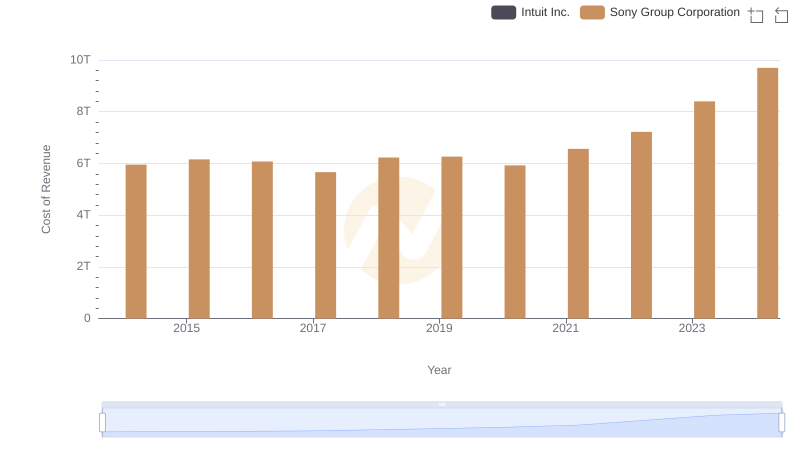

Cost of Revenue Trends: Intuit Inc. vs Sony Group Corporation

Intuit Inc. and Applied Materials, Inc.: SG&A Spending Patterns Compared

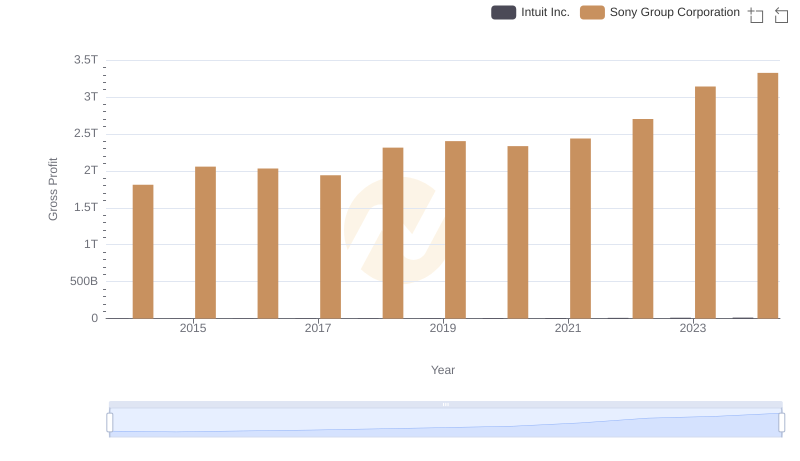

Gross Profit Analysis: Comparing Intuit Inc. and Sony Group Corporation

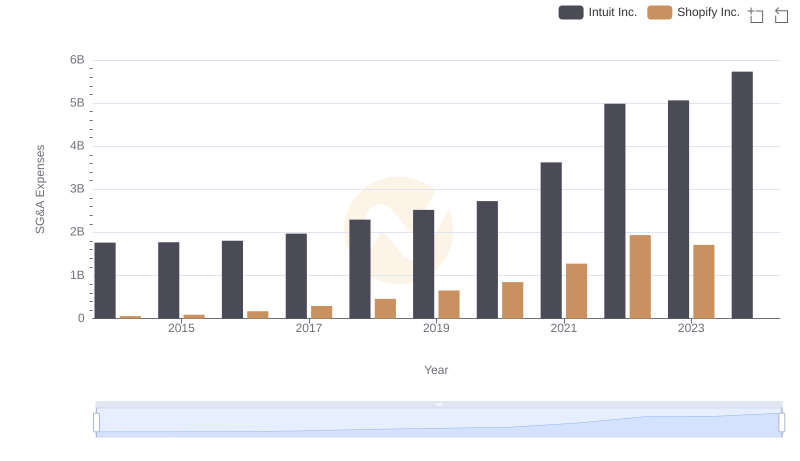

Who Optimizes SG&A Costs Better? Intuit Inc. or Shopify Inc.

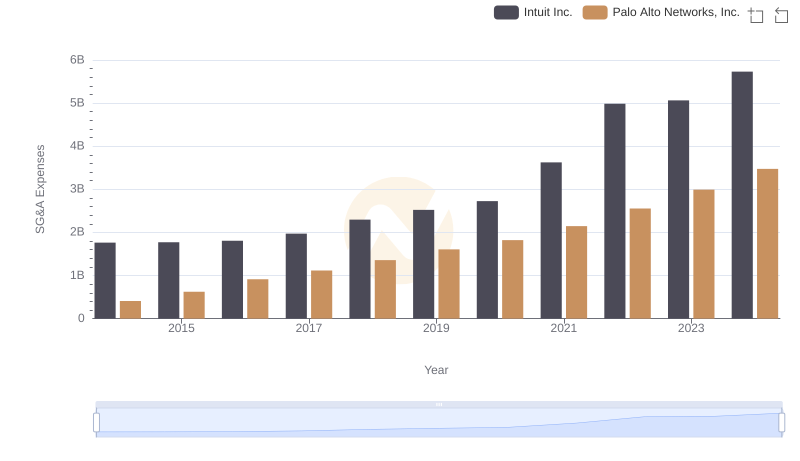

Comparing SG&A Expenses: Intuit Inc. vs Palo Alto Networks, Inc. Trends and Insights

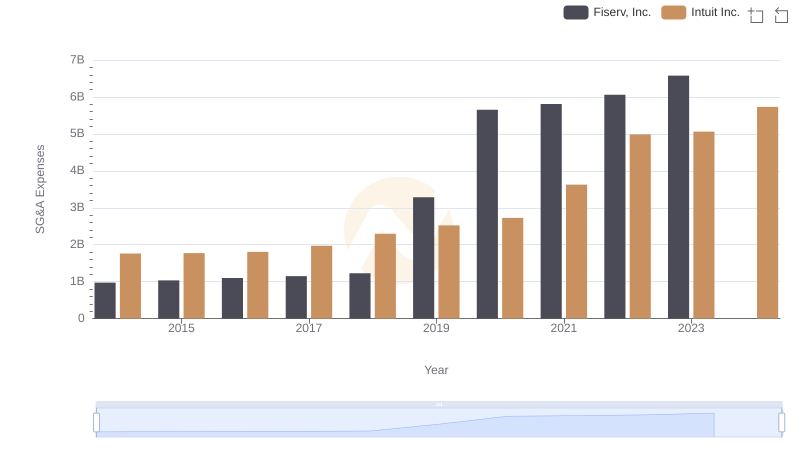

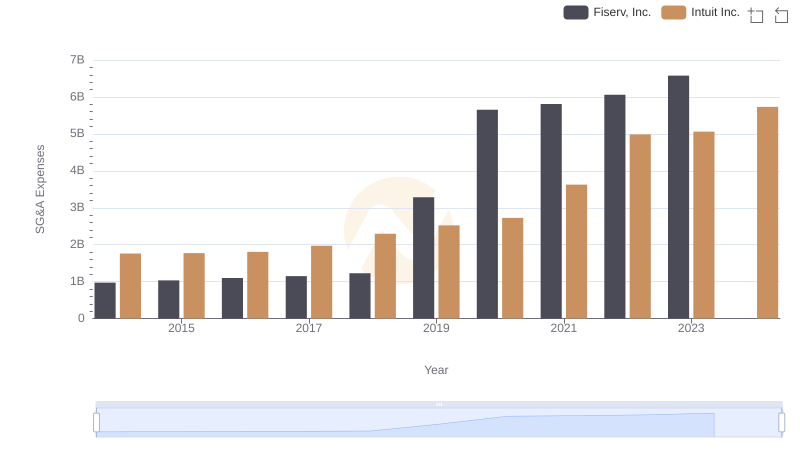

Cost Management Insights: SG&A Expenses for Intuit Inc. and Fiserv, Inc.

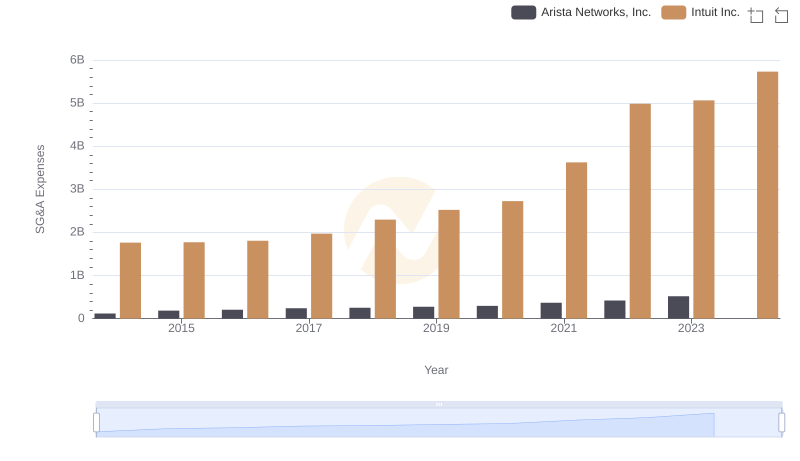

Operational Costs Compared: SG&A Analysis of Intuit Inc. and Arista Networks, Inc.

Intuit Inc. or Fiserv, Inc.: Who Manages SG&A Costs Better?

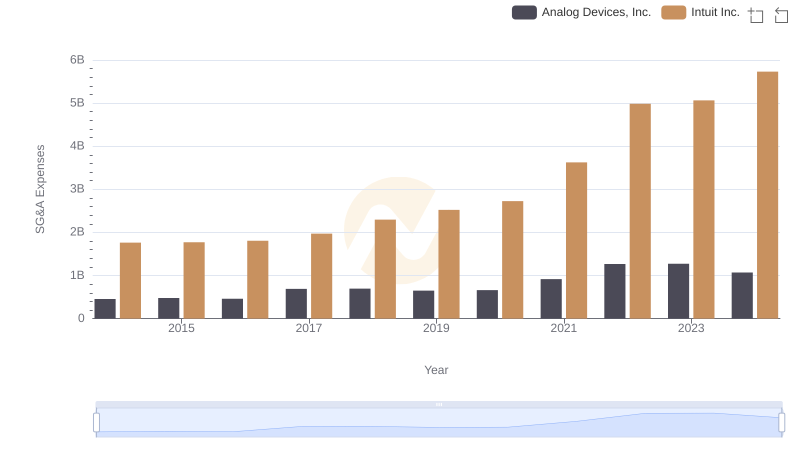

Who Optimizes SG&A Costs Better? Intuit Inc. or Analog Devices, Inc.

EBITDA Performance Review: Intuit Inc. vs Sony Group Corporation

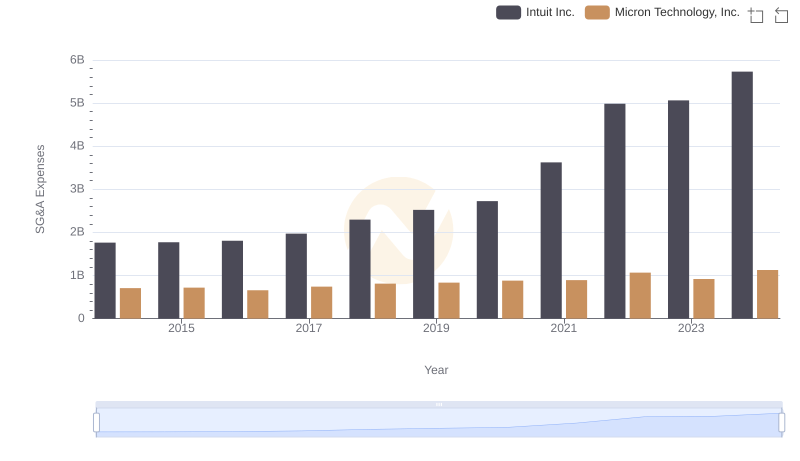

Who Optimizes SG&A Costs Better? Intuit Inc. or Micron Technology, Inc.