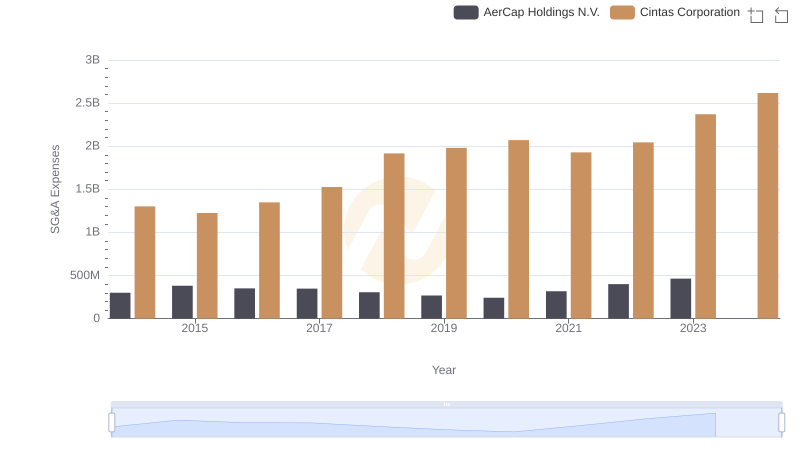

| __timestamp | AerCap Holdings N.V. | Cintas Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1282919000 | 1914386000 |

| Thursday, January 1, 2015 | 1822255000 | 1921337000 |

| Friday, January 1, 2016 | 1686404000 | 2129870000 |

| Sunday, January 1, 2017 | 1660054000 | 2380295000 |

| Monday, January 1, 2018 | 1500345000 | 2908523000 |

| Tuesday, January 1, 2019 | 1678249000 | 3128588000 |

| Wednesday, January 1, 2020 | 1276496000 | 3233748000 |

| Friday, January 1, 2021 | 1301517000 | 3314651000 |

| Saturday, January 1, 2022 | 2109708000 | 3632246000 |

| Sunday, January 1, 2023 | 4337648000 | 4173368000 |

| Monday, January 1, 2024 | 4686416000 |

In pursuit of knowledge

In the competitive world of corporate finance, understanding who leads in generating gross profit can offer valuable insights. From 2014 to 2023, Cintas Corporation consistently outperformed AerCap Holdings N.V. in terms of gross profit. Cintas saw a remarkable growth, with its gross profit increasing by over 118% from 2014 to 2023. In contrast, AerCap Holdings experienced a more modest growth of approximately 238% during the same period, with a significant spike in 2023.

Cintas Corporation's steady climb reflects its robust business model and market adaptability, while AerCap's recent surge suggests strategic shifts or market conditions favoring its operations. Notably, Cintas maintained a higher average gross profit, underscoring its dominance in the sector. As we look to the future, the absence of data for AerCap in 2024 leaves room for speculation on its trajectory.

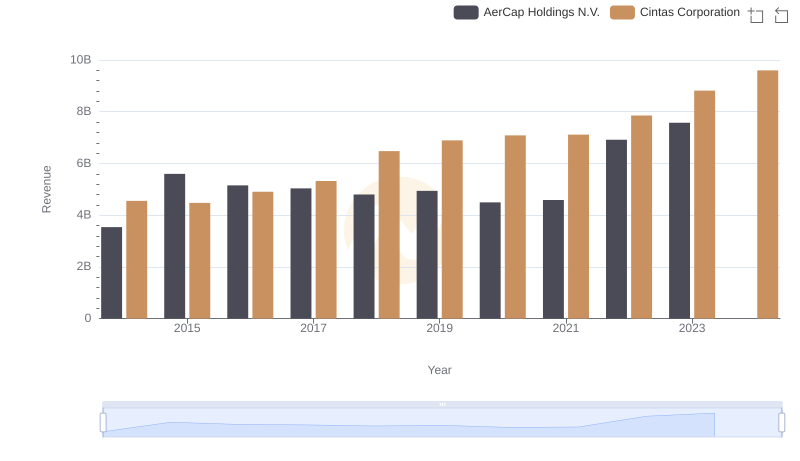

Annual Revenue Comparison: Cintas Corporation vs AerCap Holdings N.V.

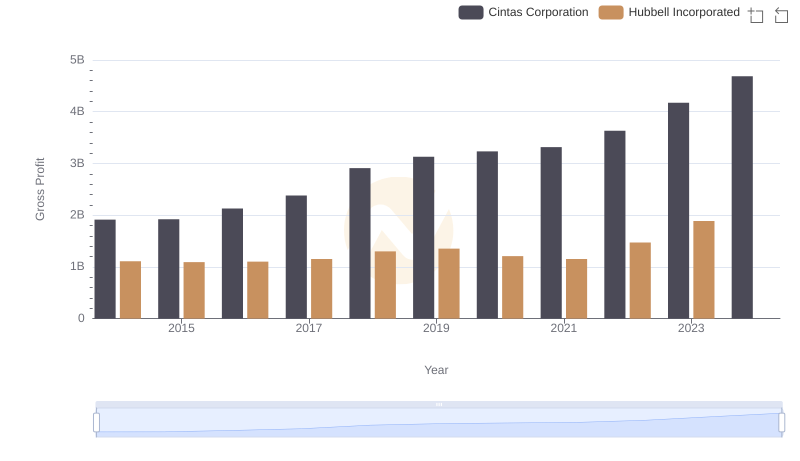

Gross Profit Comparison: Cintas Corporation and Hubbell Incorporated Trends

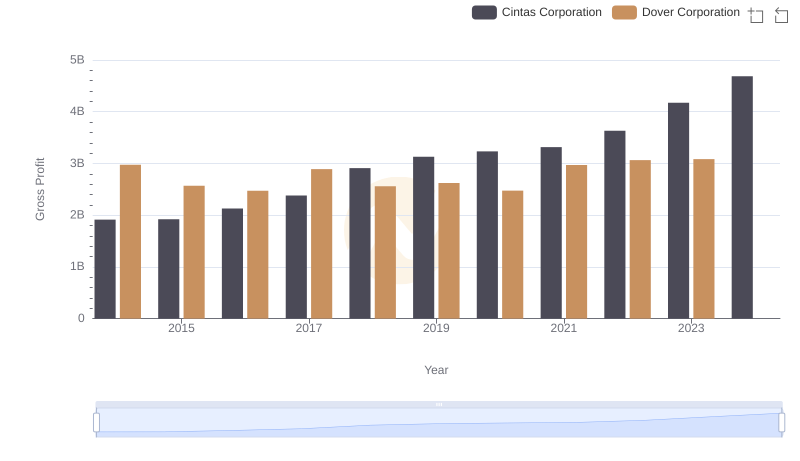

Gross Profit Analysis: Comparing Cintas Corporation and Dover Corporation

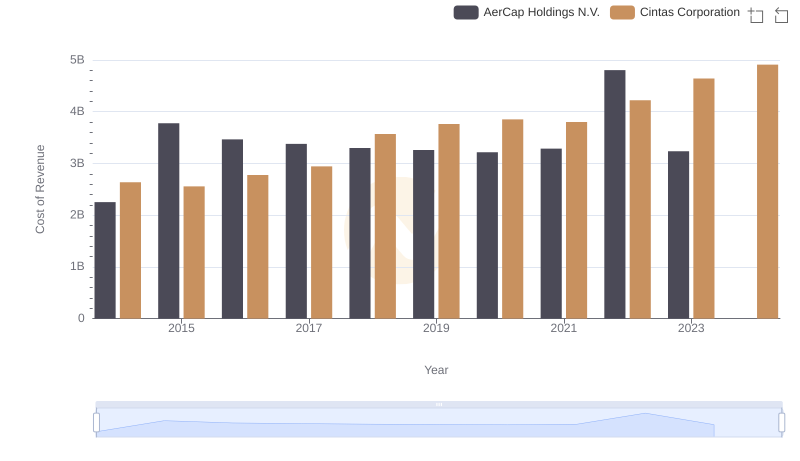

Cost of Revenue Trends: Cintas Corporation vs AerCap Holdings N.V.

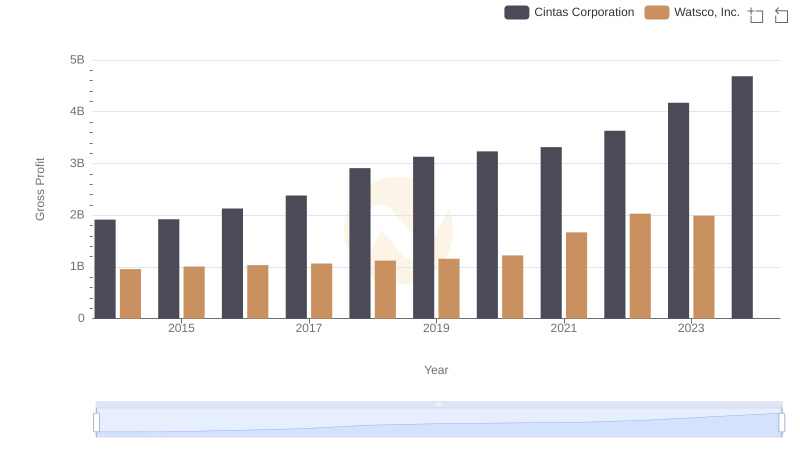

Cintas Corporation and Watsco, Inc.: A Detailed Gross Profit Analysis

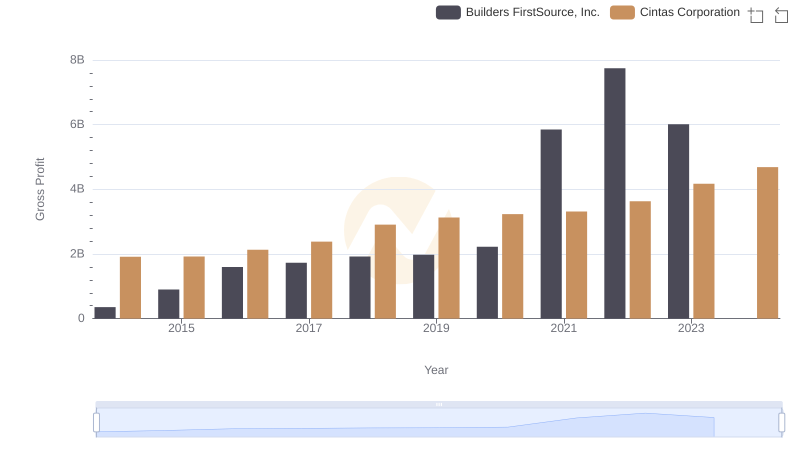

Key Insights on Gross Profit: Cintas Corporation vs Builders FirstSource, Inc.

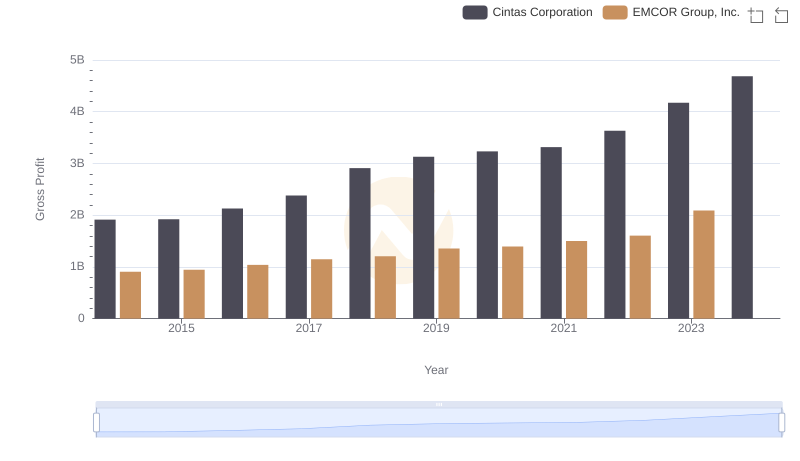

Gross Profit Trends Compared: Cintas Corporation vs EMCOR Group, Inc.

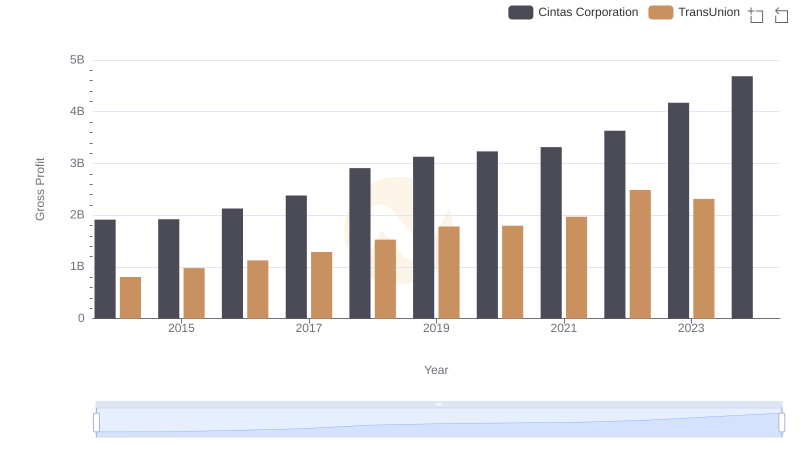

Gross Profit Trends Compared: Cintas Corporation vs TransUnion

Selling, General, and Administrative Costs: Cintas Corporation vs AerCap Holdings N.V.

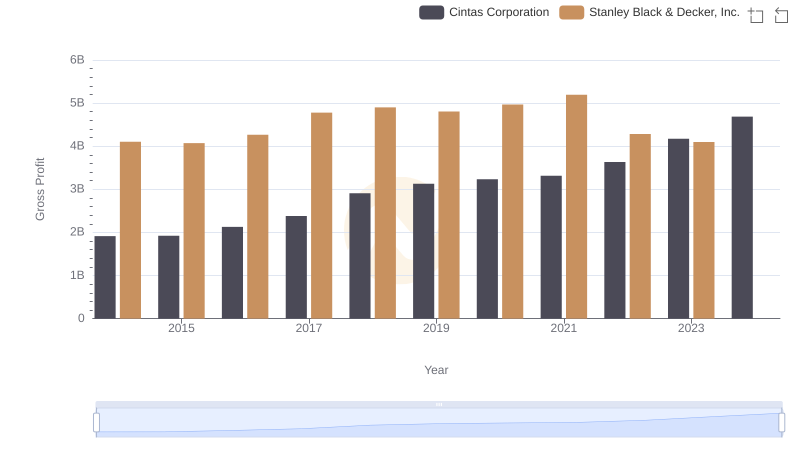

Key Insights on Gross Profit: Cintas Corporation vs Stanley Black & Decker, Inc.

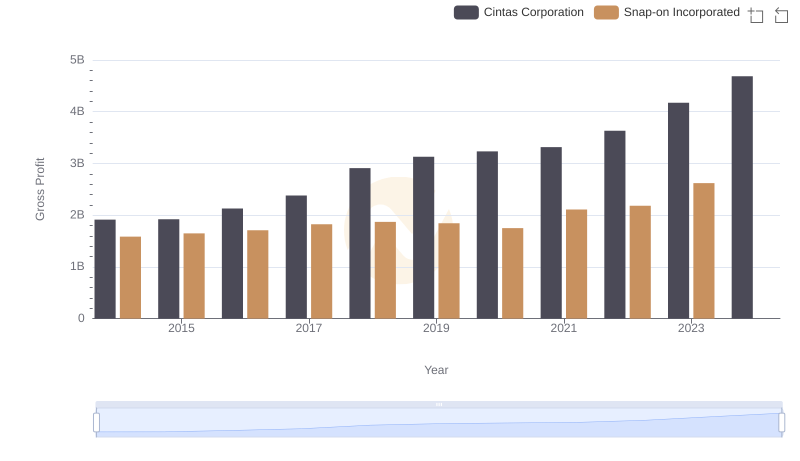

Gross Profit Trends Compared: Cintas Corporation vs Snap-on Incorporated

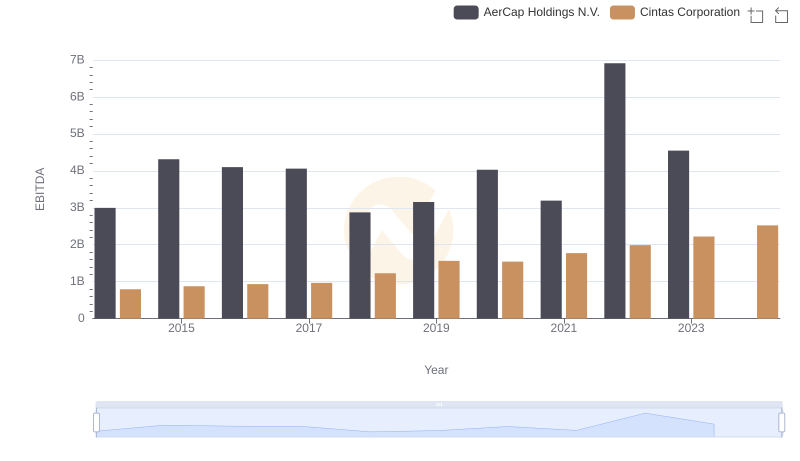

EBITDA Performance Review: Cintas Corporation vs AerCap Holdings N.V.