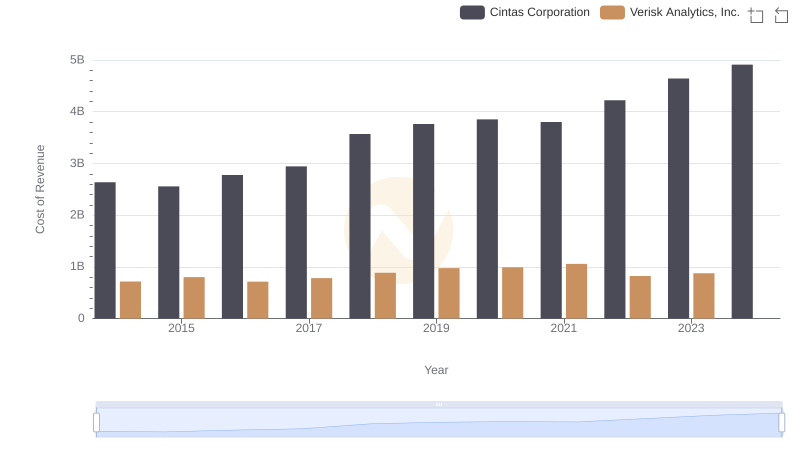

| __timestamp | Cintas Corporation | Verisk Analytics, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1914386000 | 1030128000 |

| Thursday, January 1, 2015 | 1921337000 | 1264736000 |

| Friday, January 1, 2016 | 2129870000 | 1280800000 |

| Sunday, January 1, 2017 | 2380295000 | 1361400000 |

| Monday, January 1, 2018 | 2908523000 | 1508900000 |

| Tuesday, January 1, 2019 | 3128588000 | 1630300000 |

| Wednesday, January 1, 2020 | 3233748000 | 1790700000 |

| Friday, January 1, 2021 | 3314651000 | 1940800000 |

| Saturday, January 1, 2022 | 3632246000 | 1672400000 |

| Sunday, January 1, 2023 | 4173368000 | 1804900000 |

| Monday, January 1, 2024 | 4686416000 |

Unlocking the unknown

In the ever-evolving landscape of corporate finance, understanding the trajectory of gross profit is crucial for investors and analysts alike. From 2014 to 2023, Cintas Corporation has demonstrated a robust growth in gross profit, surging by approximately 145%. This impressive increase highlights Cintas' strategic prowess in optimizing operational efficiencies and expanding market reach. In contrast, Verisk Analytics, Inc. has shown a steady, albeit more modest, growth of around 75% over the same period. This reflects Verisk's consistent performance in the competitive analytics industry.

Interestingly, the data for 2024 reveals a gap for Verisk, indicating either a reporting delay or a strategic shift. Such insights are invaluable for stakeholders aiming to make informed decisions. As we delve deeper into these financial narratives, the importance of gross profit as a key performance indicator becomes increasingly evident.

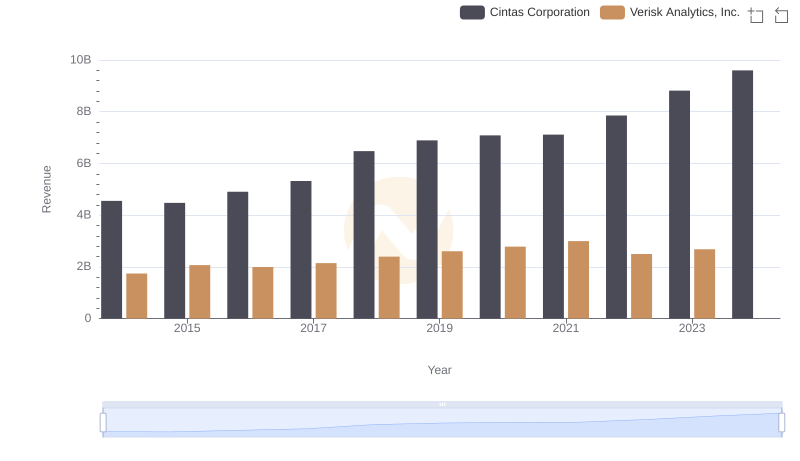

Comparing Revenue Performance: Cintas Corporation or Verisk Analytics, Inc.?

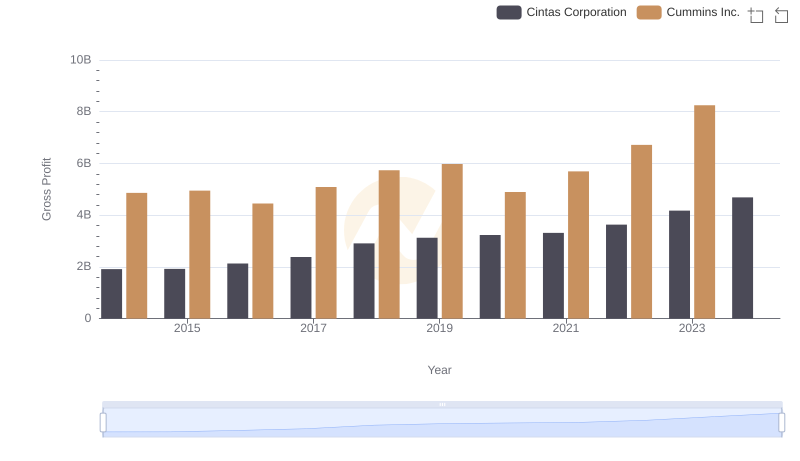

Gross Profit Trends Compared: Cintas Corporation vs Cummins Inc.

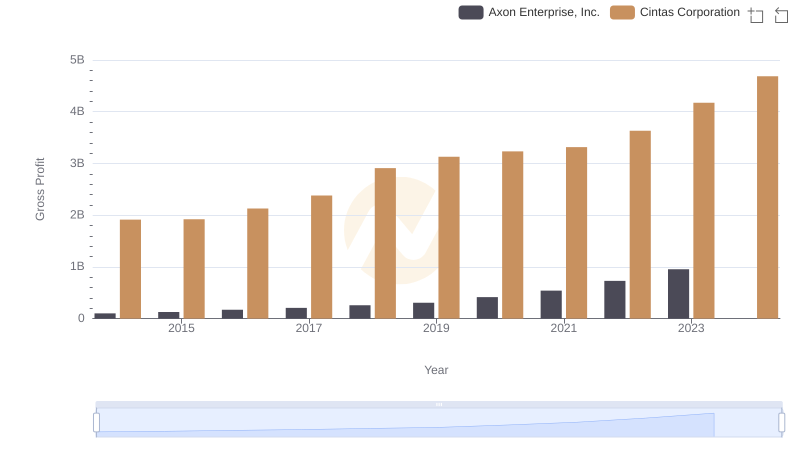

Key Insights on Gross Profit: Cintas Corporation vs Axon Enterprise, Inc.

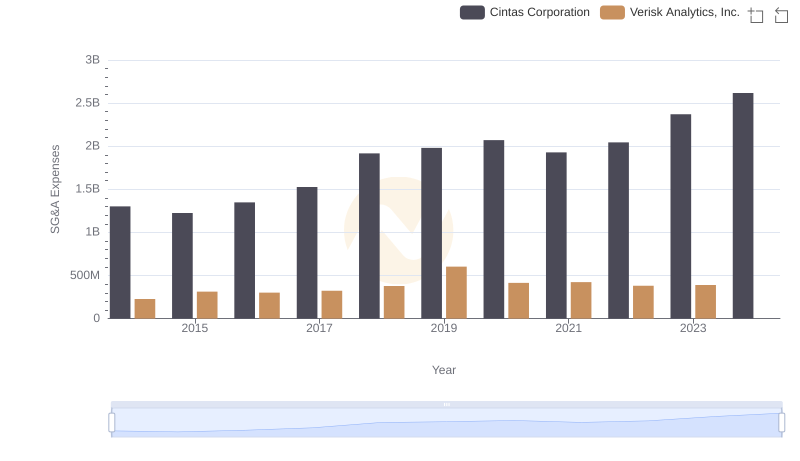

Cost Insights: Breaking Down Cintas Corporation and Verisk Analytics, Inc.'s Expenses

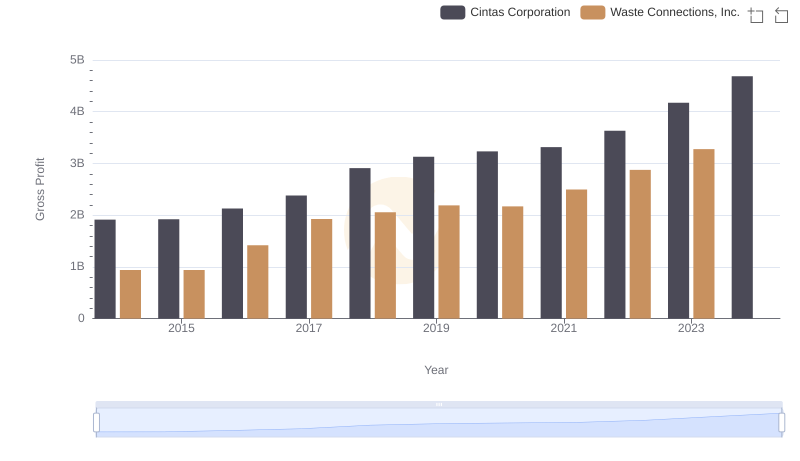

Key Insights on Gross Profit: Cintas Corporation vs Waste Connections, Inc.

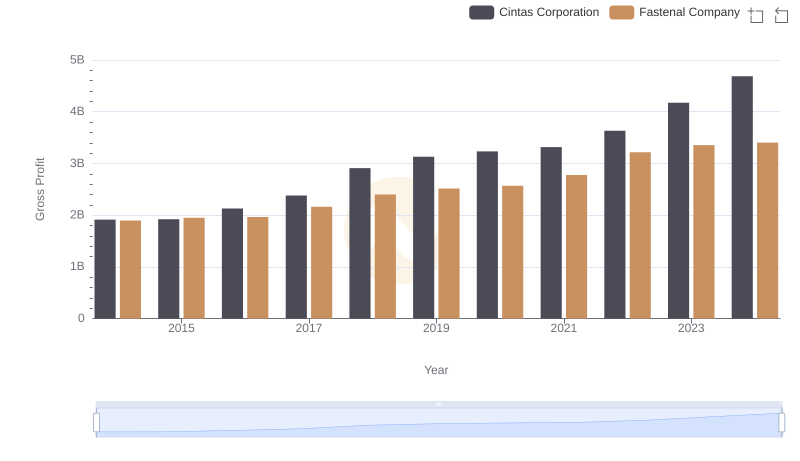

Key Insights on Gross Profit: Cintas Corporation vs Fastenal Company

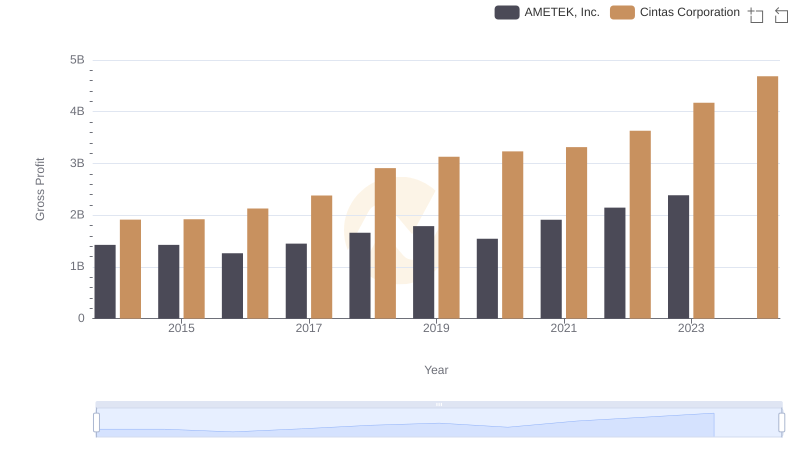

Cintas Corporation vs AMETEK, Inc.: A Gross Profit Performance Breakdown

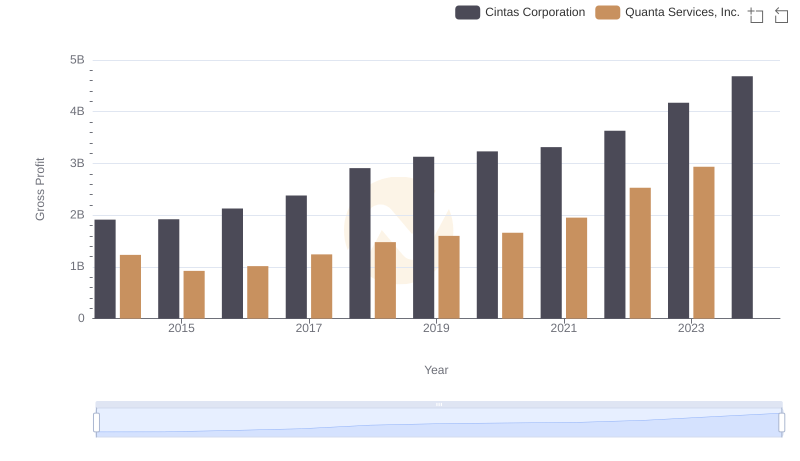

Gross Profit Comparison: Cintas Corporation and Quanta Services, Inc. Trends

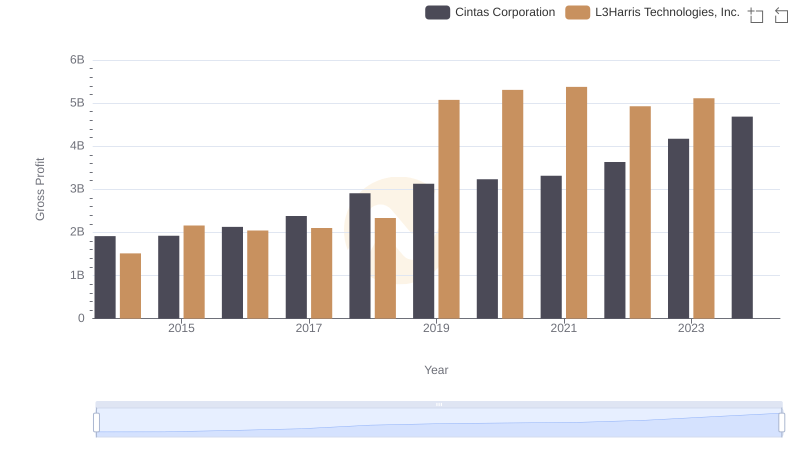

Gross Profit Trends Compared: Cintas Corporation vs L3Harris Technologies, Inc.

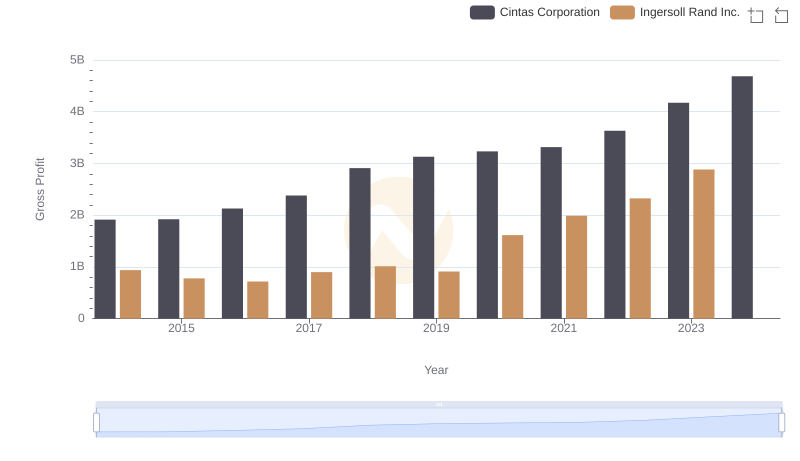

Gross Profit Trends Compared: Cintas Corporation vs Ingersoll Rand Inc.

Cintas Corporation vs Verisk Analytics, Inc.: SG&A Expense Trends

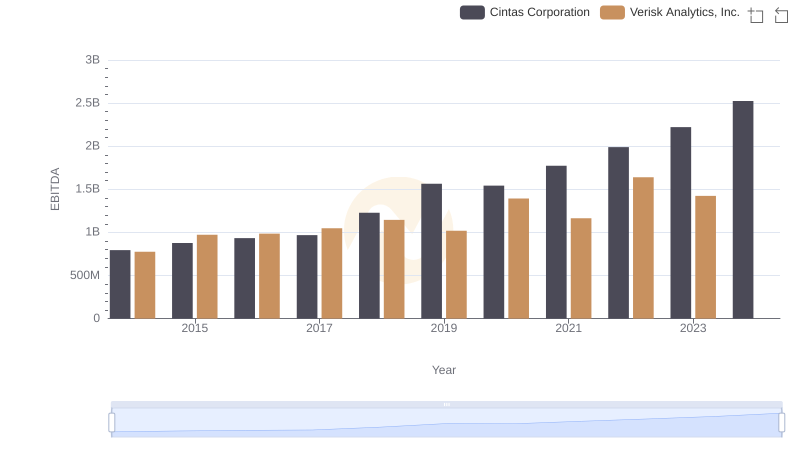

A Side-by-Side Analysis of EBITDA: Cintas Corporation and Verisk Analytics, Inc.