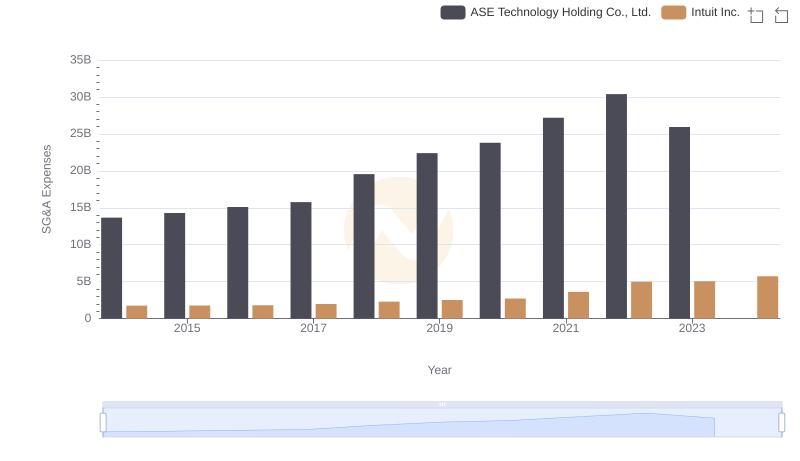

| __timestamp | ASE Technology Holding Co., Ltd. | Intuit Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 57728376000 | 1528000000 |

| Thursday, January 1, 2015 | 56716330000 | 970000000 |

| Friday, January 1, 2016 | 58196307000 | 1480000000 |

| Sunday, January 1, 2017 | 61377328000 | 1634000000 |

| Monday, January 1, 2018 | 78432873000 | 1839000000 |

| Tuesday, January 1, 2019 | 77173662000 | 2121000000 |

| Wednesday, January 1, 2020 | 89377502000 | 2430000000 |

| Friday, January 1, 2021 | 135966088000 | 2948000000 |

| Saturday, January 1, 2022 | 138852591000 | 3369000000 |

| Sunday, January 1, 2023 | 104757657000 | 4043000000 |

| Monday, January 1, 2024 | 104735170000 | 4581000000 |

Infusing magic into the data realm

In the ever-evolving landscape of global finance, understanding the EBITDA trends of major corporations offers invaluable insights. Over the past decade, ASE Technology Holding Co., Ltd. has consistently outperformed Intuit Inc. in terms of EBITDA, showcasing a robust growth trajectory. From 2014 to 2023, ASE Technology's EBITDA surged by approximately 82%, peaking in 2022. In contrast, Intuit Inc. demonstrated a steady, albeit modest, growth of around 165% over the same period, with its EBITDA reaching its zenith in 2024. This divergence highlights ASE Technology's dominance in the semiconductor industry, while Intuit's growth reflects its strategic expansion in the software sector. Notably, the data for 2024 is incomplete for ASE Technology, indicating potential volatility or reporting delays. As investors and analysts scrutinize these metrics, the narrative of technological advancement and financial strategy continues to unfold.

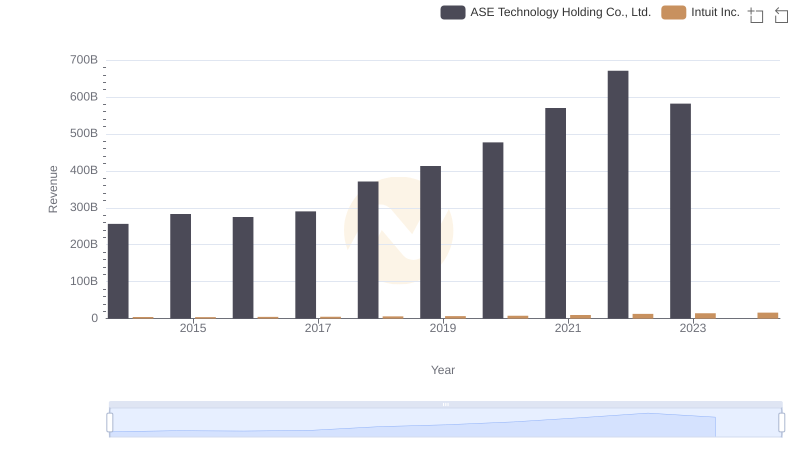

Annual Revenue Comparison: Intuit Inc. vs ASE Technology Holding Co., Ltd.

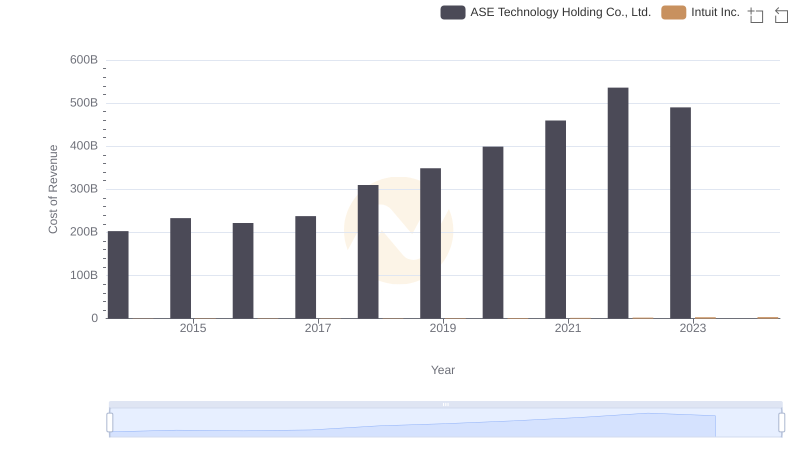

Cost of Revenue Comparison: Intuit Inc. vs ASE Technology Holding Co., Ltd.

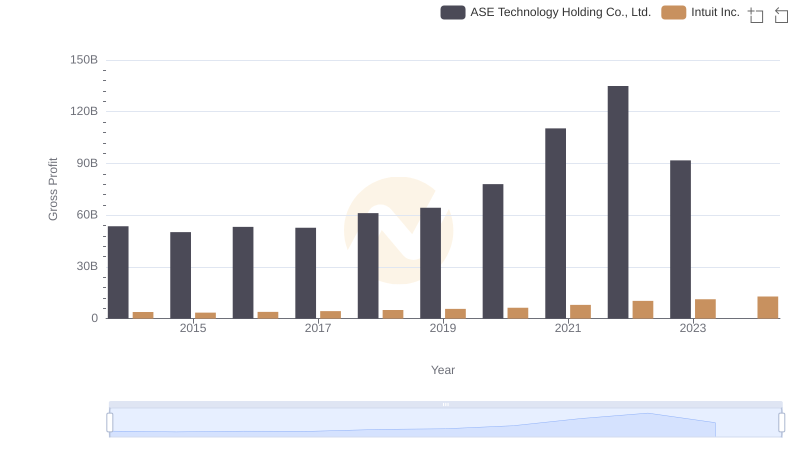

Intuit Inc. vs ASE Technology Holding Co., Ltd.: A Gross Profit Performance Breakdown

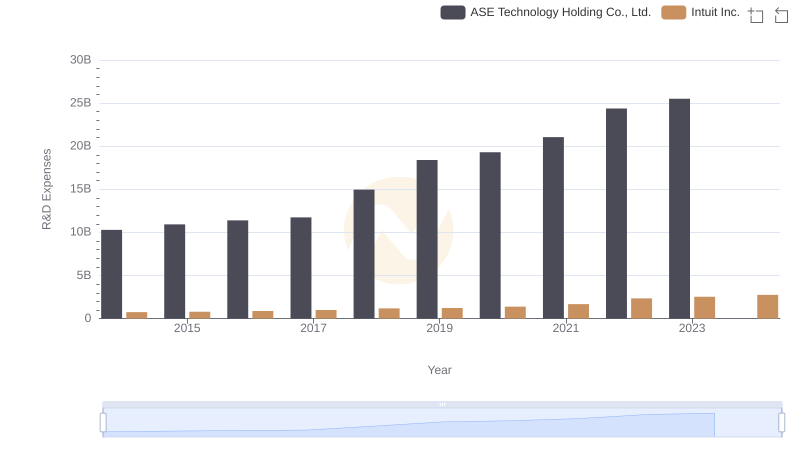

Intuit Inc. or ASE Technology Holding Co., Ltd.: Who Invests More in Innovation?

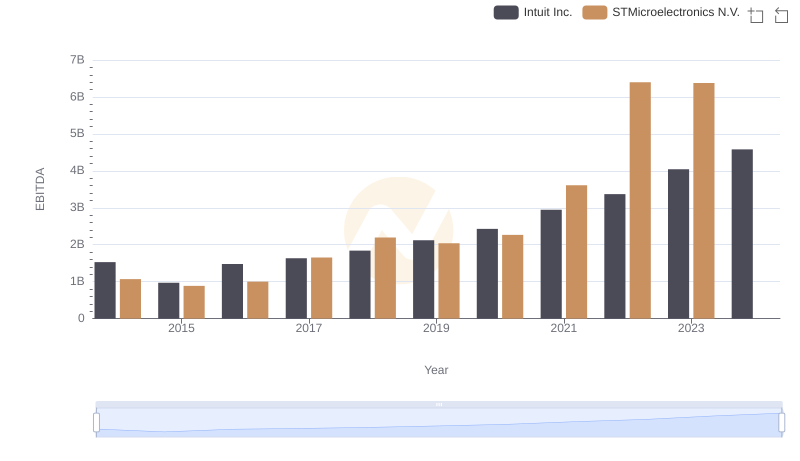

EBITDA Analysis: Evaluating Intuit Inc. Against STMicroelectronics N.V.

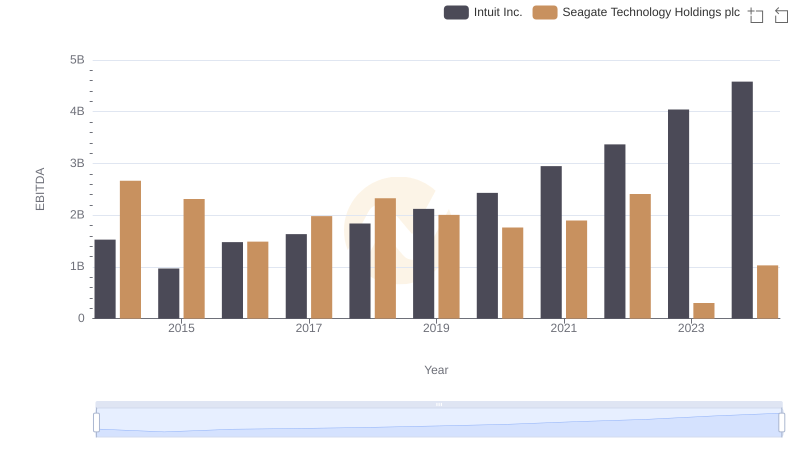

Intuit Inc. vs Seagate Technology Holdings plc: In-Depth EBITDA Performance Comparison

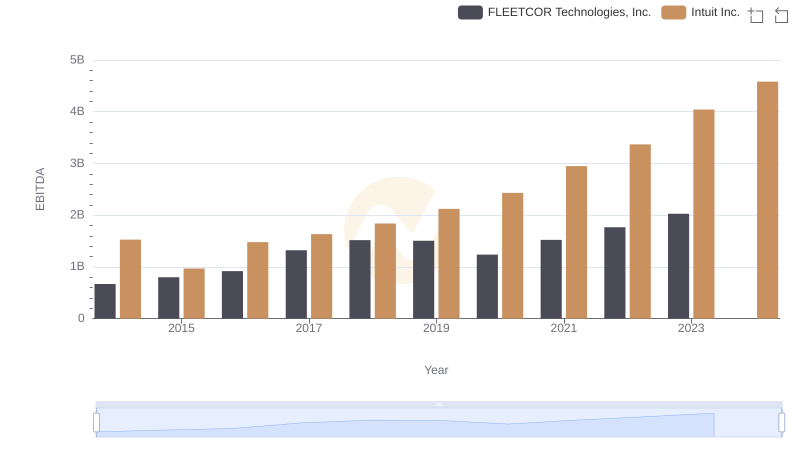

Professional EBITDA Benchmarking: Intuit Inc. vs FLEETCOR Technologies, Inc.

Cost Management Insights: SG&A Expenses for Intuit Inc. and ASE Technology Holding Co., Ltd.

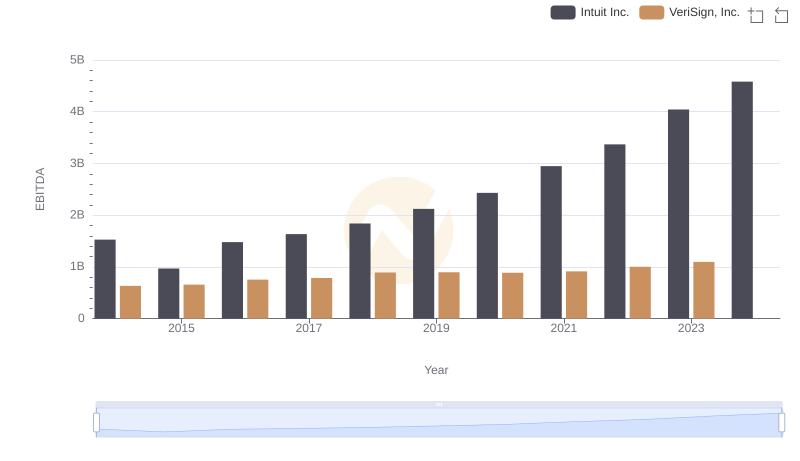

Professional EBITDA Benchmarking: Intuit Inc. vs VeriSign, Inc.

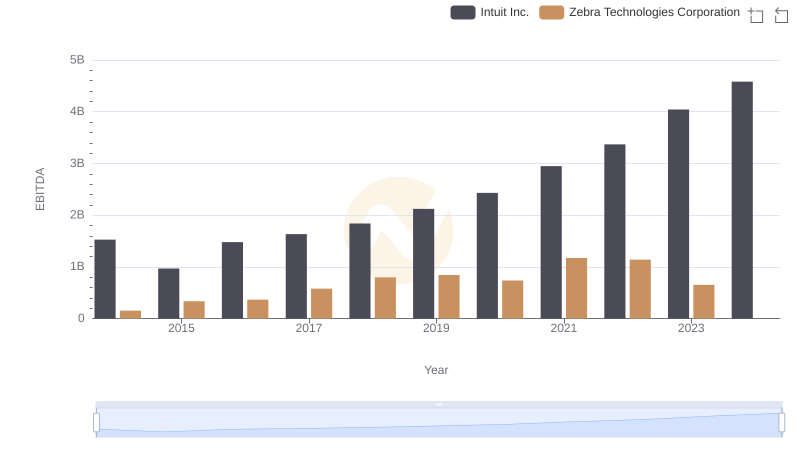

EBITDA Analysis: Evaluating Intuit Inc. Against Zebra Technologies Corporation

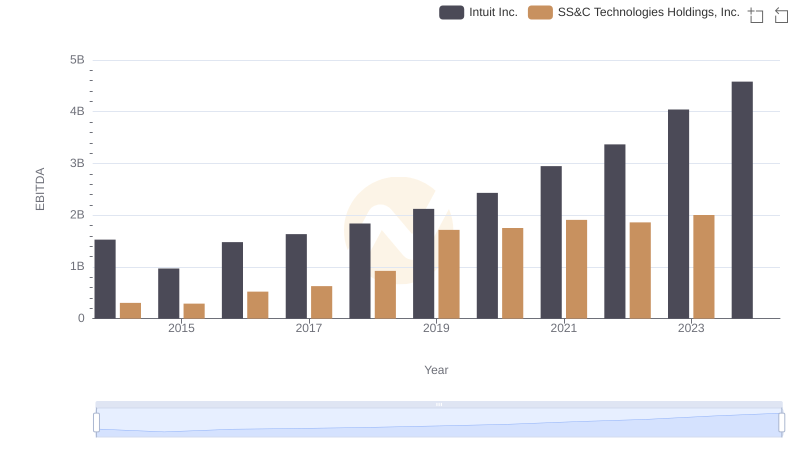

EBITDA Performance Review: Intuit Inc. vs SS&C Technologies Holdings, Inc.

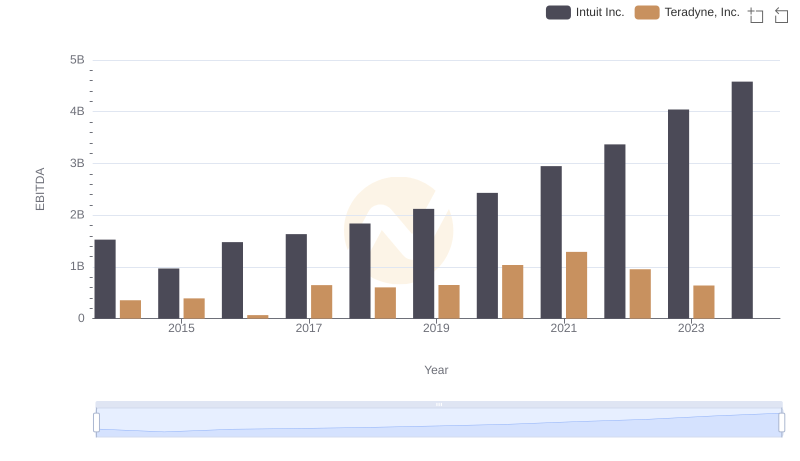

A Side-by-Side Analysis of EBITDA: Intuit Inc. and Teradyne, Inc.