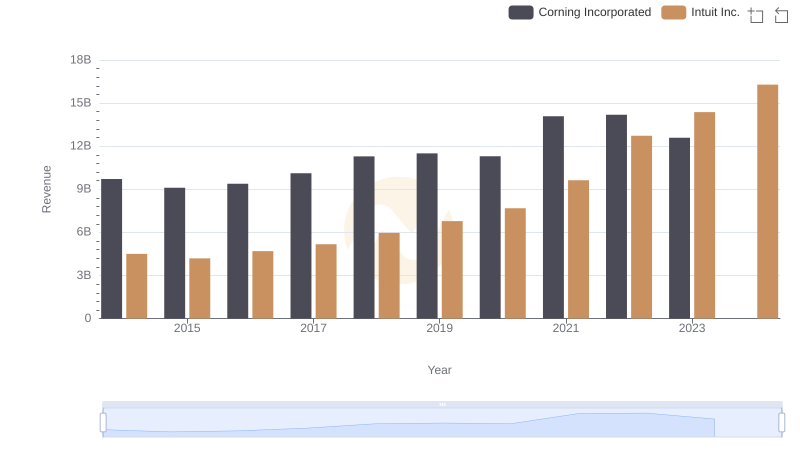

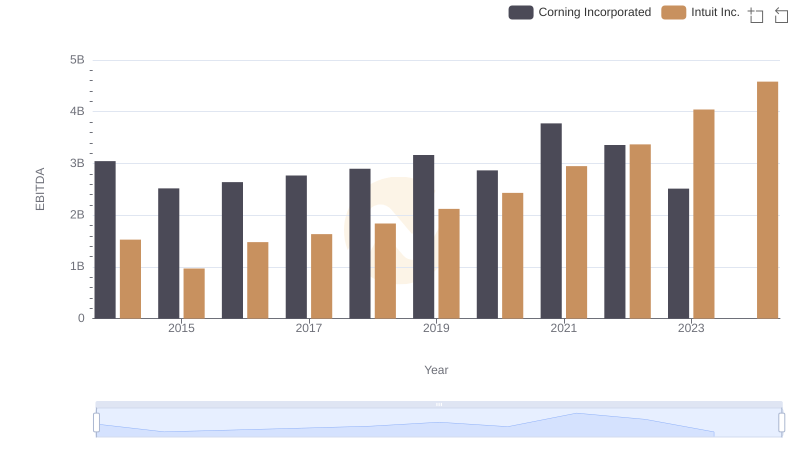

| __timestamp | Corning Incorporated | Intuit Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 4052000000 | 3838000000 |

| Thursday, January 1, 2015 | 3653000000 | 3467000000 |

| Friday, January 1, 2016 | 3746000000 | 3942000000 |

| Sunday, January 1, 2017 | 4032000000 | 4368000000 |

| Monday, January 1, 2018 | 4461000000 | 4987000000 |

| Tuesday, January 1, 2019 | 4035000000 | 5617000000 |

| Wednesday, January 1, 2020 | 3531000000 | 6301000000 |

| Friday, January 1, 2021 | 5063000000 | 7950000000 |

| Saturday, January 1, 2022 | 4506000000 | 10320000000 |

| Sunday, January 1, 2023 | 3931000000 | 11225000000 |

| Monday, January 1, 2024 | 4276000000 | 12820000000 |

Cracking the code

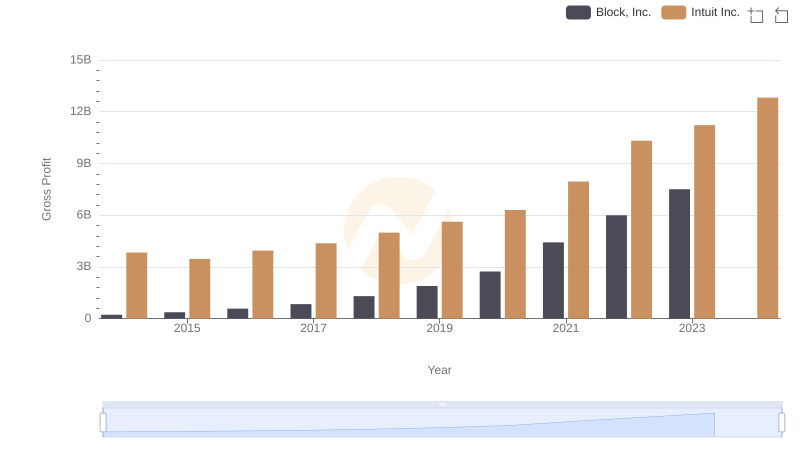

In the ever-evolving landscape of American business, the financial performance of companies like Intuit Inc. and Corning Incorporated offers a fascinating glimpse into their strategic prowess. Over the past decade, Intuit Inc. has demonstrated a remarkable growth trajectory, with its gross profit surging by approximately 233% from 2014 to 2024. This growth reflects Intuit's successful adaptation to the digital economy, leveraging its software solutions to capture a larger market share.

Conversely, Corning Incorporated, a stalwart in the materials science sector, has experienced a more modest increase of around 6% in gross profit over the same period. Despite facing challenges in the global supply chain, Corning's commitment to innovation in glass and ceramics has kept it competitive. This comparison underscores the diverse strategies employed by these industry giants to navigate economic shifts and technological advancements.

Intuit Inc. vs Corning Incorporated: Examining Key Revenue Metrics

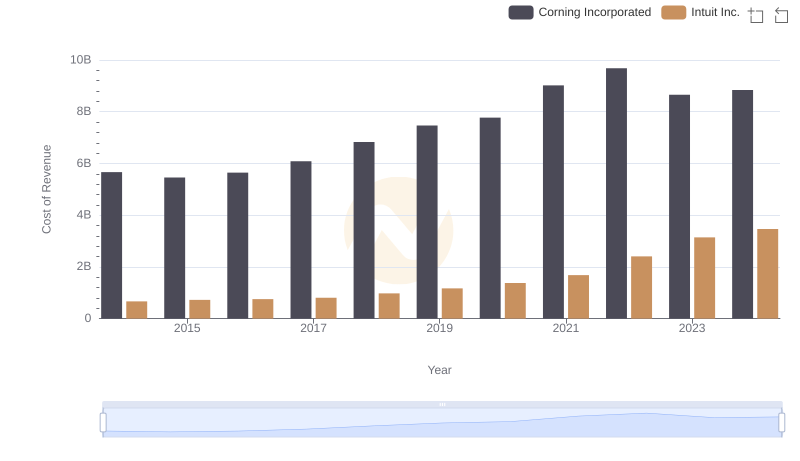

Cost of Revenue Trends: Intuit Inc. vs Corning Incorporated

Gross Profit Comparison: Intuit Inc. and Block, Inc. Trends

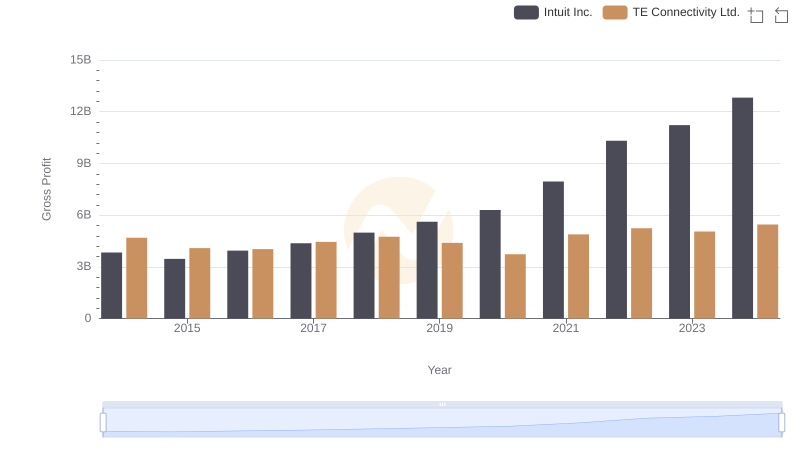

Intuit Inc. vs TE Connectivity Ltd.: A Gross Profit Performance Breakdown

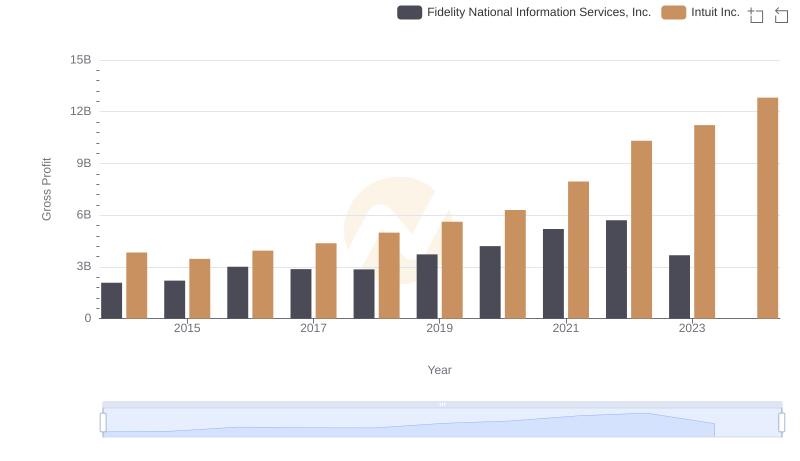

Gross Profit Analysis: Comparing Intuit Inc. and Fidelity National Information Services, Inc.

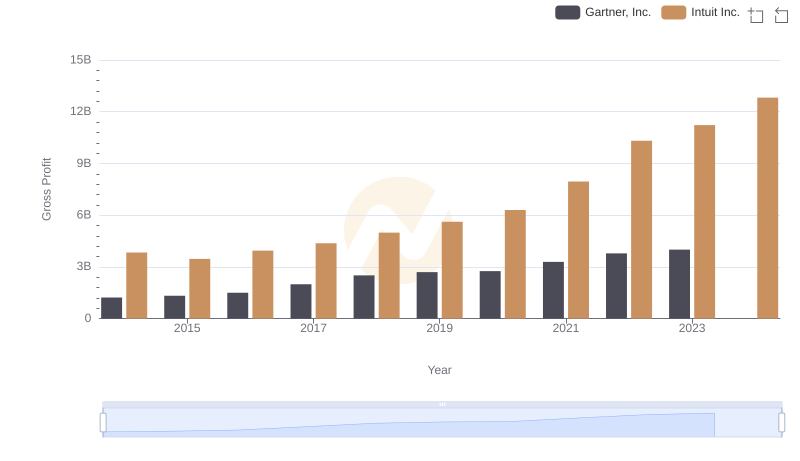

Who Generates Higher Gross Profit? Intuit Inc. or Gartner, Inc.

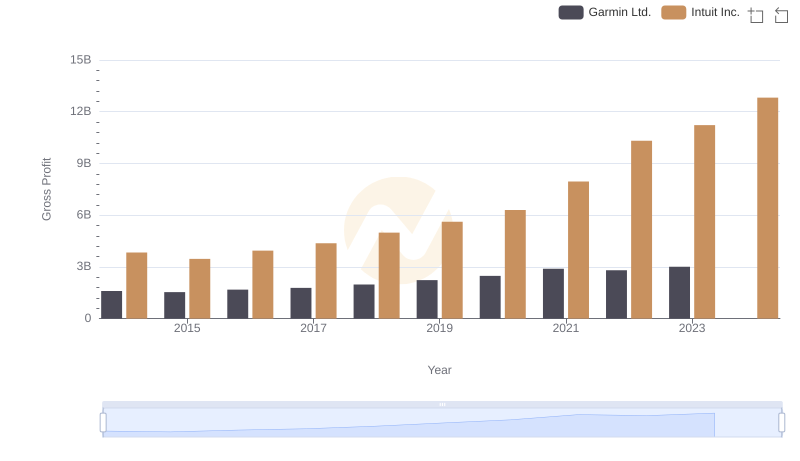

Intuit Inc. vs Garmin Ltd.: A Gross Profit Performance Breakdown

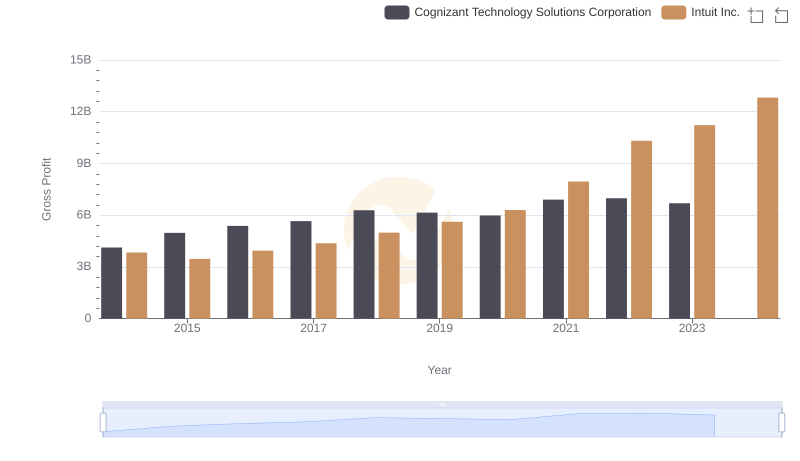

Gross Profit Analysis: Comparing Intuit Inc. and Cognizant Technology Solutions Corporation

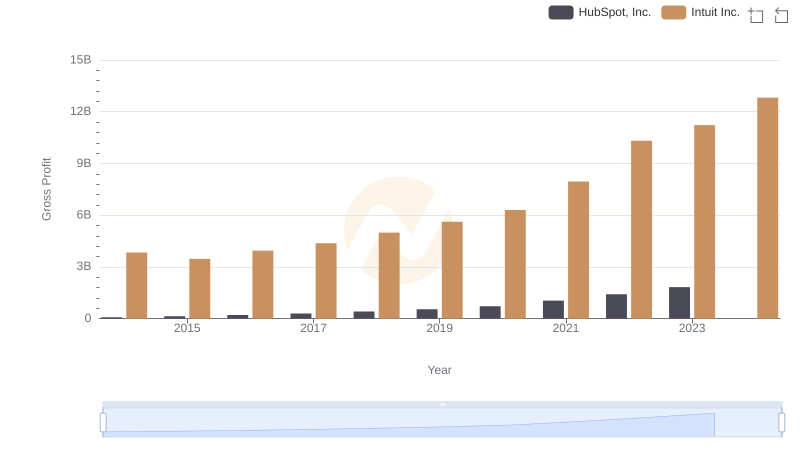

Gross Profit Analysis: Comparing Intuit Inc. and HubSpot, Inc.

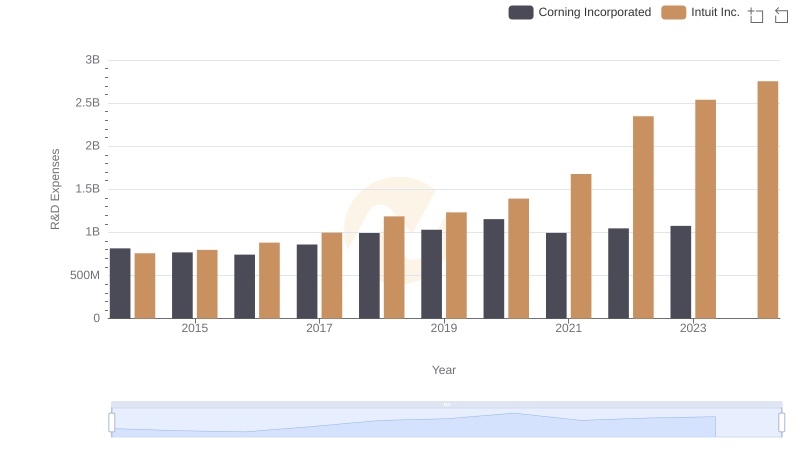

Analyzing R&D Budgets: Intuit Inc. vs Corning Incorporated

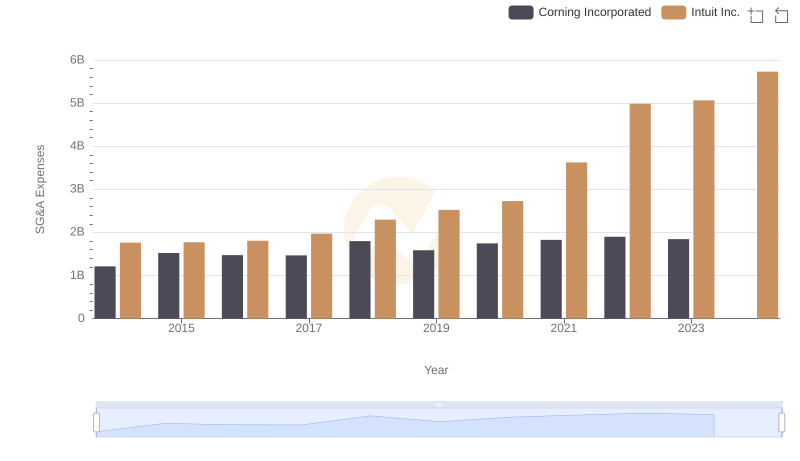

Selling, General, and Administrative Costs: Intuit Inc. vs Corning Incorporated

EBITDA Metrics Evaluated: Intuit Inc. vs Corning Incorporated