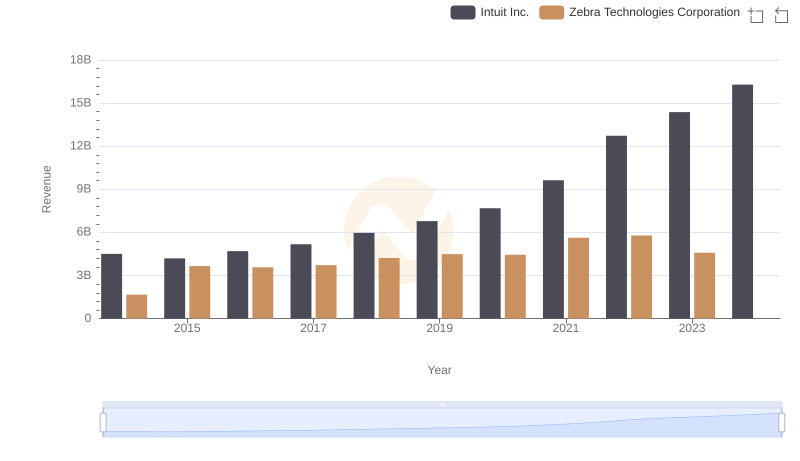

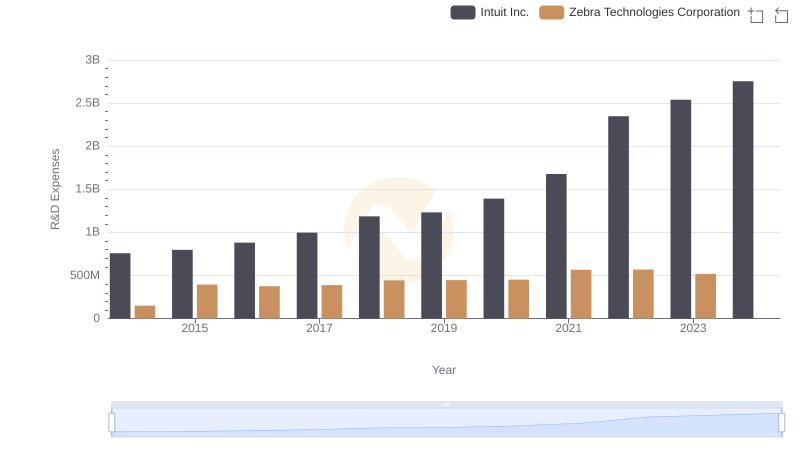

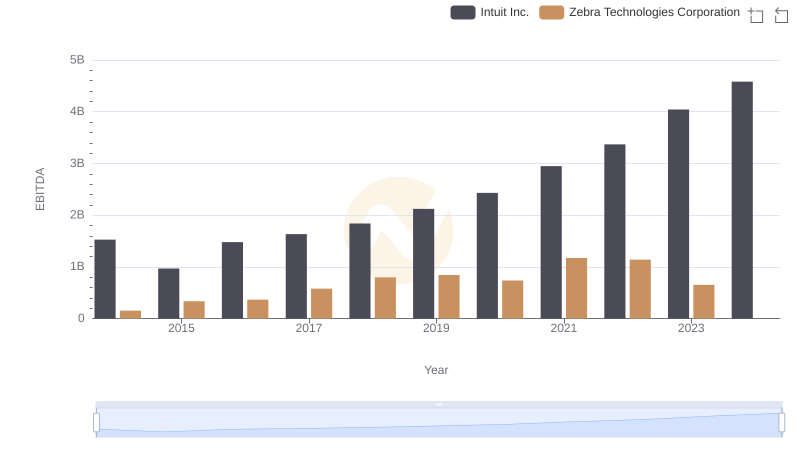

| __timestamp | Intuit Inc. | Zebra Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 3838000000 | 778025000 |

| Thursday, January 1, 2015 | 3467000000 | 1644233000 |

| Friday, January 1, 2016 | 3942000000 | 1642000000 |

| Sunday, January 1, 2017 | 4368000000 | 1710000000 |

| Monday, January 1, 2018 | 4987000000 | 1981000000 |

| Tuesday, January 1, 2019 | 5617000000 | 2100000000 |

| Wednesday, January 1, 2020 | 6301000000 | 2003000000 |

| Friday, January 1, 2021 | 7950000000 | 2628000000 |

| Saturday, January 1, 2022 | 10320000000 | 2624000000 |

| Sunday, January 1, 2023 | 11225000000 | 2123000000 |

| Monday, January 1, 2024 | 12820000000 | 2413000000 |

Unleashing insights

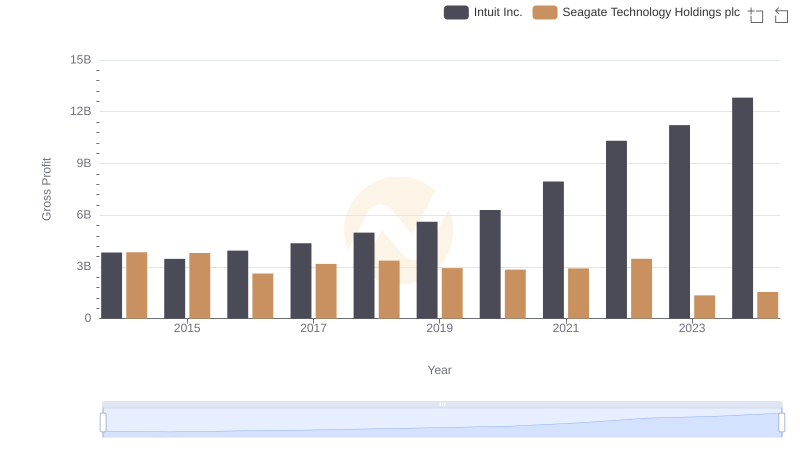

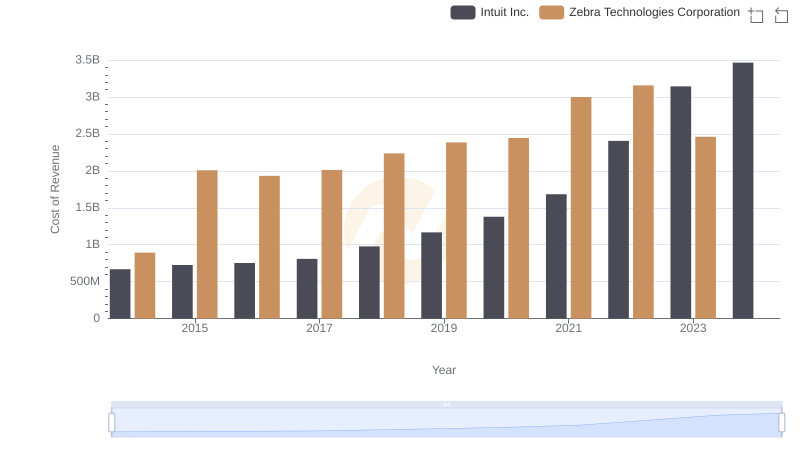

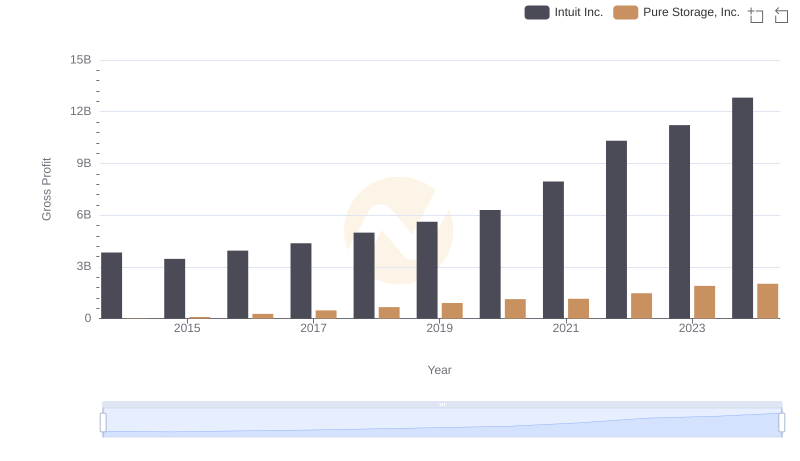

In the ever-evolving landscape of technology and innovation, Intuit Inc. and Zebra Technologies Corporation have emerged as key players. Over the past decade, Intuit Inc. has consistently outperformed Zebra Technologies in terms of gross profit. From 2014 to 2023, Intuit's gross profit surged by approximately 234%, showcasing its robust growth trajectory. In contrast, Zebra Technologies experienced a more modest increase of around 173% during the same period.

Intuit's strategic focus on financial software solutions has propelled its financial success, with a notable leap in gross profit from 2021 to 2023, reaching over $11 billion. Meanwhile, Zebra Technologies, known for its enterprise asset intelligence solutions, peaked in 2021 with a gross profit of $2.6 billion. The data for 2024 remains incomplete, but Intuit's upward trend suggests continued dominance. This comparison highlights the dynamic nature of the tech industry and the varying growth strategies of its leaders.

Intuit Inc. vs Zebra Technologies Corporation: Examining Key Revenue Metrics

Gross Profit Analysis: Comparing Intuit Inc. and Seagate Technology Holdings plc

Cost of Revenue: Key Insights for Intuit Inc. and Zebra Technologies Corporation

Intuit Inc. vs Pure Storage, Inc.: A Gross Profit Performance Breakdown

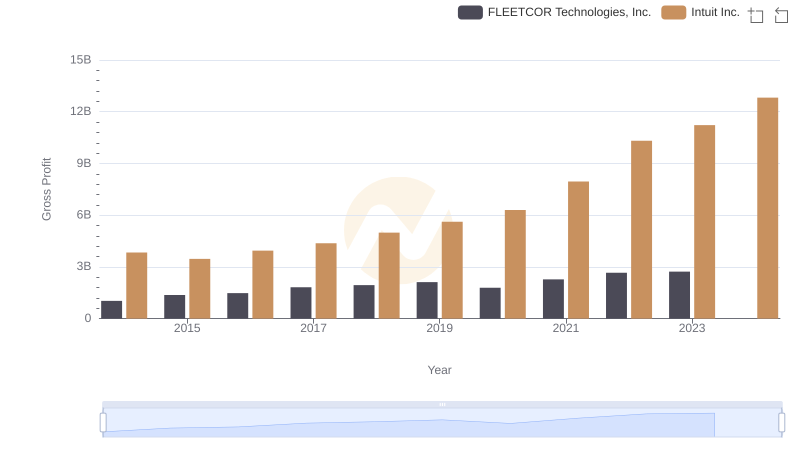

Gross Profit Trends Compared: Intuit Inc. vs FLEETCOR Technologies, Inc.

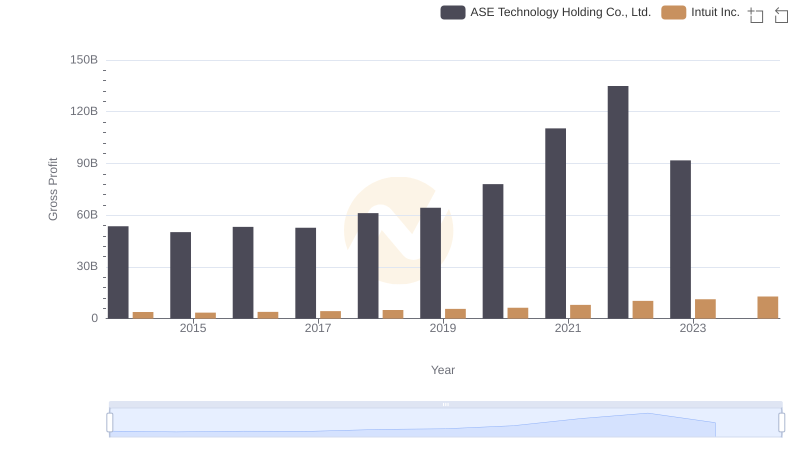

Intuit Inc. vs ASE Technology Holding Co., Ltd.: A Gross Profit Performance Breakdown

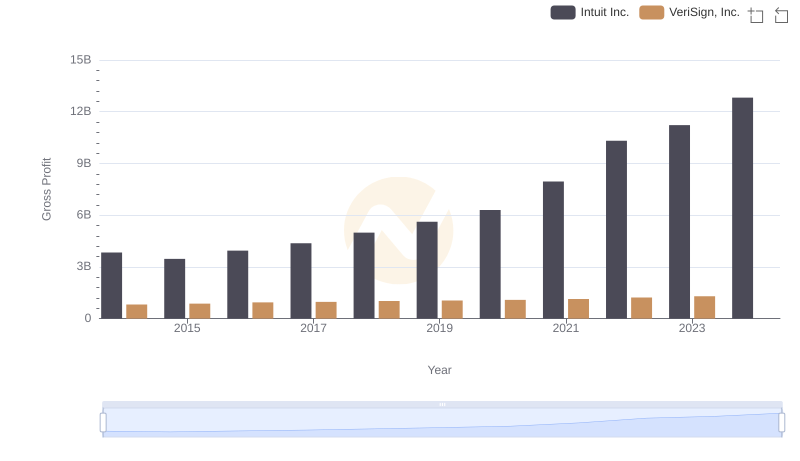

Gross Profit Comparison: Intuit Inc. and VeriSign, Inc. Trends

Intuit Inc. vs Zebra Technologies Corporation: Strategic Focus on R&D Spending

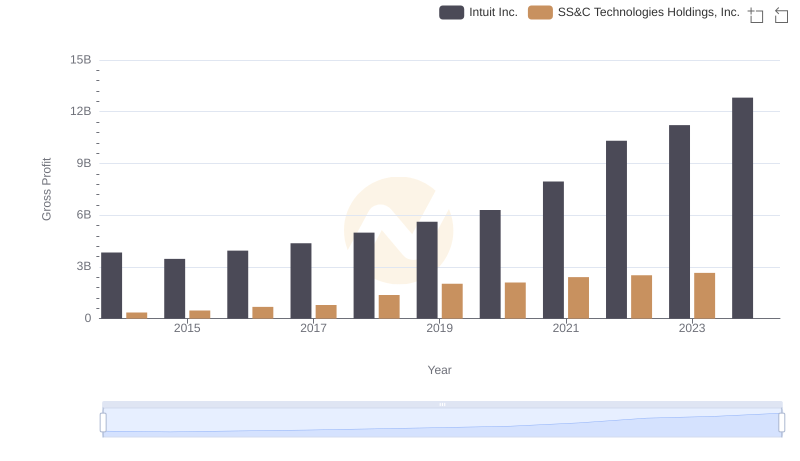

Gross Profit Comparison: Intuit Inc. and SS&C Technologies Holdings, Inc. Trends

Operational Costs Compared: SG&A Analysis of Intuit Inc. and Zebra Technologies Corporation

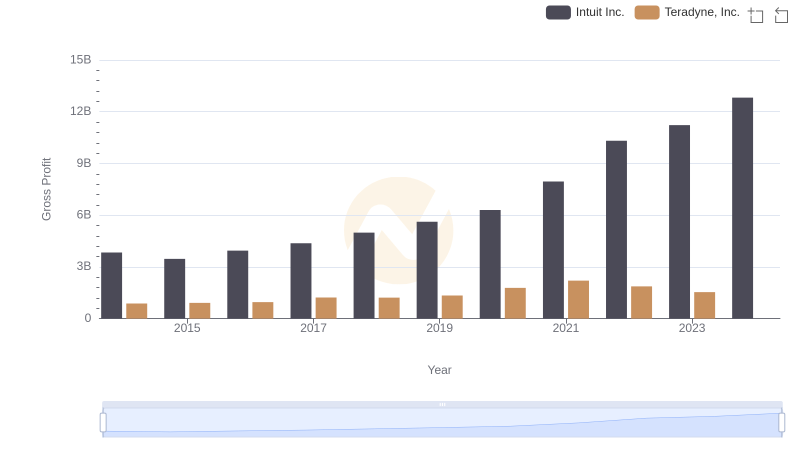

Gross Profit Analysis: Comparing Intuit Inc. and Teradyne, Inc.

EBITDA Analysis: Evaluating Intuit Inc. Against Zebra Technologies Corporation