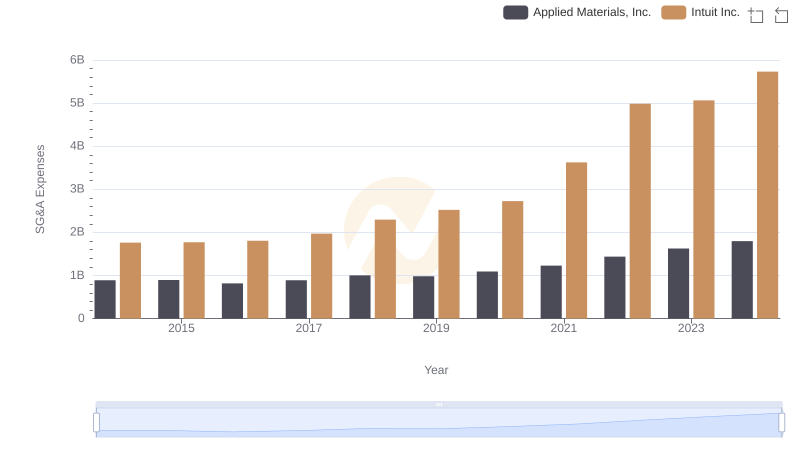

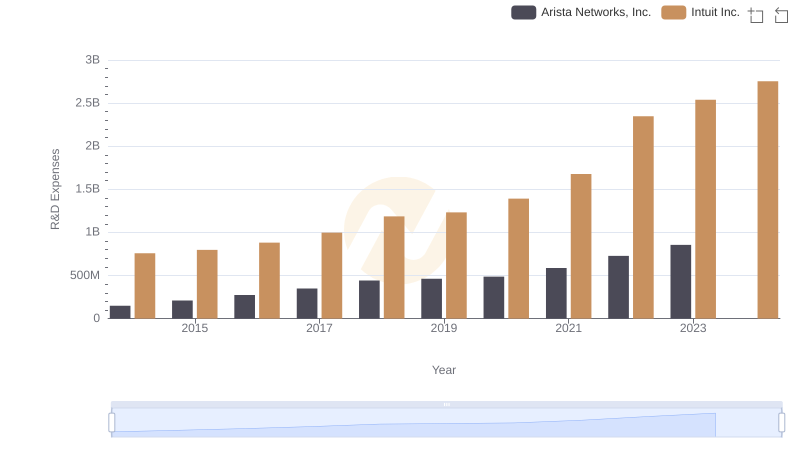

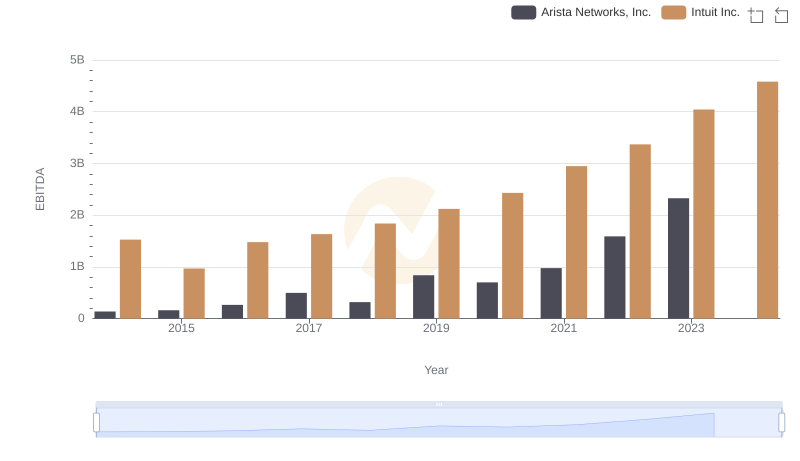

| __timestamp | Arista Networks, Inc. | Intuit Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 117669000 | 1762000000 |

| Thursday, January 1, 2015 | 184804000 | 1771000000 |

| Friday, January 1, 2016 | 206126000 | 1807000000 |

| Sunday, January 1, 2017 | 241903000 | 1973000000 |

| Monday, January 1, 2018 | 252562000 | 2298000000 |

| Tuesday, January 1, 2019 | 275805000 | 2524000000 |

| Wednesday, January 1, 2020 | 295608000 | 2727000000 |

| Friday, January 1, 2021 | 369288000 | 3626000000 |

| Saturday, January 1, 2022 | 420196000 | 4986000000 |

| Sunday, January 1, 2023 | 518114000 | 5062000000 |

| Monday, January 1, 2024 | 549970000 | 5730000000 |

In pursuit of knowledge

In the ever-evolving landscape of corporate finance, understanding operational costs is crucial. Over the past decade, Intuit Inc. and Arista Networks, Inc. have showcased distinct trajectories in their Selling, General, and Administrative (SG&A) expenses. From 2014 to 2023, Intuit's SG&A expenses surged by approximately 187%, reflecting its expansive growth strategy. In contrast, Arista Networks experienced a remarkable 340% increase, indicating its aggressive market penetration and scaling efforts.

By 2023, Intuit's SG&A expenses reached nearly $5.1 billion, while Arista's expenses were around $518 million. This stark difference highlights the varied operational scales and strategic priorities of these tech giants. Notably, 2024 data for Arista is missing, suggesting potential shifts or reporting delays. As these companies continue to innovate, their financial strategies will undoubtedly shape their future market positions.

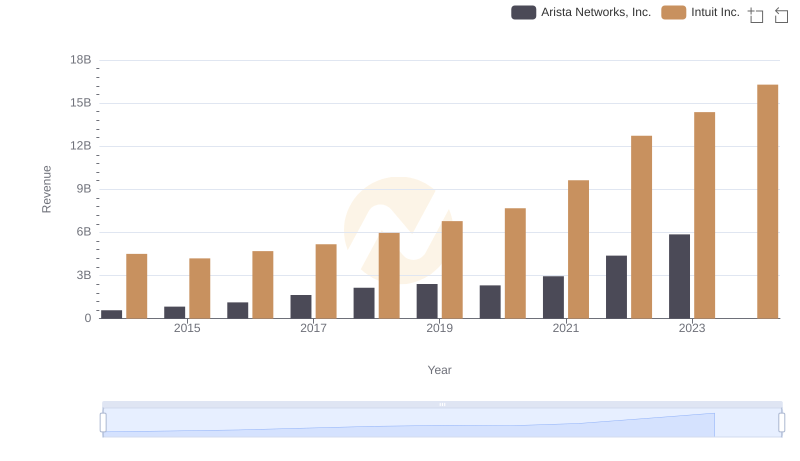

Annual Revenue Comparison: Intuit Inc. vs Arista Networks, Inc.

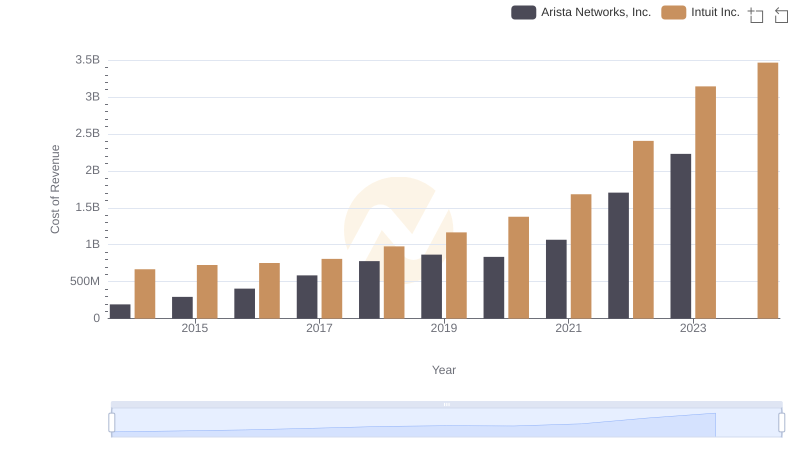

Cost of Revenue: Key Insights for Intuit Inc. and Arista Networks, Inc.

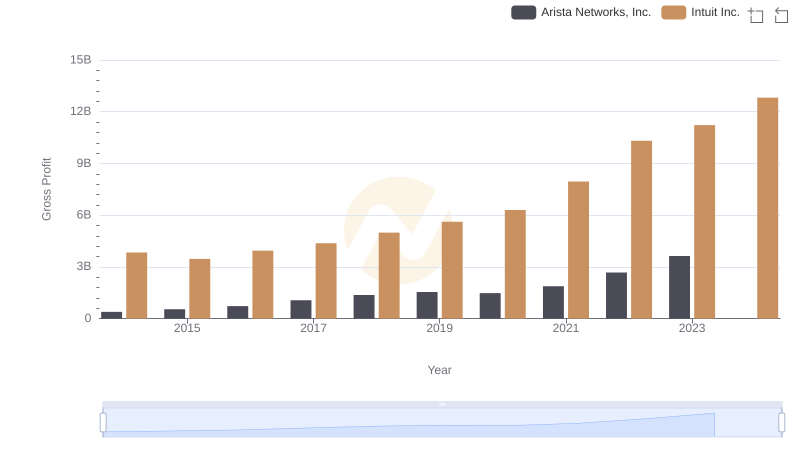

Intuit Inc. vs Arista Networks, Inc.: A Gross Profit Performance Breakdown

Intuit Inc. and Applied Materials, Inc.: SG&A Spending Patterns Compared

Intuit Inc. or Arista Networks, Inc.: Who Invests More in Innovation?

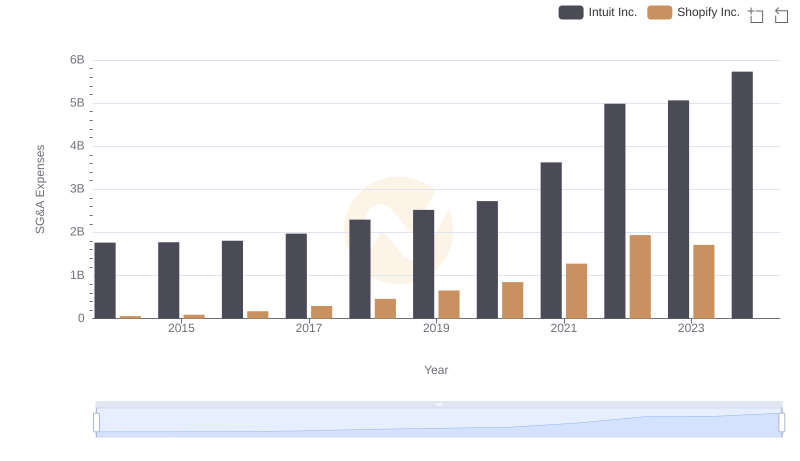

Who Optimizes SG&A Costs Better? Intuit Inc. or Shopify Inc.

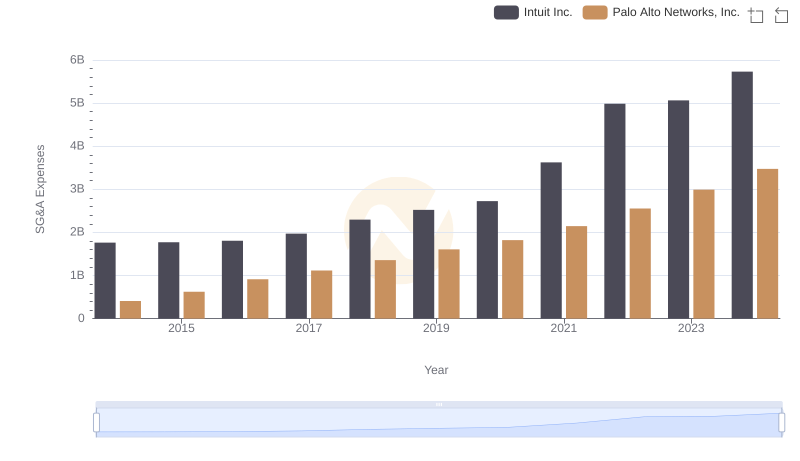

Comparing SG&A Expenses: Intuit Inc. vs Palo Alto Networks, Inc. Trends and Insights

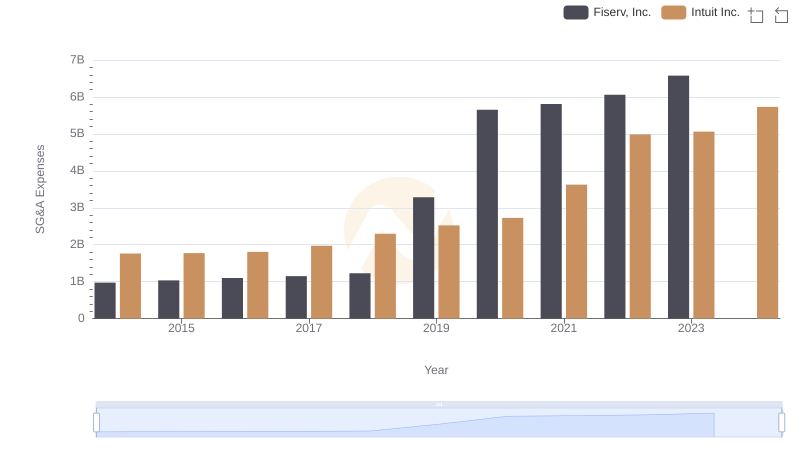

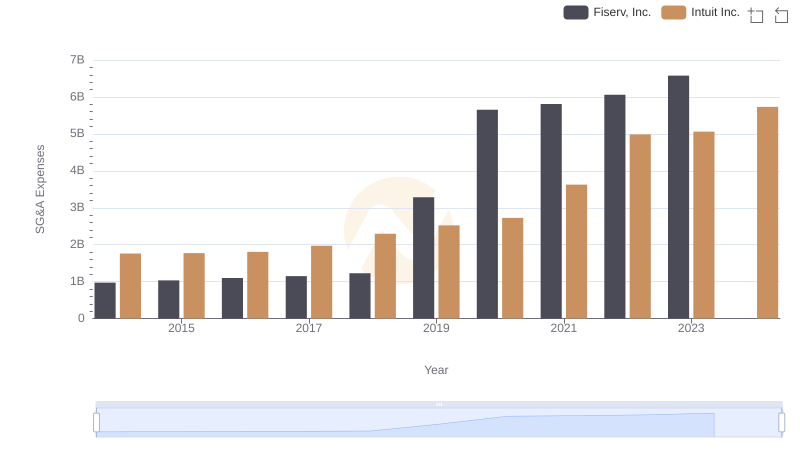

Cost Management Insights: SG&A Expenses for Intuit Inc. and Fiserv, Inc.

Intuit Inc. or Fiserv, Inc.: Who Manages SG&A Costs Better?

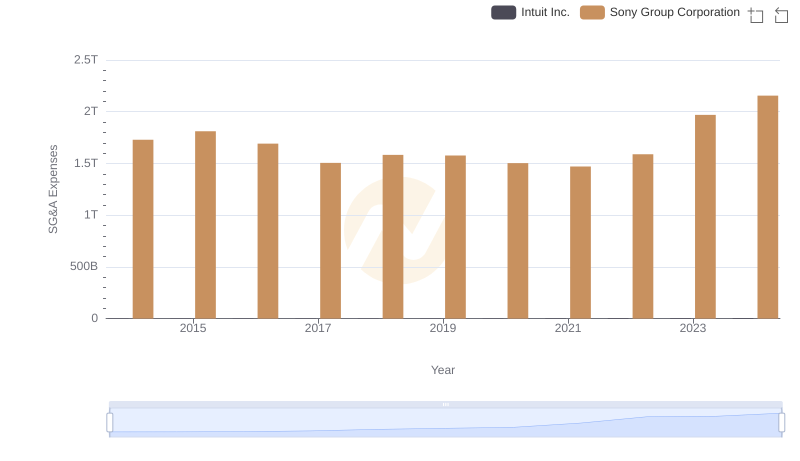

Who Optimizes SG&A Costs Better? Intuit Inc. or Sony Group Corporation

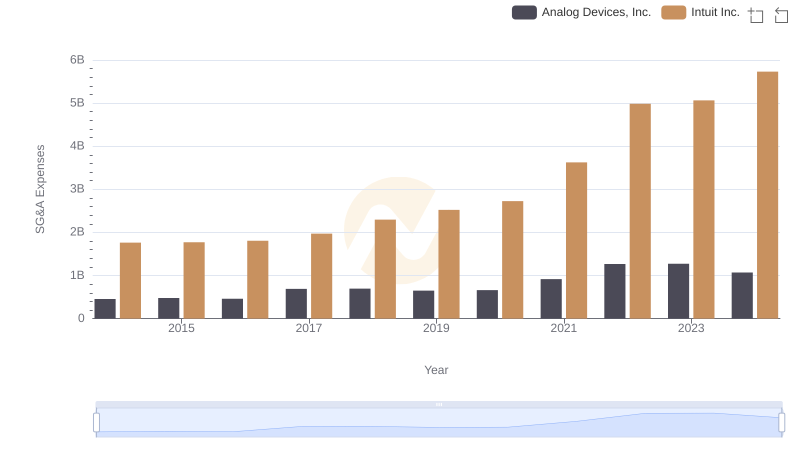

Who Optimizes SG&A Costs Better? Intuit Inc. or Analog Devices, Inc.

Intuit Inc. and Arista Networks, Inc.: A Detailed Examination of EBITDA Performance