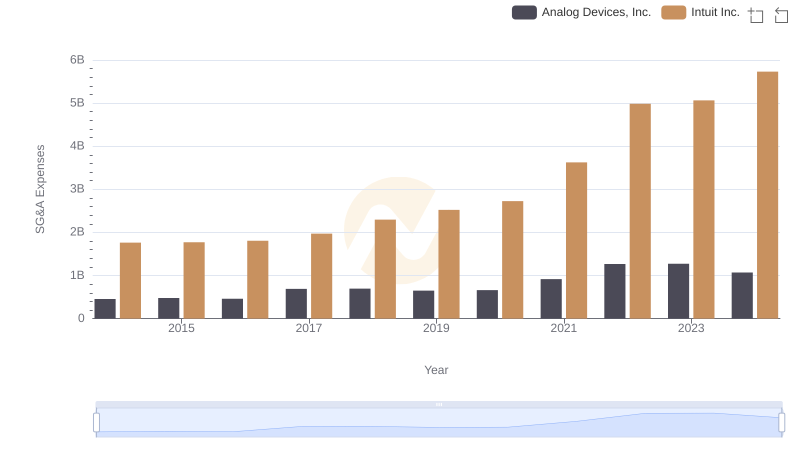

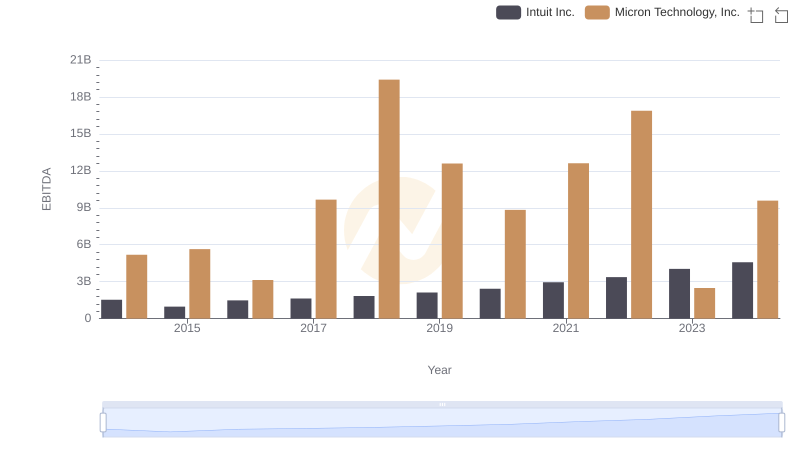

| __timestamp | Intuit Inc. | Micron Technology, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1762000000 | 707000000 |

| Thursday, January 1, 2015 | 1771000000 | 719000000 |

| Friday, January 1, 2016 | 1807000000 | 659000000 |

| Sunday, January 1, 2017 | 1973000000 | 743000000 |

| Monday, January 1, 2018 | 2298000000 | 813000000 |

| Tuesday, January 1, 2019 | 2524000000 | 836000000 |

| Wednesday, January 1, 2020 | 2727000000 | 881000000 |

| Friday, January 1, 2021 | 3626000000 | 894000000 |

| Saturday, January 1, 2022 | 4986000000 | 1066000000 |

| Sunday, January 1, 2023 | 5062000000 | 920000000 |

| Monday, January 1, 2024 | 5730000000 | 1129000000 |

Unlocking the unknown

In the competitive landscape of technology, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Intuit Inc. and Micron Technology, Inc. have taken distinct paths in this regard over the past decade. From 2014 to 2024, Intuit's SG&A expenses have surged by over 225%, reflecting its aggressive growth strategy and investment in innovation. In contrast, Micron Technology has maintained a more conservative approach, with a modest increase of around 60% in the same period.

Intuit's expenses peaked in 2024, reaching nearly $5.73 billion, a testament to its expansive market initiatives. Meanwhile, Micron's expenses, though significantly lower, have shown a steady rise, peaking at $1.13 billion. This divergence highlights the different strategic priorities of these tech titans. As investors and analysts scrutinize these figures, the question remains: which strategy will yield the greatest long-term success?

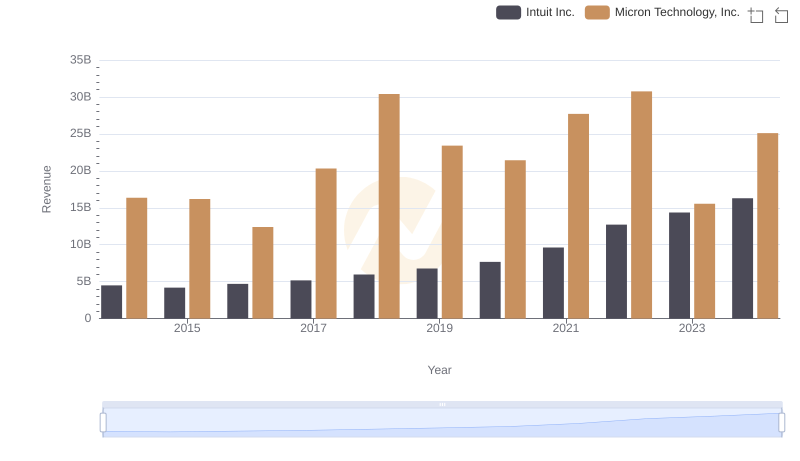

Breaking Down Revenue Trends: Intuit Inc. vs Micron Technology, Inc.

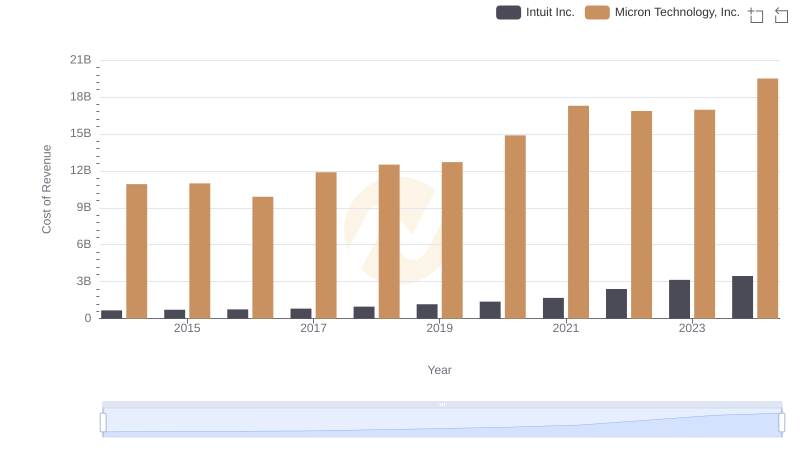

Cost of Revenue Trends: Intuit Inc. vs Micron Technology, Inc.

Who Optimizes SG&A Costs Better? Intuit Inc. or Analog Devices, Inc.

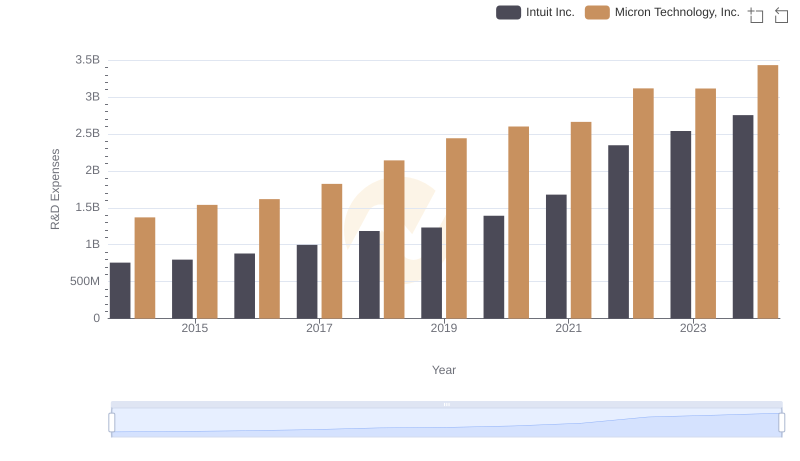

Who Prioritizes Innovation? R&D Spending Compared for Intuit Inc. and Micron Technology, Inc.

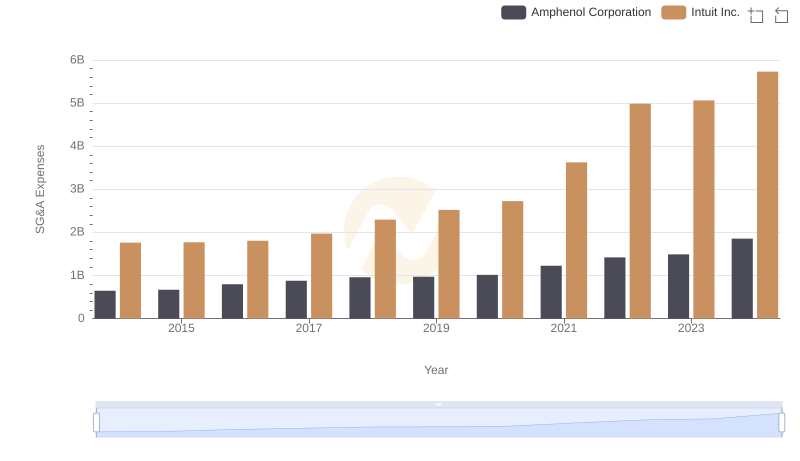

Who Optimizes SG&A Costs Better? Intuit Inc. or Amphenol Corporation

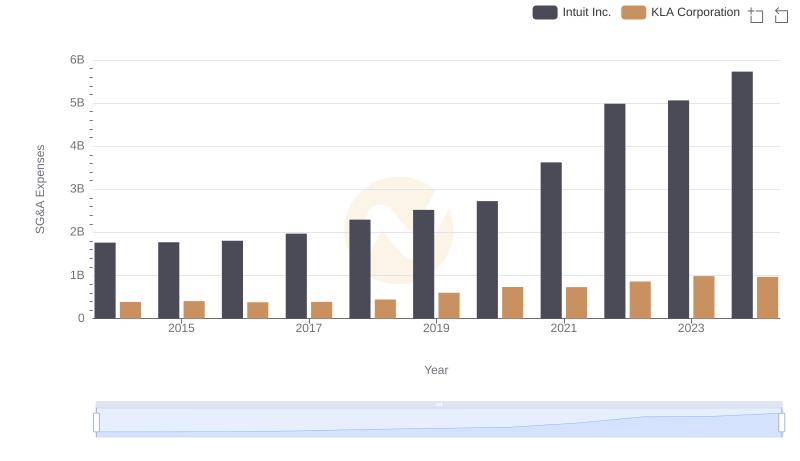

Intuit Inc. and KLA Corporation: SG&A Spending Patterns Compared

A Side-by-Side Analysis of EBITDA: Intuit Inc. and Micron Technology, Inc.

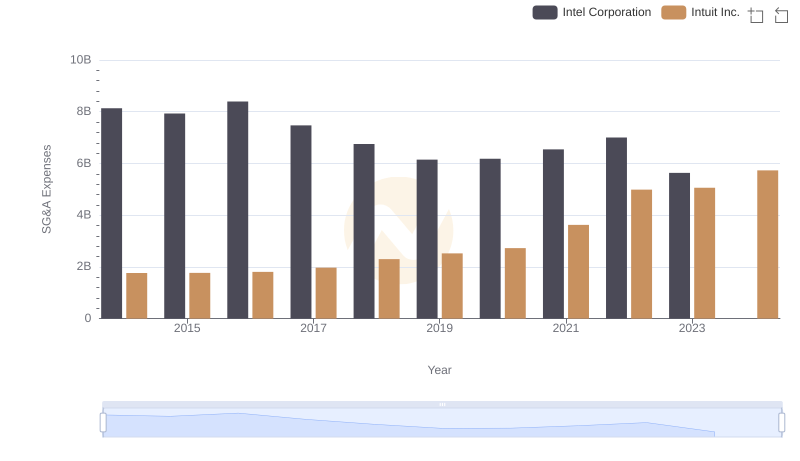

Intuit Inc. and Intel Corporation: SG&A Spending Patterns Compared

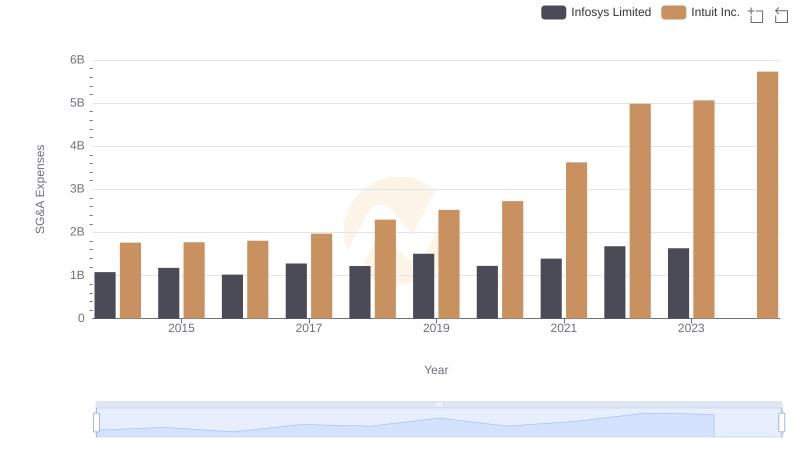

Intuit Inc. and Infosys Limited: SG&A Spending Patterns Compared

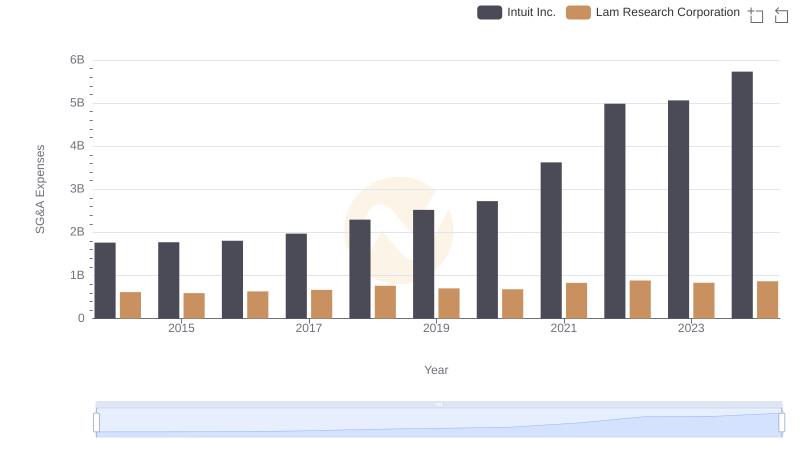

Comparing SG&A Expenses: Intuit Inc. vs Lam Research Corporation Trends and Insights

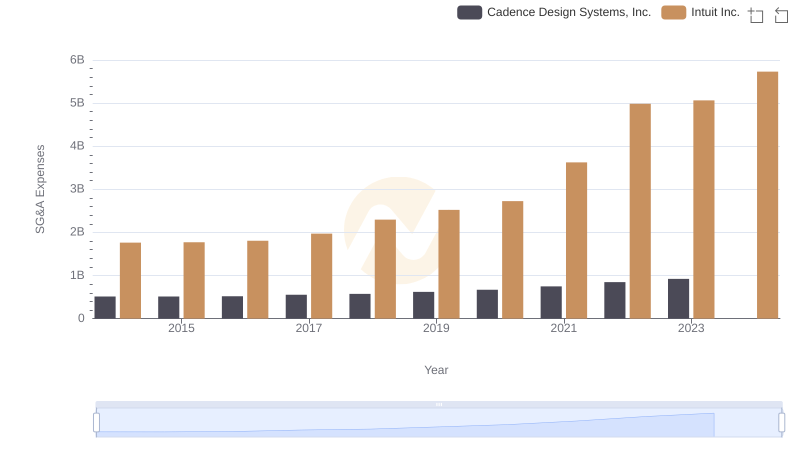

Operational Costs Compared: SG&A Analysis of Intuit Inc. and Cadence Design Systems, Inc.

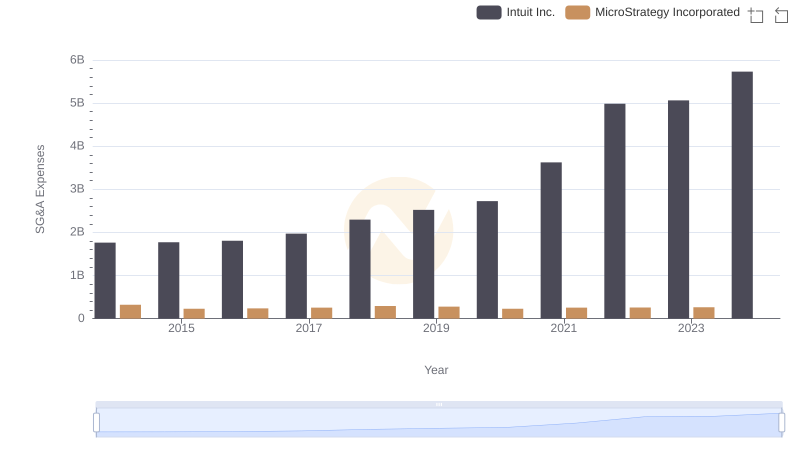

Intuit Inc. and MicroStrategy Incorporated: SG&A Spending Patterns Compared