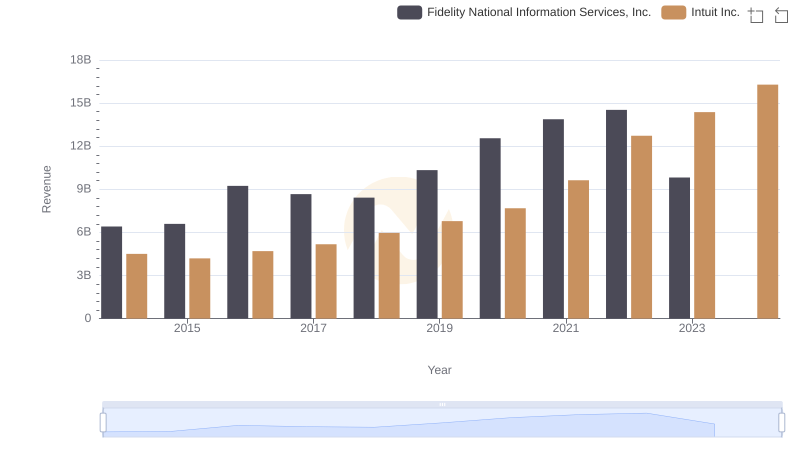

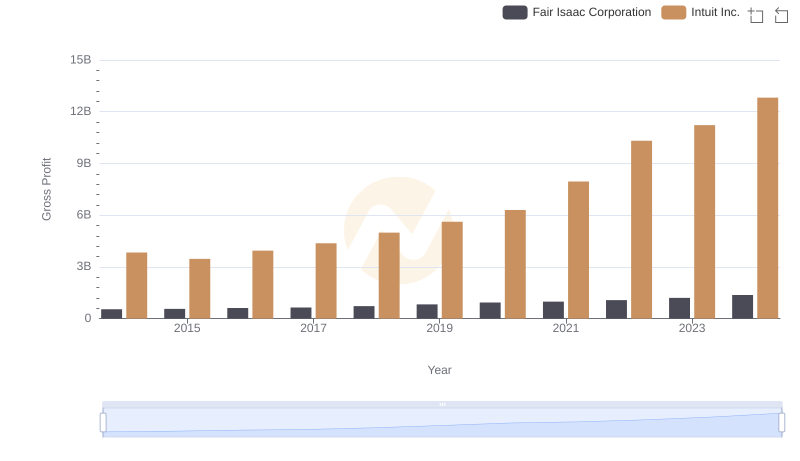

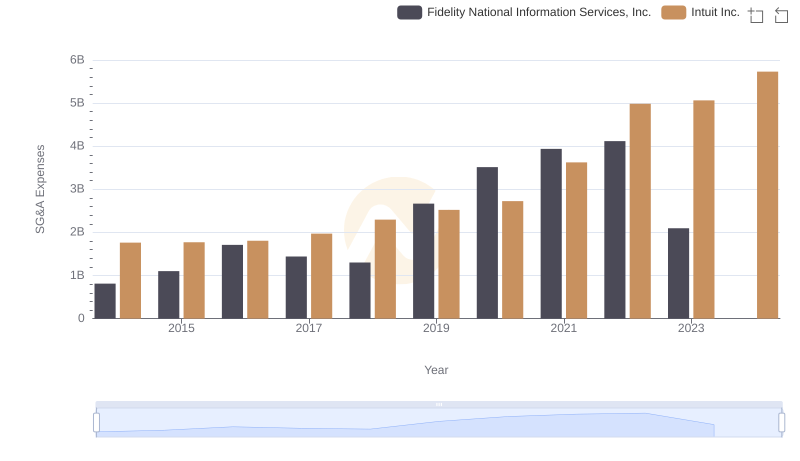

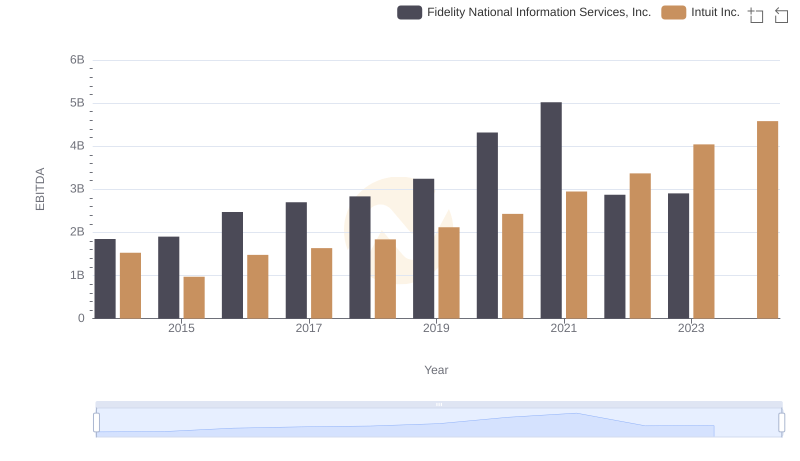

| __timestamp | Fidelity National Information Services, Inc. | Intuit Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2081100000 | 3838000000 |

| Thursday, January 1, 2015 | 2202000000 | 3467000000 |

| Friday, January 1, 2016 | 3008000000 | 3942000000 |

| Sunday, January 1, 2017 | 2874000000 | 4368000000 |

| Monday, January 1, 2018 | 2854000000 | 4987000000 |

| Tuesday, January 1, 2019 | 3723000000 | 5617000000 |

| Wednesday, January 1, 2020 | 4204000000 | 6301000000 |

| Friday, January 1, 2021 | 5195000000 | 7950000000 |

| Saturday, January 1, 2022 | 5708000000 | 10320000000 |

| Sunday, January 1, 2023 | 3676000000 | 11225000000 |

| Monday, January 1, 2024 | 3804000000 | 12820000000 |

Unleashing the power of data

In the ever-evolving landscape of financial technology, Intuit Inc. and Fidelity National Information Services, Inc. (FIS) have emerged as key players. From 2014 to 2023, Intuit's gross profit surged by approximately 193%, reflecting its robust growth trajectory. In contrast, FIS experienced a more modest increase of around 77% over the same period. Notably, Intuit's gross profit consistently outpaced FIS, peaking in 2023 with a remarkable 11.2 billion, while FIS reached its zenith in 2022 with 5.7 billion. The data for 2024 is incomplete, highlighting the dynamic nature of financial reporting. This analysis underscores Intuit's strategic prowess in capitalizing on market opportunities, while FIS continues to solidify its position in the industry. As the fintech sector continues to expand, these trends offer valuable insights into the competitive landscape and future growth potential.

Revenue Insights: Intuit Inc. and Fidelity National Information Services, Inc. Performance Compared

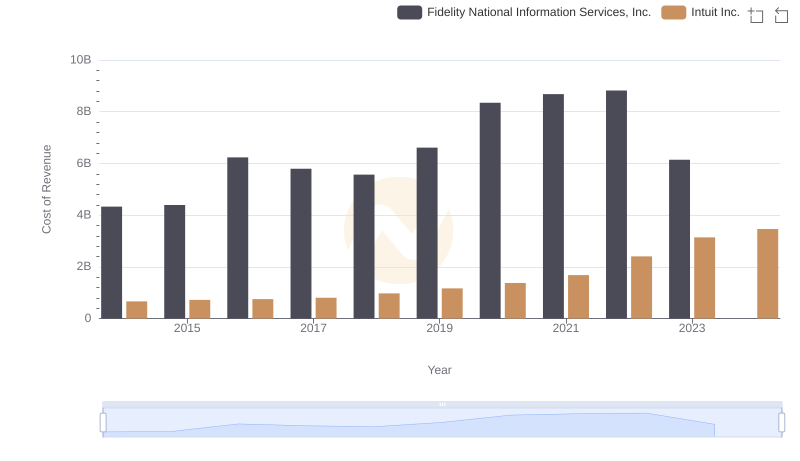

Intuit Inc. vs Fidelity National Information Services, Inc.: Efficiency in Cost of Revenue Explored

Gross Profit Trends Compared: Intuit Inc. vs NXP Semiconductors N.V.

Intuit Inc. and Fair Isaac Corporation: A Detailed Gross Profit Analysis

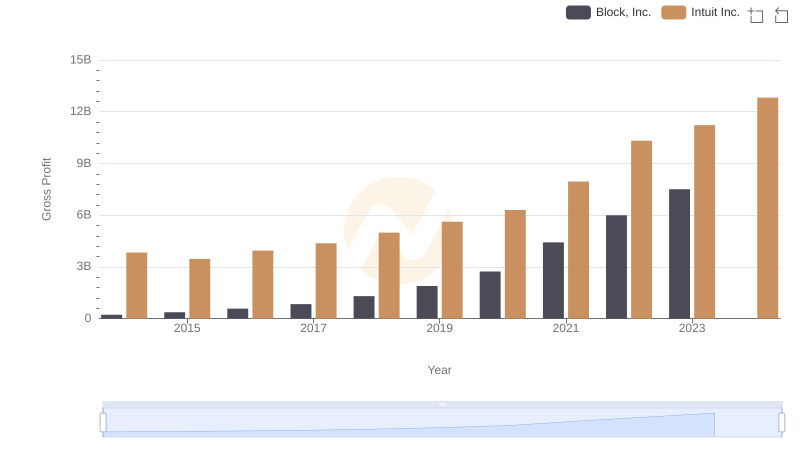

Gross Profit Comparison: Intuit Inc. and Block, Inc. Trends

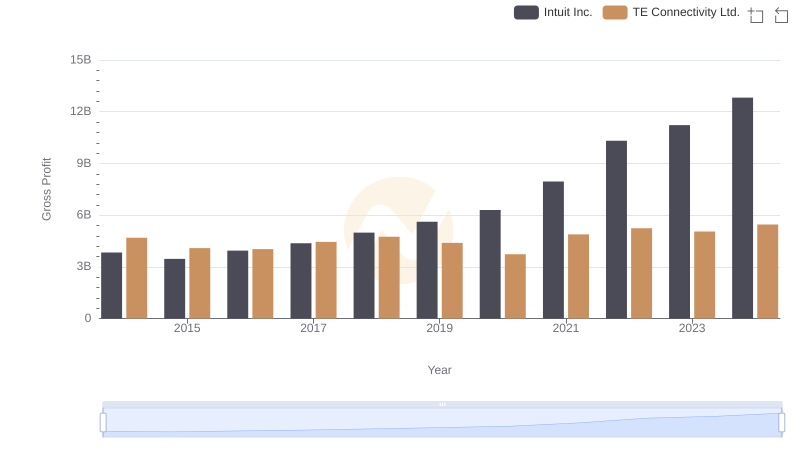

Intuit Inc. vs TE Connectivity Ltd.: A Gross Profit Performance Breakdown

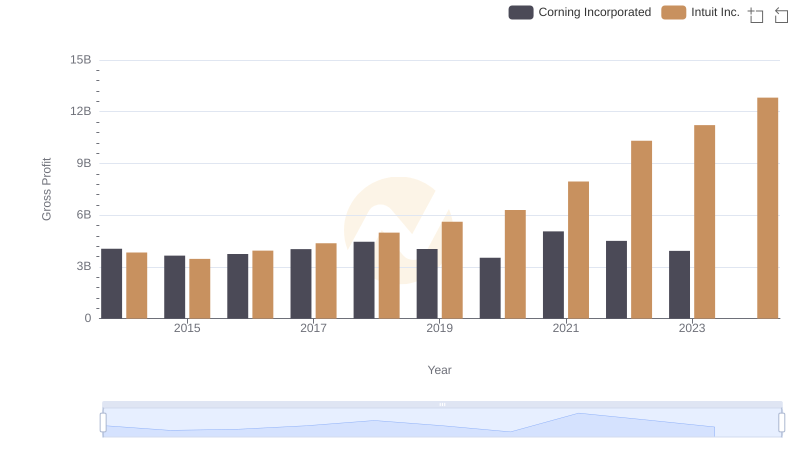

Gross Profit Trends Compared: Intuit Inc. vs Corning Incorporated

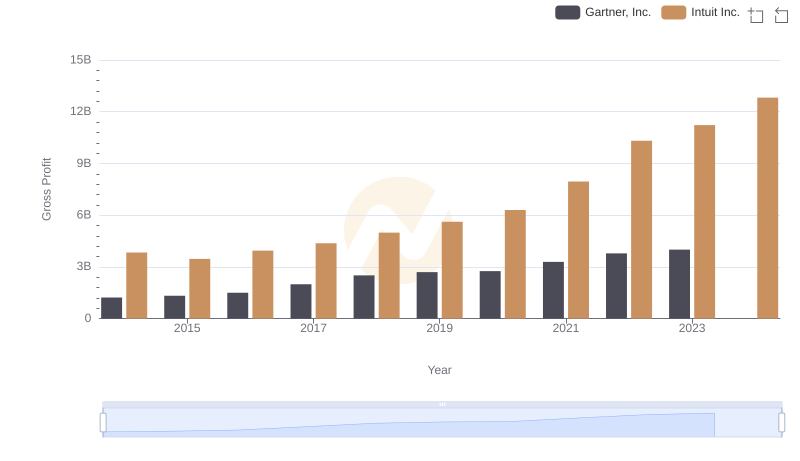

Who Generates Higher Gross Profit? Intuit Inc. or Gartner, Inc.

Comparing SG&A Expenses: Intuit Inc. vs Fidelity National Information Services, Inc. Trends and Insights

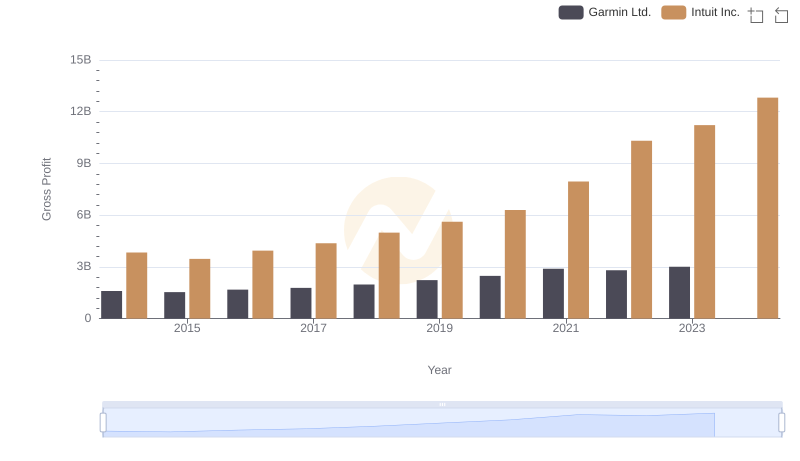

Intuit Inc. vs Garmin Ltd.: A Gross Profit Performance Breakdown

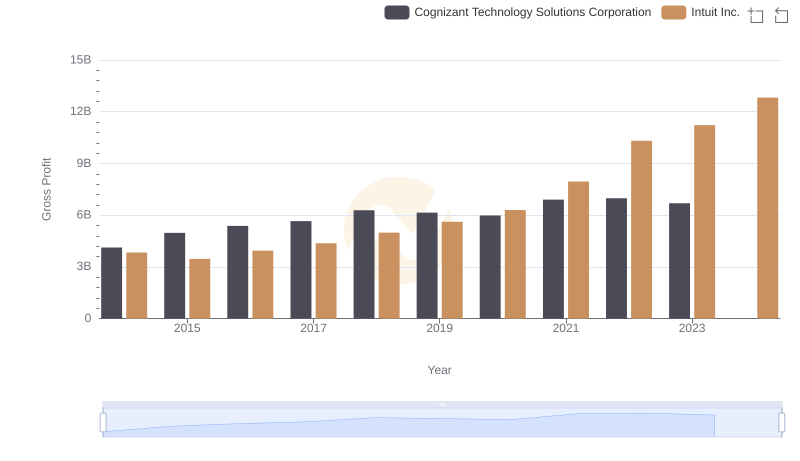

Gross Profit Analysis: Comparing Intuit Inc. and Cognizant Technology Solutions Corporation

Comparative EBITDA Analysis: Intuit Inc. vs Fidelity National Information Services, Inc.