| __timestamp | AMETEK, Inc. | Cintas Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1424947000 | 1914386000 |

| Thursday, January 1, 2015 | 1425015000 | 1921337000 |

| Friday, January 1, 2016 | 1264867000 | 2129870000 |

| Sunday, January 1, 2017 | 1448739000 | 2380295000 |

| Monday, January 1, 2018 | 1659562000 | 2908523000 |

| Tuesday, January 1, 2019 | 1787660000 | 3128588000 |

| Wednesday, January 1, 2020 | 1543514000 | 3233748000 |

| Friday, January 1, 2021 | 1912614000 | 3314651000 |

| Saturday, January 1, 2022 | 2145269000 | 3632246000 |

| Sunday, January 1, 2023 | 2384465001 | 4173368000 |

| Monday, January 1, 2024 | 6941180000 | 4686416000 |

Unleashing insights

In the competitive landscape of industrial services and manufacturing, Cintas Corporation and AMETEK, Inc. have emerged as formidable players. Over the past decade, Cintas has consistently outperformed AMETEK in terms of gross profit, showcasing a robust growth trajectory. From 2014 to 2023, Cintas's gross profit surged by approximately 118%, reaching a peak in 2023. In contrast, AMETEK's growth, while steady, was more modest, with a 67% increase over the same period.

Cintas's strategic focus on expanding its service offerings and enhancing operational efficiency has paid dividends, particularly evident in the 2023 figures, where its gross profit was nearly double that of AMETEK. However, AMETEK's resilience and steady growth cannot be overlooked, as it continues to innovate within its niche markets. As we look to the future, the missing data for 2024 leaves room for speculation on how these industry giants will continue to evolve.

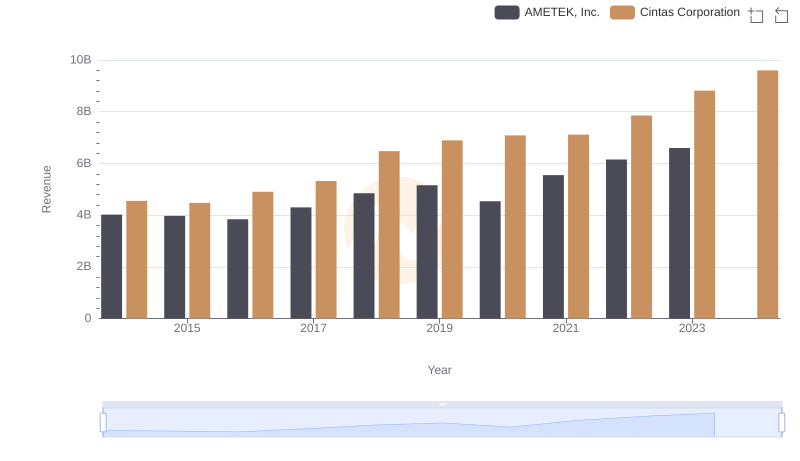

Cintas Corporation vs AMETEK, Inc.: Examining Key Revenue Metrics

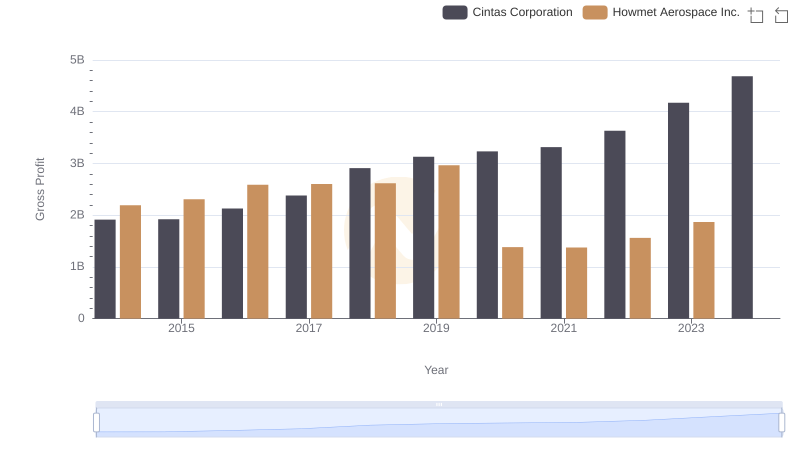

Who Generates Higher Gross Profit? Cintas Corporation or Howmet Aerospace Inc.

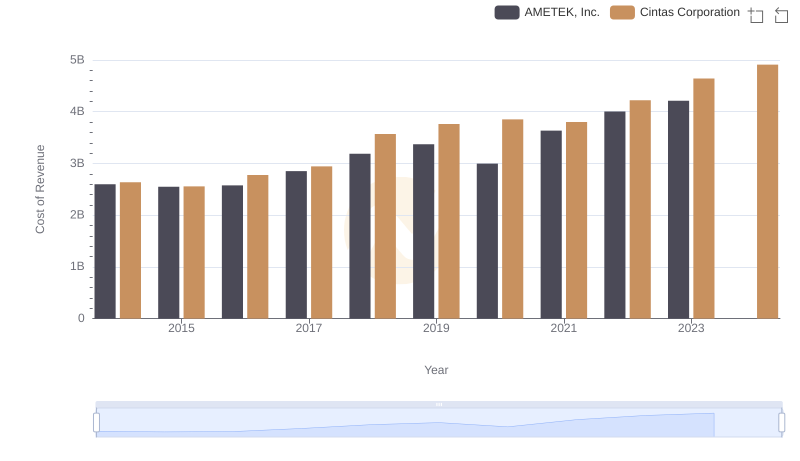

Analyzing Cost of Revenue: Cintas Corporation and AMETEK, Inc.

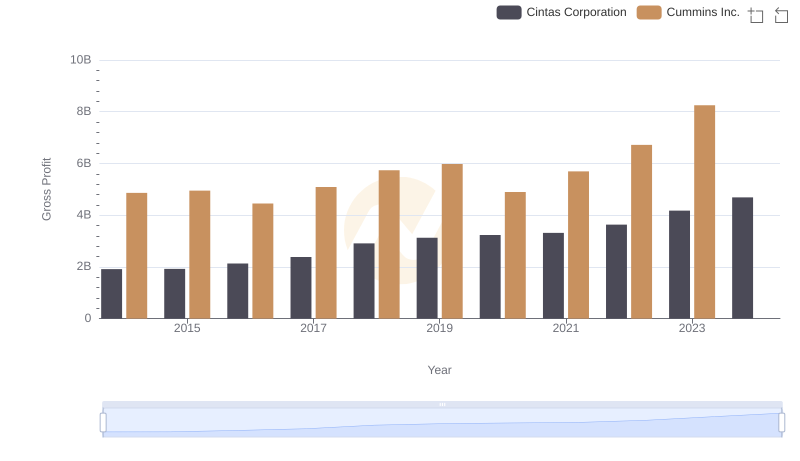

Gross Profit Trends Compared: Cintas Corporation vs Cummins Inc.

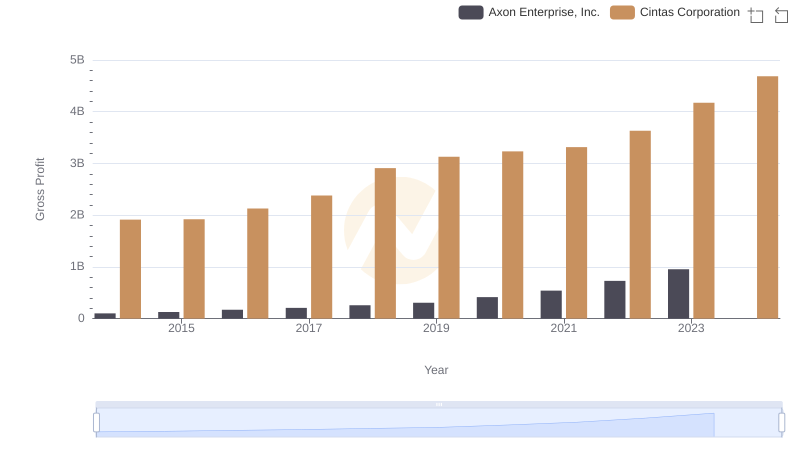

Key Insights on Gross Profit: Cintas Corporation vs Axon Enterprise, Inc.

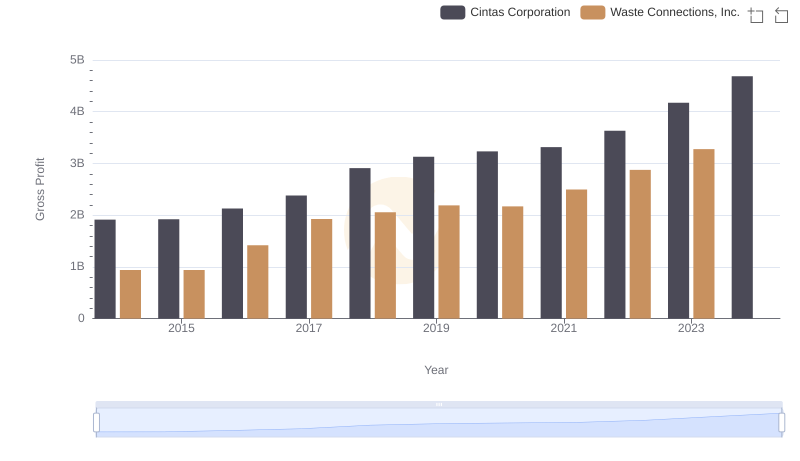

Key Insights on Gross Profit: Cintas Corporation vs Waste Connections, Inc.

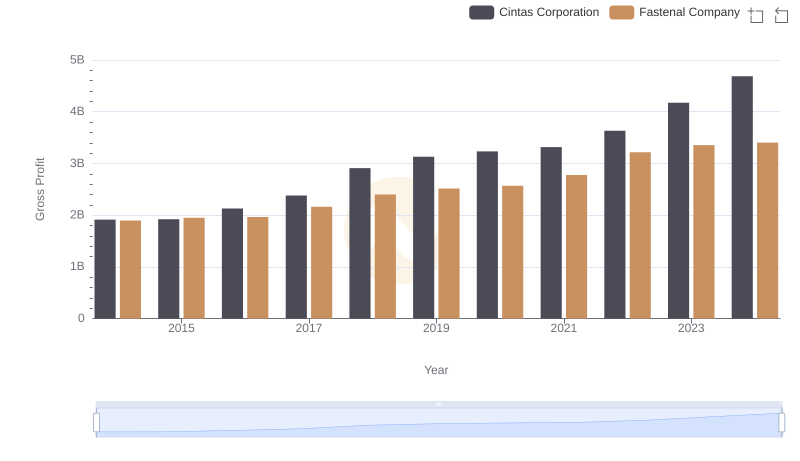

Key Insights on Gross Profit: Cintas Corporation vs Fastenal Company

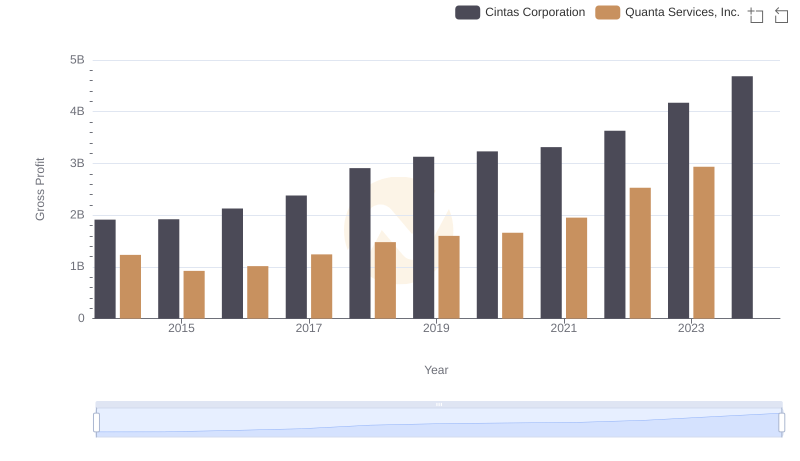

Gross Profit Comparison: Cintas Corporation and Quanta Services, Inc. Trends

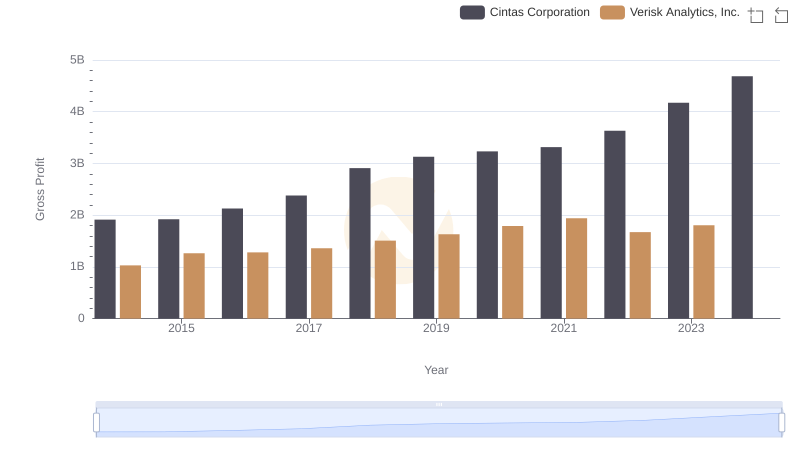

Cintas Corporation and Verisk Analytics, Inc.: A Detailed Gross Profit Analysis

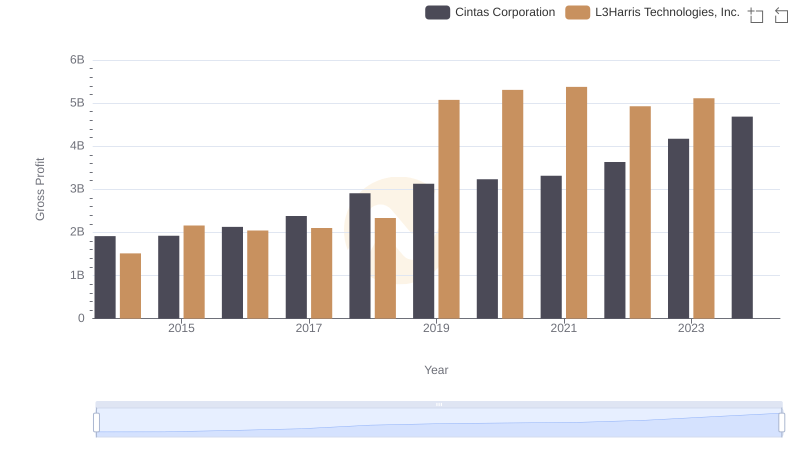

Gross Profit Trends Compared: Cintas Corporation vs L3Harris Technologies, Inc.

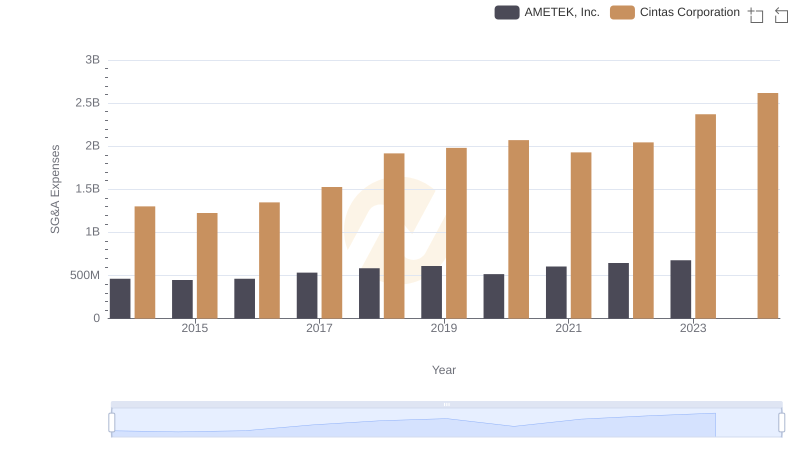

Cintas Corporation vs AMETEK, Inc.: SG&A Expense Trends

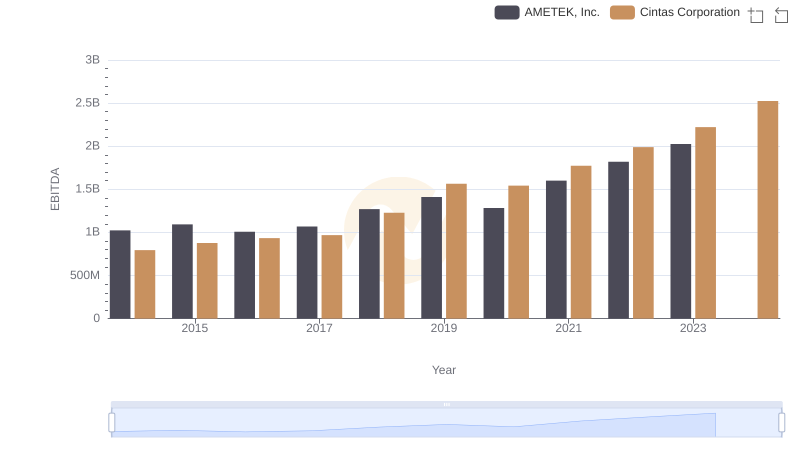

Cintas Corporation vs AMETEK, Inc.: In-Depth EBITDA Performance Comparison