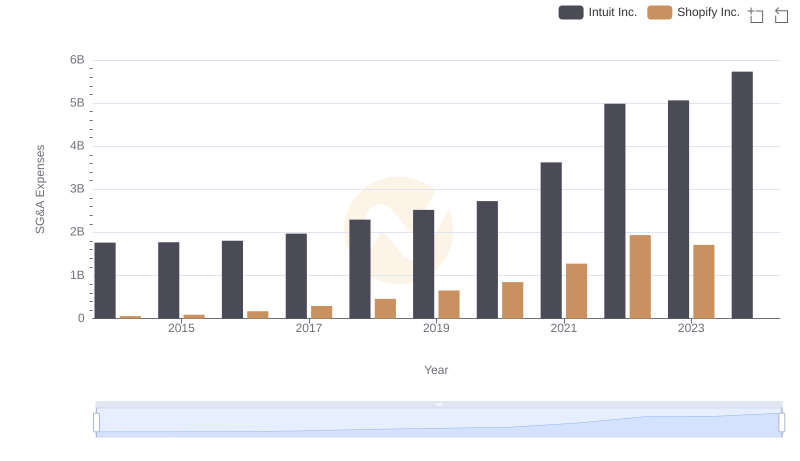

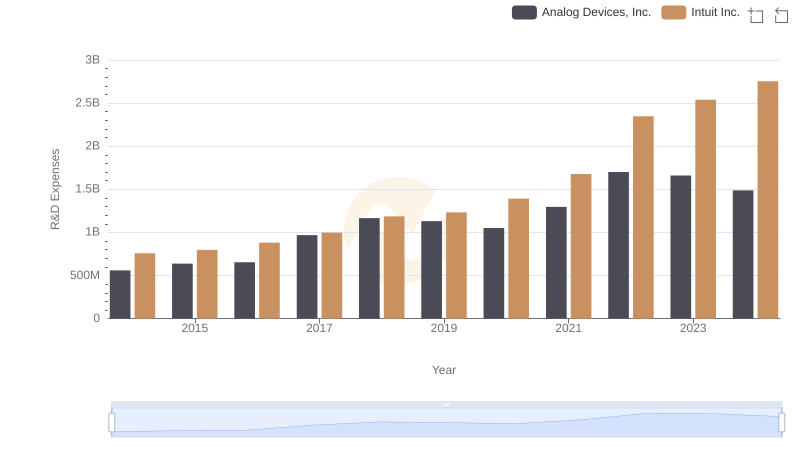

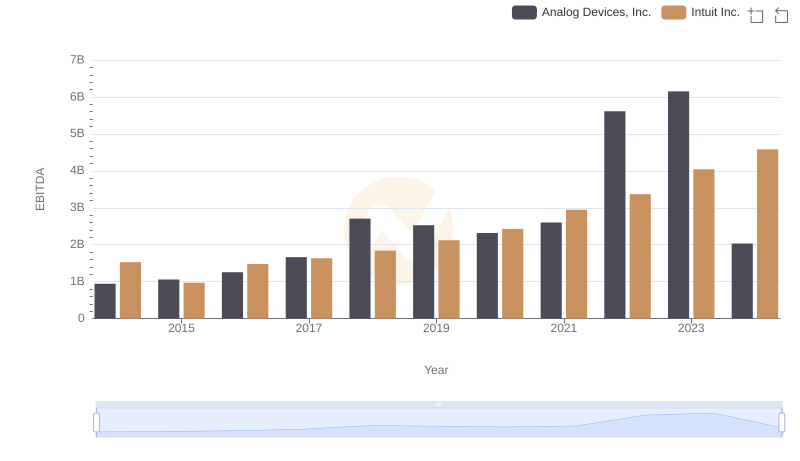

| __timestamp | Analog Devices, Inc. | Intuit Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 454676000 | 1762000000 |

| Thursday, January 1, 2015 | 478972000 | 1771000000 |

| Friday, January 1, 2016 | 461438000 | 1807000000 |

| Sunday, January 1, 2017 | 691046000 | 1973000000 |

| Monday, January 1, 2018 | 695937000 | 2298000000 |

| Tuesday, January 1, 2019 | 648094000 | 2524000000 |

| Wednesday, January 1, 2020 | 659923000 | 2727000000 |

| Friday, January 1, 2021 | 915418000 | 3626000000 |

| Saturday, January 1, 2022 | 1266175000 | 4986000000 |

| Sunday, January 1, 2023 | 1273584000 | 5062000000 |

| Monday, January 1, 2024 | 1068640000 | 5730000000 |

Igniting the spark of knowledge

In the competitive landscape of technology, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Over the past decade, Intuit Inc. and Analog Devices, Inc. have showcased contrasting strategies in this domain. From 2014 to 2024, Intuit's SG&A expenses surged by approximately 225%, reflecting its aggressive expansion and investment in customer acquisition. In contrast, Analog Devices maintained a more conservative growth of around 135%, indicating a focus on operational efficiency.

By 2023, Intuit's SG&A expenses were nearly four times higher than Analog Devices, highlighting its expansive business model. However, Analog Devices' steady increase suggests a strategic balance between growth and cost management. This comparison offers valuable insights into how two industry leaders navigate financial strategies to optimize their operational costs.

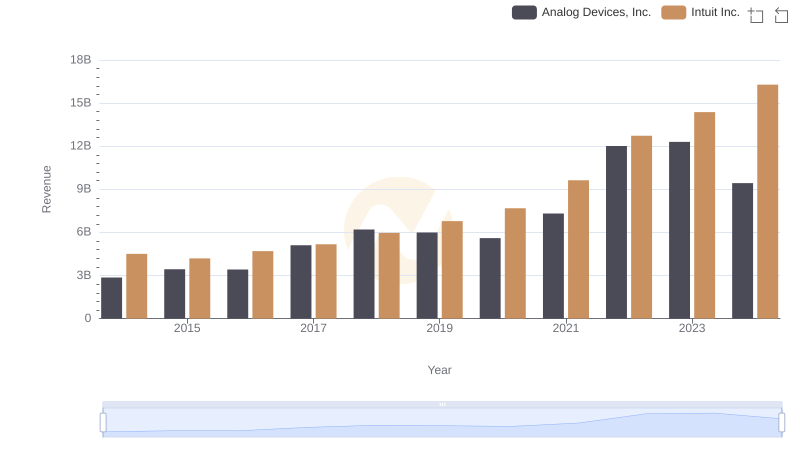

Who Generates More Revenue? Intuit Inc. or Analog Devices, Inc.

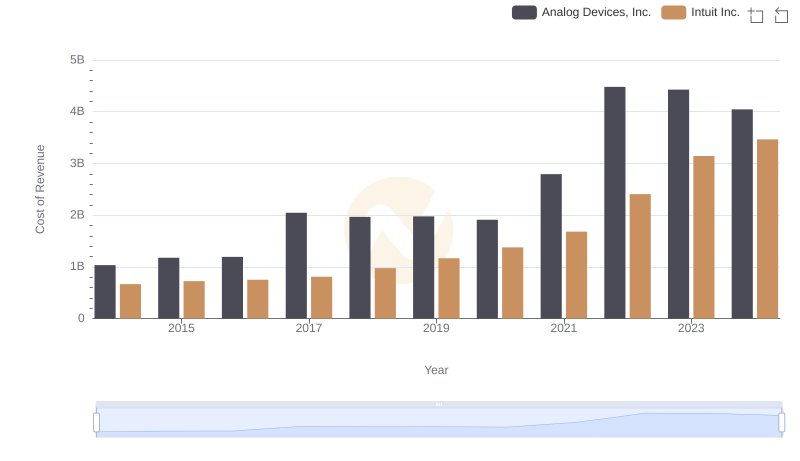

Cost Insights: Breaking Down Intuit Inc. and Analog Devices, Inc.'s Expenses

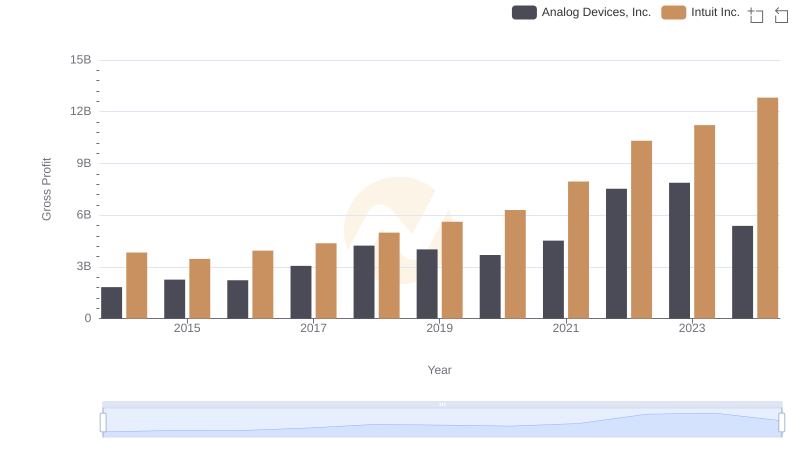

Who Generates Higher Gross Profit? Intuit Inc. or Analog Devices, Inc.

Who Optimizes SG&A Costs Better? Intuit Inc. or Shopify Inc.

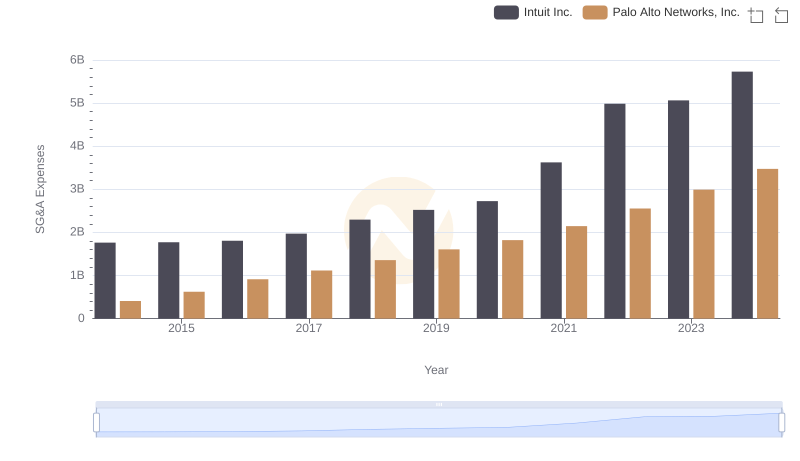

Comparing SG&A Expenses: Intuit Inc. vs Palo Alto Networks, Inc. Trends and Insights

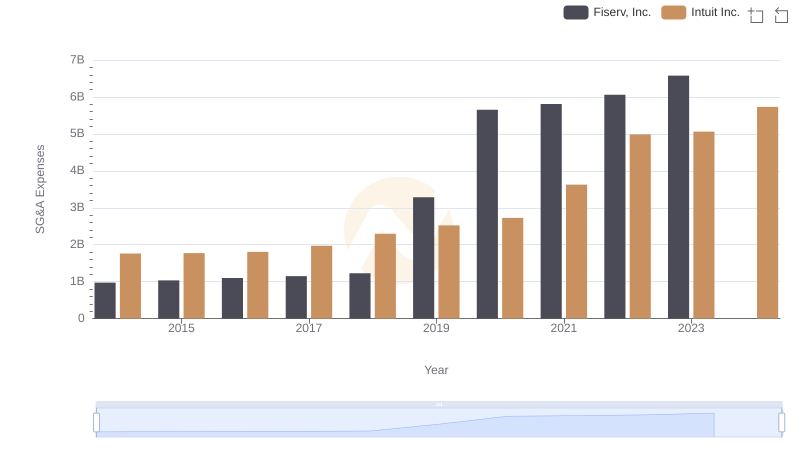

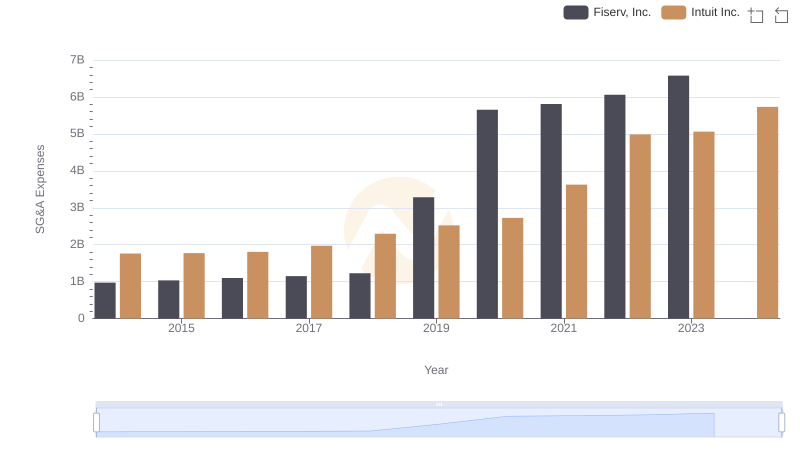

Cost Management Insights: SG&A Expenses for Intuit Inc. and Fiserv, Inc.

Research and Development Investment: Intuit Inc. vs Analog Devices, Inc.

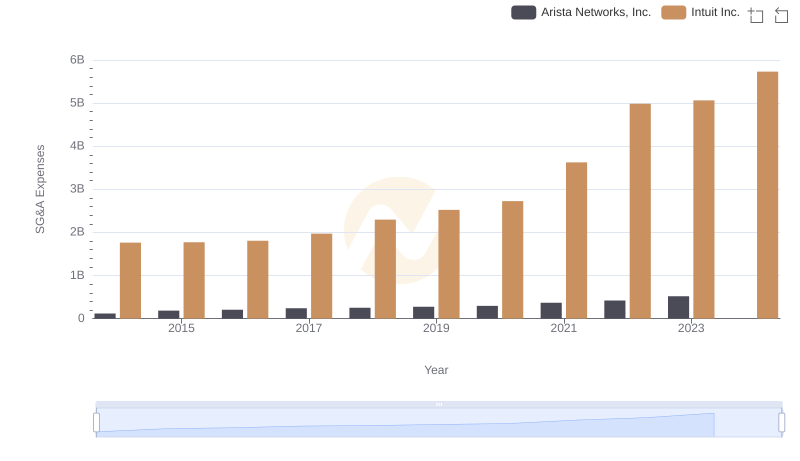

Operational Costs Compared: SG&A Analysis of Intuit Inc. and Arista Networks, Inc.

Intuit Inc. or Fiserv, Inc.: Who Manages SG&A Costs Better?

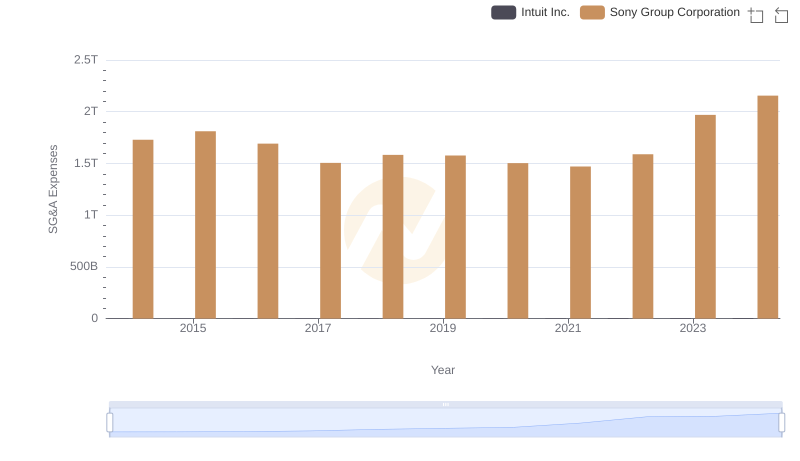

Who Optimizes SG&A Costs Better? Intuit Inc. or Sony Group Corporation

A Side-by-Side Analysis of EBITDA: Intuit Inc. and Analog Devices, Inc.

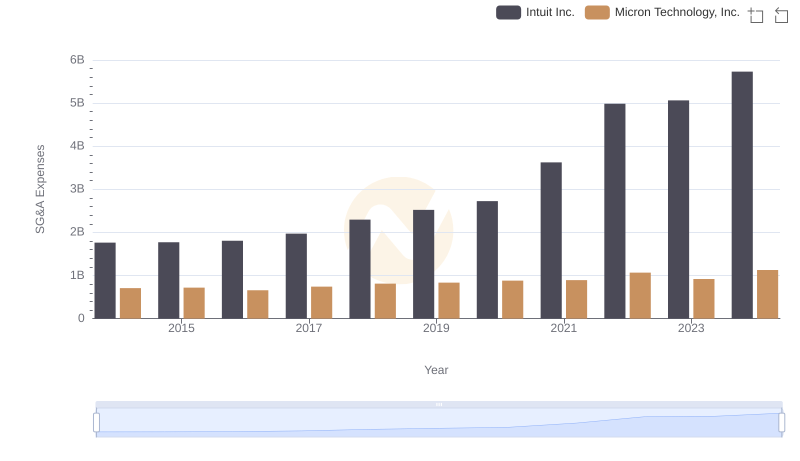

Who Optimizes SG&A Costs Better? Intuit Inc. or Micron Technology, Inc.