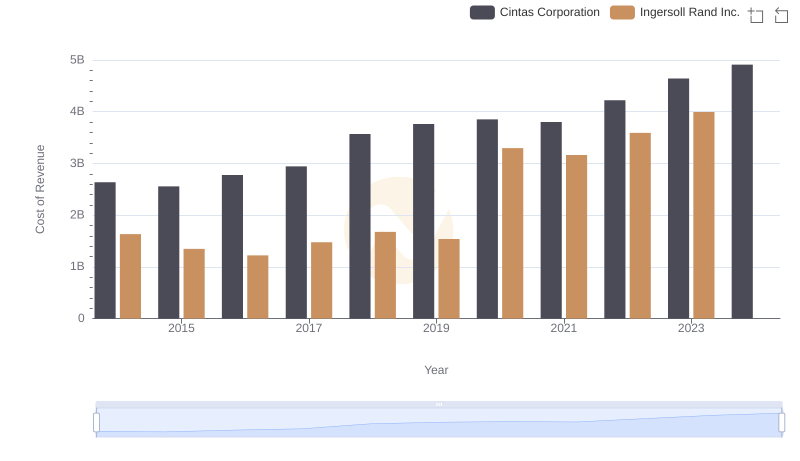

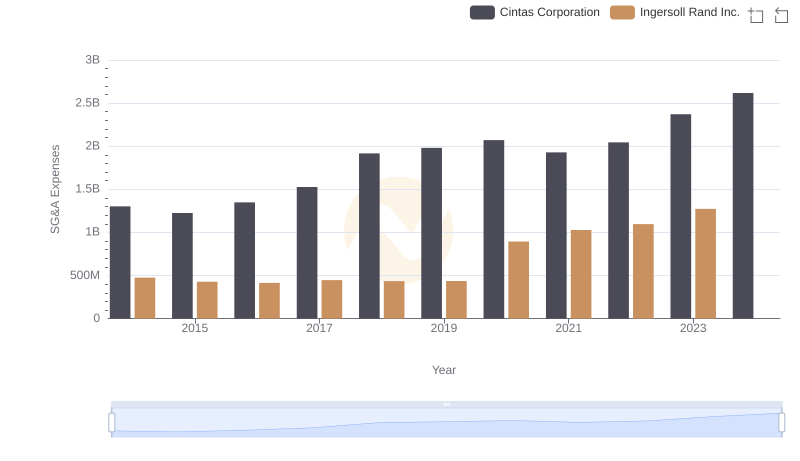

| __timestamp | Cintas Corporation | Ingersoll Rand Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1914386000 | 936781000 |

| Thursday, January 1, 2015 | 1921337000 | 779100000 |

| Friday, January 1, 2016 | 2129870000 | 716731000 |

| Sunday, January 1, 2017 | 2380295000 | 897900000 |

| Monday, January 1, 2018 | 2908523000 | 1012500000 |

| Tuesday, January 1, 2019 | 3128588000 | 911700000 |

| Wednesday, January 1, 2020 | 3233748000 | 1613400000 |

| Friday, January 1, 2021 | 3314651000 | 1988500000 |

| Saturday, January 1, 2022 | 3632246000 | 2325600000 |

| Sunday, January 1, 2023 | 4173368000 | 2882200000 |

| Monday, January 1, 2024 | 4686416000 | 0 |

In pursuit of knowledge

In the competitive landscape of industrial services and manufacturing, Cintas Corporation and Ingersoll Rand Inc. have shown distinct trajectories in their gross profit trends over the past decade. Since 2014, Cintas has consistently outperformed Ingersoll Rand, with its gross profit growing by approximately 145% by 2023. This remarkable growth reflects Cintas's strategic expansions and operational efficiencies.

Ingersoll Rand, while experiencing a more modest increase of around 207% from 2014 to 2023, has shown resilience and adaptability in a challenging market. Notably, the data for 2024 is incomplete, highlighting the dynamic nature of financial forecasting.

These trends underscore the importance of strategic planning and market adaptation in achieving financial success. As we look to the future, both companies' ability to innovate and respond to market demands will be crucial in maintaining their upward trajectories.

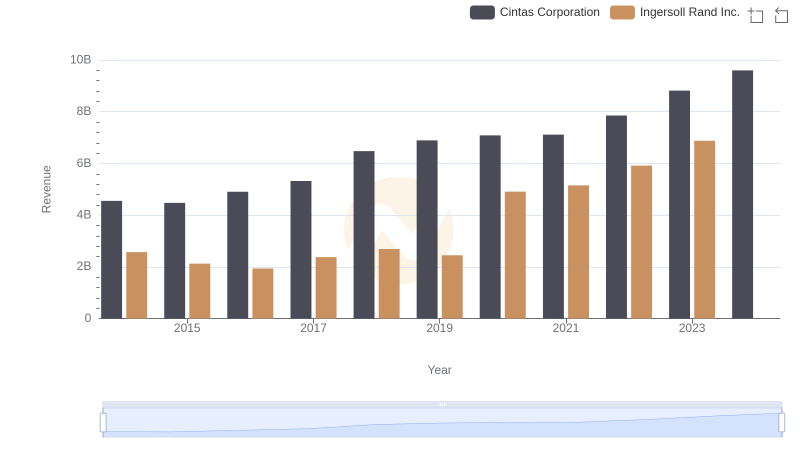

Revenue Showdown: Cintas Corporation vs Ingersoll Rand Inc.

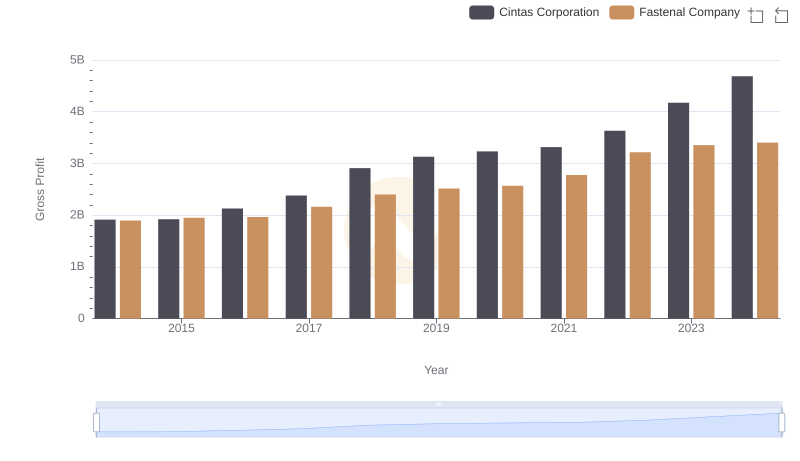

Key Insights on Gross Profit: Cintas Corporation vs Fastenal Company

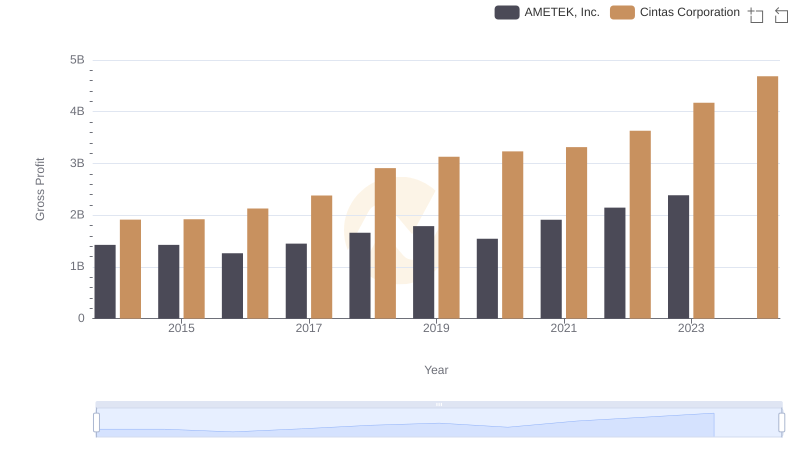

Cintas Corporation vs AMETEK, Inc.: A Gross Profit Performance Breakdown

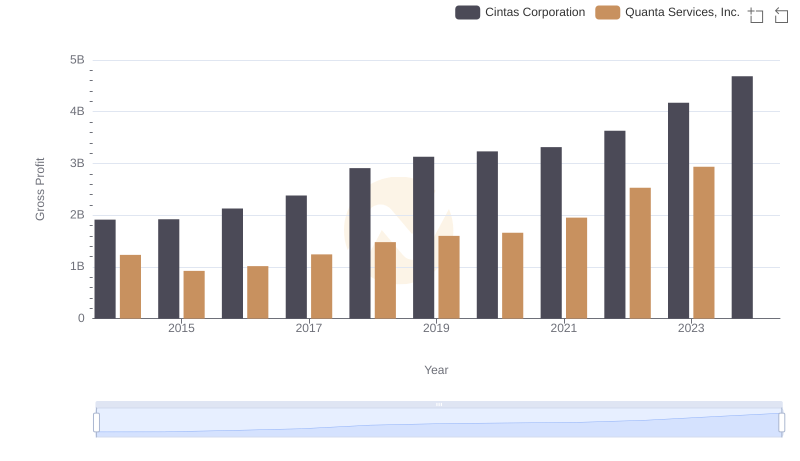

Gross Profit Comparison: Cintas Corporation and Quanta Services, Inc. Trends

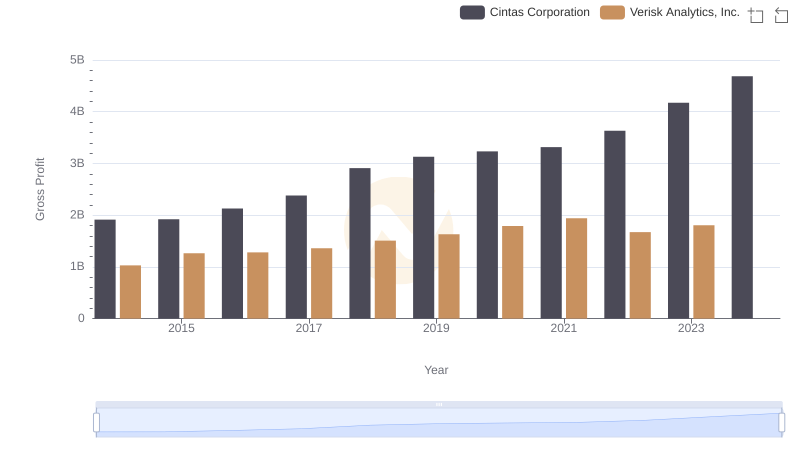

Cintas Corporation and Verisk Analytics, Inc.: A Detailed Gross Profit Analysis

Cost Insights: Breaking Down Cintas Corporation and Ingersoll Rand Inc.'s Expenses

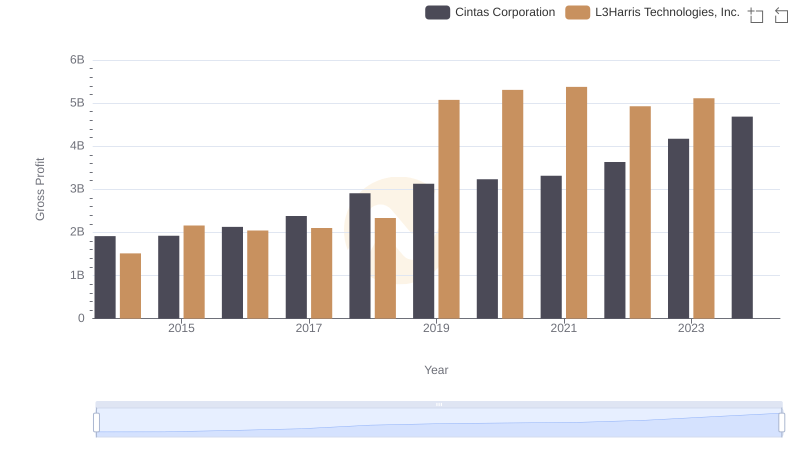

Gross Profit Trends Compared: Cintas Corporation vs L3Harris Technologies, Inc.

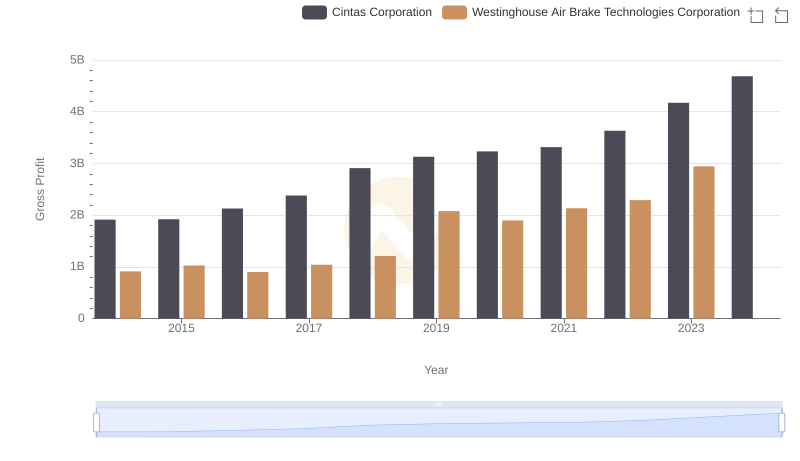

Who Generates Higher Gross Profit? Cintas Corporation or Westinghouse Air Brake Technologies Corporation

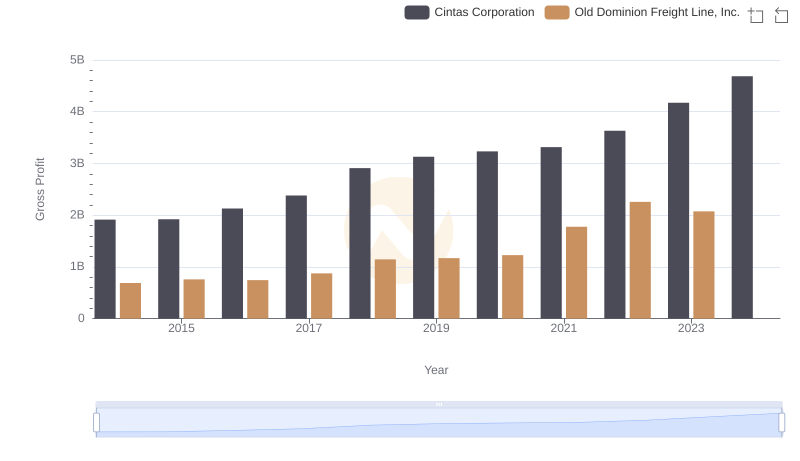

Gross Profit Analysis: Comparing Cintas Corporation and Old Dominion Freight Line, Inc.

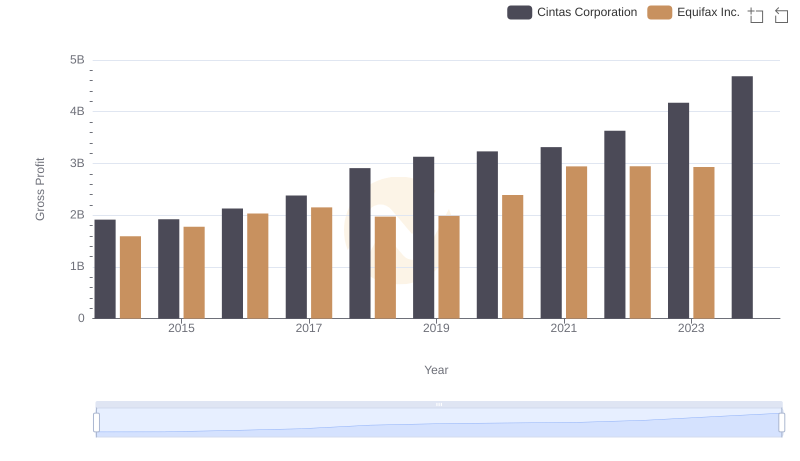

Gross Profit Comparison: Cintas Corporation and Equifax Inc. Trends

Cintas Corporation and Ingersoll Rand Inc.: SG&A Spending Patterns Compared

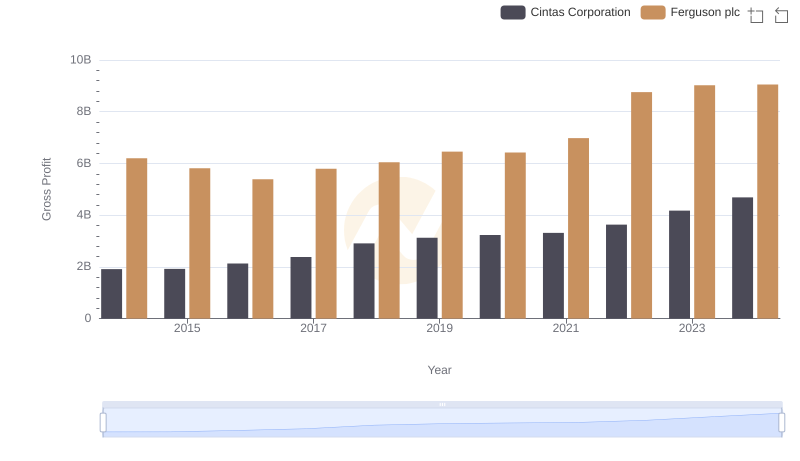

Gross Profit Trends Compared: Cintas Corporation vs Ferguson plc