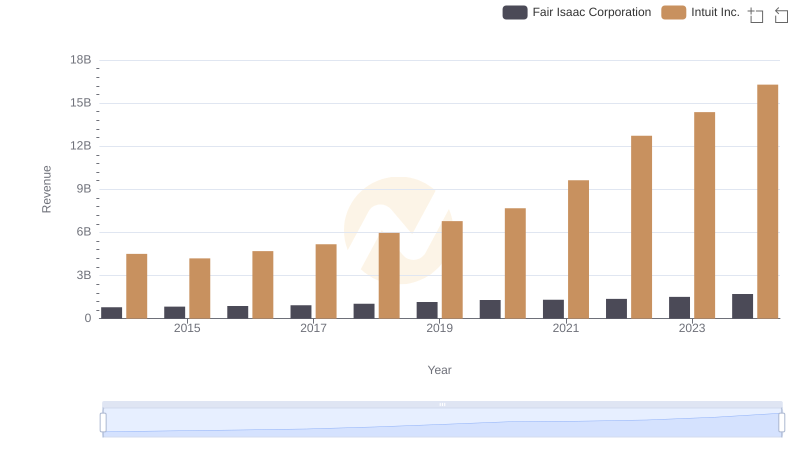

| __timestamp | Fair Isaac Corporation | Intuit Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 539704000 | 3838000000 |

| Thursday, January 1, 2015 | 568246000 | 3467000000 |

| Friday, January 1, 2016 | 616183000 | 3942000000 |

| Sunday, January 1, 2017 | 645046000 | 4368000000 |

| Monday, January 1, 2018 | 721776000 | 4987000000 |

| Tuesday, January 1, 2019 | 823238000 | 5617000000 |

| Wednesday, January 1, 2020 | 933420000 | 6301000000 |

| Friday, January 1, 2021 | 984074000 | 7950000000 |

| Saturday, January 1, 2022 | 1075096000 | 10320000000 |

| Sunday, January 1, 2023 | 1202504000 | 11225000000 |

| Monday, January 1, 2024 | 1369320000 | 12820000000 |

Igniting the spark of knowledge

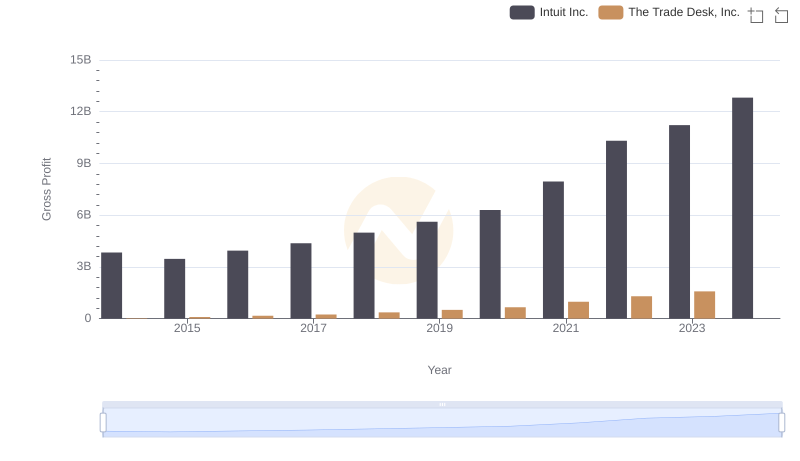

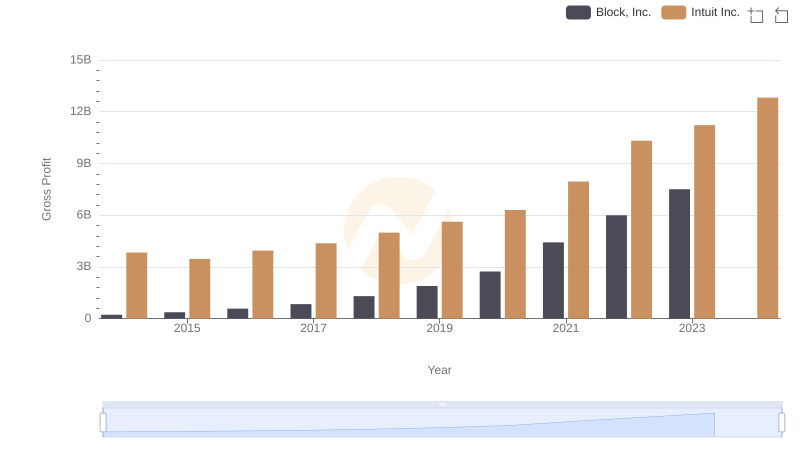

In the ever-evolving landscape of financial technology, Intuit Inc. and Fair Isaac Corporation have emerged as titans, showcasing remarkable growth over the past decade. From 2014 to 2024, Intuit's gross profit surged by an impressive 234%, reflecting its strategic innovations and market adaptability. Meanwhile, Fair Isaac Corporation, known for its FICO scores, demonstrated a robust 154% increase in gross profit, underscoring its pivotal role in credit analytics.

This analysis highlights the dynamic growth trajectories of these two industry leaders, offering valuable insights for investors and market enthusiasts alike.

Revenue Insights: Intuit Inc. and Fair Isaac Corporation Performance Compared

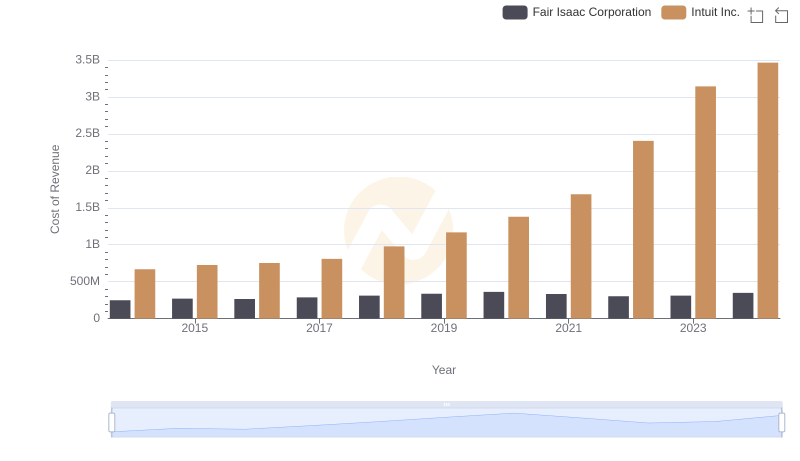

Cost of Revenue Comparison: Intuit Inc. vs Fair Isaac Corporation

Gross Profit Comparison: Intuit Inc. and The Trade Desk, Inc. Trends

Gross Profit Trends Compared: Intuit Inc. vs NXP Semiconductors N.V.

Gross Profit Comparison: Intuit Inc. and Block, Inc. Trends

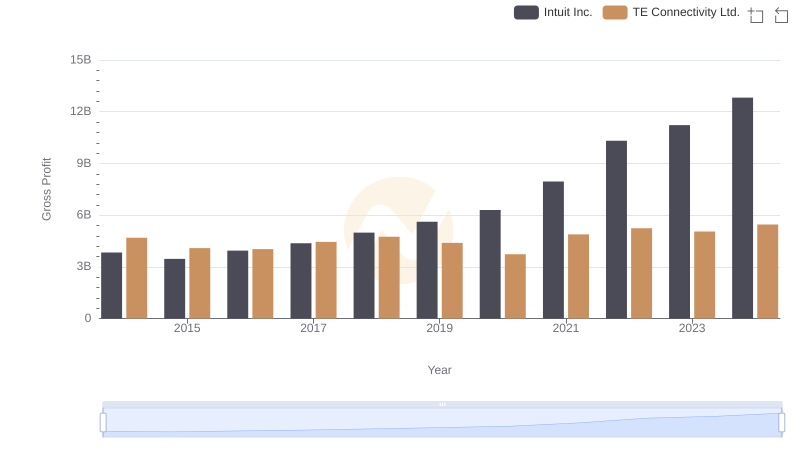

Intuit Inc. vs TE Connectivity Ltd.: A Gross Profit Performance Breakdown

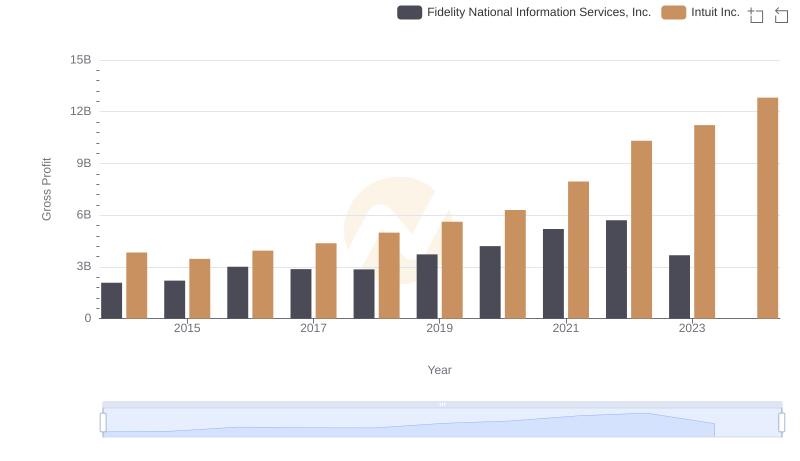

Gross Profit Analysis: Comparing Intuit Inc. and Fidelity National Information Services, Inc.

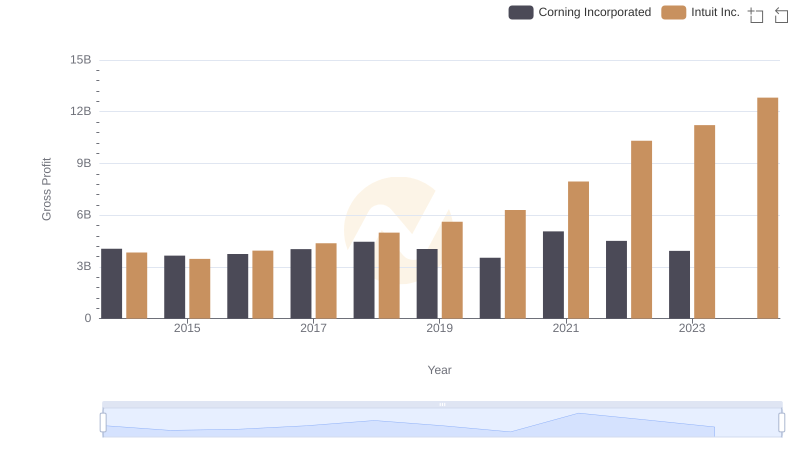

Gross Profit Trends Compared: Intuit Inc. vs Corning Incorporated

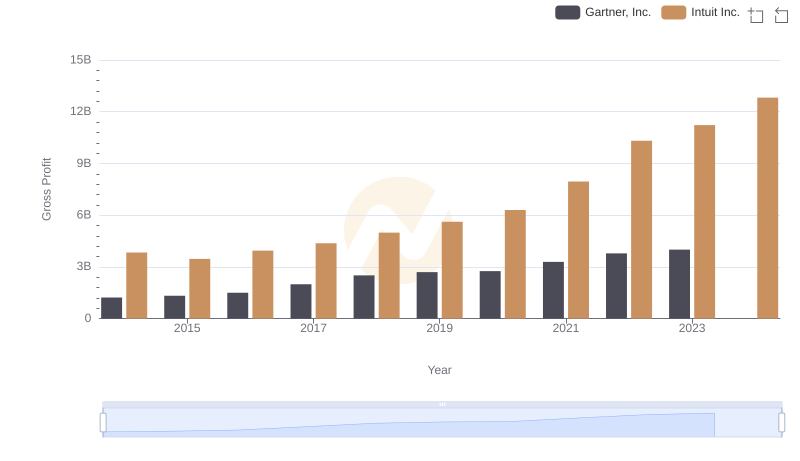

Who Generates Higher Gross Profit? Intuit Inc. or Gartner, Inc.

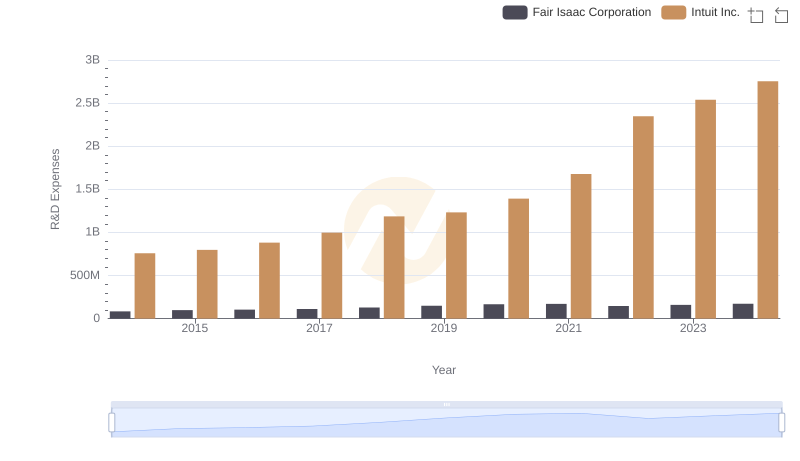

R&D Spending Showdown: Intuit Inc. vs Fair Isaac Corporation

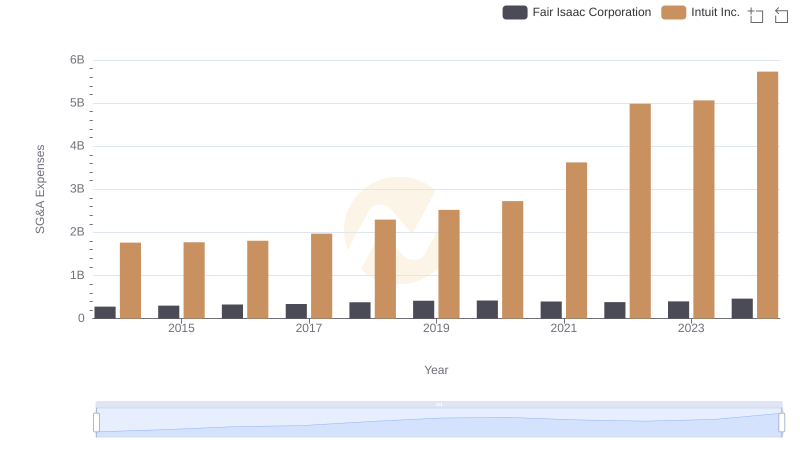

Comparing SG&A Expenses: Intuit Inc. vs Fair Isaac Corporation Trends and Insights

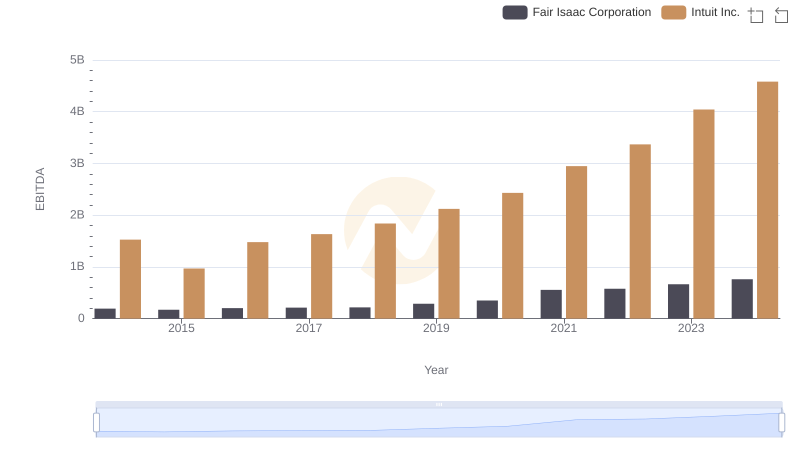

EBITDA Analysis: Evaluating Intuit Inc. Against Fair Isaac Corporation