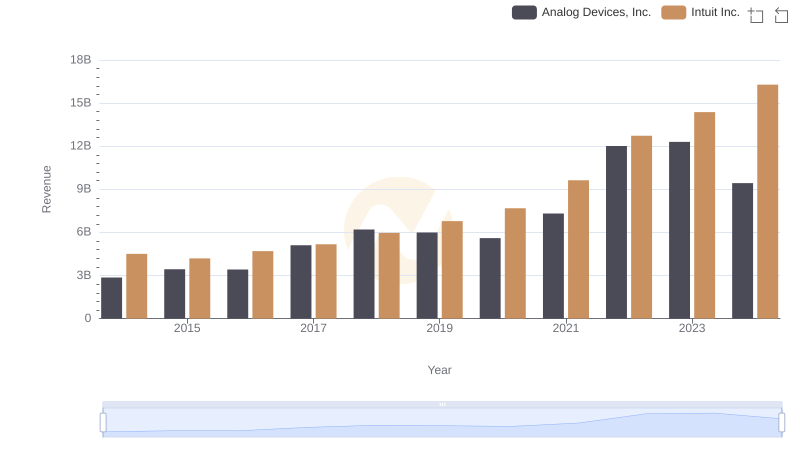

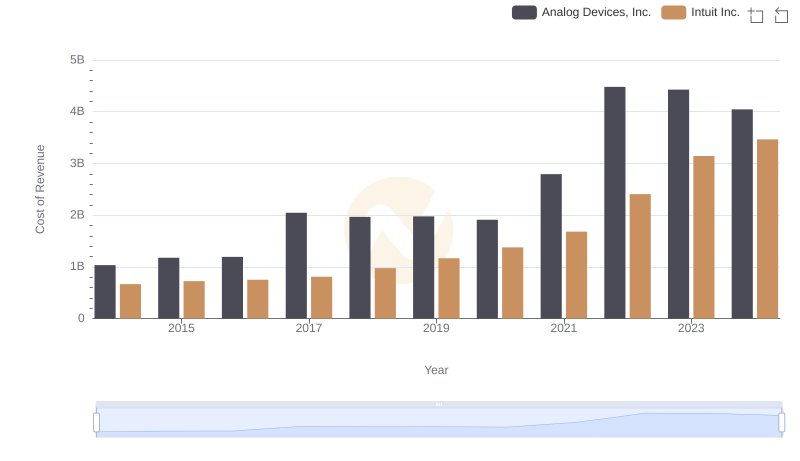

| __timestamp | Analog Devices, Inc. | Intuit Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1830188000 | 3838000000 |

| Thursday, January 1, 2015 | 2259262000 | 3467000000 |

| Friday, January 1, 2016 | 2227173000 | 3942000000 |

| Sunday, January 1, 2017 | 3061596000 | 4368000000 |

| Monday, January 1, 2018 | 4233302000 | 4987000000 |

| Tuesday, January 1, 2019 | 4013750000 | 5617000000 |

| Wednesday, January 1, 2020 | 3690478000 | 6301000000 |

| Friday, January 1, 2021 | 4525012000 | 7950000000 |

| Saturday, January 1, 2022 | 7532474000 | 10320000000 |

| Sunday, January 1, 2023 | 7877218000 | 11225000000 |

| Monday, January 1, 2024 | 5381343000 | 12820000000 |

In pursuit of knowledge

In the ever-evolving landscape of technology and finance, two titans stand out: Intuit Inc. and Analog Devices, Inc. Over the past decade, these companies have showcased remarkable growth in gross profit, reflecting their strategic prowess and market adaptability. From 2014 to 2024, Intuit Inc. consistently outperformed Analog Devices, with an average gross profit approximately 60% higher. Notably, in 2023, Intuit's gross profit surged to over $11 billion, marking a 190% increase from 2014. Meanwhile, Analog Devices also demonstrated impressive growth, peaking at nearly $7.9 billion in 2023, a 330% rise from its 2014 figures. This data underscores the dynamic nature of the tech industry, where innovation and strategic investments drive financial success. As we look to the future, these trends highlight the importance of agility and foresight in maintaining competitive advantage.

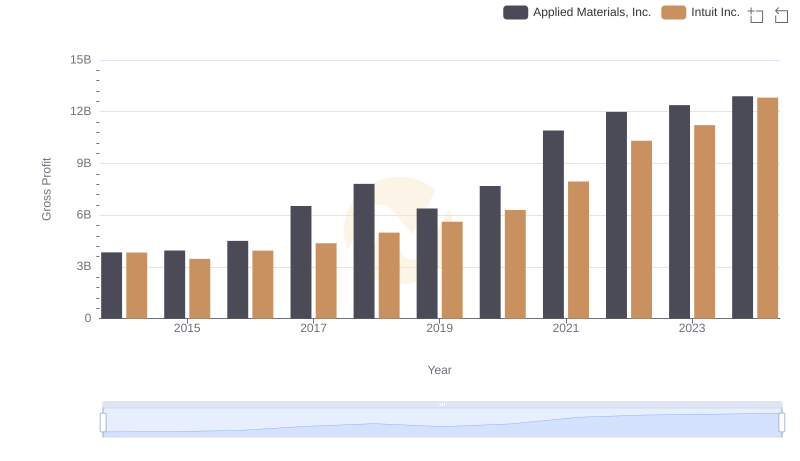

Intuit Inc. and Applied Materials, Inc.: A Detailed Gross Profit Analysis

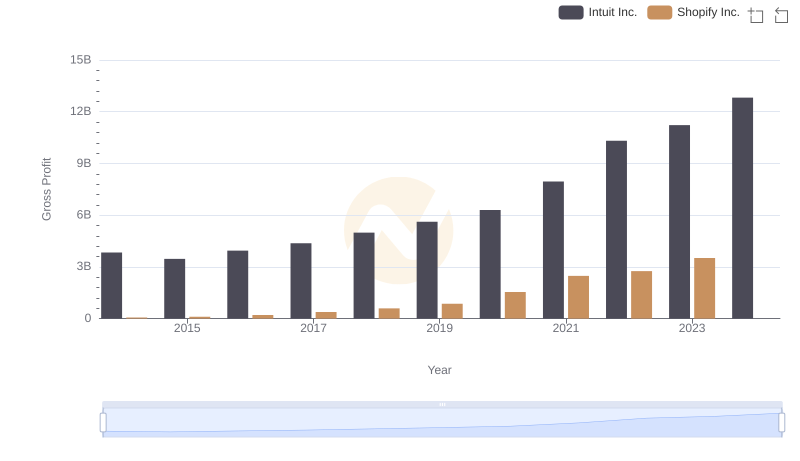

Gross Profit Comparison: Intuit Inc. and Shopify Inc. Trends

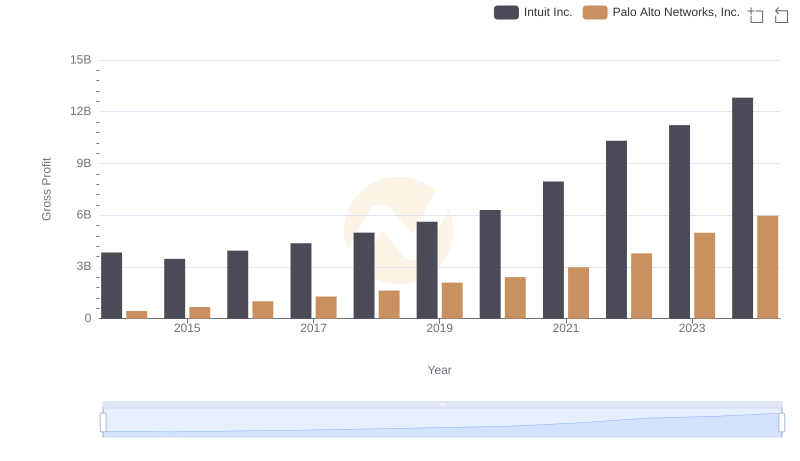

Who Generates Higher Gross Profit? Intuit Inc. or Palo Alto Networks, Inc.

Who Generates More Revenue? Intuit Inc. or Analog Devices, Inc.

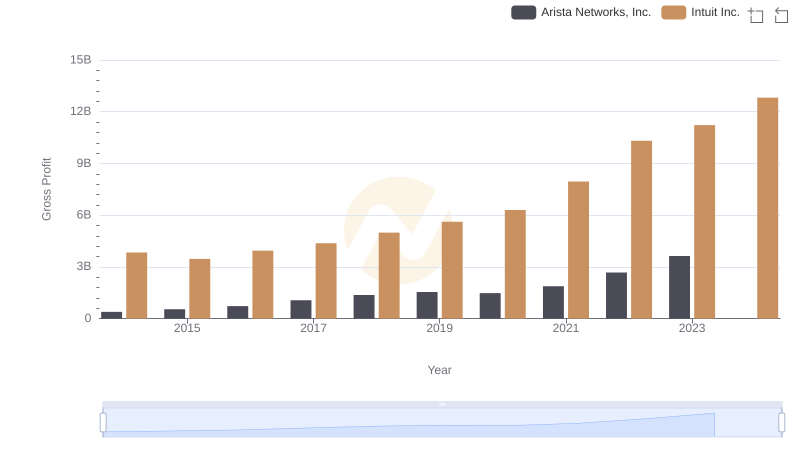

Intuit Inc. vs Arista Networks, Inc.: A Gross Profit Performance Breakdown

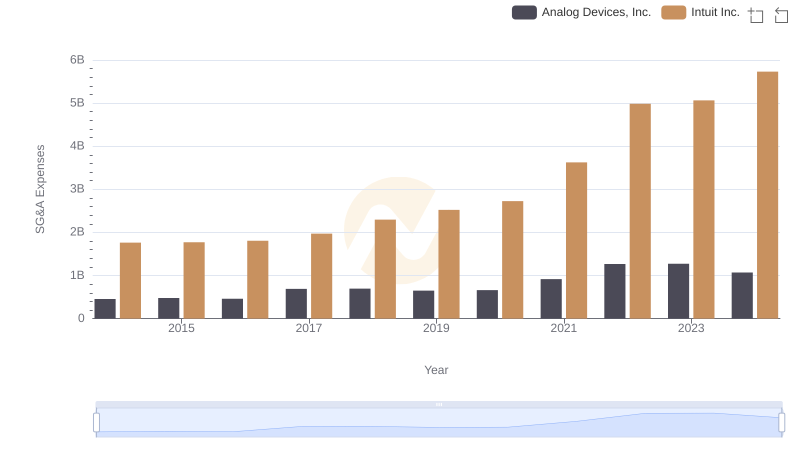

Cost Insights: Breaking Down Intuit Inc. and Analog Devices, Inc.'s Expenses

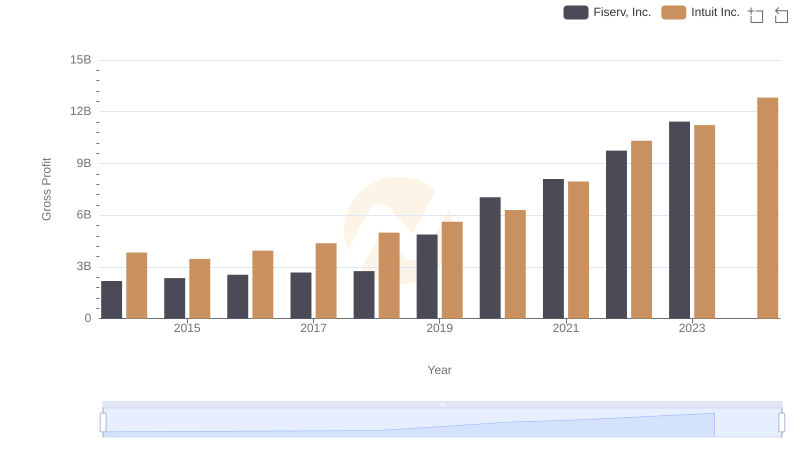

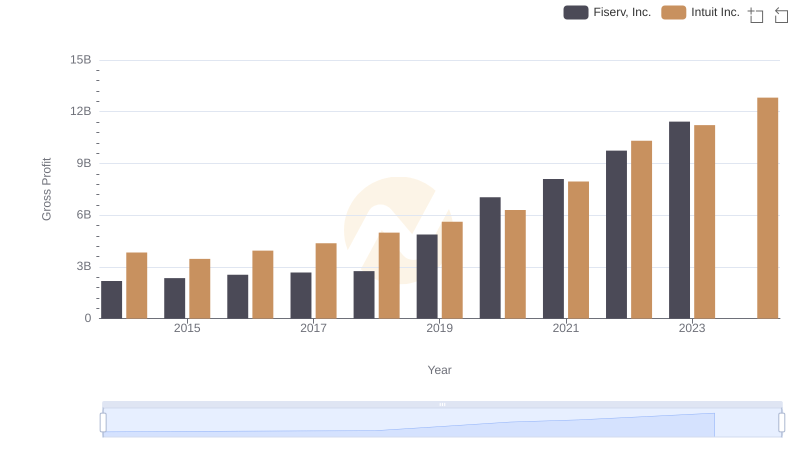

Who Generates Higher Gross Profit? Intuit Inc. or Fiserv, Inc.

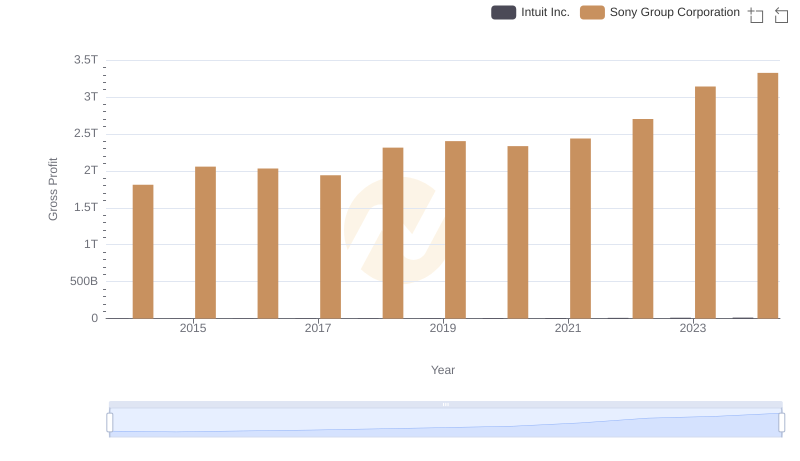

Gross Profit Analysis: Comparing Intuit Inc. and Sony Group Corporation

Intuit Inc. vs Fiserv, Inc.: A Gross Profit Performance Breakdown

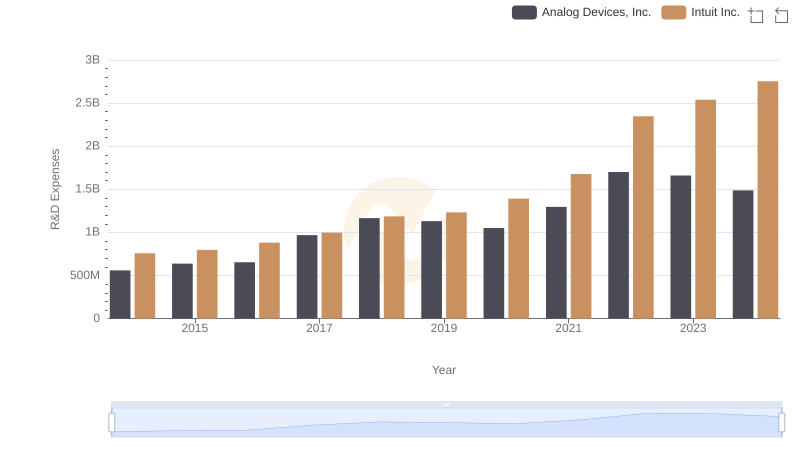

Research and Development Investment: Intuit Inc. vs Analog Devices, Inc.

Who Optimizes SG&A Costs Better? Intuit Inc. or Analog Devices, Inc.

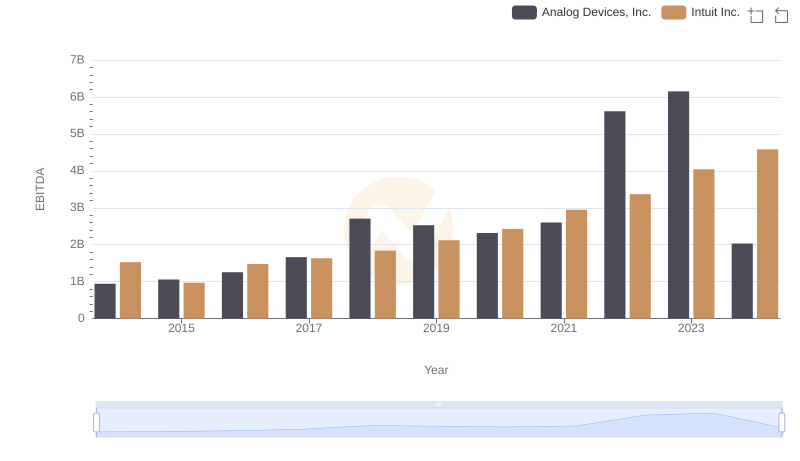

A Side-by-Side Analysis of EBITDA: Intuit Inc. and Analog Devices, Inc.