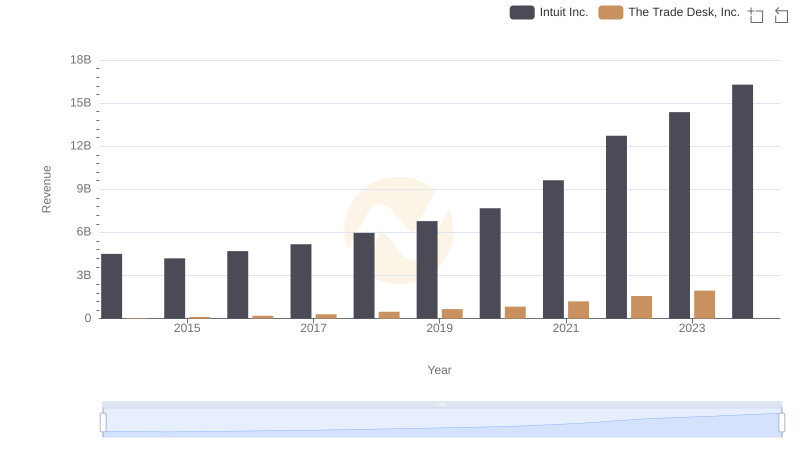

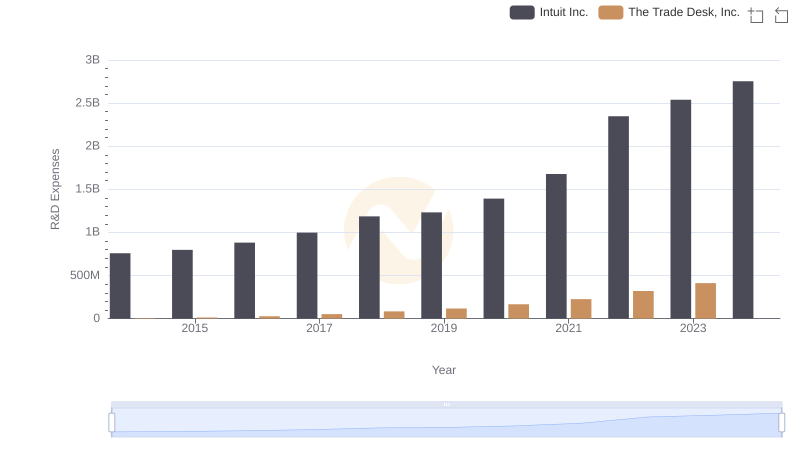

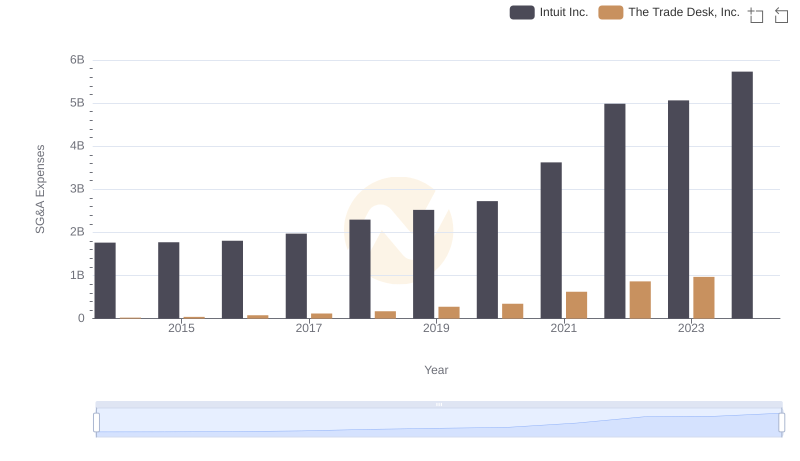

| __timestamp | Intuit Inc. | The Trade Desk, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 3838000000 | 31989000 |

| Thursday, January 1, 2015 | 3467000000 | 90869000 |

| Friday, January 1, 2016 | 3942000000 | 163050000 |

| Sunday, January 1, 2017 | 4368000000 | 241987000 |

| Monday, January 1, 2018 | 4987000000 | 363196000 |

| Tuesday, January 1, 2019 | 5617000000 | 504878000 |

| Wednesday, January 1, 2020 | 6301000000 | 657221000 |

| Friday, January 1, 2021 | 7950000000 | 974913000 |

| Saturday, January 1, 2022 | 10320000000 | 1296672000 |

| Sunday, January 1, 2023 | 11225000000 | 1580522000 |

| Monday, January 1, 2024 | 12820000000 | 1972819000 |

In pursuit of knowledge

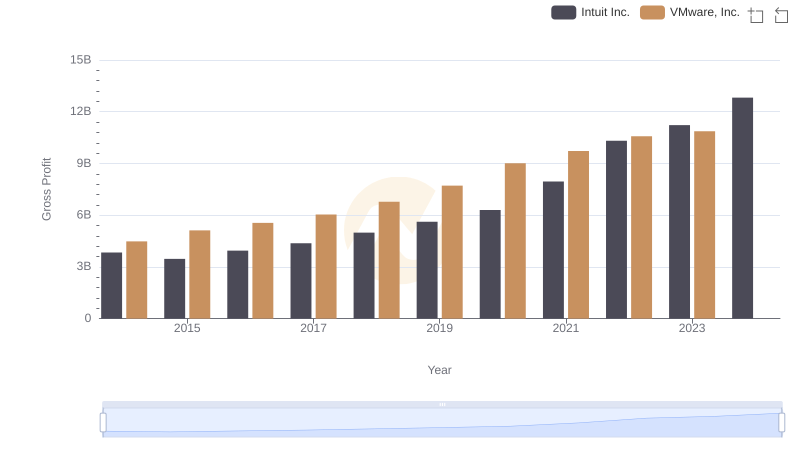

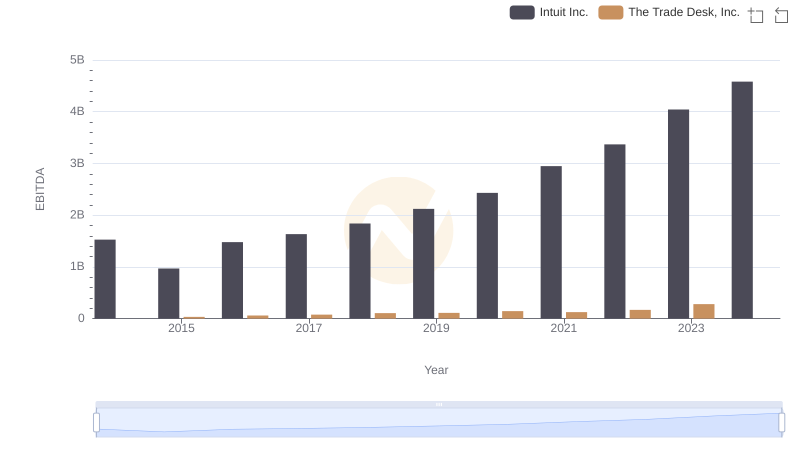

In the ever-evolving landscape of technology and finance, Intuit Inc. and The Trade Desk, Inc. have emerged as formidable players. Over the past decade, Intuit has demonstrated a robust growth trajectory, with its gross profit surging by approximately 234% from 2014 to 2023. This impressive growth underscores Intuit's strategic prowess in the financial software sector.

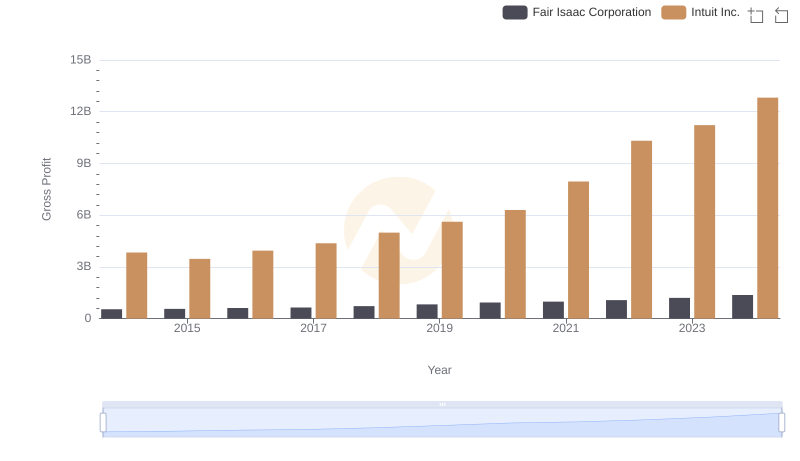

Meanwhile, The Trade Desk, Inc., a leader in digital advertising, has also shown remarkable progress. From 2014 to 2023, its gross profit skyrocketed by over 4,800%, reflecting the explosive growth in digital ad spending. However, data for 2024 remains elusive, leaving room for speculation on future trends.

This comparison not only highlights the dynamic nature of these industries but also offers a glimpse into the strategic maneuvers that have propelled these companies to the forefront of their respective fields.

Revenue Insights: Intuit Inc. and The Trade Desk, Inc. Performance Compared

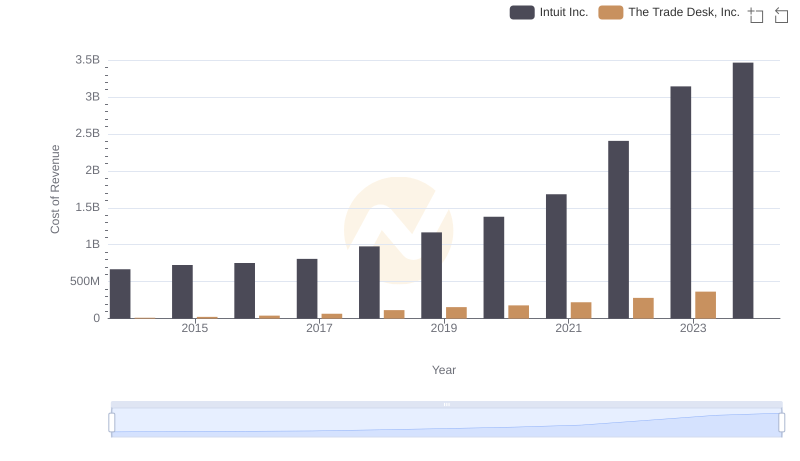

Intuit Inc. vs The Trade Desk, Inc.: Efficiency in Cost of Revenue Explored

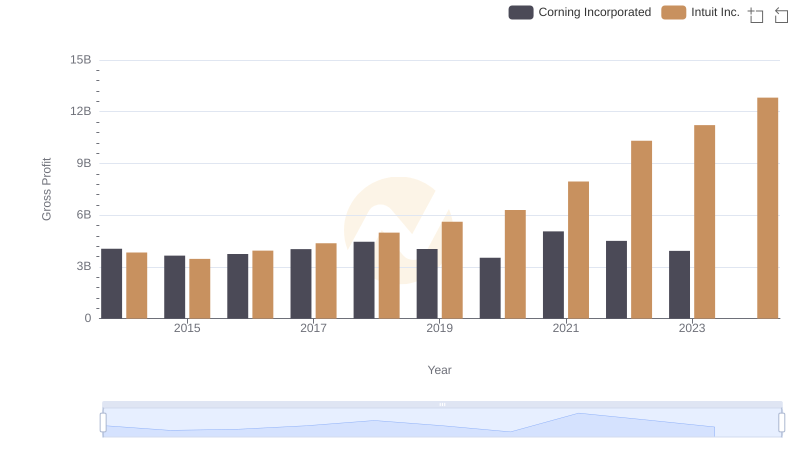

Intuit Inc. and VMware, Inc.: A Detailed Gross Profit Analysis

Gross Profit Trends Compared: Intuit Inc. vs NXP Semiconductors N.V.

Intuit Inc. and Fair Isaac Corporation: A Detailed Gross Profit Analysis

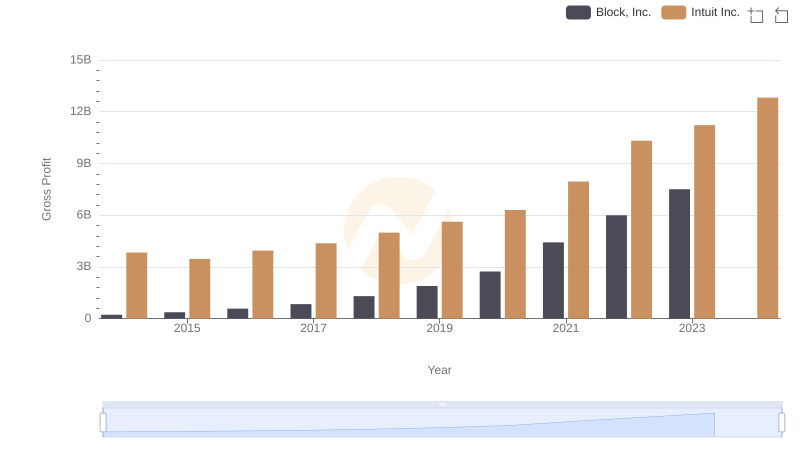

Gross Profit Comparison: Intuit Inc. and Block, Inc. Trends

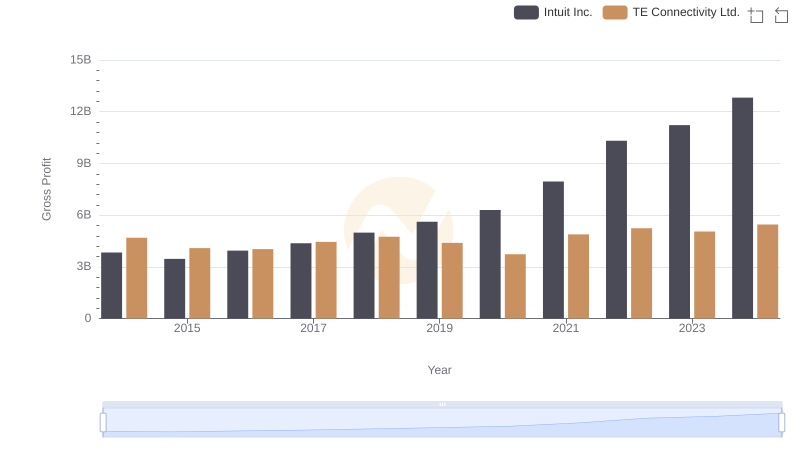

Intuit Inc. vs TE Connectivity Ltd.: A Gross Profit Performance Breakdown

Research and Development Expenses Breakdown: Intuit Inc. vs The Trade Desk, Inc.

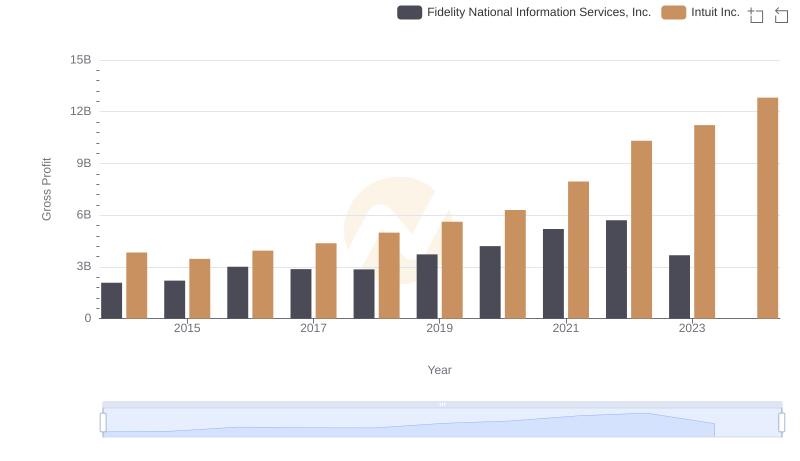

Gross Profit Analysis: Comparing Intuit Inc. and Fidelity National Information Services, Inc.

Gross Profit Trends Compared: Intuit Inc. vs Corning Incorporated

Intuit Inc. vs The Trade Desk, Inc.: SG&A Expense Trends

EBITDA Metrics Evaluated: Intuit Inc. vs The Trade Desk, Inc.