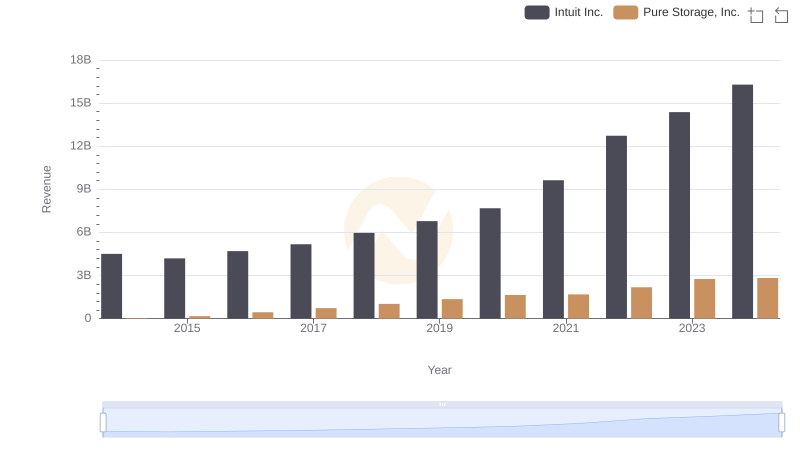

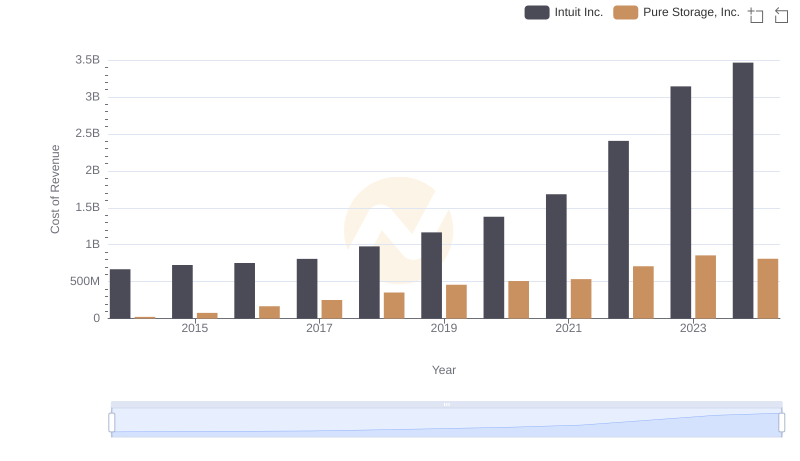

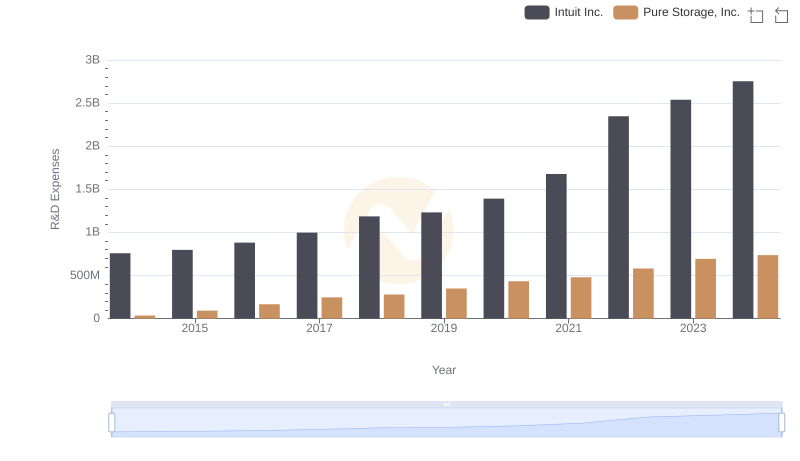

| __timestamp | Intuit Inc. | Pure Storage, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 3838000000 | 18604000 |

| Thursday, January 1, 2015 | 3467000000 | 96899000 |

| Friday, January 1, 2016 | 3942000000 | 272440000 |

| Sunday, January 1, 2017 | 4368000000 | 475698000 |

| Monday, January 1, 2018 | 4987000000 | 669238000 |

| Tuesday, January 1, 2019 | 5617000000 | 902296000 |

| Wednesday, January 1, 2020 | 6301000000 | 1133554000 |

| Friday, January 1, 2021 | 7950000000 | 1148924000 |

| Saturday, January 1, 2022 | 10320000000 | 1472519000 |

| Sunday, January 1, 2023 | 11225000000 | 1897646000 |

| Monday, January 1, 2024 | 12820000000 | 2021191000 |

Cracking the code

In the ever-evolving landscape of technology, Intuit Inc. and Pure Storage, Inc. have showcased remarkable growth trajectories in their gross profit over the past decade. Starting in 2014, Intuit's gross profit was approximately $3.8 billion, while Pure Storage was just beginning its journey with a modest $18.6 million. Fast forward to 2024, Intuit's gross profit has surged by over 230%, reaching an impressive $12.8 billion. Meanwhile, Pure Storage has experienced exponential growth, with its gross profit increasing by more than 10,000% to $2 billion.

This performance highlights Intuit's steady and robust growth, reflecting its strong market position and strategic innovations. On the other hand, Pure Storage's rapid ascent underscores its disruptive potential in the storage solutions market. As we look to the future, these trends suggest a dynamic competitive landscape, with both companies poised for continued success.

Intuit Inc. or Pure Storage, Inc.: Who Leads in Yearly Revenue?

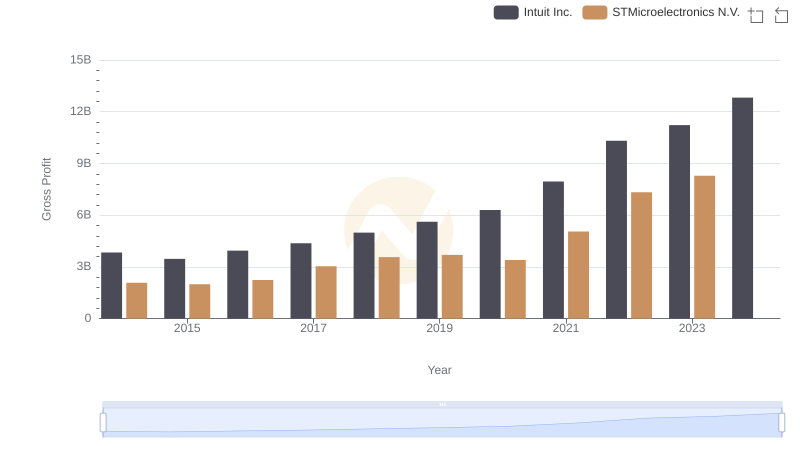

Gross Profit Analysis: Comparing Intuit Inc. and STMicroelectronics N.V.

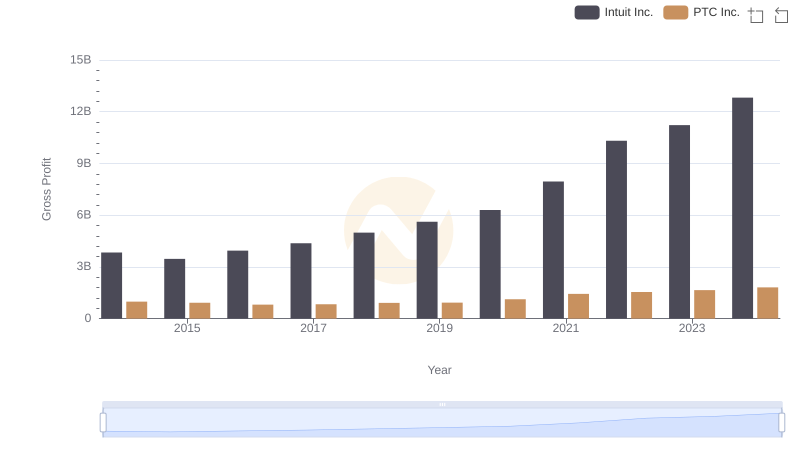

Gross Profit Analysis: Comparing Intuit Inc. and PTC Inc.

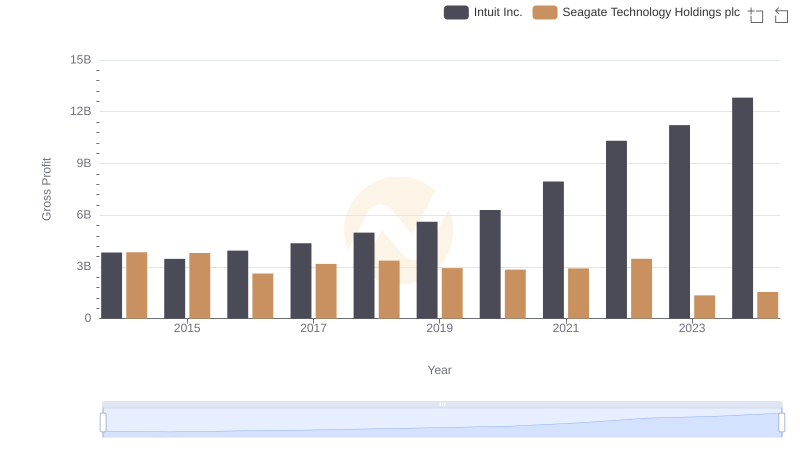

Gross Profit Analysis: Comparing Intuit Inc. and Seagate Technology Holdings plc

Analyzing Cost of Revenue: Intuit Inc. and Pure Storage, Inc.

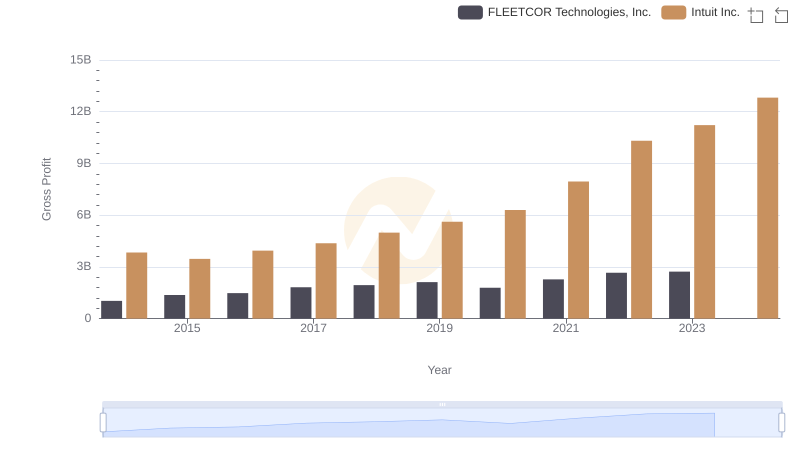

Gross Profit Trends Compared: Intuit Inc. vs FLEETCOR Technologies, Inc.

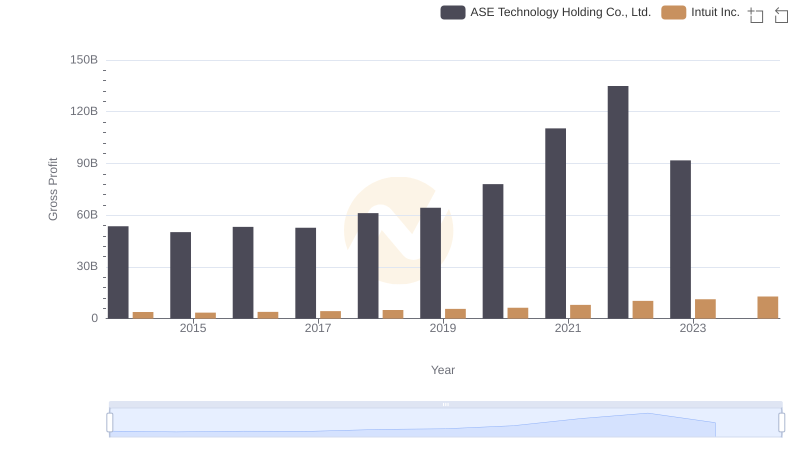

Intuit Inc. vs ASE Technology Holding Co., Ltd.: A Gross Profit Performance Breakdown

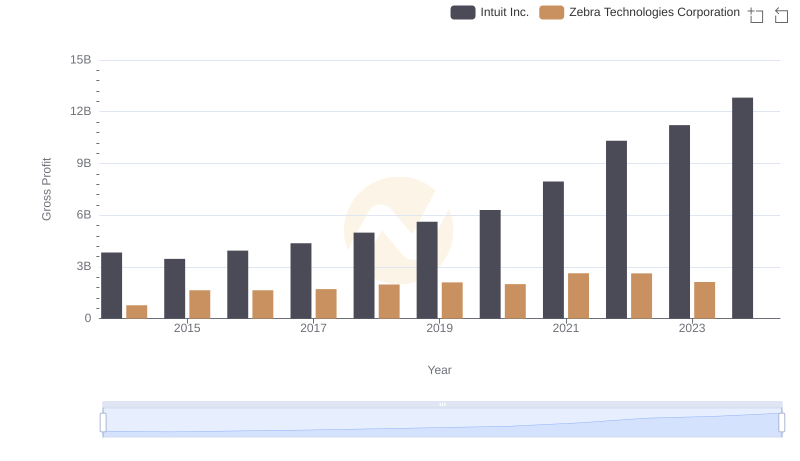

Who Generates Higher Gross Profit? Intuit Inc. or Zebra Technologies Corporation

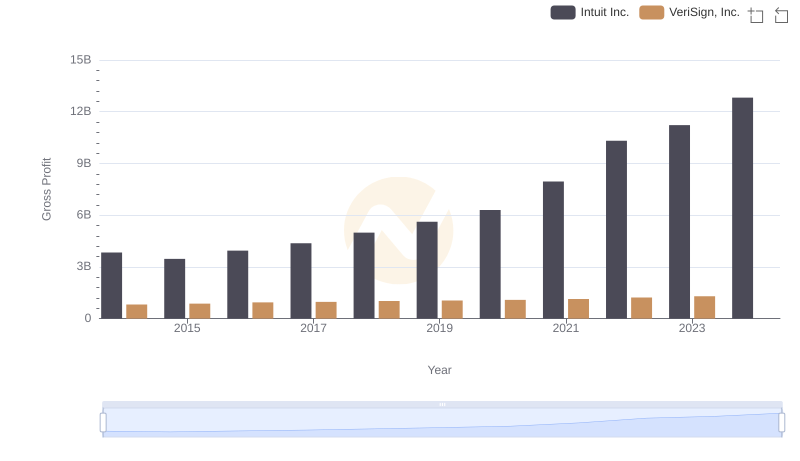

Gross Profit Comparison: Intuit Inc. and VeriSign, Inc. Trends

R&D Spending Showdown: Intuit Inc. vs Pure Storage, Inc.

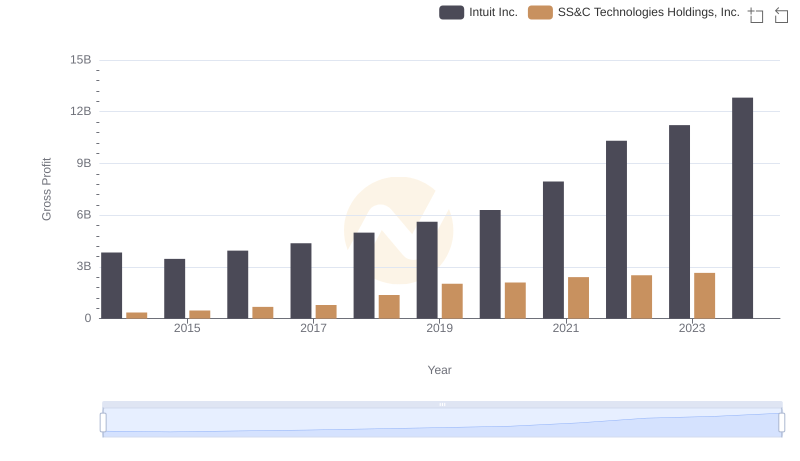

Gross Profit Comparison: Intuit Inc. and SS&C Technologies Holdings, Inc. Trends

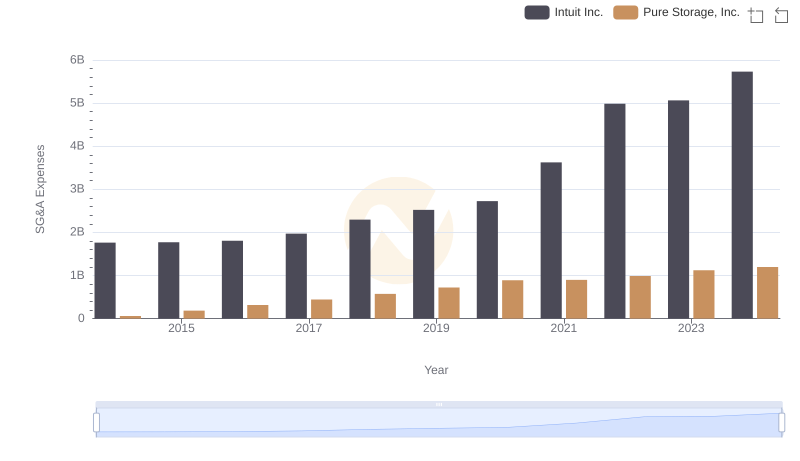

Comparing SG&A Expenses: Intuit Inc. vs Pure Storage, Inc. Trends and Insights