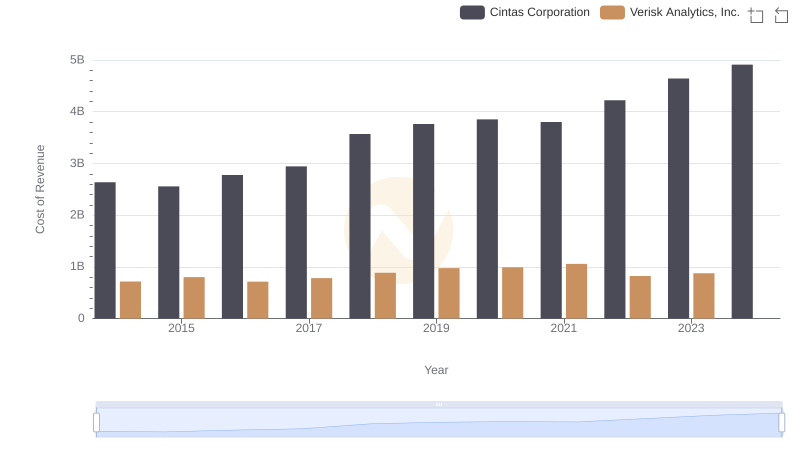

| __timestamp | Cintas Corporation | Verisk Analytics, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 4551812000 | 1746726000 |

| Thursday, January 1, 2015 | 4476886000 | 2068010000 |

| Friday, January 1, 2016 | 4905458000 | 1995200000 |

| Sunday, January 1, 2017 | 5323381000 | 2145200000 |

| Monday, January 1, 2018 | 6476632000 | 2395100000 |

| Tuesday, January 1, 2019 | 6892303000 | 2607100000 |

| Wednesday, January 1, 2020 | 7085120000 | 2784600000 |

| Friday, January 1, 2021 | 7116340000 | 2998600000 |

| Saturday, January 1, 2022 | 7854459000 | 2497000000 |

| Sunday, January 1, 2023 | 8815769000 | 2681400000 |

| Monday, January 1, 2024 | 9596615000 |

In pursuit of knowledge

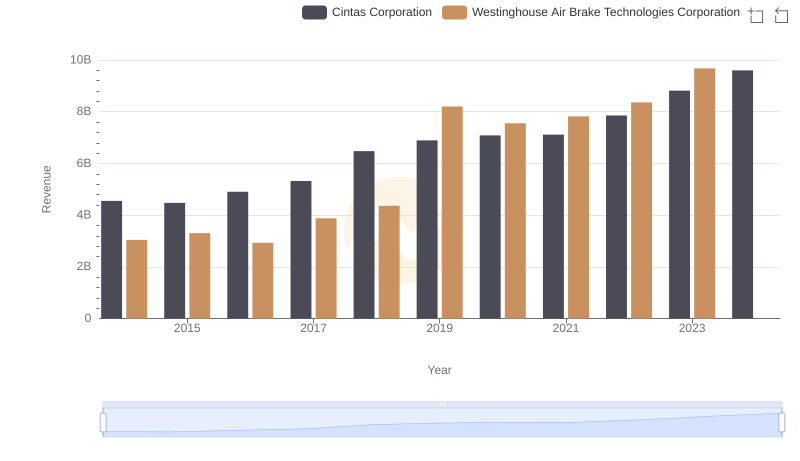

In the competitive landscape of corporate America, revenue growth is a key indicator of success. Over the past decade, Cintas Corporation and Verisk Analytics, Inc. have demonstrated distinct trajectories in their financial performance.

From 2014 to 2023, Cintas Corporation has seen its revenue nearly double, showcasing a robust growth rate of approximately 95%. This consistent upward trend highlights Cintas's strategic prowess in expanding its market share and operational efficiency.

Verisk Analytics, Inc., while not matching the explosive growth of Cintas, has maintained a steady increase in revenue, growing by about 54% over the same period. This reflects Verisk's stronghold in the analytics sector, despite facing challenges in 2022.

As we look to 2024, Cintas continues its upward trajectory, while Verisk's data for the year remains to be seen, leaving room for speculation and anticipation.

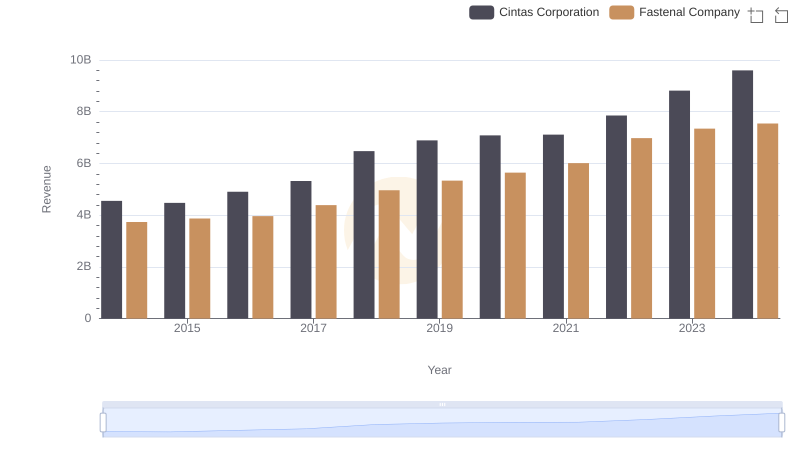

Cintas Corporation vs Fastenal Company: Examining Key Revenue Metrics

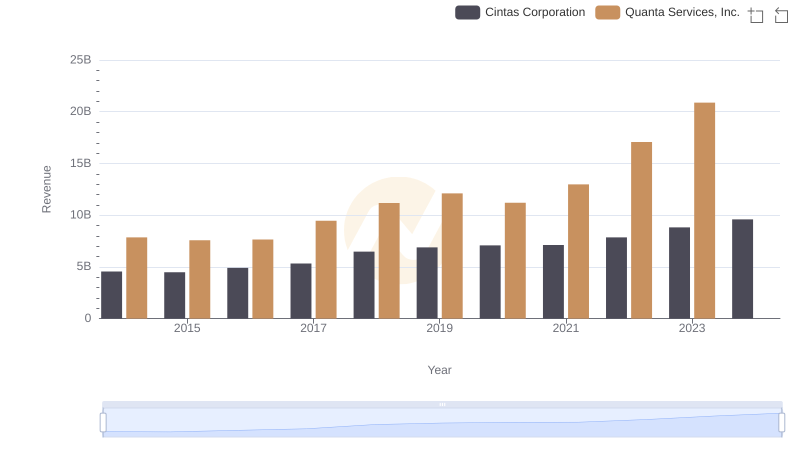

Who Generates More Revenue? Cintas Corporation or Quanta Services, Inc.

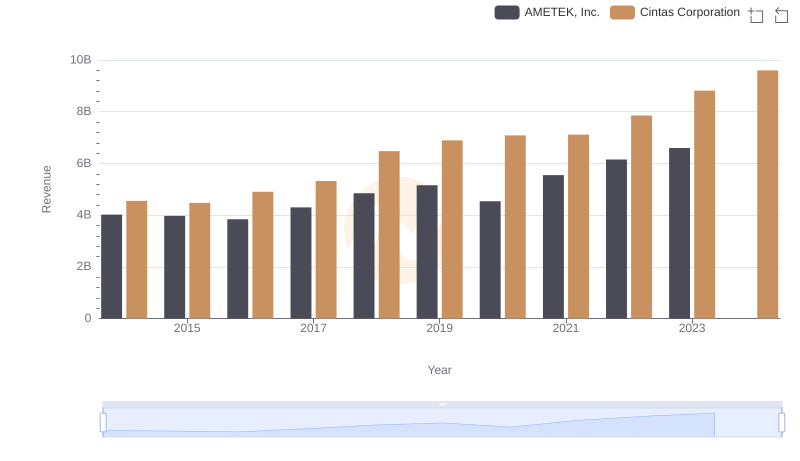

Cintas Corporation vs AMETEK, Inc.: Examining Key Revenue Metrics

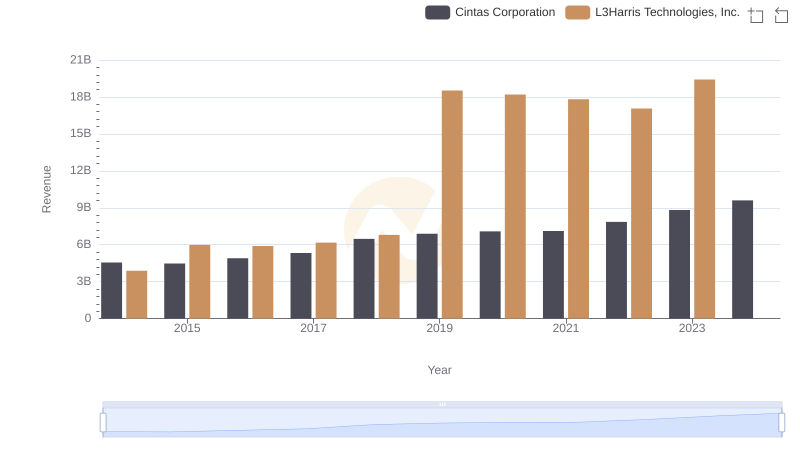

Cintas Corporation and L3Harris Technologies, Inc.: A Comprehensive Revenue Analysis

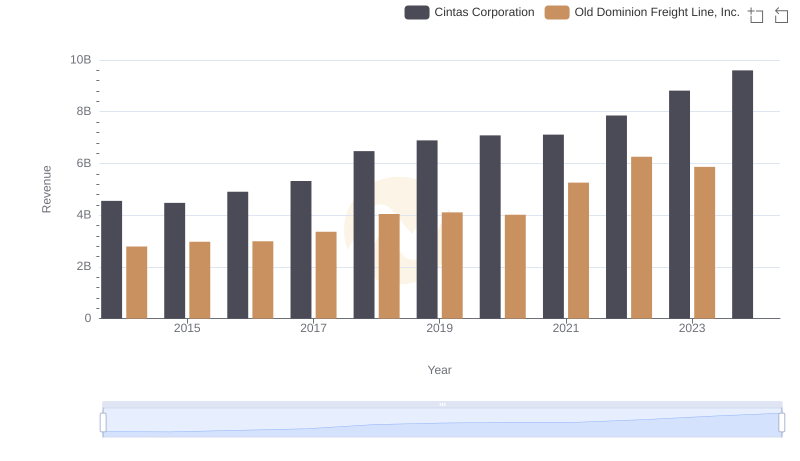

Revenue Insights: Cintas Corporation and Old Dominion Freight Line, Inc. Performance Compared

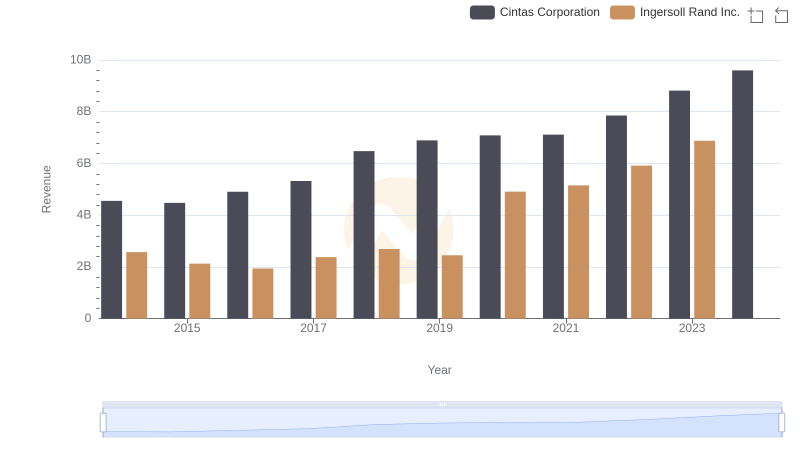

Revenue Showdown: Cintas Corporation vs Ingersoll Rand Inc.

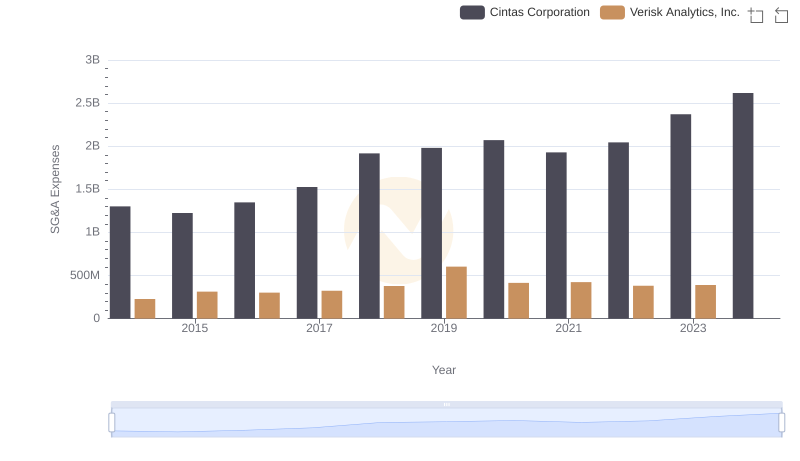

Cost Insights: Breaking Down Cintas Corporation and Verisk Analytics, Inc.'s Expenses

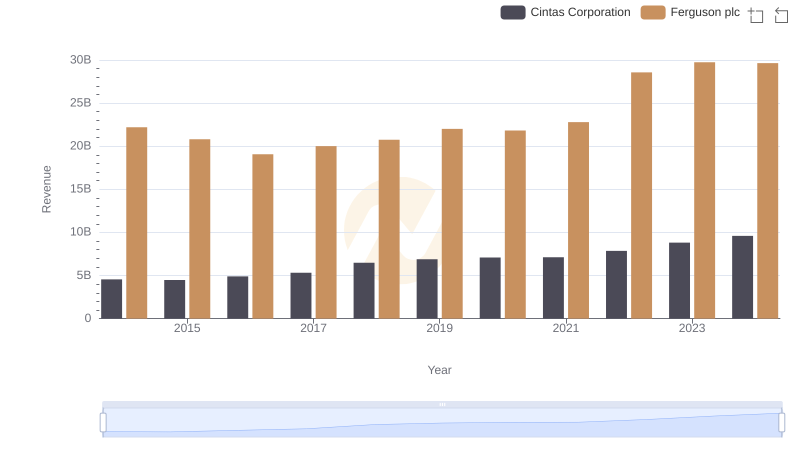

Who Generates More Revenue? Cintas Corporation or Ferguson plc

Revenue Showdown: Cintas Corporation vs Westinghouse Air Brake Technologies Corporation

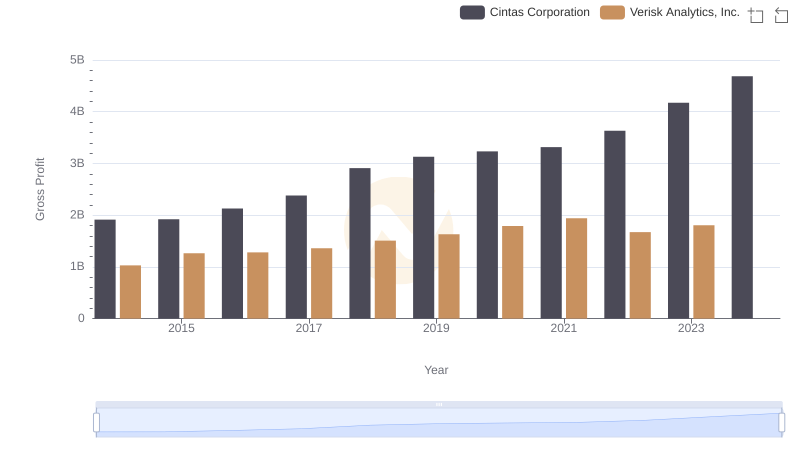

Cintas Corporation and Verisk Analytics, Inc.: A Detailed Gross Profit Analysis

Cintas Corporation vs Verisk Analytics, Inc.: SG&A Expense Trends

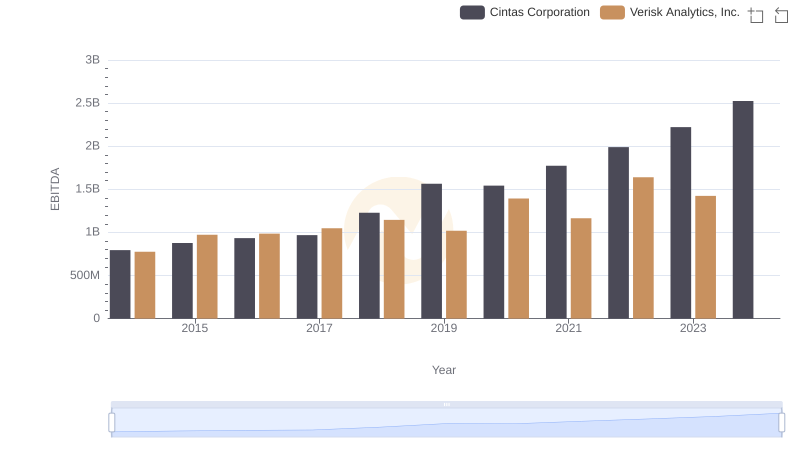

A Side-by-Side Analysis of EBITDA: Cintas Corporation and Verisk Analytics, Inc.