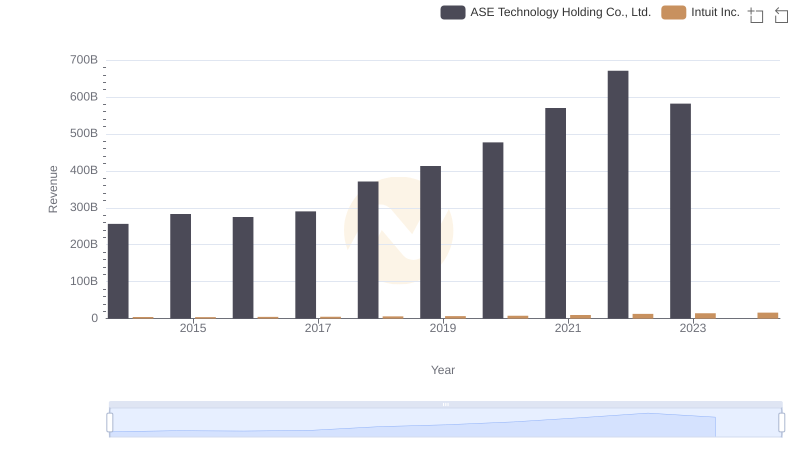

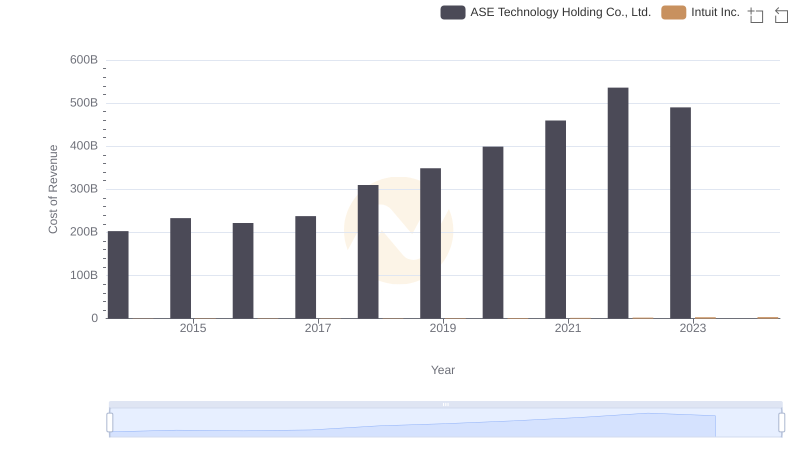

| __timestamp | ASE Technology Holding Co., Ltd. | Intuit Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 53540000000 | 3838000000 |

| Thursday, January 1, 2015 | 50149000000 | 3467000000 |

| Friday, January 1, 2016 | 53194000000 | 3942000000 |

| Sunday, January 1, 2017 | 52732000000 | 4368000000 |

| Monday, January 1, 2018 | 61163000000 | 4987000000 |

| Tuesday, January 1, 2019 | 64311000000 | 5617000000 |

| Wednesday, January 1, 2020 | 77984000000 | 6301000000 |

| Friday, January 1, 2021 | 110369000000 | 7950000000 |

| Saturday, January 1, 2022 | 134930000000 | 10320000000 |

| Sunday, January 1, 2023 | 91757132000 | 11225000000 |

| Monday, January 1, 2024 | 95687183000 | 12820000000 |

Data in motion

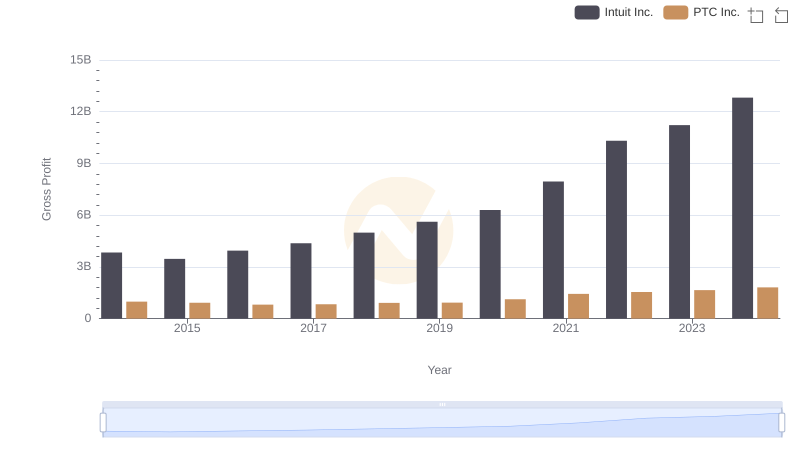

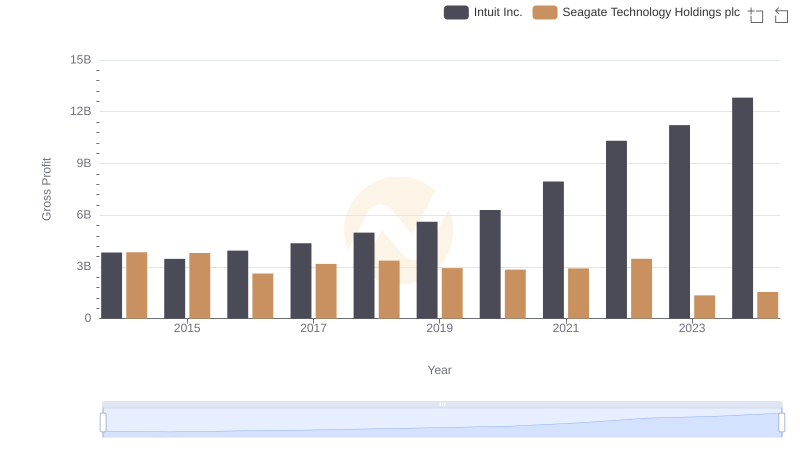

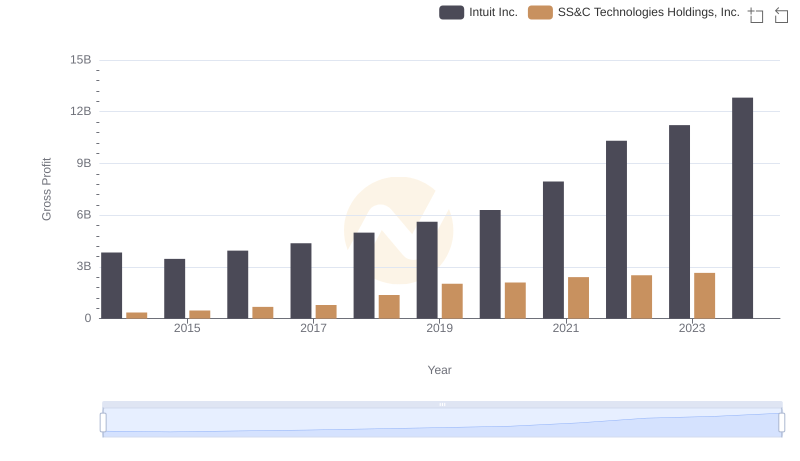

In the ever-evolving landscape of global finance, the performance of industry titans like Intuit Inc. and ASE Technology Holding Co., Ltd. offers a fascinating glimpse into market dynamics. Over the past decade, ASE Technology has consistently outperformed Intuit in terms of gross profit, boasting a staggering 1,349% increase from 2014 to 2022. In contrast, Intuit's growth, while impressive, saw a more modest 234% rise during the same period.

The year 2021 marked a significant milestone for ASE Technology, with gross profits peaking at over 110% compared to the previous year, reflecting its robust market position. Meanwhile, Intuit's steady climb reached a new high in 2023, with a 12% increase from 2022. However, data for ASE Technology in 2024 remains elusive, leaving room for speculation on its future trajectory.

This comparative analysis underscores the diverse strategies and market conditions shaping these two corporate giants.

Annual Revenue Comparison: Intuit Inc. vs ASE Technology Holding Co., Ltd.

Gross Profit Analysis: Comparing Intuit Inc. and PTC Inc.

Gross Profit Analysis: Comparing Intuit Inc. and Seagate Technology Holdings plc

Cost of Revenue Comparison: Intuit Inc. vs ASE Technology Holding Co., Ltd.

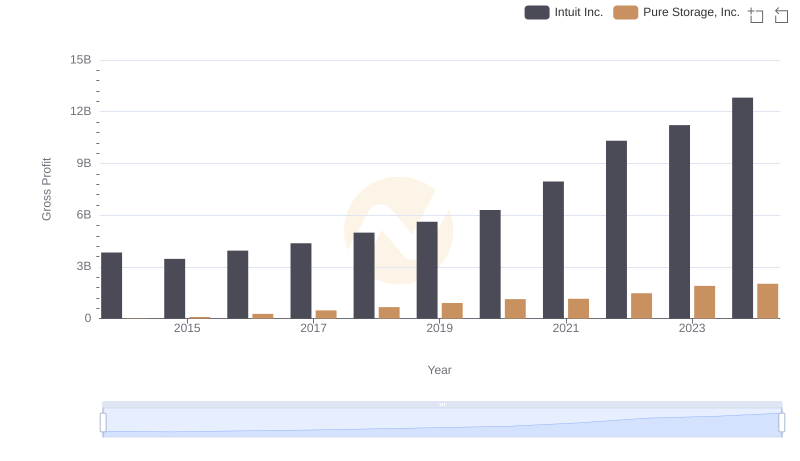

Intuit Inc. vs Pure Storage, Inc.: A Gross Profit Performance Breakdown

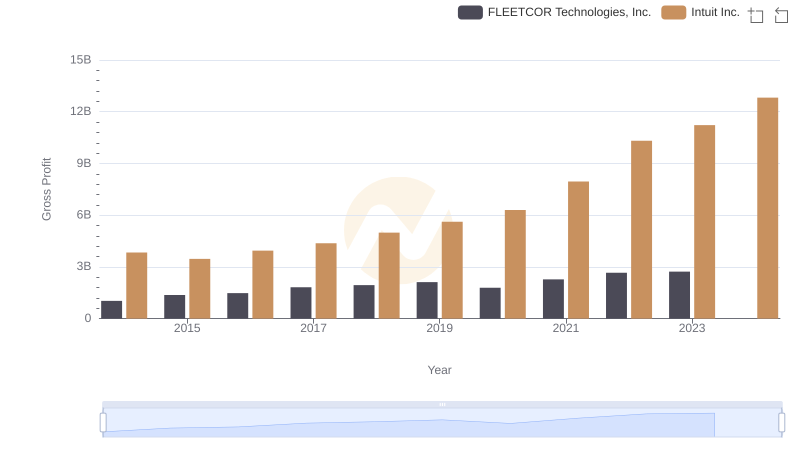

Gross Profit Trends Compared: Intuit Inc. vs FLEETCOR Technologies, Inc.

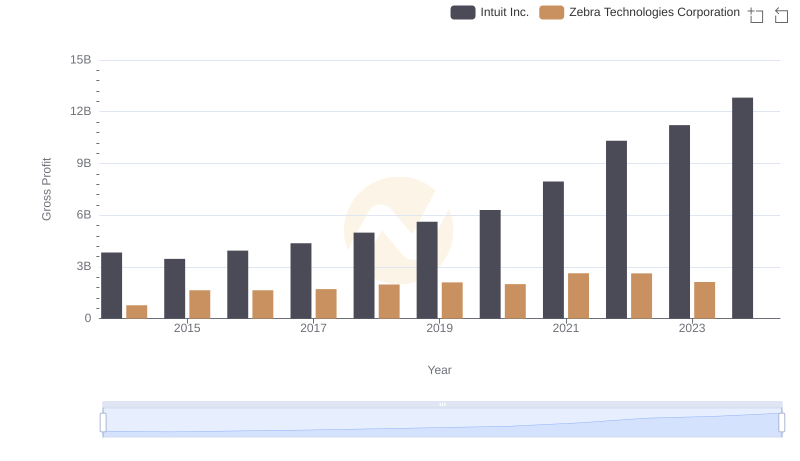

Who Generates Higher Gross Profit? Intuit Inc. or Zebra Technologies Corporation

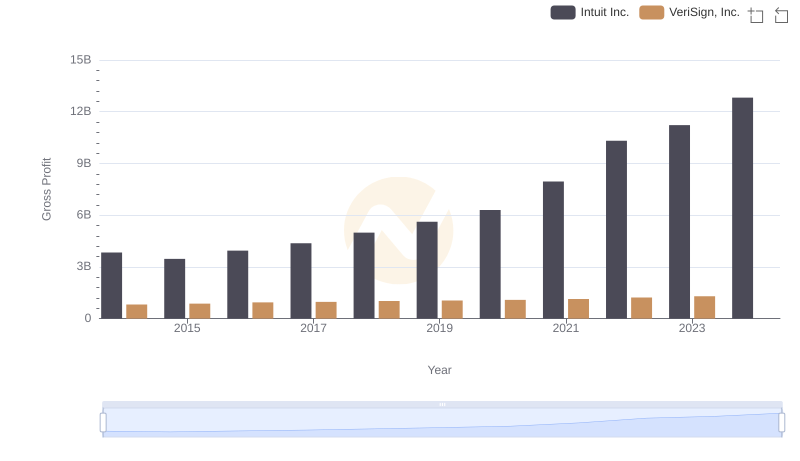

Gross Profit Comparison: Intuit Inc. and VeriSign, Inc. Trends

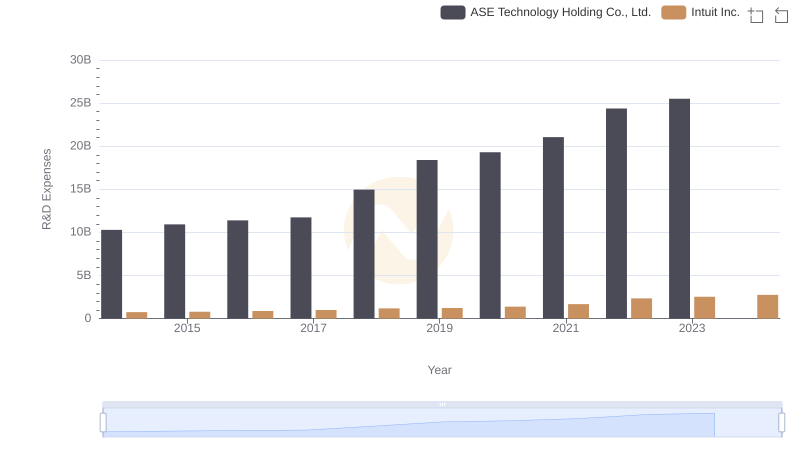

Intuit Inc. or ASE Technology Holding Co., Ltd.: Who Invests More in Innovation?

Gross Profit Comparison: Intuit Inc. and SS&C Technologies Holdings, Inc. Trends

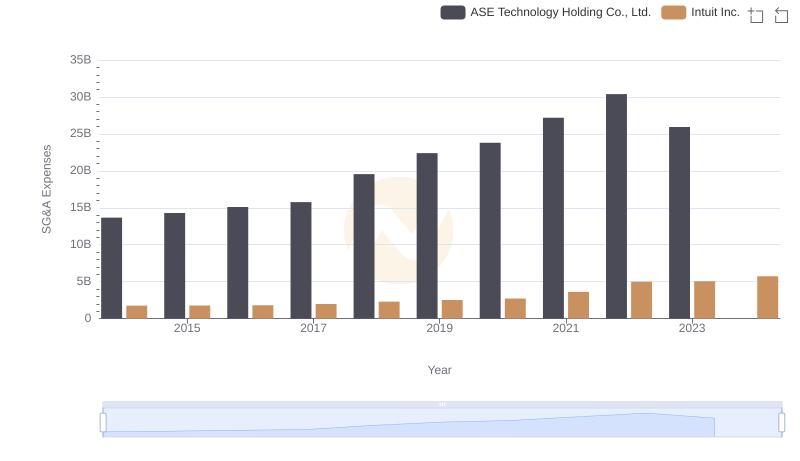

Cost Management Insights: SG&A Expenses for Intuit Inc. and ASE Technology Holding Co., Ltd.

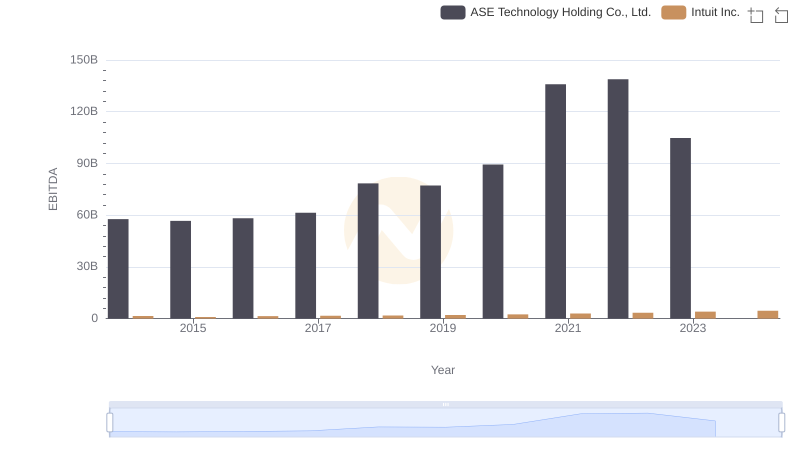

EBITDA Metrics Evaluated: Intuit Inc. vs ASE Technology Holding Co., Ltd.