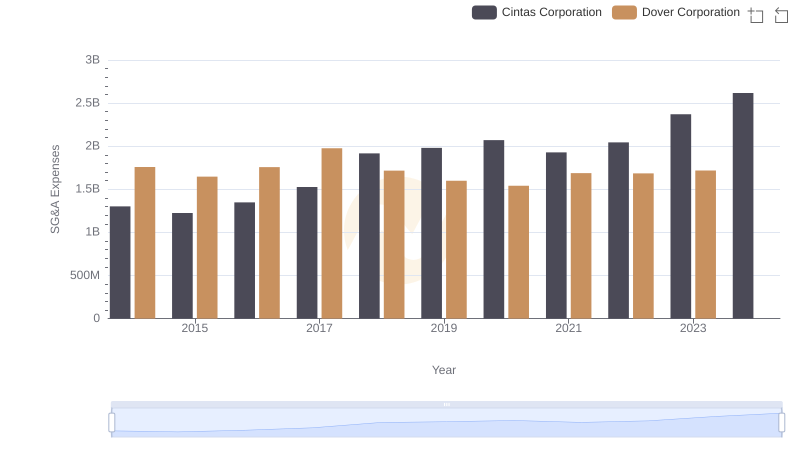

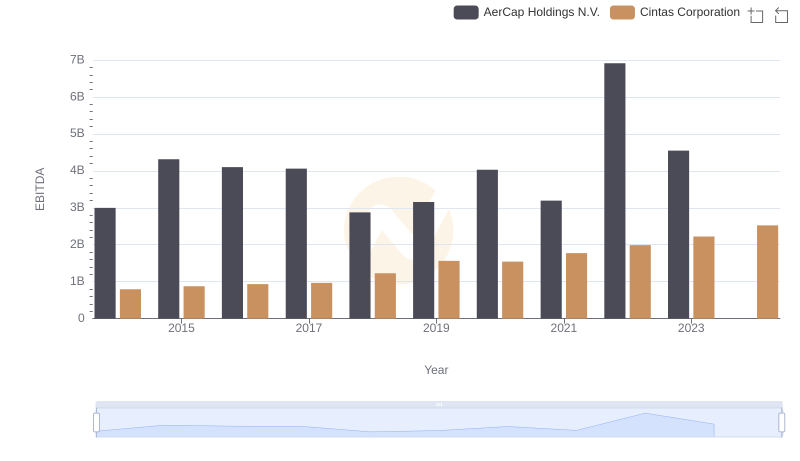

| __timestamp | AerCap Holdings N.V. | Cintas Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 299900000 | 1302752000 |

| Thursday, January 1, 2015 | 381308000 | 1224930000 |

| Friday, January 1, 2016 | 351012000 | 1348122000 |

| Sunday, January 1, 2017 | 348291000 | 1527380000 |

| Monday, January 1, 2018 | 305226000 | 1916792000 |

| Tuesday, January 1, 2019 | 267458000 | 1980644000 |

| Wednesday, January 1, 2020 | 242161000 | 2071052000 |

| Friday, January 1, 2021 | 317888000 | 1929159000 |

| Saturday, January 1, 2022 | 399530000 | 2044876000 |

| Sunday, January 1, 2023 | 464128000 | 2370704000 |

| Monday, January 1, 2024 | 2617783000 |

Igniting the spark of knowledge

In the world of corporate finance, Selling, General, and Administrative (SG&A) expenses are a critical measure of operational efficiency. Over the past decade, Cintas Corporation and AerCap Holdings N.V. have showcased contrasting trends in their SG&A expenses. From 2014 to 2023, Cintas Corporation's SG&A costs have surged by approximately 82%, reflecting its aggressive expansion and operational scaling. In contrast, AerCap Holdings N.V. has experienced a more modest increase of around 55% in the same period, indicating a more conservative growth strategy.

Cintas consistently outpaces AerCap in SG&A expenses, with 2023 figures showing Cintas at nearly five times AerCap's costs. This disparity highlights the differing business models and market strategies of these two industry leaders. Notably, data for AerCap in 2024 is missing, suggesting potential shifts or reporting changes. As these companies evolve, their SG&A trends offer valuable insights into their strategic priorities.

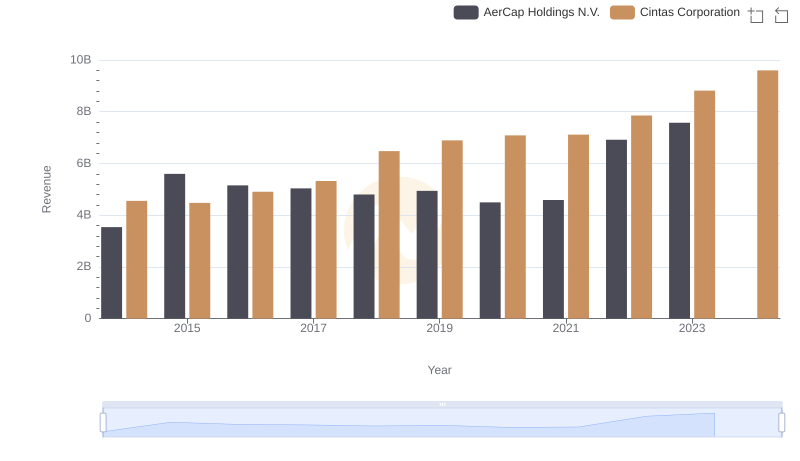

Annual Revenue Comparison: Cintas Corporation vs AerCap Holdings N.V.

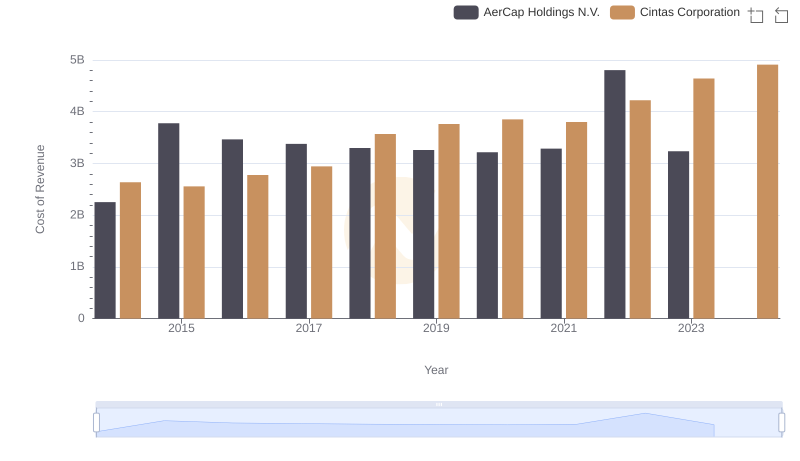

Cost of Revenue Trends: Cintas Corporation vs AerCap Holdings N.V.

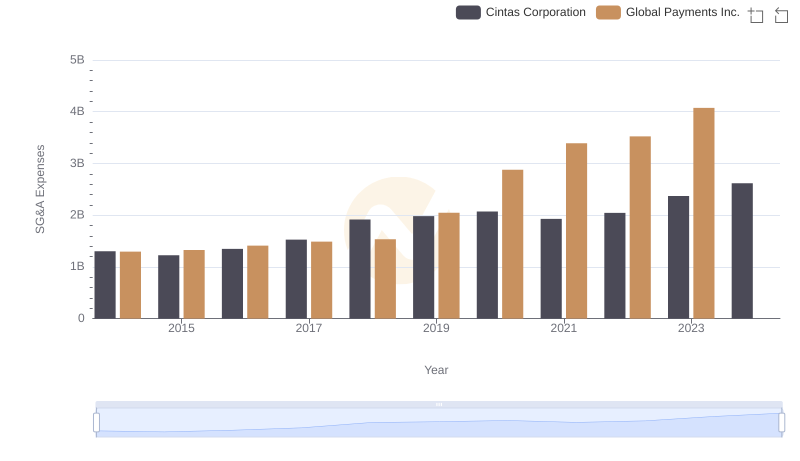

Cintas Corporation and Global Payments Inc.: SG&A Spending Patterns Compared

Cintas Corporation and Dover Corporation: SG&A Spending Patterns Compared

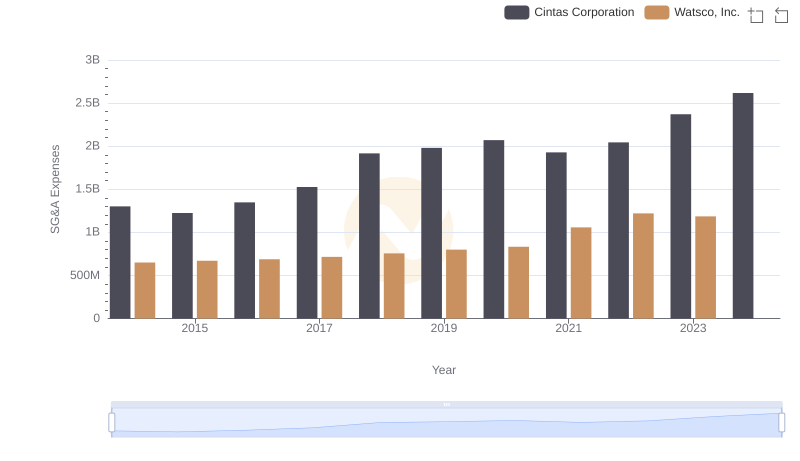

Cintas Corporation vs Watsco, Inc.: SG&A Expense Trends

Who Generates Higher Gross Profit? Cintas Corporation or AerCap Holdings N.V.

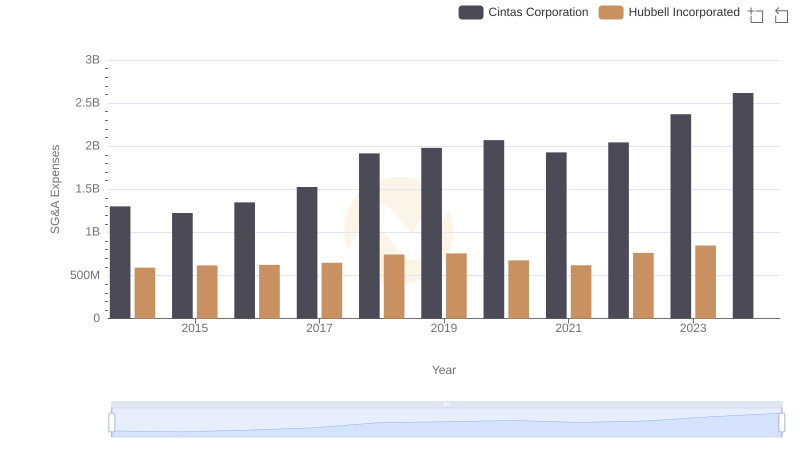

SG&A Efficiency Analysis: Comparing Cintas Corporation and Hubbell Incorporated

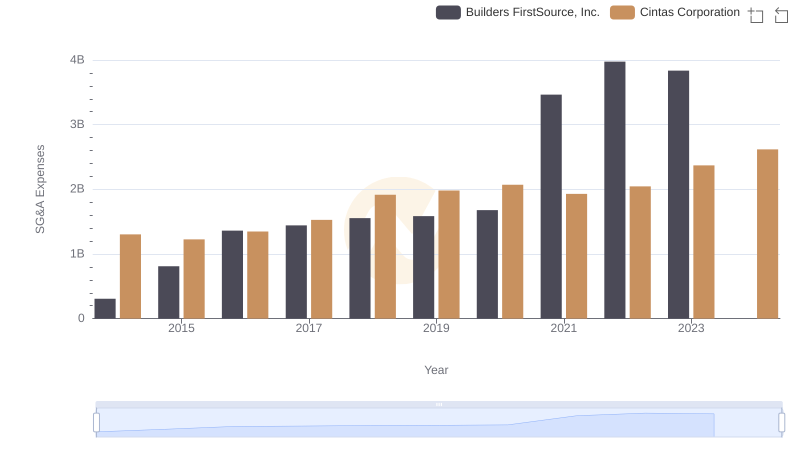

Breaking Down SG&A Expenses: Cintas Corporation vs Builders FirstSource, Inc.

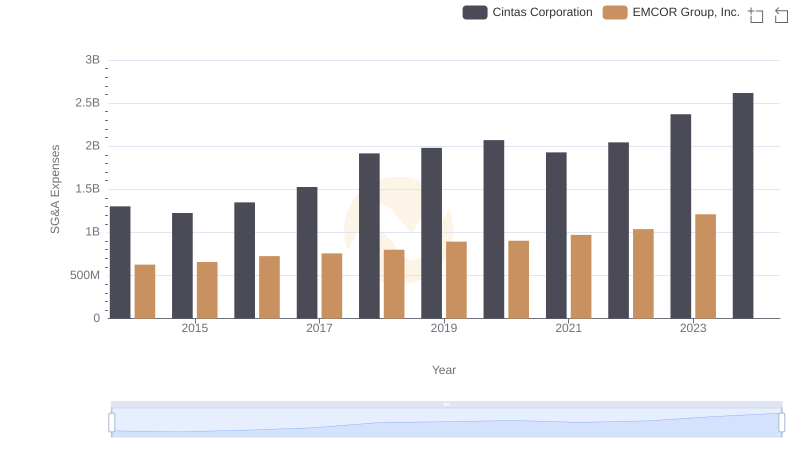

Comparing SG&A Expenses: Cintas Corporation vs EMCOR Group, Inc. Trends and Insights

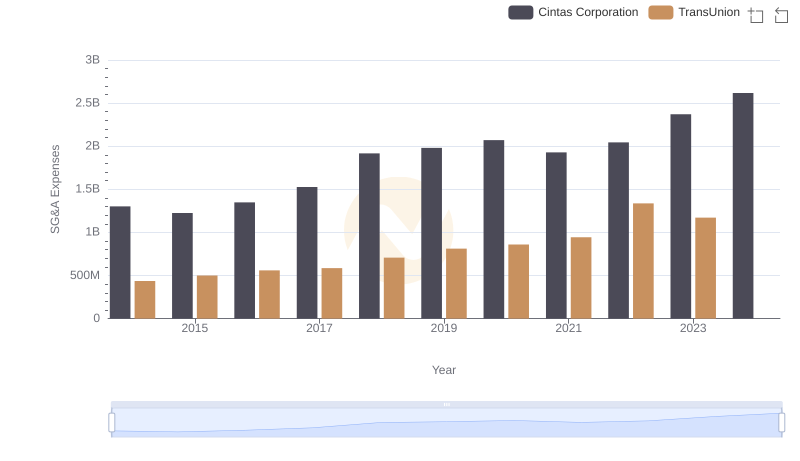

Who Optimizes SG&A Costs Better? Cintas Corporation or TransUnion

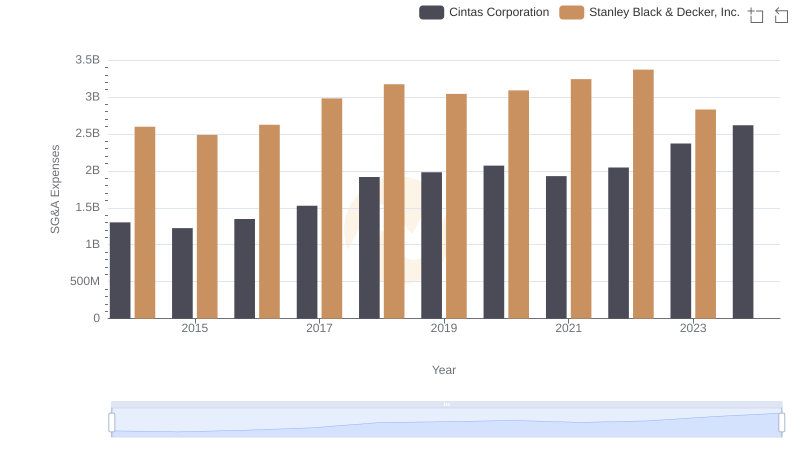

Operational Costs Compared: SG&A Analysis of Cintas Corporation and Stanley Black & Decker, Inc.

EBITDA Performance Review: Cintas Corporation vs AerCap Holdings N.V.