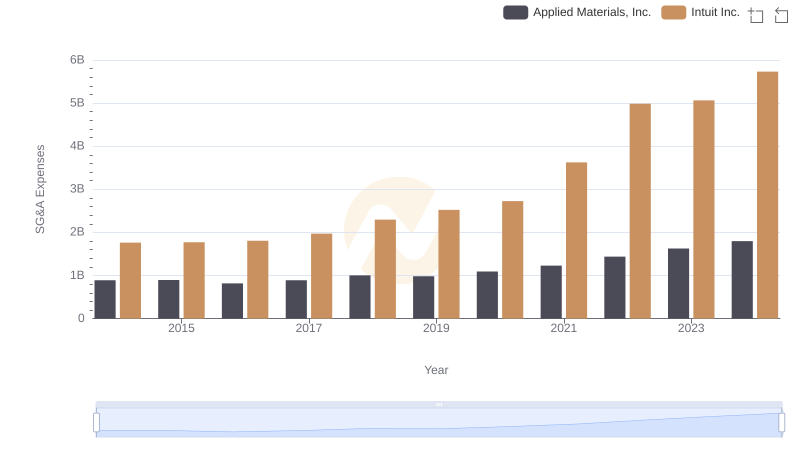

| __timestamp | Intuit Inc. | Shopify Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1762000000 | 57495000 |

| Thursday, January 1, 2015 | 1771000000 | 89105000 |

| Friday, January 1, 2016 | 1807000000 | 172324000 |

| Sunday, January 1, 2017 | 1973000000 | 293413000 |

| Monday, January 1, 2018 | 2298000000 | 457513000 |

| Tuesday, January 1, 2019 | 2524000000 | 651775000 |

| Wednesday, January 1, 2020 | 2727000000 | 847391000 |

| Friday, January 1, 2021 | 3626000000 | 1276401000 |

| Saturday, January 1, 2022 | 4986000000 | 1938255000 |

| Sunday, January 1, 2023 | 5062000000 | 1711000000 |

| Monday, January 1, 2024 | 5730000000 | 1796000000 |

Unleashing the power of data

In the competitive landscape of tech giants, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Intuit Inc. and Shopify Inc., two leaders in their respective domains, have shown contrasting trends in SG&A optimization over the past decade.

From 2014 to 2023, Intuit's SG&A expenses have steadily increased, peaking at approximately $5.06 billion in 2023. This represents a growth of nearly 187% over the period, reflecting Intuit's strategic investments in expanding its market reach and enhancing customer experience.

Shopify, on the other hand, saw its SG&A expenses skyrocket from a modest $57 million in 2014 to around $1.71 billion in 2023, marking an astonishing increase of over 2,800%. This surge aligns with Shopify's aggressive expansion and scaling efforts. However, the data for 2024 is missing, leaving room for speculation on future trends.

Both companies illustrate different approaches to managing operational costs, offering valuable insights into strategic financial planning.

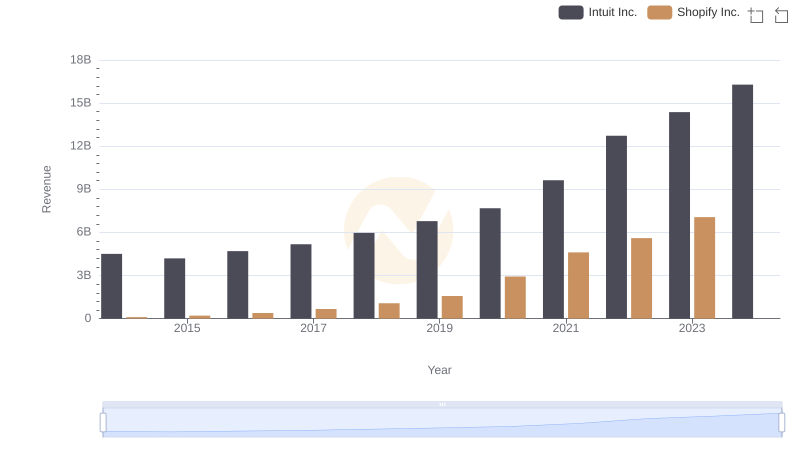

Breaking Down Revenue Trends: Intuit Inc. vs Shopify Inc.

Cost Insights: Breaking Down Intuit Inc. and Shopify Inc.'s Expenses

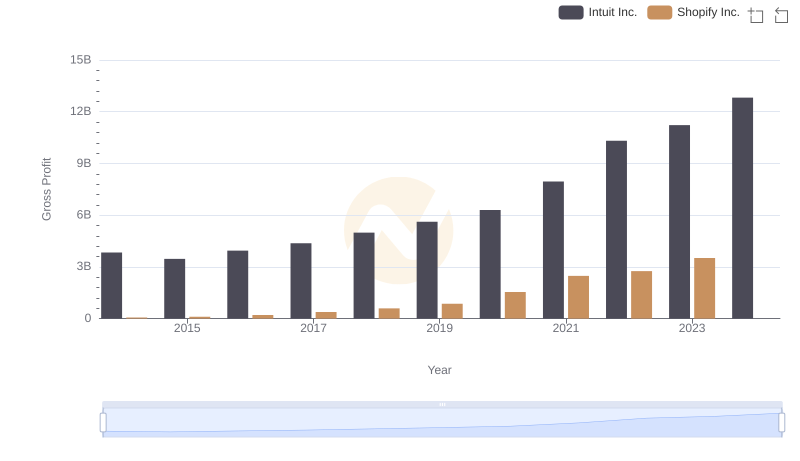

Gross Profit Comparison: Intuit Inc. and Shopify Inc. Trends

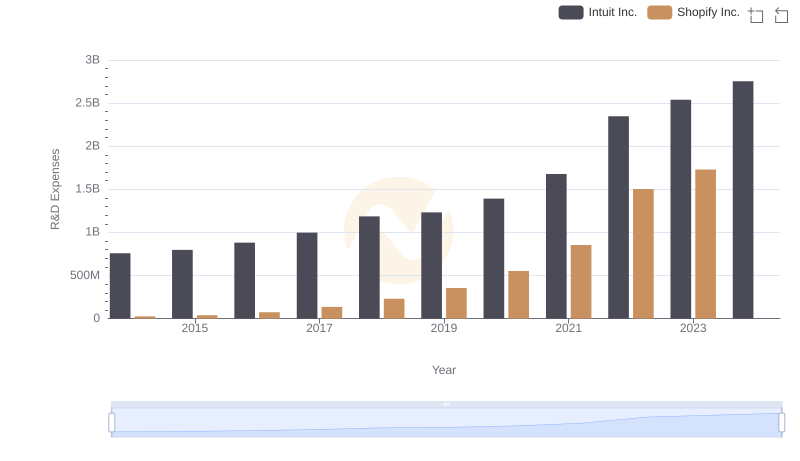

Research and Development: Comparing Key Metrics for Intuit Inc. and Shopify Inc.

Intuit Inc. and Applied Materials, Inc.: SG&A Spending Patterns Compared

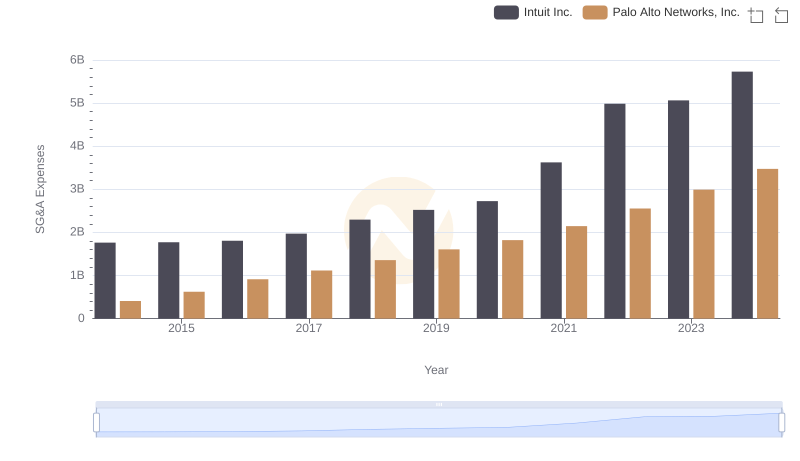

Comparing SG&A Expenses: Intuit Inc. vs Palo Alto Networks, Inc. Trends and Insights

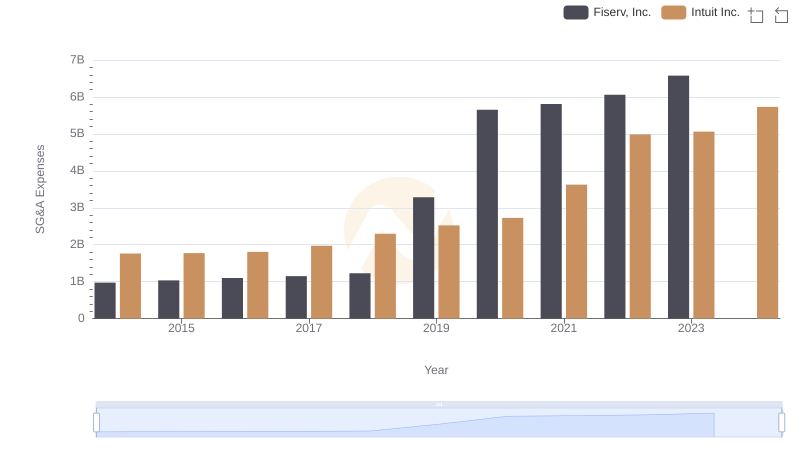

Cost Management Insights: SG&A Expenses for Intuit Inc. and Fiserv, Inc.

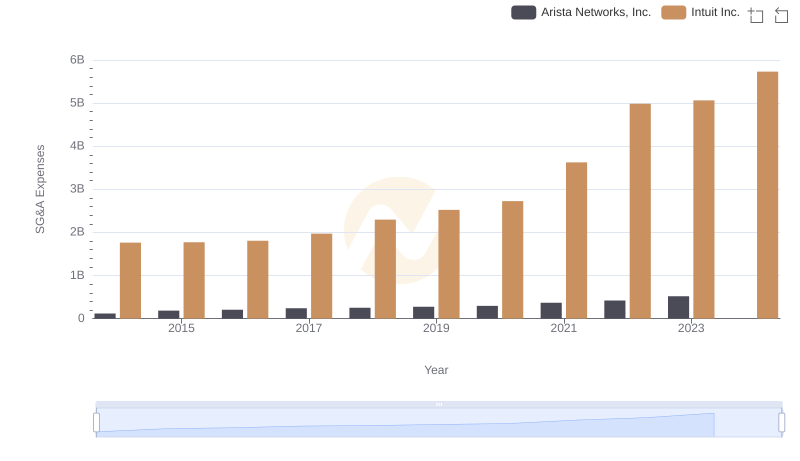

Operational Costs Compared: SG&A Analysis of Intuit Inc. and Arista Networks, Inc.

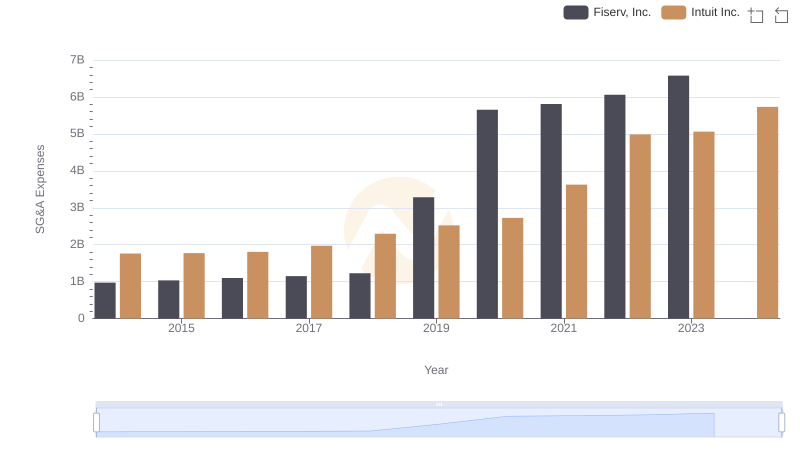

Intuit Inc. or Fiserv, Inc.: Who Manages SG&A Costs Better?

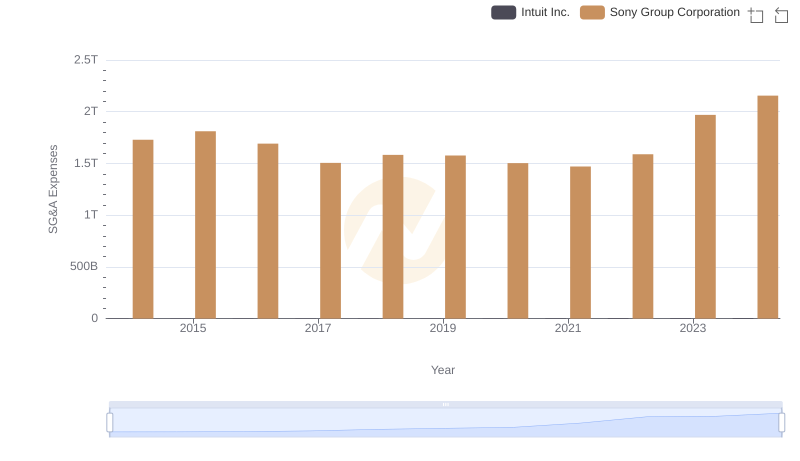

Who Optimizes SG&A Costs Better? Intuit Inc. or Sony Group Corporation

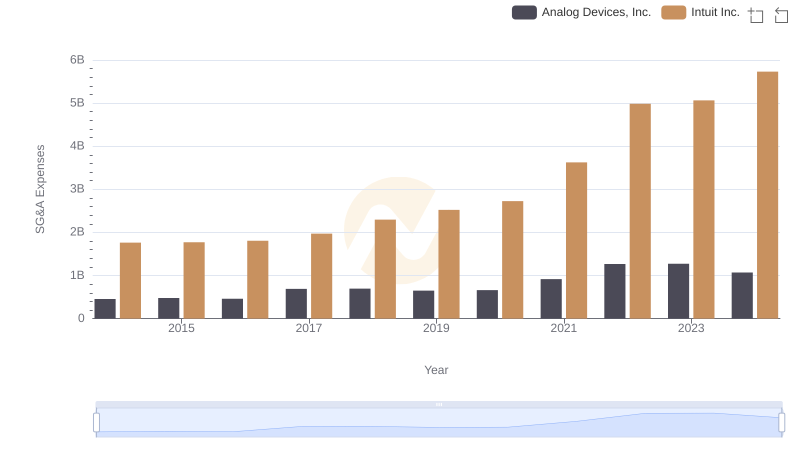

Who Optimizes SG&A Costs Better? Intuit Inc. or Analog Devices, Inc.

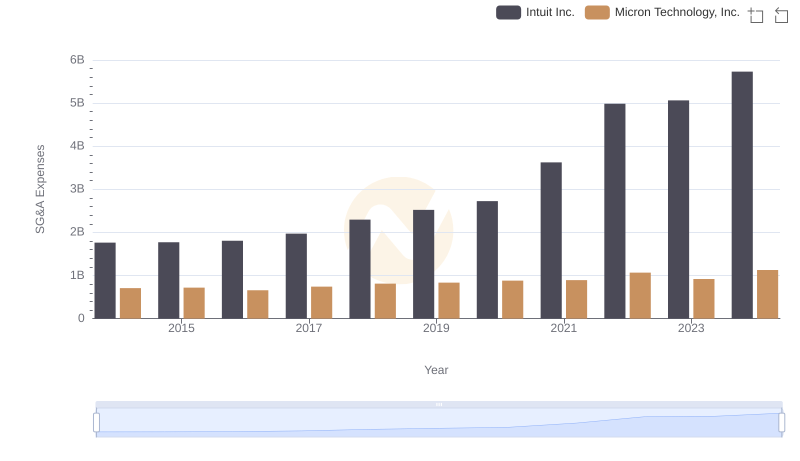

Who Optimizes SG&A Costs Better? Intuit Inc. or Micron Technology, Inc.