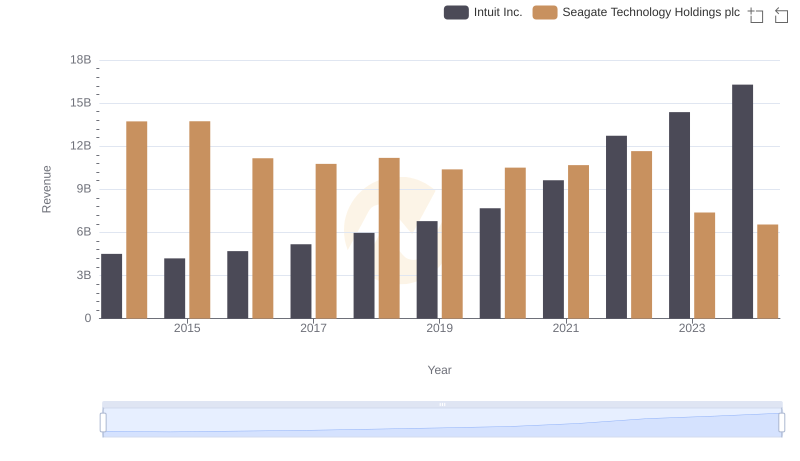

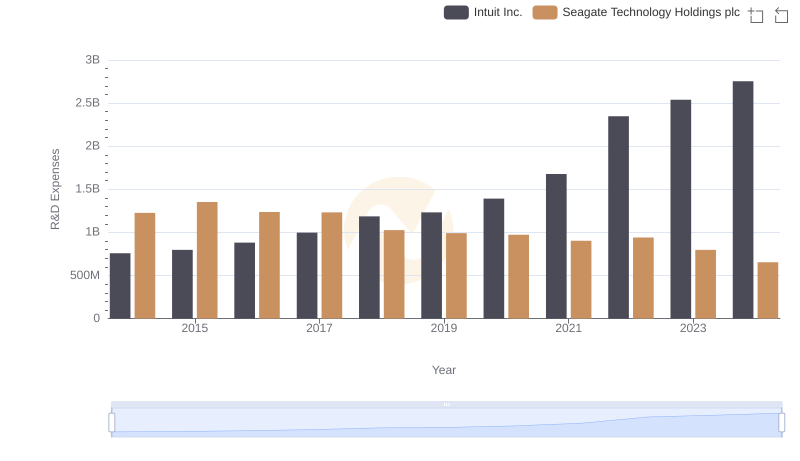

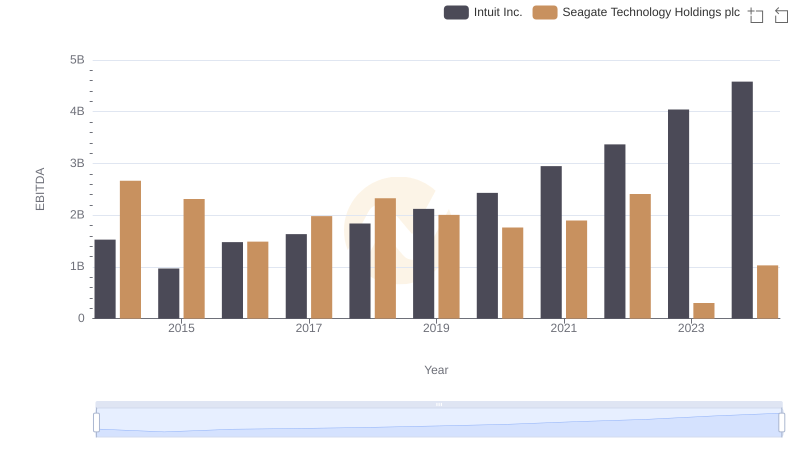

| __timestamp | Intuit Inc. | Seagate Technology Holdings plc |

|---|---|---|

| Wednesday, January 1, 2014 | 3838000000 | 3846000000 |

| Thursday, January 1, 2015 | 3467000000 | 3809000000 |

| Friday, January 1, 2016 | 3942000000 | 2615000000 |

| Sunday, January 1, 2017 | 4368000000 | 3174000000 |

| Monday, January 1, 2018 | 4987000000 | 3364000000 |

| Tuesday, January 1, 2019 | 5617000000 | 2932000000 |

| Wednesday, January 1, 2020 | 6301000000 | 2842000000 |

| Friday, January 1, 2021 | 7950000000 | 2917000000 |

| Saturday, January 1, 2022 | 10320000000 | 3469000000 |

| Sunday, January 1, 2023 | 11225000000 | 1351000000 |

| Monday, January 1, 2024 | 12820000000 | 1546000000 |

Igniting the spark of knowledge

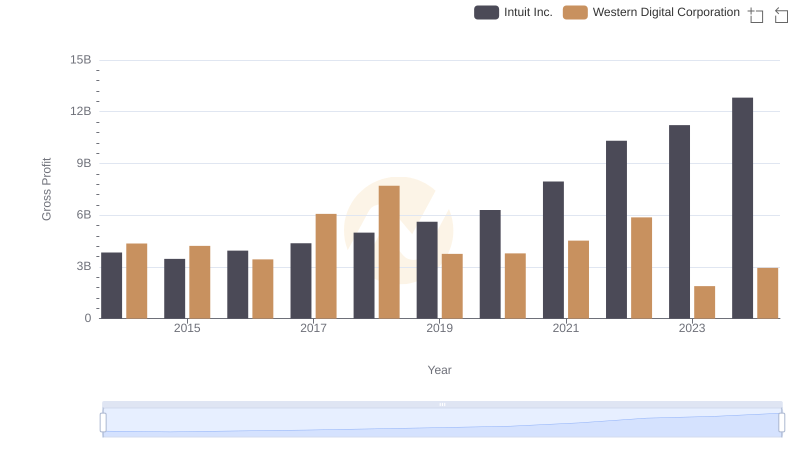

In the ever-evolving landscape of technology, financial performance is a key indicator of a company's resilience and growth. Over the past decade, Intuit Inc. has demonstrated a remarkable upward trajectory in gross profit, growing by approximately 233% from 2014 to 2024. This growth reflects Intuit's strategic innovations and market adaptability, positioning it as a leader in financial software solutions.

Conversely, Seagate Technology Holdings plc has faced challenges, with its gross profit declining by about 60% over the same period. This trend highlights the competitive pressures in the data storage industry and the need for Seagate to innovate and diversify its offerings.

The contrasting financial paths of these two giants underscore the dynamic nature of the tech industry, where adaptability and innovation are crucial for sustained success.

Revenue Showdown: Intuit Inc. vs Seagate Technology Holdings plc

Intuit Inc. vs ON Semiconductor Corporation: A Gross Profit Performance Breakdown

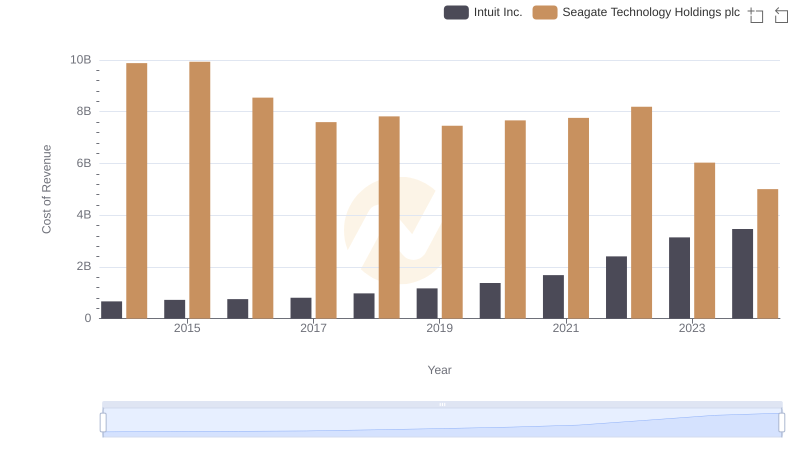

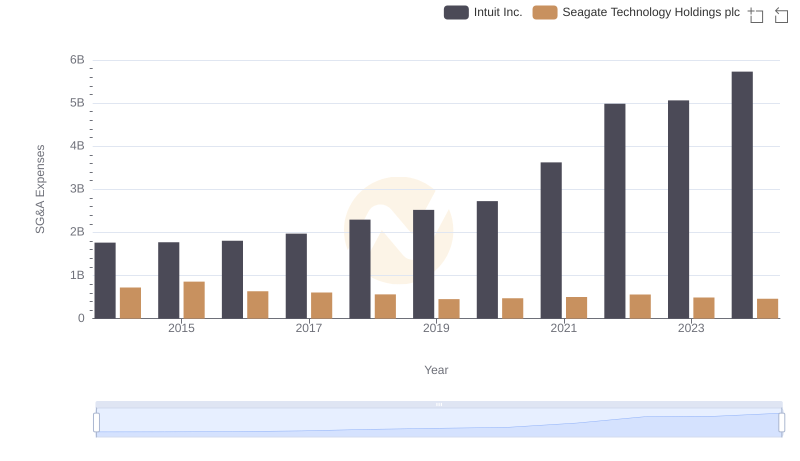

Cost Insights: Breaking Down Intuit Inc. and Seagate Technology Holdings plc's Expenses

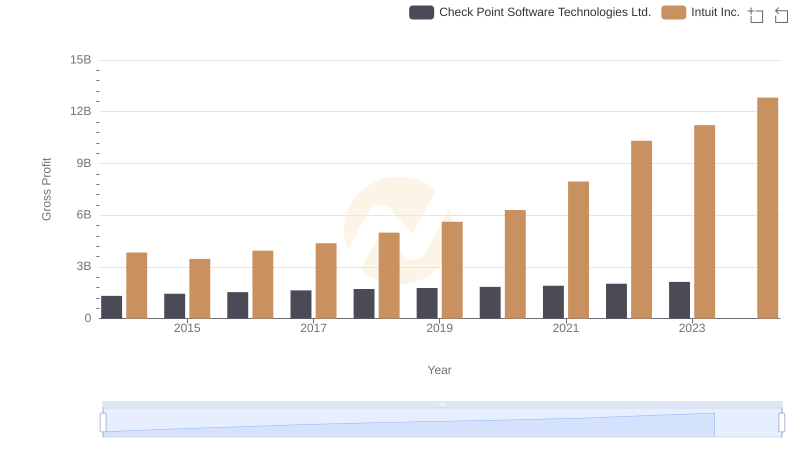

Who Generates Higher Gross Profit? Intuit Inc. or Check Point Software Technologies Ltd.

Intuit Inc. and Western Digital Corporation: A Detailed Gross Profit Analysis

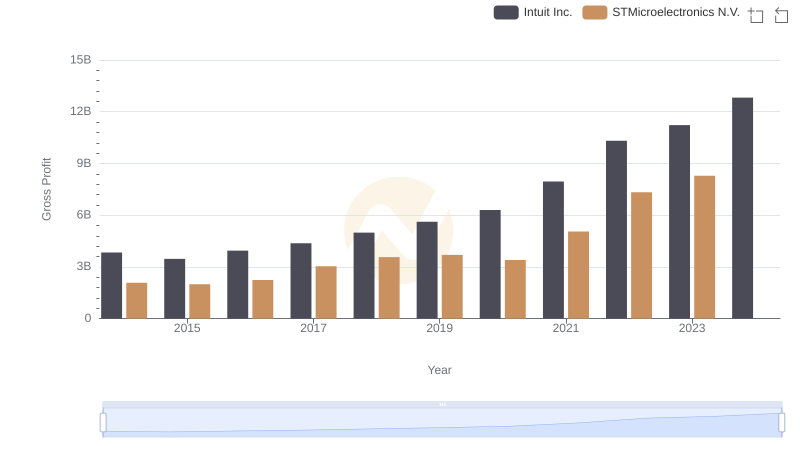

Gross Profit Analysis: Comparing Intuit Inc. and STMicroelectronics N.V.

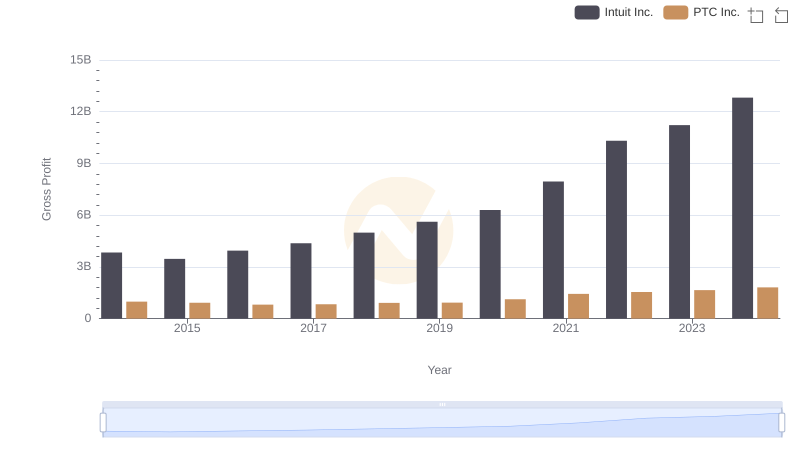

Gross Profit Analysis: Comparing Intuit Inc. and PTC Inc.

Research and Development Investment: Intuit Inc. vs Seagate Technology Holdings plc

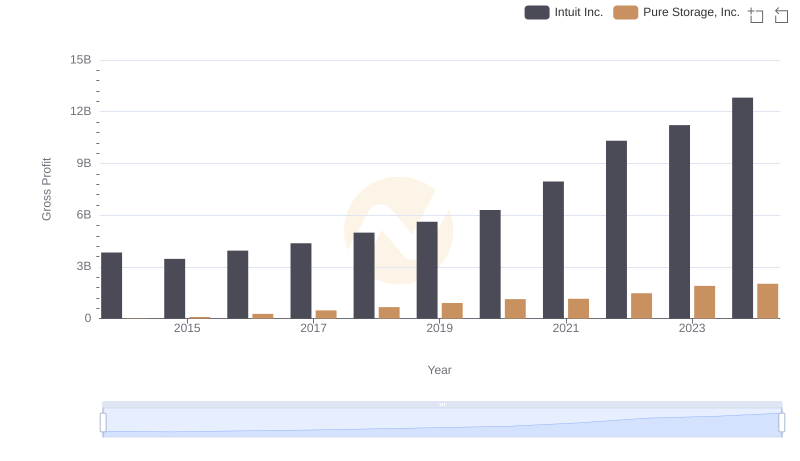

Intuit Inc. vs Pure Storage, Inc.: A Gross Profit Performance Breakdown

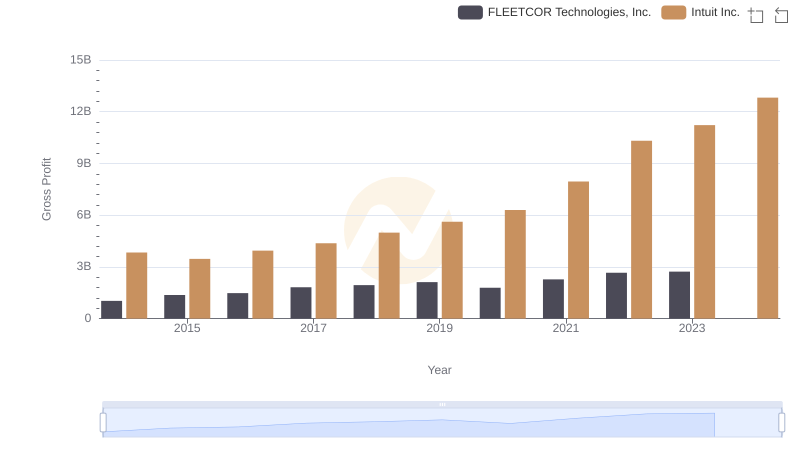

Gross Profit Trends Compared: Intuit Inc. vs FLEETCOR Technologies, Inc.

Cost Management Insights: SG&A Expenses for Intuit Inc. and Seagate Technology Holdings plc

Intuit Inc. vs Seagate Technology Holdings plc: In-Depth EBITDA Performance Comparison