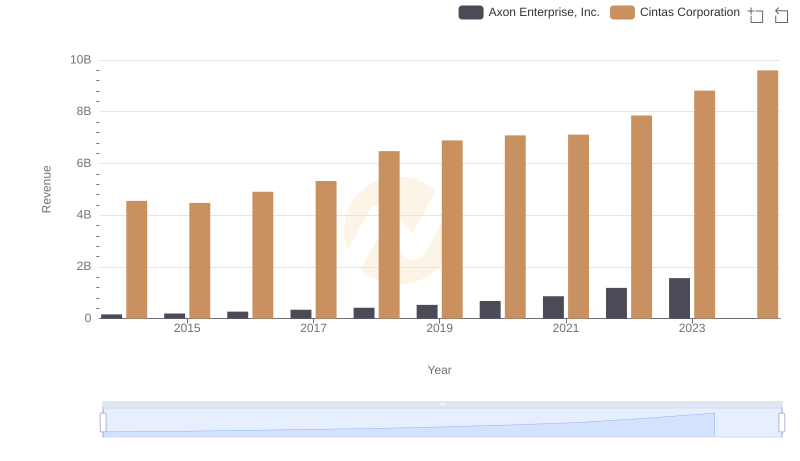

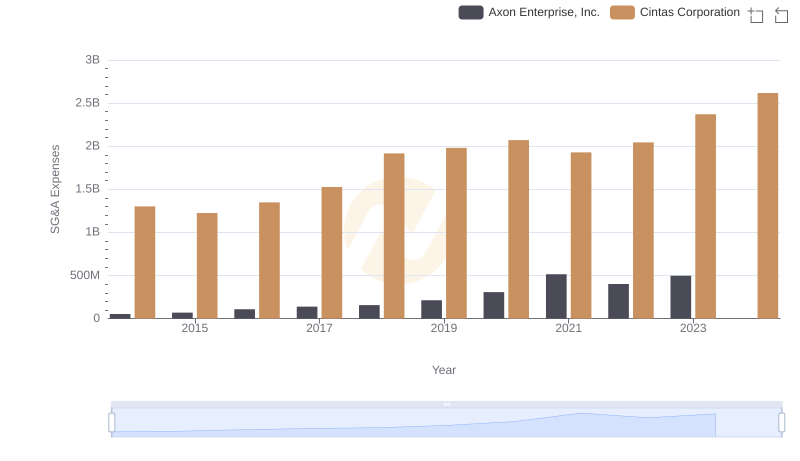

| __timestamp | Axon Enterprise, Inc. | Cintas Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 101548000 | 1914386000 |

| Thursday, January 1, 2015 | 128647000 | 1921337000 |

| Friday, January 1, 2016 | 170536000 | 2129870000 |

| Sunday, January 1, 2017 | 207088000 | 2380295000 |

| Monday, January 1, 2018 | 258583000 | 2908523000 |

| Tuesday, January 1, 2019 | 307286000 | 3128588000 |

| Wednesday, January 1, 2020 | 416331000 | 3233748000 |

| Friday, January 1, 2021 | 540910000 | 3314651000 |

| Saturday, January 1, 2022 | 728638000 | 3632246000 |

| Sunday, January 1, 2023 | 955382000 | 4173368000 |

| Monday, January 1, 2024 | 4686416000 |

Data in motion

In the competitive landscape of corporate America, Cintas Corporation and Axon Enterprise, Inc. have carved distinct paths in their financial journeys. Over the past decade, Cintas has consistently outperformed Axon in terms of gross profit, showcasing a robust growth trajectory. From 2014 to 2023, Cintas saw its gross profit soar by approximately 118%, reaching a peak in 2023. In contrast, Axon, while demonstrating impressive growth, increased its gross profit by around 841% during the same period, albeit from a smaller base.

Cintas's steady climb reflects its stronghold in the uniform and facility services industry, while Axon's rapid ascent highlights its innovation in public safety technology. As we look to the future, the missing data for 2024 leaves us anticipating whether Cintas will maintain its lead or if Axon will continue its upward momentum.

Cintas Corporation vs Axon Enterprise, Inc.: Annual Revenue Growth Compared

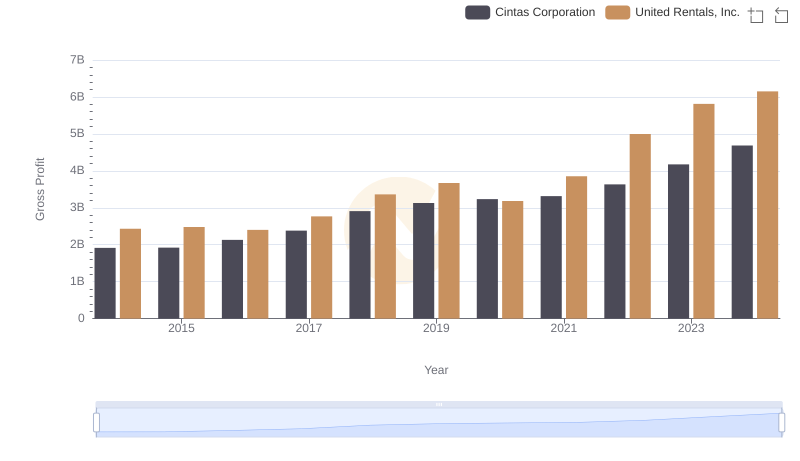

Gross Profit Analysis: Comparing Cintas Corporation and United Rentals, Inc.

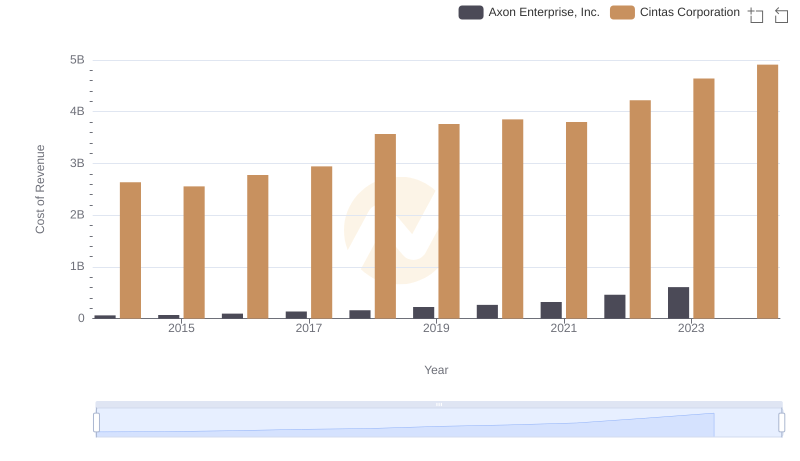

Cost of Revenue: Key Insights for Cintas Corporation and Axon Enterprise, Inc.

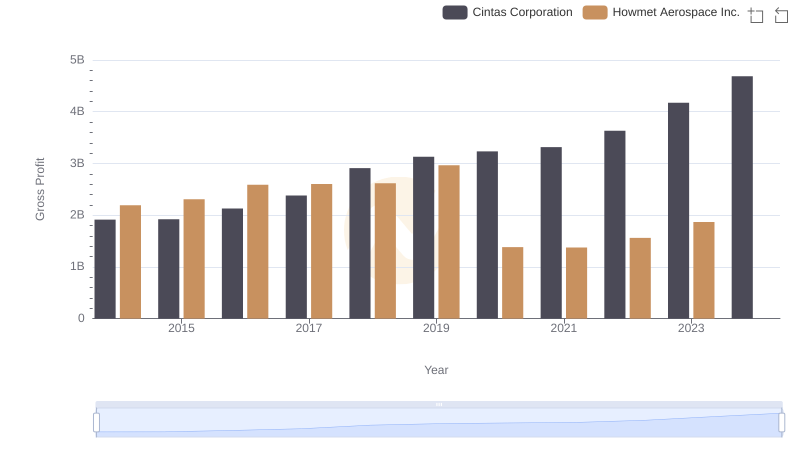

Who Generates Higher Gross Profit? Cintas Corporation or Howmet Aerospace Inc.

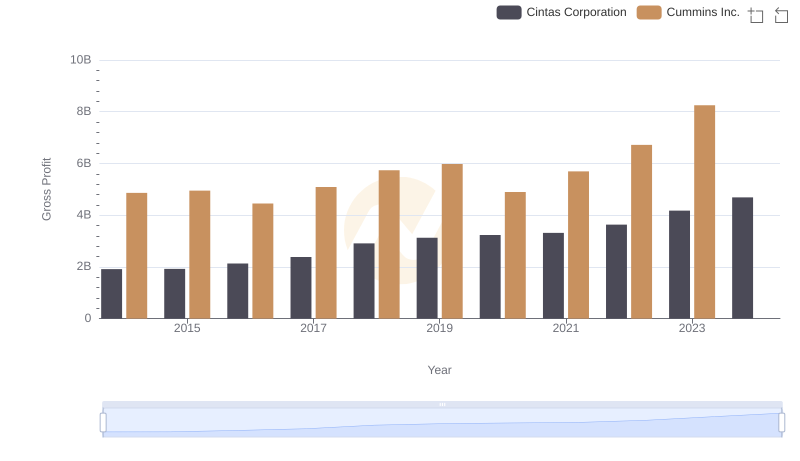

Gross Profit Trends Compared: Cintas Corporation vs Cummins Inc.

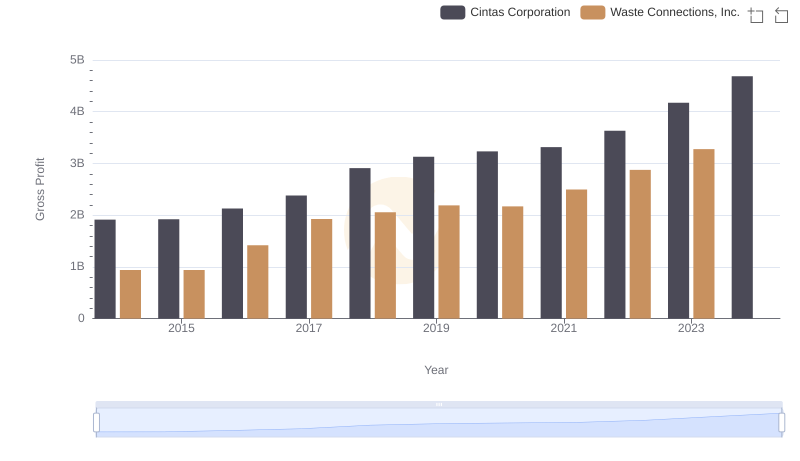

Key Insights on Gross Profit: Cintas Corporation vs Waste Connections, Inc.

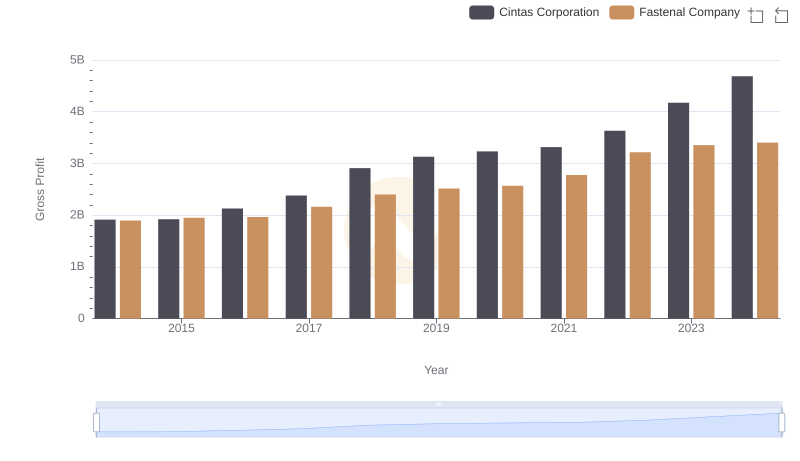

Key Insights on Gross Profit: Cintas Corporation vs Fastenal Company

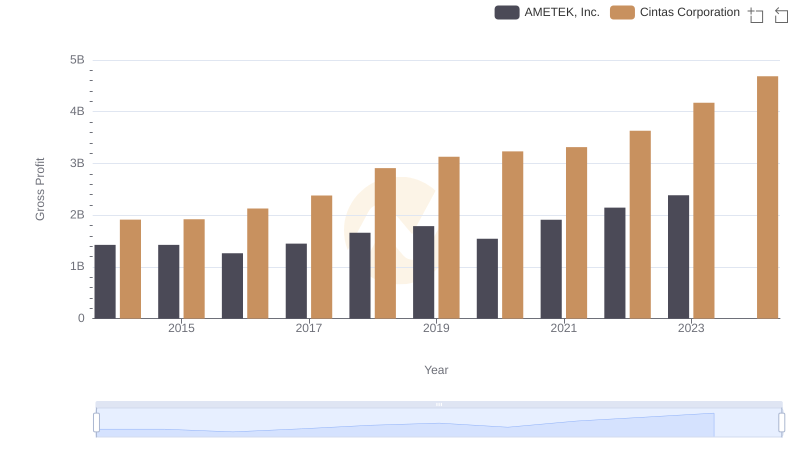

Cintas Corporation vs AMETEK, Inc.: A Gross Profit Performance Breakdown

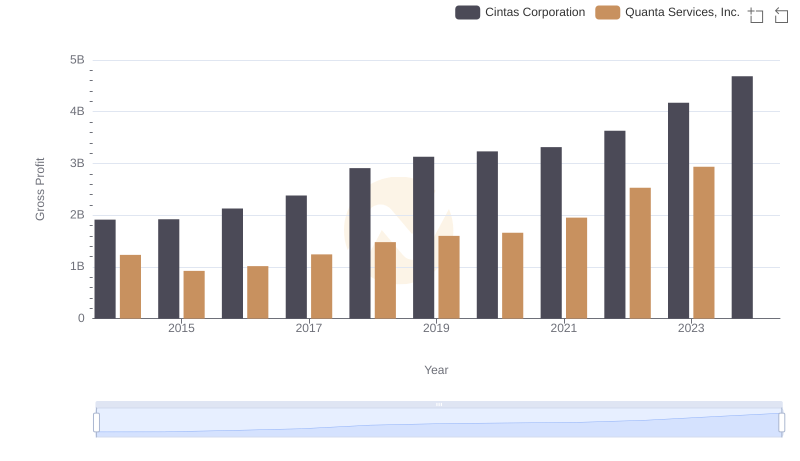

Gross Profit Comparison: Cintas Corporation and Quanta Services, Inc. Trends

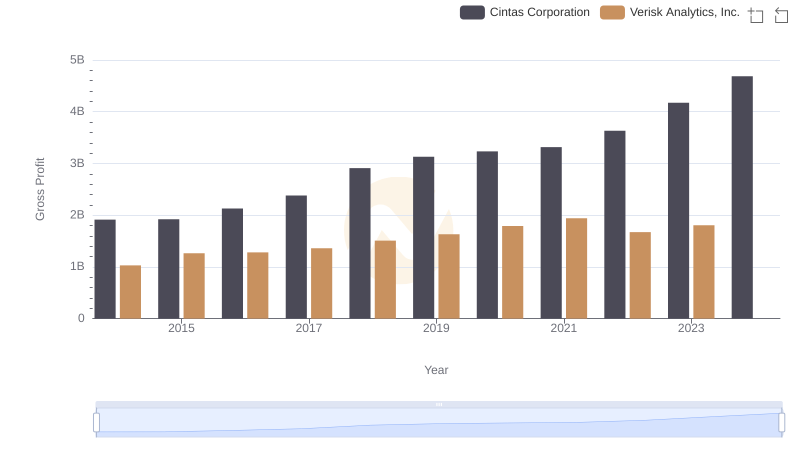

Cintas Corporation and Verisk Analytics, Inc.: A Detailed Gross Profit Analysis

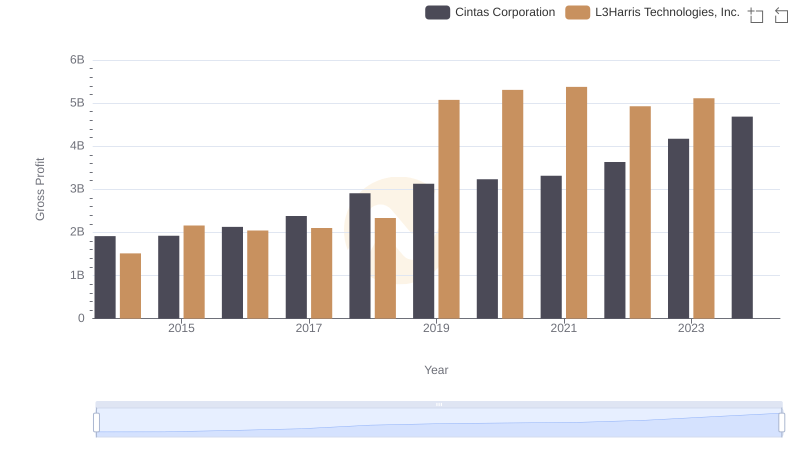

Gross Profit Trends Compared: Cintas Corporation vs L3Harris Technologies, Inc.

Cintas Corporation and Axon Enterprise, Inc.: SG&A Spending Patterns Compared