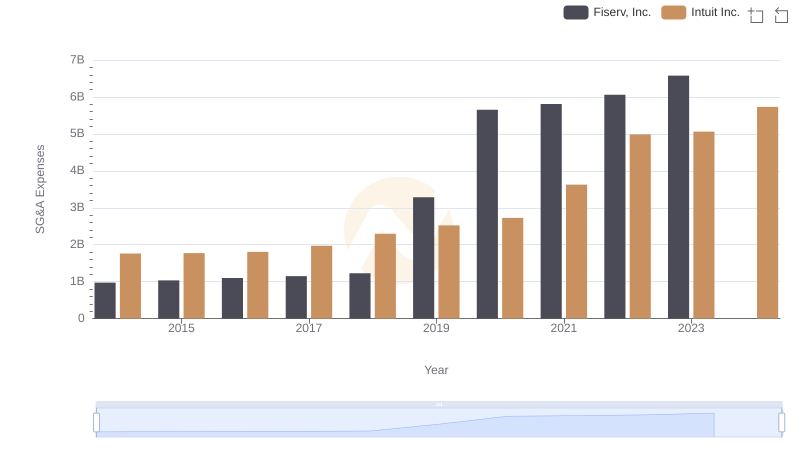

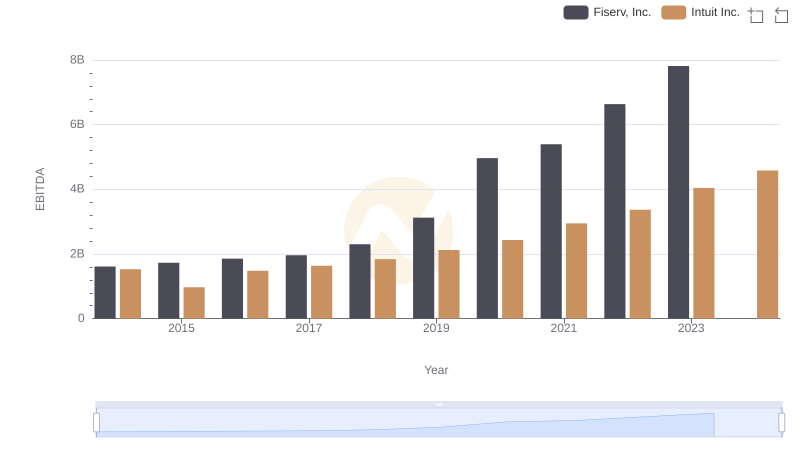

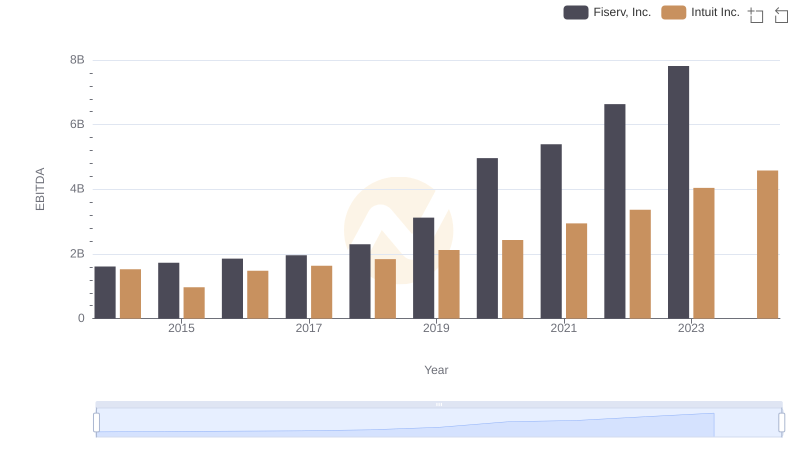

| __timestamp | Fiserv, Inc. | Intuit Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 975000000 | 1762000000 |

| Thursday, January 1, 2015 | 1034000000 | 1771000000 |

| Friday, January 1, 2016 | 1101000000 | 1807000000 |

| Sunday, January 1, 2017 | 1150000000 | 1973000000 |

| Monday, January 1, 2018 | 1228000000 | 2298000000 |

| Tuesday, January 1, 2019 | 3284000000 | 2524000000 |

| Wednesday, January 1, 2020 | 5652000000 | 2727000000 |

| Friday, January 1, 2021 | 5810000000 | 3626000000 |

| Saturday, January 1, 2022 | 6059000000 | 4986000000 |

| Sunday, January 1, 2023 | 6576000000 | 5062000000 |

| Monday, January 1, 2024 | 6564000000 | 5730000000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of financial technology, managing operational costs is crucial for sustained growth. Over the past decade, Intuit Inc. and Fiserv, Inc. have demonstrated contrasting strategies in handling Selling, General, and Administrative (SG&A) expenses. From 2014 to 2023, Fiserv's SG&A expenses surged by over 570%, peaking in 2023, while Intuit's expenses grew by approximately 187% during the same period. This stark difference highlights Fiserv's aggressive expansion strategy, possibly driven by acquisitions and scaling operations. In contrast, Intuit's more measured increase suggests a focus on efficiency and cost control. Notably, 2024 data for Fiserv is missing, leaving room for speculation on their future trajectory. As these industry giants continue to innovate, their approach to managing SG&A costs will remain a key indicator of their financial health and strategic priorities.

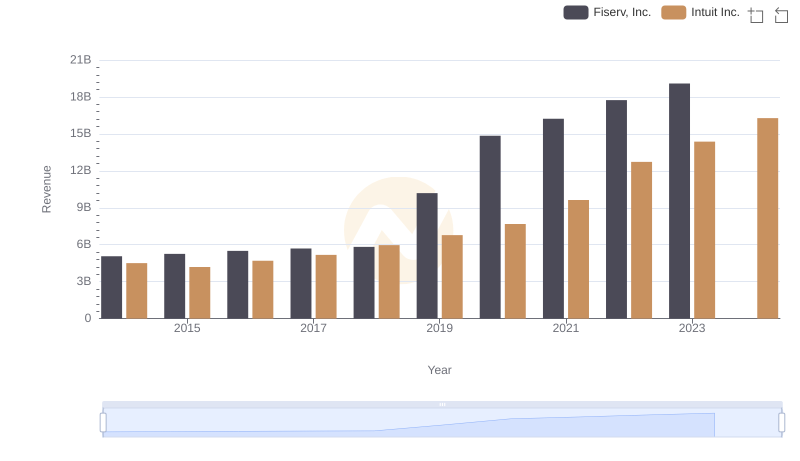

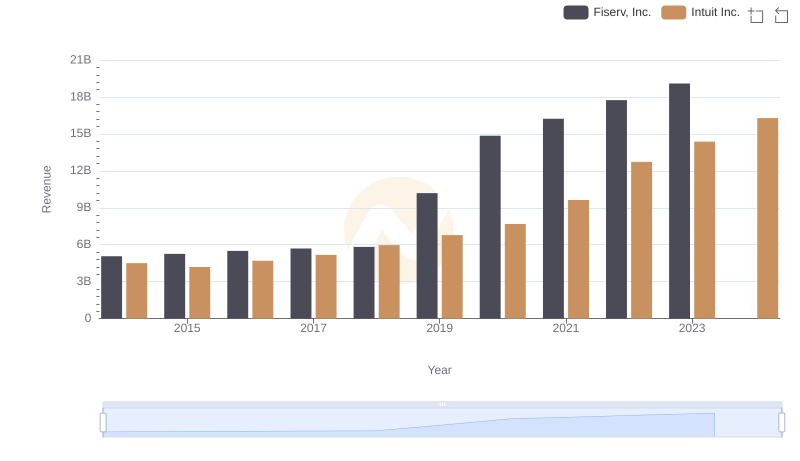

Comparing Revenue Performance: Intuit Inc. or Fiserv, Inc.?

Annual Revenue Comparison: Intuit Inc. vs Fiserv, Inc.

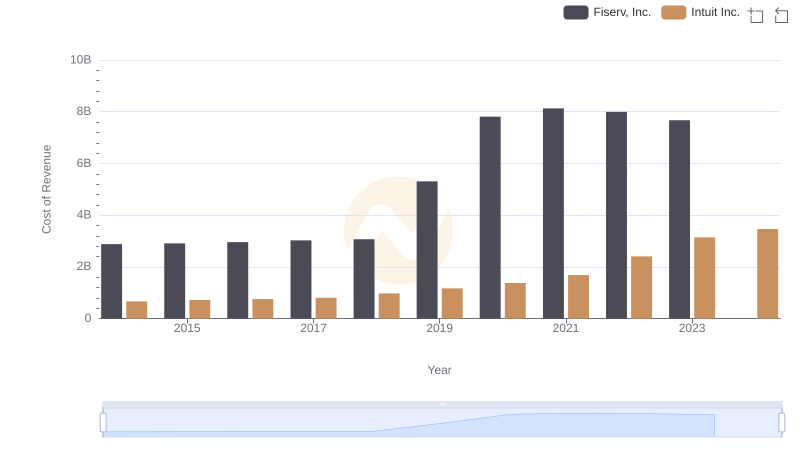

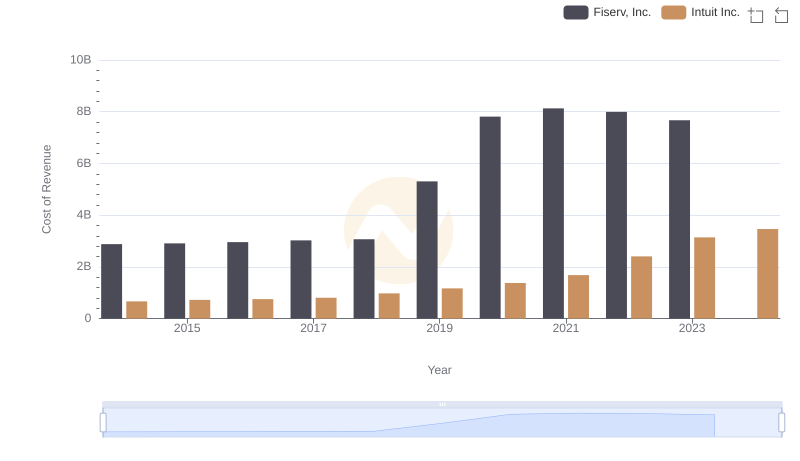

Cost Insights: Breaking Down Intuit Inc. and Fiserv, Inc.'s Expenses

Cost Insights: Breaking Down Intuit Inc. and Fiserv, Inc.'s Expenses

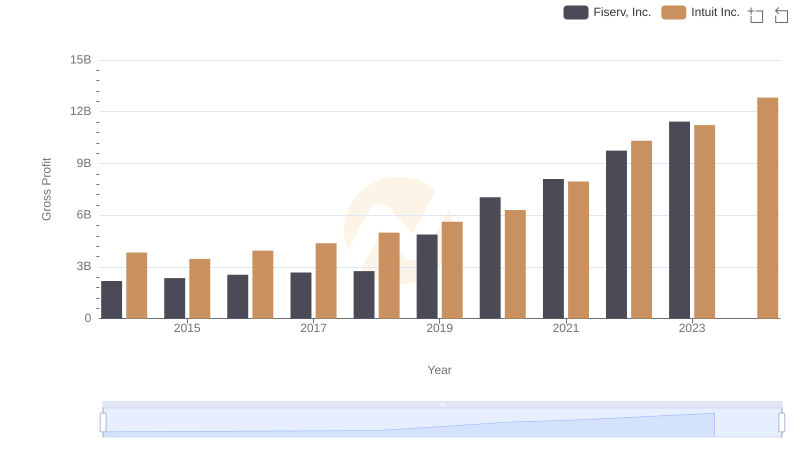

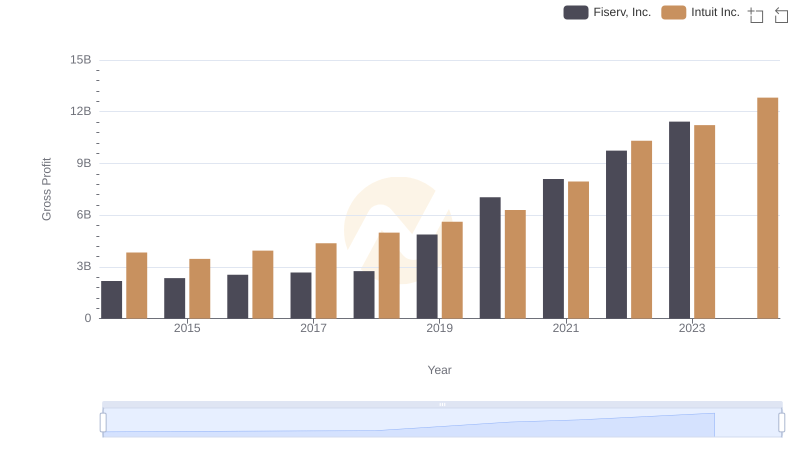

Who Generates Higher Gross Profit? Intuit Inc. or Fiserv, Inc.

Intuit Inc. vs Fiserv, Inc.: A Gross Profit Performance Breakdown

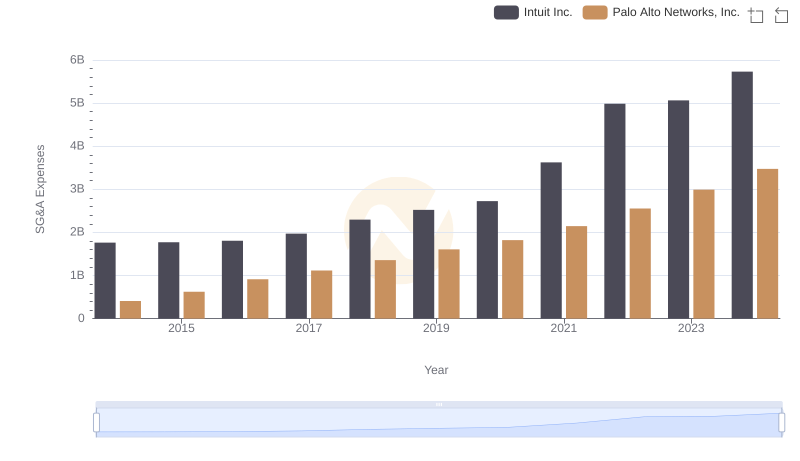

Comparing SG&A Expenses: Intuit Inc. vs Palo Alto Networks, Inc. Trends and Insights

Cost Management Insights: SG&A Expenses for Intuit Inc. and Fiserv, Inc.

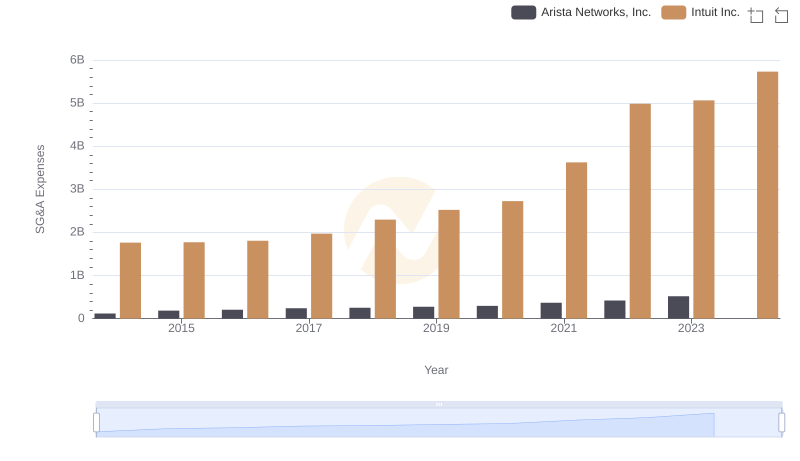

Operational Costs Compared: SG&A Analysis of Intuit Inc. and Arista Networks, Inc.

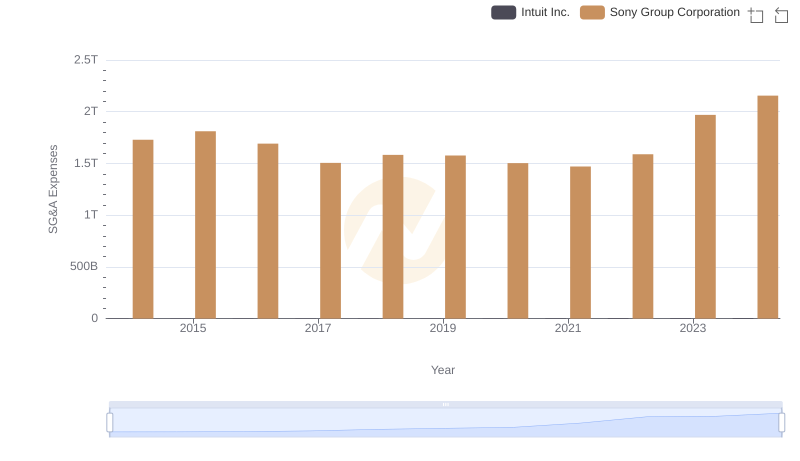

Who Optimizes SG&A Costs Better? Intuit Inc. or Sony Group Corporation

Comprehensive EBITDA Comparison: Intuit Inc. vs Fiserv, Inc.

Comprehensive EBITDA Comparison: Intuit Inc. vs Fiserv, Inc.