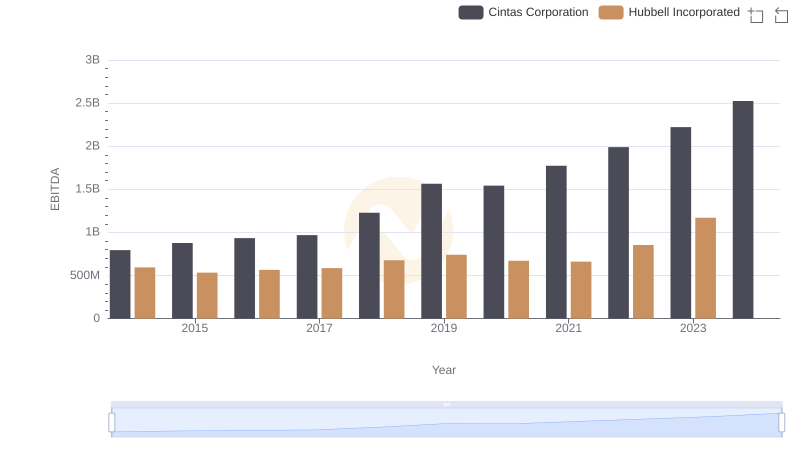

| __timestamp | Cintas Corporation | Hubbell Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 1302752000 | 591600000 |

| Thursday, January 1, 2015 | 1224930000 | 617200000 |

| Friday, January 1, 2016 | 1348122000 | 622900000 |

| Sunday, January 1, 2017 | 1527380000 | 648200000 |

| Monday, January 1, 2018 | 1916792000 | 743500000 |

| Tuesday, January 1, 2019 | 1980644000 | 756100000 |

| Wednesday, January 1, 2020 | 2071052000 | 676300000 |

| Friday, January 1, 2021 | 1929159000 | 619200000 |

| Saturday, January 1, 2022 | 2044876000 | 762500000 |

| Sunday, January 1, 2023 | 2370704000 | 848600000 |

| Monday, January 1, 2024 | 2617783000 | 812500000 |

Unleashing insights

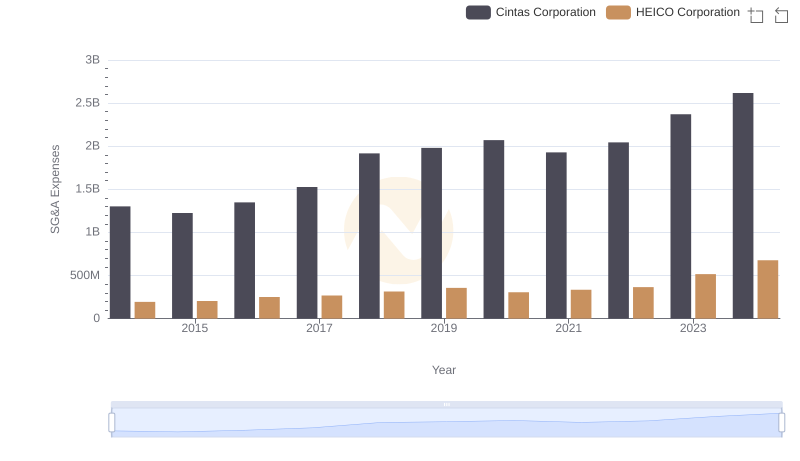

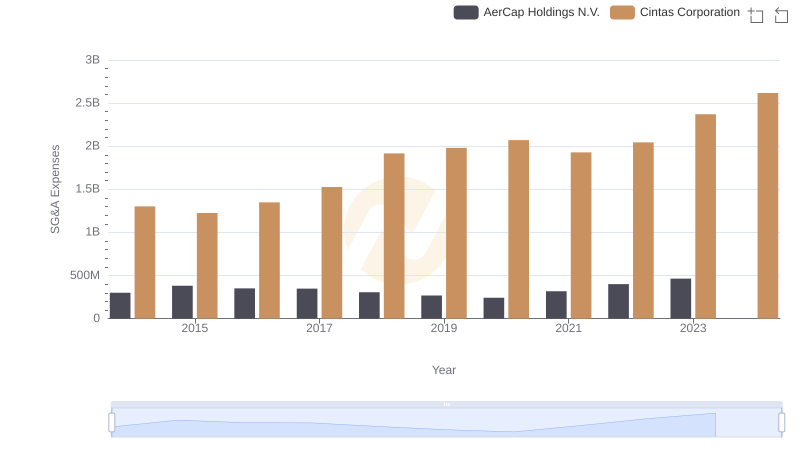

In the competitive landscape of corporate America, understanding the efficiency of Selling, General, and Administrative (SG&A) expenses is crucial. Cintas Corporation and Hubbell Incorporated, two giants in their respective industries, offer a fascinating study in contrasts over the past decade.

From 2014 to 2023, Cintas Corporation has seen a remarkable 82% increase in SG&A expenses, reflecting its aggressive growth strategy. In contrast, Hubbell Incorporated's SG&A expenses grew by approximately 43% during the same period, indicating a more conservative approach. Notably, Cintas's expenses surged in 2023, reaching a peak, while Hubbell's data for 2024 remains elusive.

This analysis highlights the strategic choices companies make in managing operational costs, with Cintas focusing on expansion and Hubbell maintaining steady growth. As we look to the future, these trends offer valuable insights into the financial health and strategic priorities of these industry leaders.

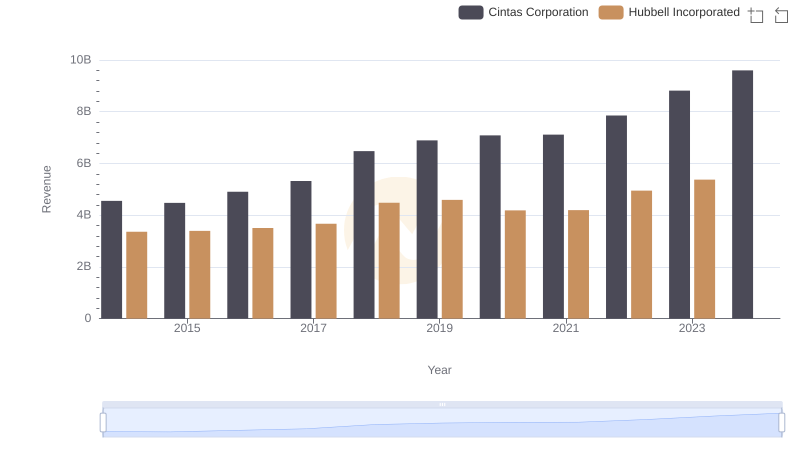

Comparing Revenue Performance: Cintas Corporation or Hubbell Incorporated?

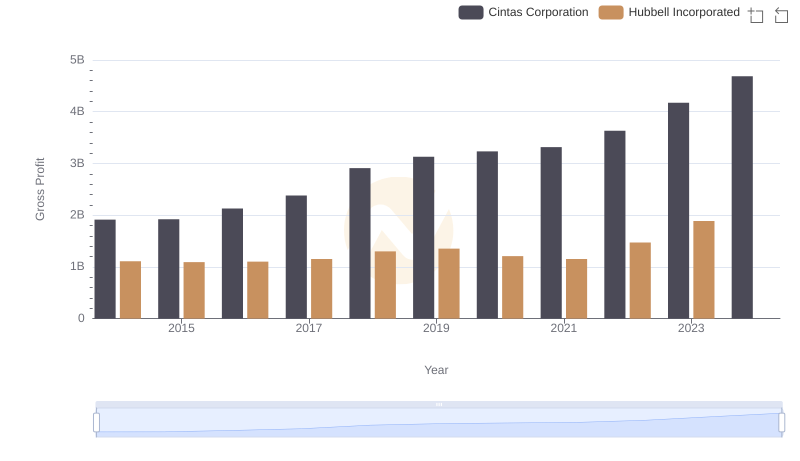

Gross Profit Comparison: Cintas Corporation and Hubbell Incorporated Trends

Cintas Corporation vs HEICO Corporation: SG&A Expense Trends

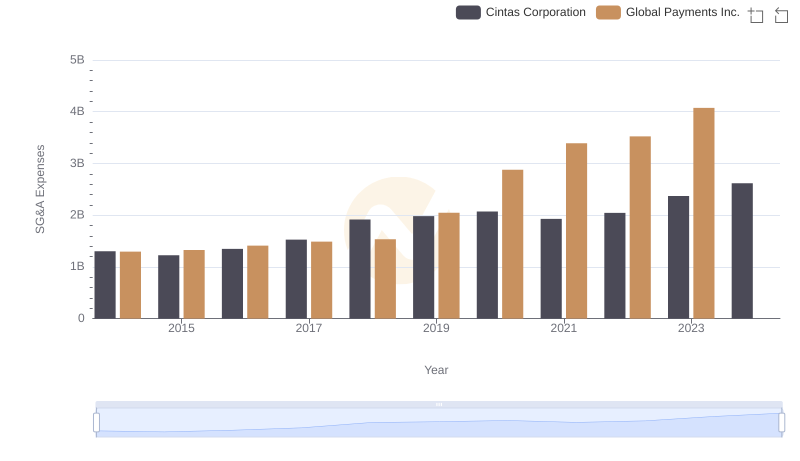

Cintas Corporation and Global Payments Inc.: SG&A Spending Patterns Compared

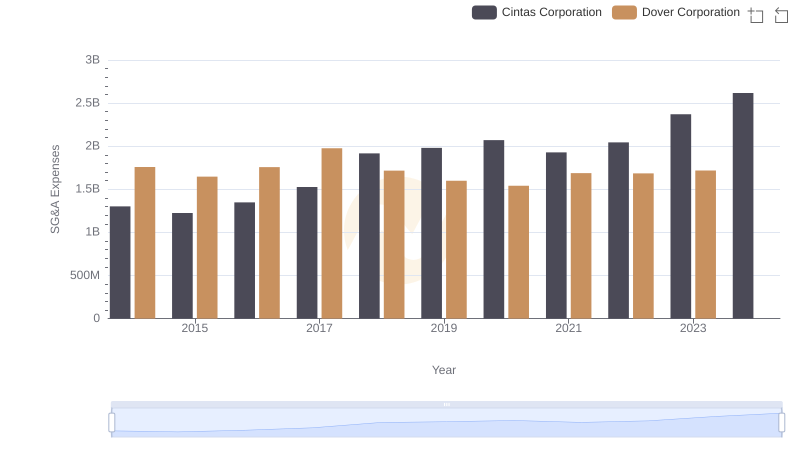

Cintas Corporation and Dover Corporation: SG&A Spending Patterns Compared

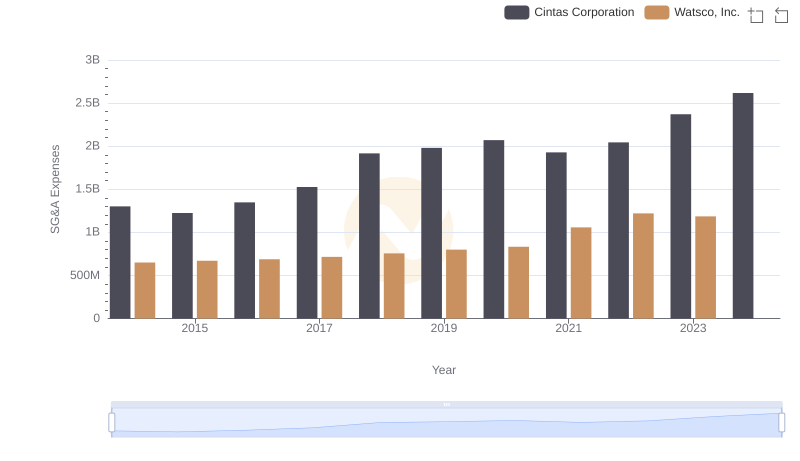

Cintas Corporation vs Watsco, Inc.: SG&A Expense Trends

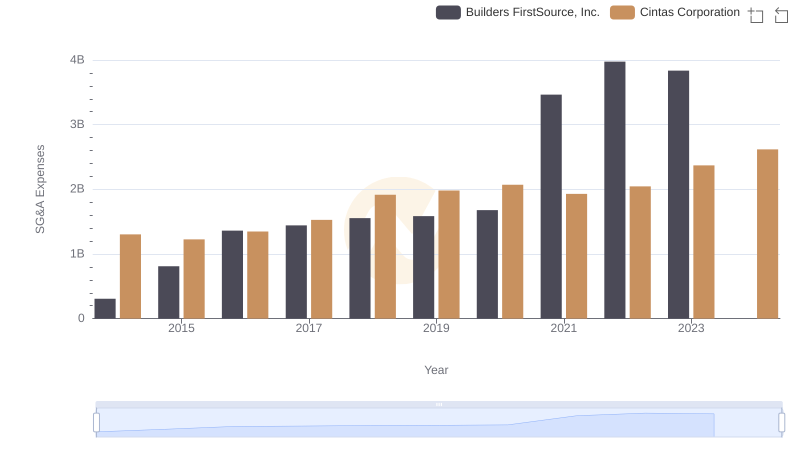

Breaking Down SG&A Expenses: Cintas Corporation vs Builders FirstSource, Inc.

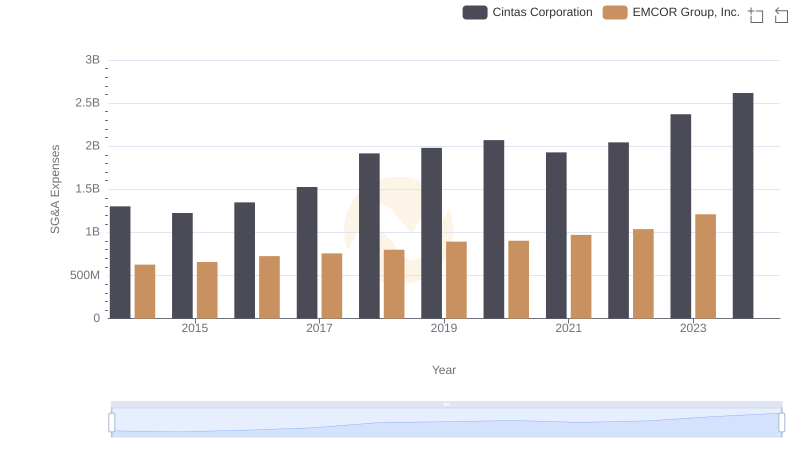

Comparing SG&A Expenses: Cintas Corporation vs EMCOR Group, Inc. Trends and Insights

EBITDA Metrics Evaluated: Cintas Corporation vs Hubbell Incorporated

Selling, General, and Administrative Costs: Cintas Corporation vs AerCap Holdings N.V.