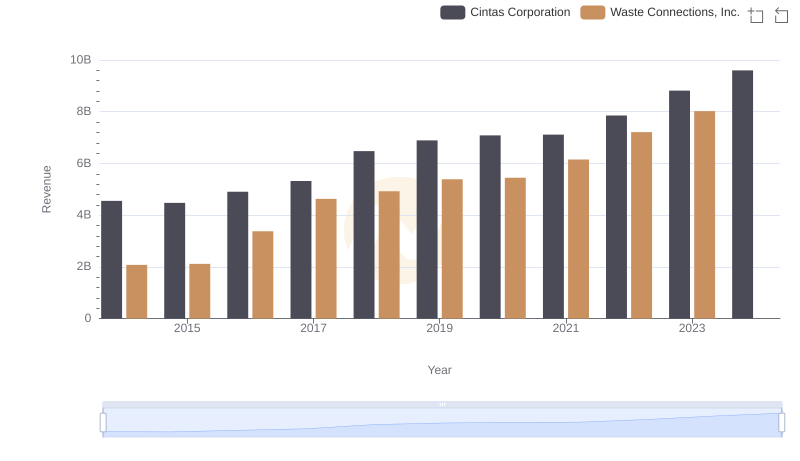

| __timestamp | Cintas Corporation | Waste Connections, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1914386000 | 940778000 |

| Thursday, January 1, 2015 | 1921337000 | 939878000 |

| Friday, January 1, 2016 | 2129870000 | 1418151000 |

| Sunday, January 1, 2017 | 2380295000 | 1925713000 |

| Monday, January 1, 2018 | 2908523000 | 2057237000 |

| Tuesday, January 1, 2019 | 3128588000 | 2189922000 |

| Wednesday, January 1, 2020 | 3233748000 | 2169182000 |

| Friday, January 1, 2021 | 3314651000 | 2497287000 |

| Saturday, January 1, 2022 | 3632246000 | 2875847000 |

| Sunday, January 1, 2023 | 4173368000 | 3277438000 |

| Monday, January 1, 2024 | 4686416000 | 3727885000 |

Unleashing insights

In the competitive landscape of corporate America, Cintas Corporation and Waste Connections, Inc. have emerged as formidable players. Over the past decade, Cintas has consistently outperformed Waste Connections in terms of gross profit, showcasing a robust growth trajectory. From 2014 to 2023, Cintas saw its gross profit soar by approximately 145%, reaching a peak in 2023. In contrast, Waste Connections experienced a commendable growth of around 248% during the same period, albeit starting from a lower base.

The data reveals a compelling narrative of strategic growth and market positioning. Cintas's steady climb reflects its stronghold in the uniform rental and facility services industry, while Waste Connections' impressive growth underscores its expanding footprint in the waste management sector. As we look to the future, the absence of data for 2024 for Waste Connections leaves room for speculation on its next strategic move.

Cintas Corporation and Waste Connections, Inc.: A Comprehensive Revenue Analysis

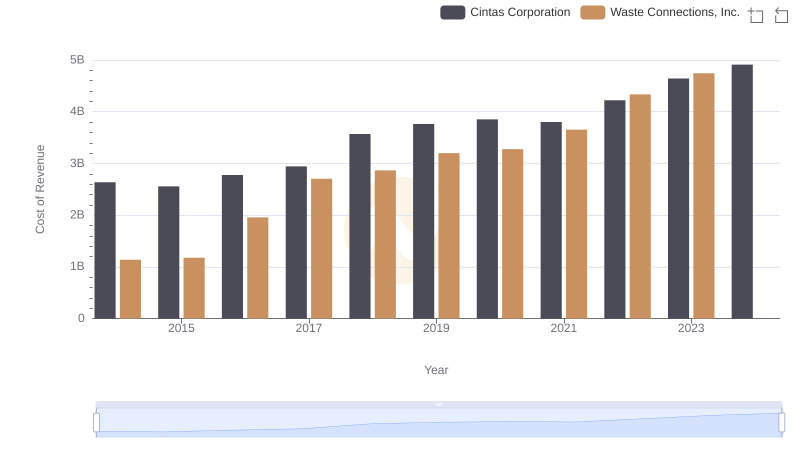

Cost of Revenue Comparison: Cintas Corporation vs Waste Connections, Inc.

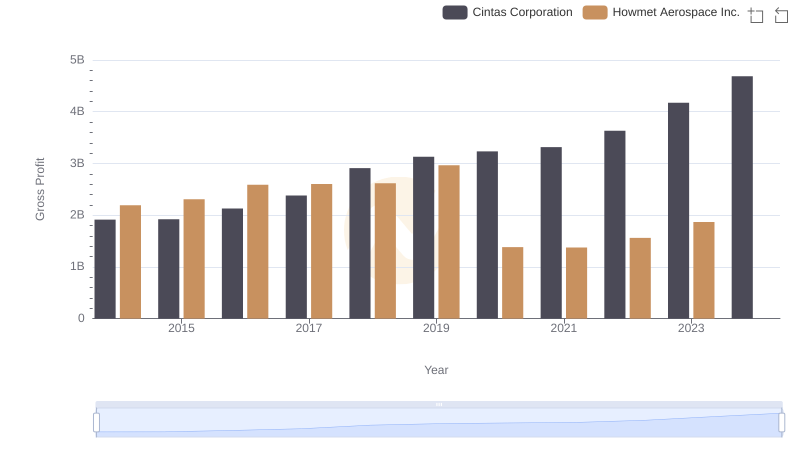

Who Generates Higher Gross Profit? Cintas Corporation or Howmet Aerospace Inc.

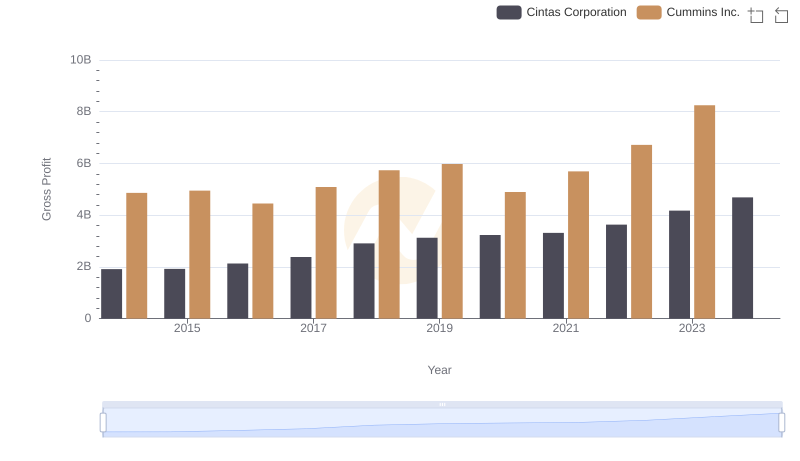

Gross Profit Trends Compared: Cintas Corporation vs Cummins Inc.

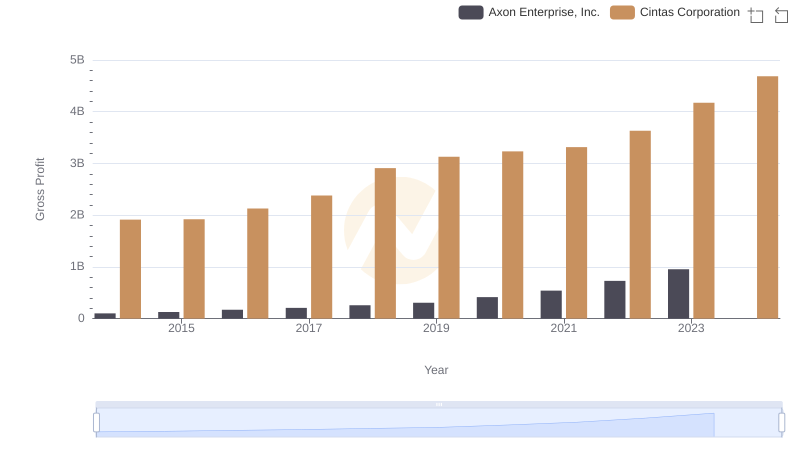

Key Insights on Gross Profit: Cintas Corporation vs Axon Enterprise, Inc.

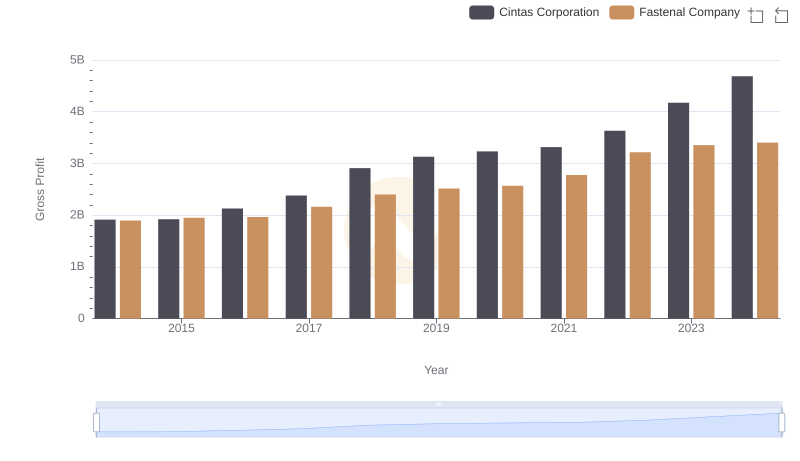

Key Insights on Gross Profit: Cintas Corporation vs Fastenal Company

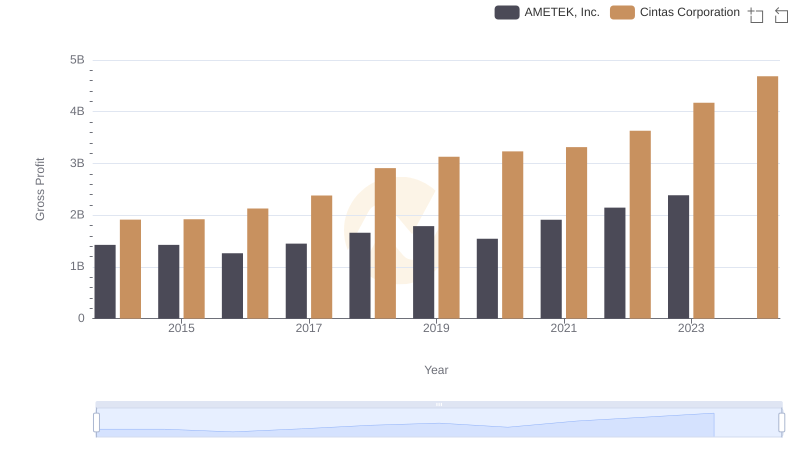

Cintas Corporation vs AMETEK, Inc.: A Gross Profit Performance Breakdown

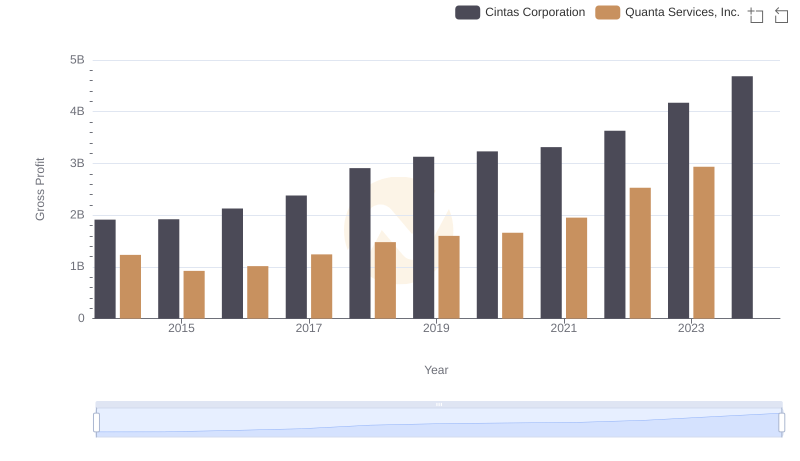

Gross Profit Comparison: Cintas Corporation and Quanta Services, Inc. Trends

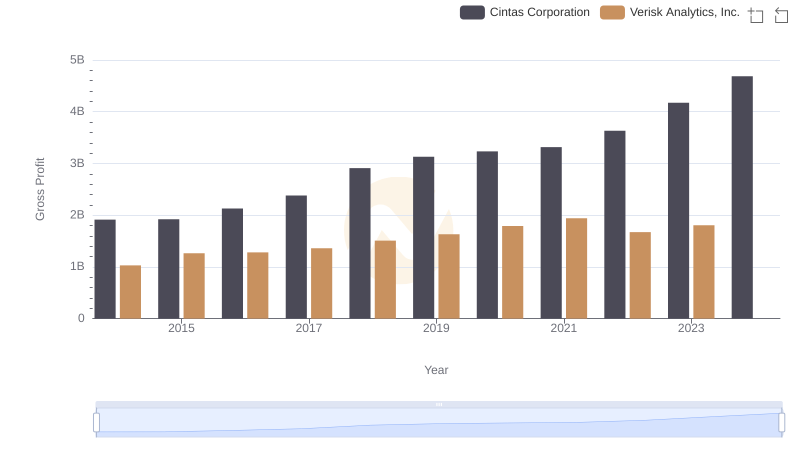

Cintas Corporation and Verisk Analytics, Inc.: A Detailed Gross Profit Analysis

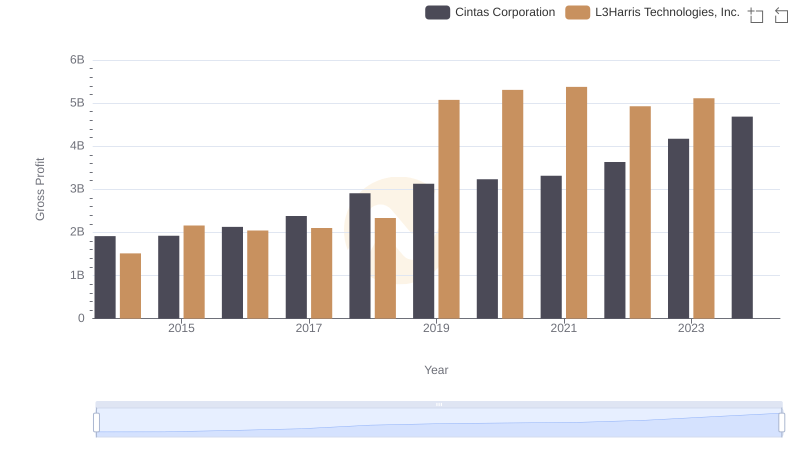

Gross Profit Trends Compared: Cintas Corporation vs L3Harris Technologies, Inc.

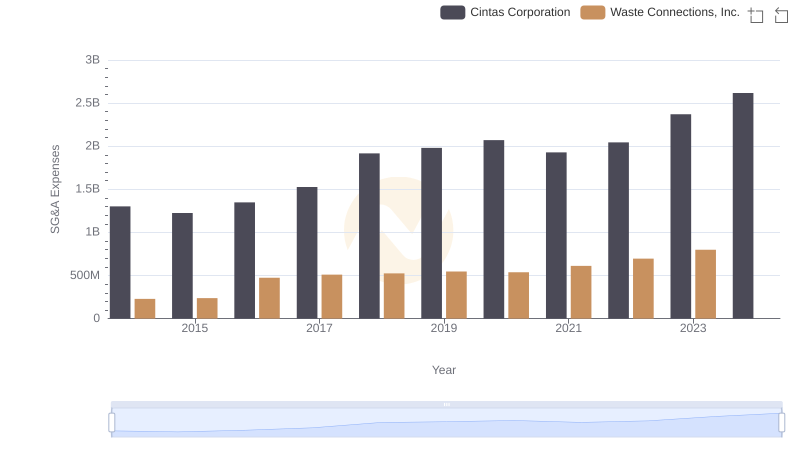

SG&A Efficiency Analysis: Comparing Cintas Corporation and Waste Connections, Inc.

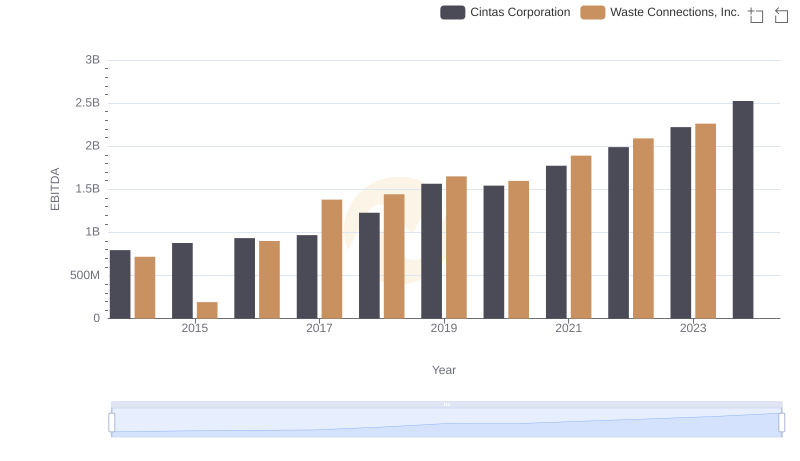

A Side-by-Side Analysis of EBITDA: Cintas Corporation and Waste Connections, Inc.