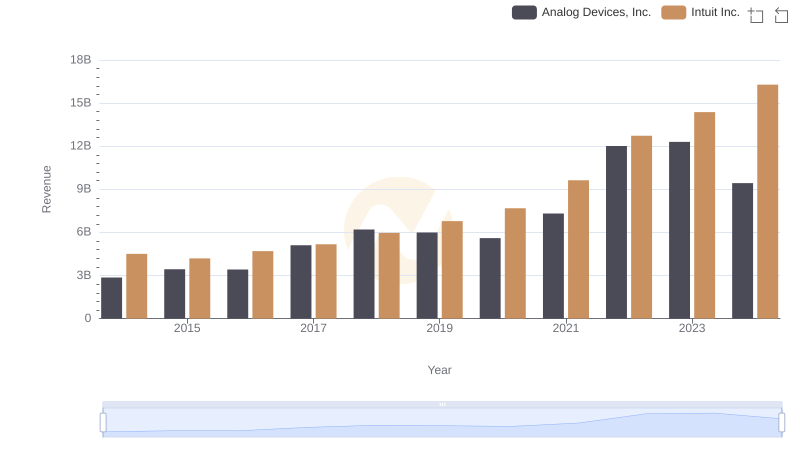

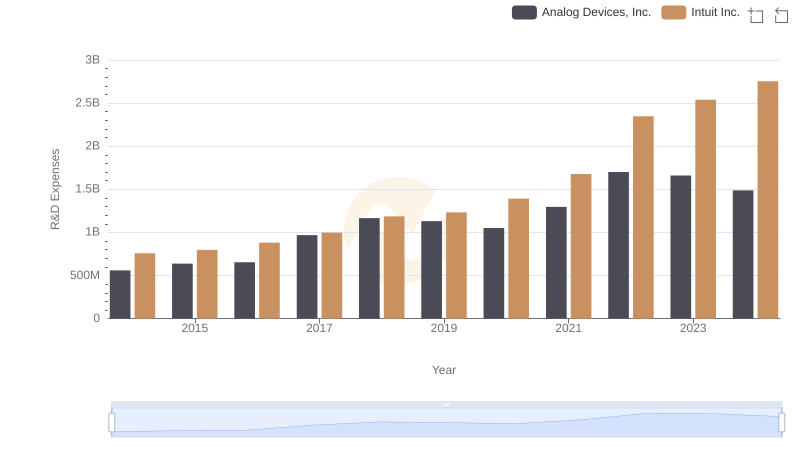

| __timestamp | Analog Devices, Inc. | Intuit Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1034585000 | 668000000 |

| Thursday, January 1, 2015 | 1175830000 | 725000000 |

| Friday, January 1, 2016 | 1194236000 | 752000000 |

| Sunday, January 1, 2017 | 2045907000 | 809000000 |

| Monday, January 1, 2018 | 1967640000 | 977000000 |

| Tuesday, January 1, 2019 | 1977315000 | 1167000000 |

| Wednesday, January 1, 2020 | 1912578000 | 1378000000 |

| Friday, January 1, 2021 | 2793274000 | 1683000000 |

| Saturday, January 1, 2022 | 4481479000 | 2406000000 |

| Sunday, January 1, 2023 | 4428321000 | 3143000000 |

| Monday, January 1, 2024 | 4045814000 | 3465000000 |

Cracking the code

In the ever-evolving landscape of technology, understanding the financial dynamics of industry giants like Intuit Inc. and Analog Devices, Inc. is crucial. Over the past decade, these companies have demonstrated significant shifts in their cost structures. From 2014 to 2024, Analog Devices, Inc. saw its cost of revenue surge by over 290%, peaking in 2022. This reflects their aggressive expansion and adaptation to market demands. Meanwhile, Intuit Inc. experienced a steady increase, with costs rising by approximately 420% during the same period, highlighting their strategic investments in innovation and customer acquisition.

The data reveals a fascinating trend: while both companies have increased their spending, Intuit Inc.'s cost growth outpaced that of Analog Devices, Inc. This insight underscores the diverse strategies employed by these tech titans to maintain their competitive edge in a rapidly changing market.

Cost Insights: Breaking Down Intuit Inc. and Shopify Inc.'s Expenses

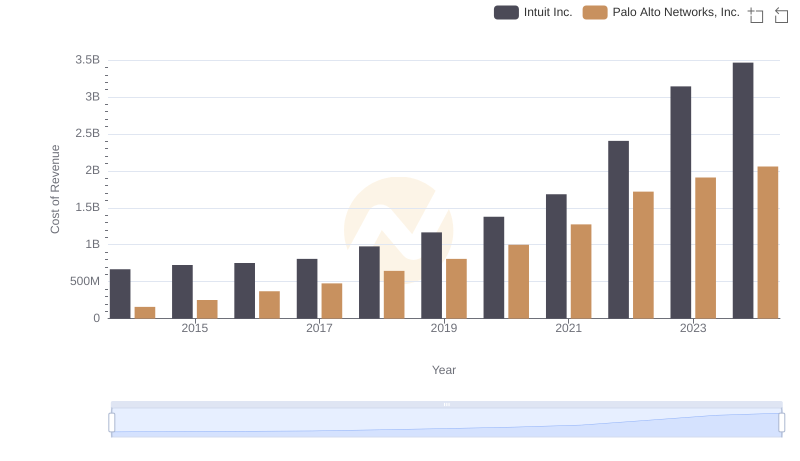

Cost Insights: Breaking Down Intuit Inc. and Palo Alto Networks, Inc.'s Expenses

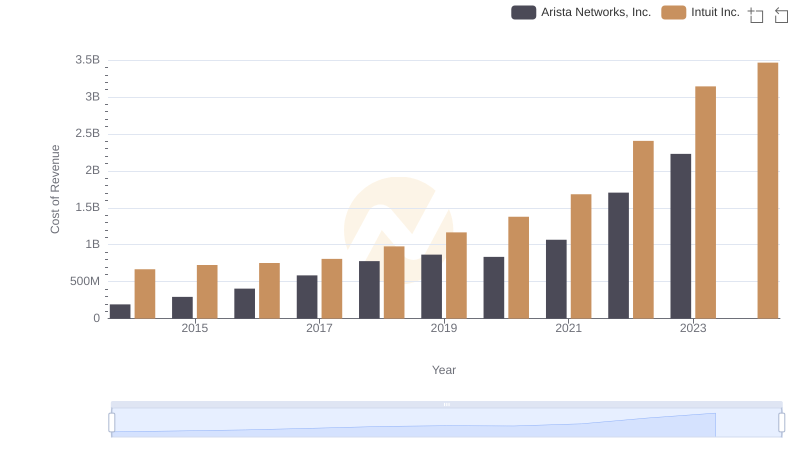

Cost of Revenue: Key Insights for Intuit Inc. and Arista Networks, Inc.

Who Generates More Revenue? Intuit Inc. or Analog Devices, Inc.

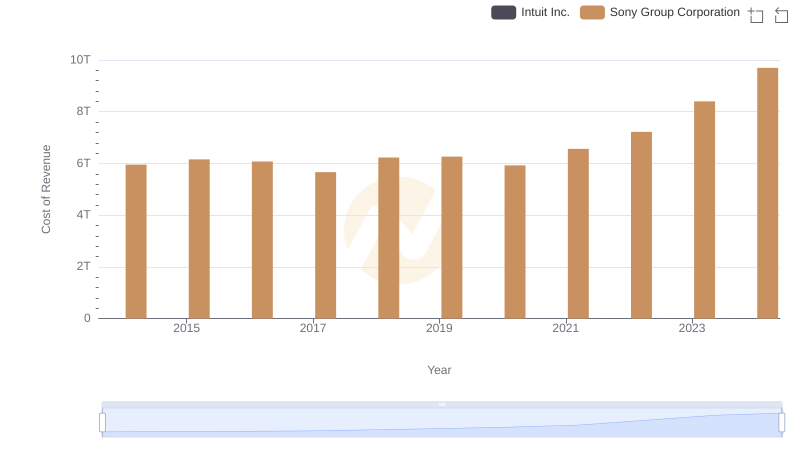

Cost of Revenue Trends: Intuit Inc. vs Sony Group Corporation

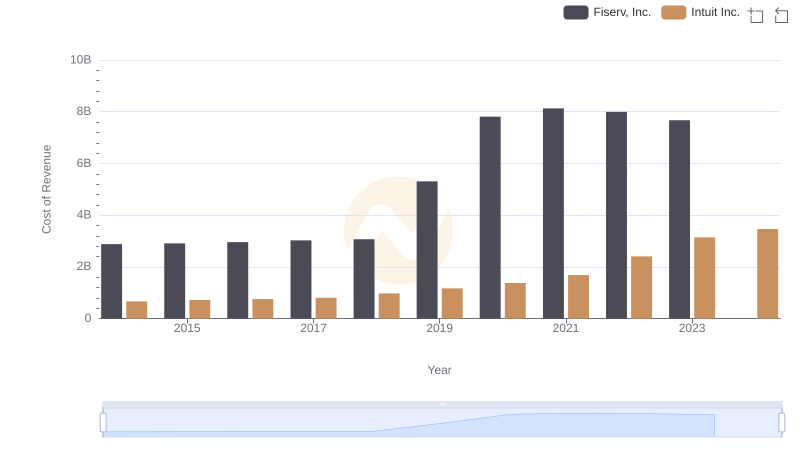

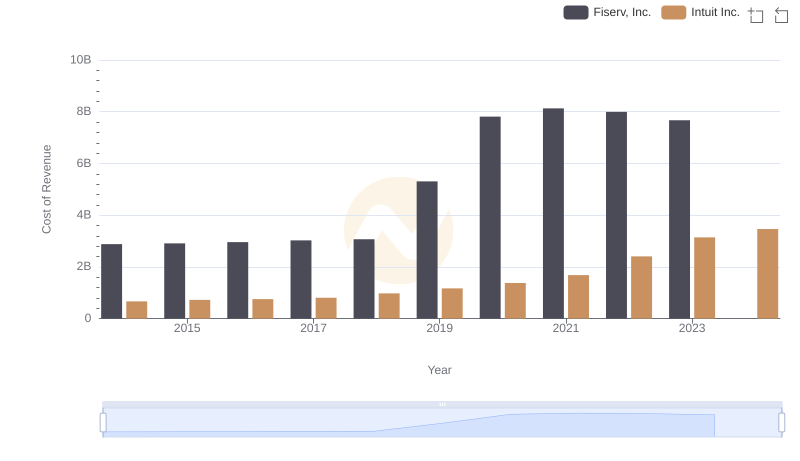

Cost Insights: Breaking Down Intuit Inc. and Fiserv, Inc.'s Expenses

Cost Insights: Breaking Down Intuit Inc. and Fiserv, Inc.'s Expenses

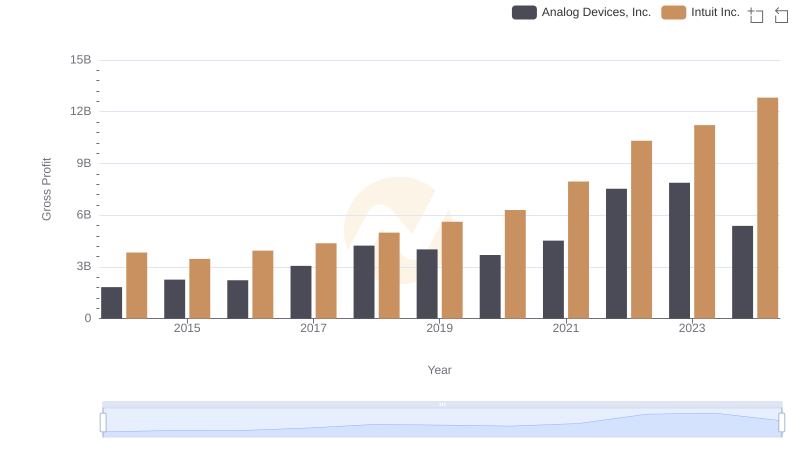

Who Generates Higher Gross Profit? Intuit Inc. or Analog Devices, Inc.

Research and Development Investment: Intuit Inc. vs Analog Devices, Inc.

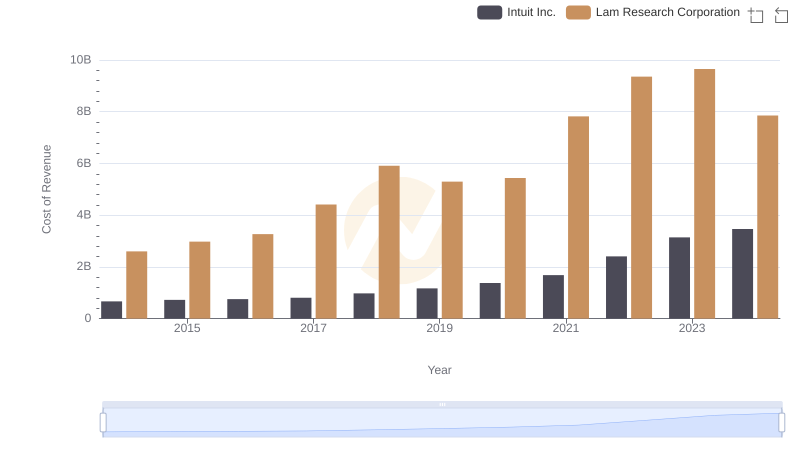

Analyzing Cost of Revenue: Intuit Inc. and Lam Research Corporation

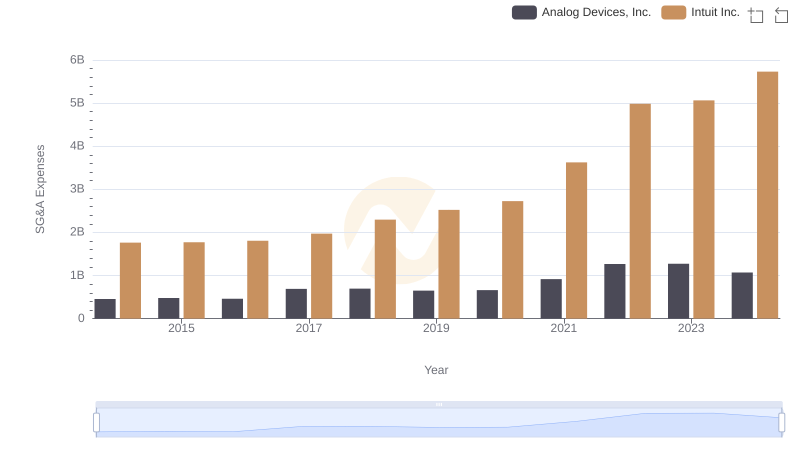

Who Optimizes SG&A Costs Better? Intuit Inc. or Analog Devices, Inc.

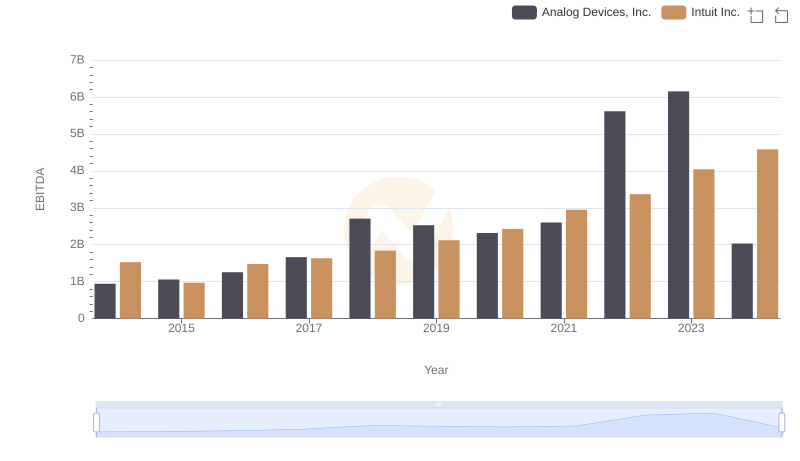

A Side-by-Side Analysis of EBITDA: Intuit Inc. and Analog Devices, Inc.