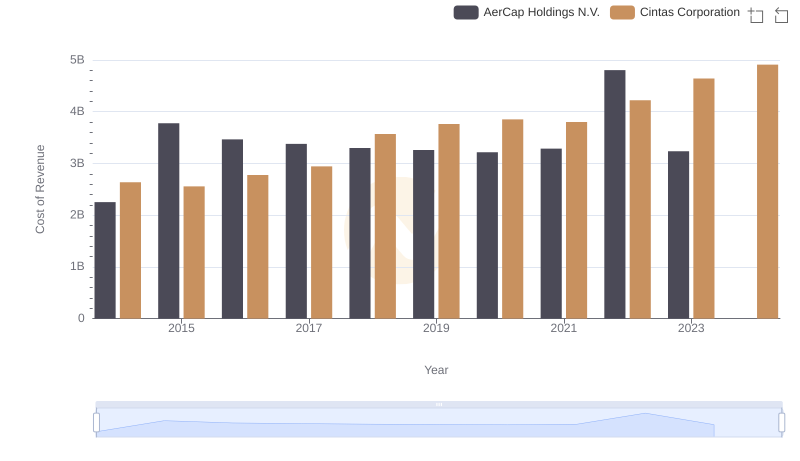

| __timestamp | AerCap Holdings N.V. | Cintas Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 3535797000 | 4551812000 |

| Thursday, January 1, 2015 | 5598662000 | 4476886000 |

| Friday, January 1, 2016 | 5152131000 | 4905458000 |

| Sunday, January 1, 2017 | 5037493000 | 5323381000 |

| Monday, January 1, 2018 | 4799980000 | 6476632000 |

| Tuesday, January 1, 2019 | 4937340000 | 6892303000 |

| Wednesday, January 1, 2020 | 4493629000 | 7085120000 |

| Friday, January 1, 2021 | 4588930000 | 7116340000 |

| Saturday, January 1, 2022 | 6914985000 | 7854459000 |

| Sunday, January 1, 2023 | 7574664000 | 8815769000 |

| Monday, January 1, 2024 | 9596615000 |

Cracking the code

In the ever-evolving landscape of global business, Cintas Corporation and AerCap Holdings N.V. stand as titans in their respective industries. Over the past decade, Cintas has consistently outpaced AerCap in revenue growth, showcasing a robust upward trajectory. From 2014 to 2023, Cintas' revenue surged by approximately 94%, reflecting its strategic expansion and market dominance. In contrast, AerCap's revenue grew by about 114% during the same period, highlighting its resilience and adaptability in the aviation leasing sector.

The year 2023 marked a significant milestone, with Cintas achieving a revenue of nearly $8.8 billion, while AerCap reached approximately $7.6 billion. Notably, Cintas' revenue for 2024 is projected to exceed $9.5 billion, underscoring its continued growth momentum. However, data for AerCap in 2024 remains unavailable, leaving room for speculation on its future performance.

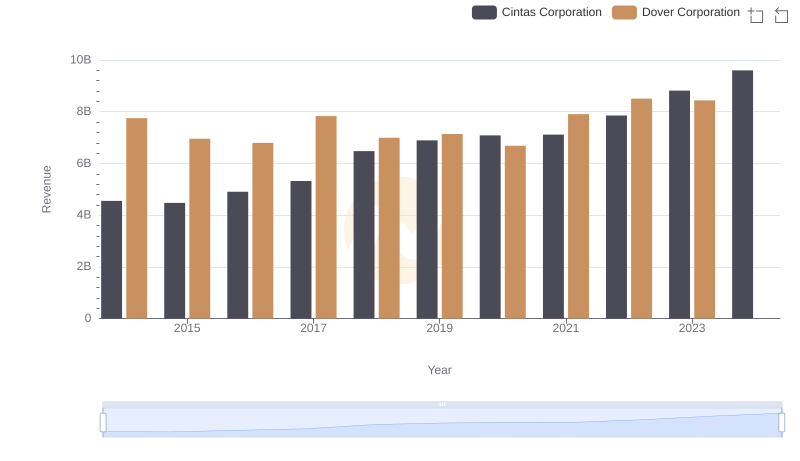

Revenue Insights: Cintas Corporation and Dover Corporation Performance Compared

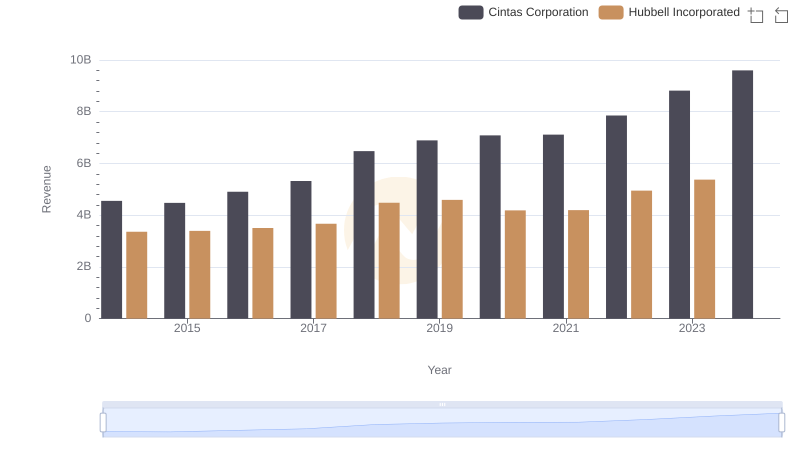

Comparing Revenue Performance: Cintas Corporation or Hubbell Incorporated?

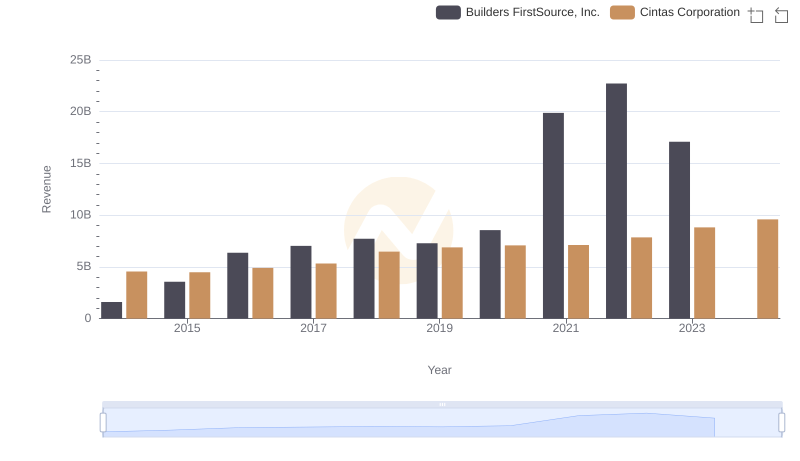

Cintas Corporation vs Builders FirstSource, Inc.: Annual Revenue Growth Compared

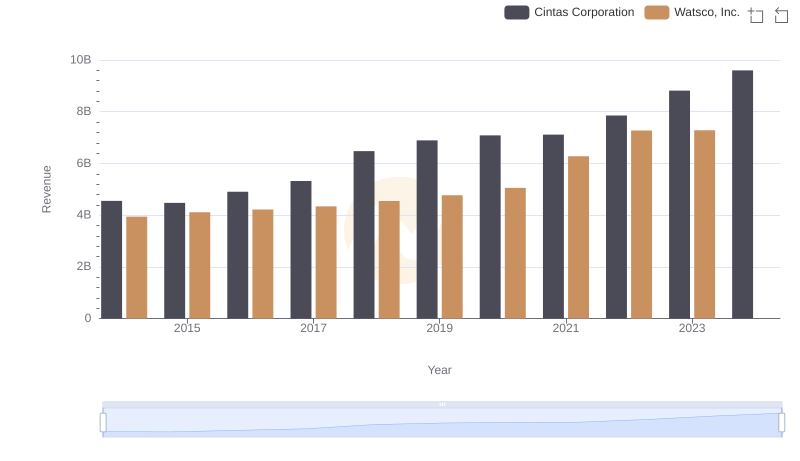

Cintas Corporation vs Watsco, Inc.: Examining Key Revenue Metrics

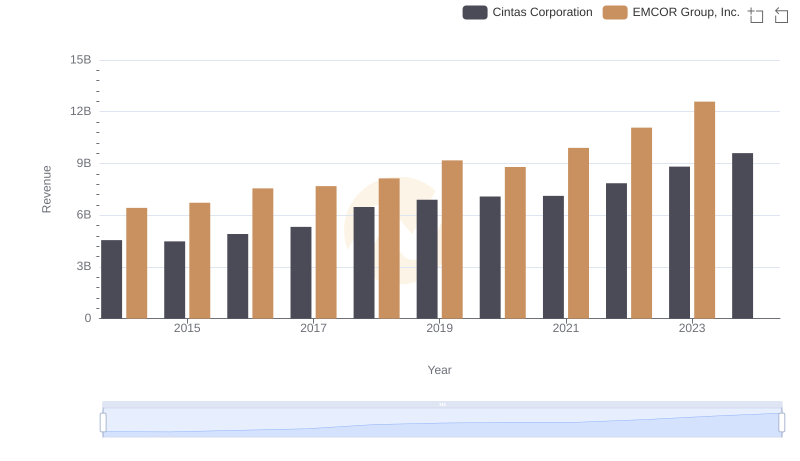

Cintas Corporation or EMCOR Group, Inc.: Who Leads in Yearly Revenue?

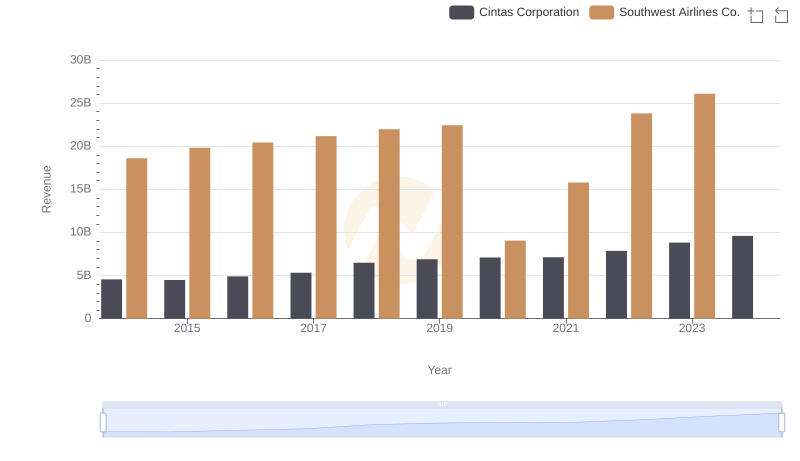

Annual Revenue Comparison: Cintas Corporation vs Southwest Airlines Co.

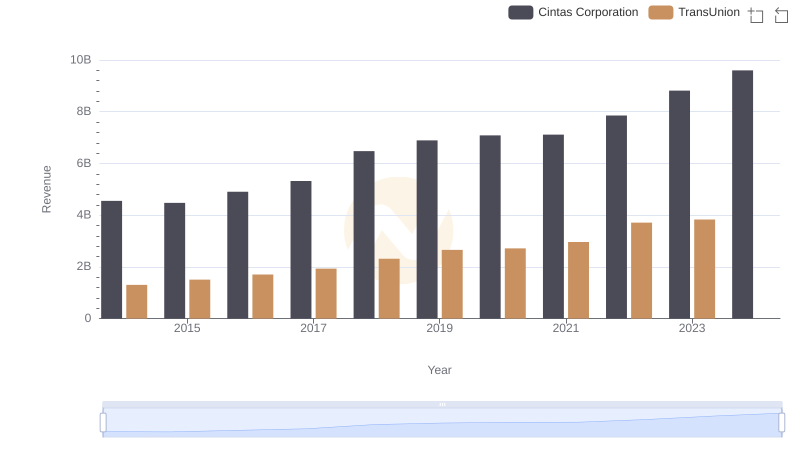

Cintas Corporation or TransUnion: Who Leads in Yearly Revenue?

Cost of Revenue Trends: Cintas Corporation vs AerCap Holdings N.V.

Who Generates Higher Gross Profit? Cintas Corporation or AerCap Holdings N.V.

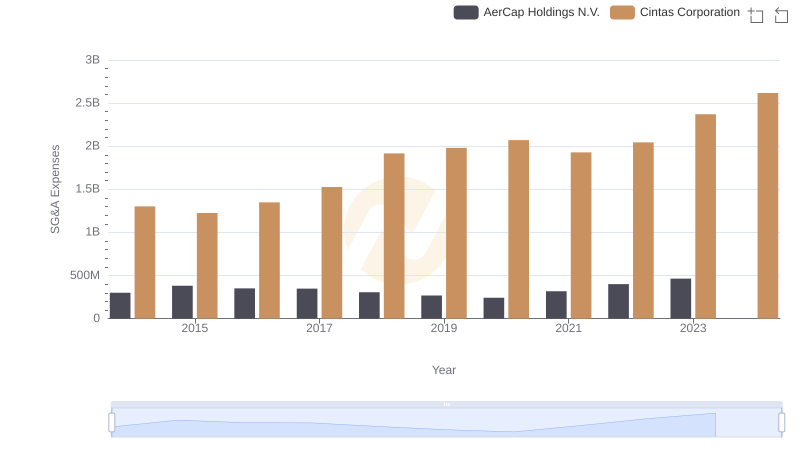

Selling, General, and Administrative Costs: Cintas Corporation vs AerCap Holdings N.V.

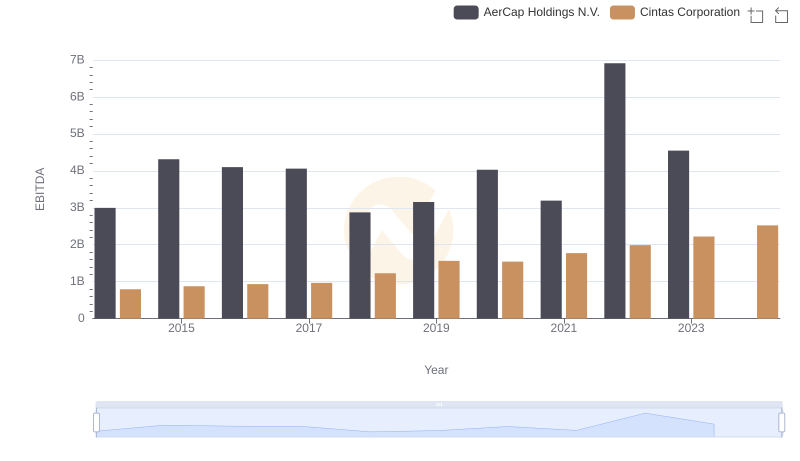

EBITDA Performance Review: Cintas Corporation vs AerCap Holdings N.V.