| __timestamp | Analog Devices, Inc. | Intuit Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2864773000 | 4506000000 |

| Thursday, January 1, 2015 | 3435092000 | 4192000000 |

| Friday, January 1, 2016 | 3421409000 | 4694000000 |

| Sunday, January 1, 2017 | 5107503000 | 5177000000 |

| Monday, January 1, 2018 | 6200942000 | 5964000000 |

| Tuesday, January 1, 2019 | 5991065000 | 6784000000 |

| Wednesday, January 1, 2020 | 5603056000 | 7679000000 |

| Friday, January 1, 2021 | 7318286000 | 9633000000 |

| Saturday, January 1, 2022 | 12013953000 | 12726000000 |

| Sunday, January 1, 2023 | 12305539000 | 14368000000 |

| Monday, January 1, 2024 | 9427157000 | 16285000000 |

Data in motion

In the ever-evolving landscape of technology, revenue generation is a key indicator of a company's market position and growth potential. Over the past decade, Intuit Inc. and Analog Devices, Inc. have been at the forefront of this financial race. From 2014 to 2023, Intuit Inc. consistently outpaced Analog Devices, Inc., with a notable 15% higher revenue on average. In 2023, Intuit's revenue surged to approximately 14.4 billion, marking a 13% increase from the previous year, while Analog Devices reached around 12.3 billion, reflecting a 2% growth. This trend highlights Intuit's robust growth trajectory, driven by its innovative financial software solutions. Meanwhile, Analog Devices, a leader in semiconductor technology, has shown steady progress, particularly in the last few years. As we look to 2024, Intuit's projected revenue of 16.3 billion suggests continued dominance, while Analog Devices anticipates a slight dip, emphasizing the dynamic nature of the tech industry.

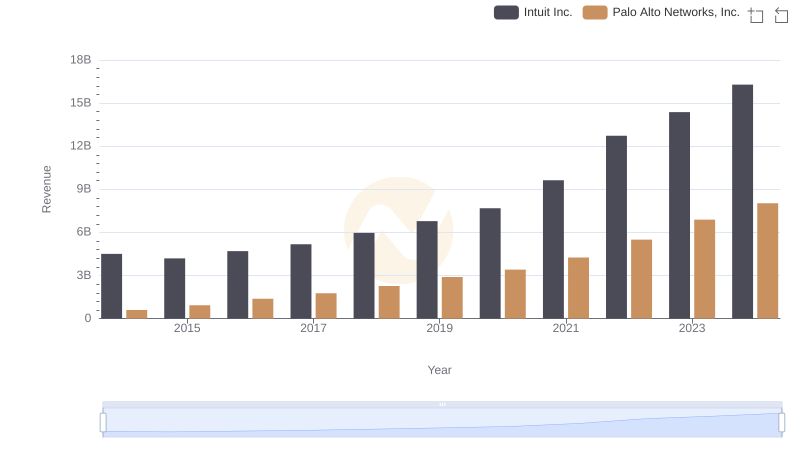

Breaking Down Revenue Trends: Intuit Inc. vs Palo Alto Networks, Inc.

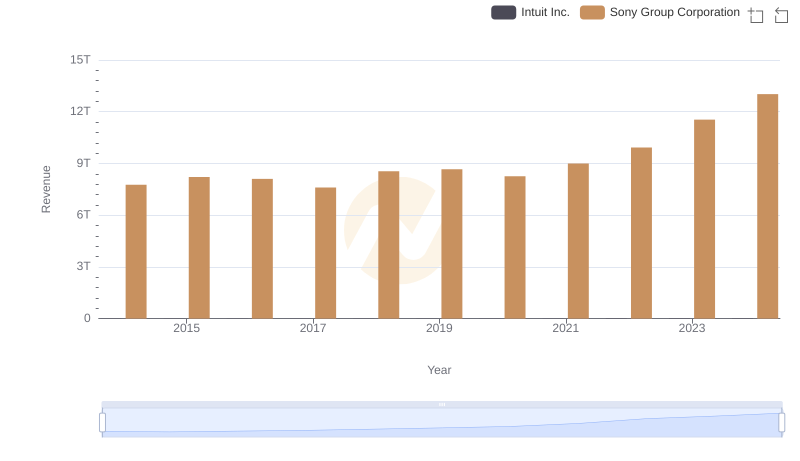

Annual Revenue Comparison: Intuit Inc. vs Sony Group Corporation

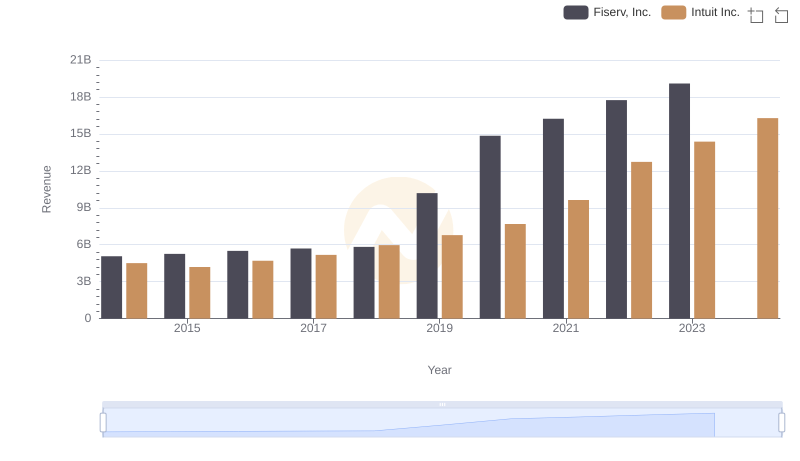

Comparing Revenue Performance: Intuit Inc. or Fiserv, Inc.?

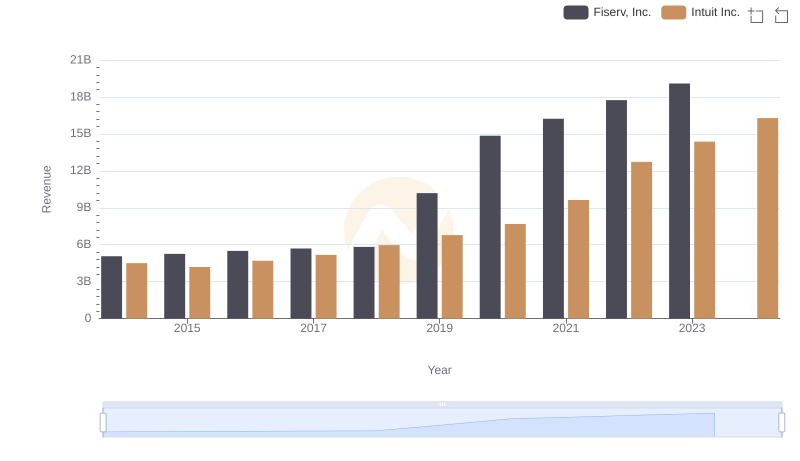

Annual Revenue Comparison: Intuit Inc. vs Fiserv, Inc.

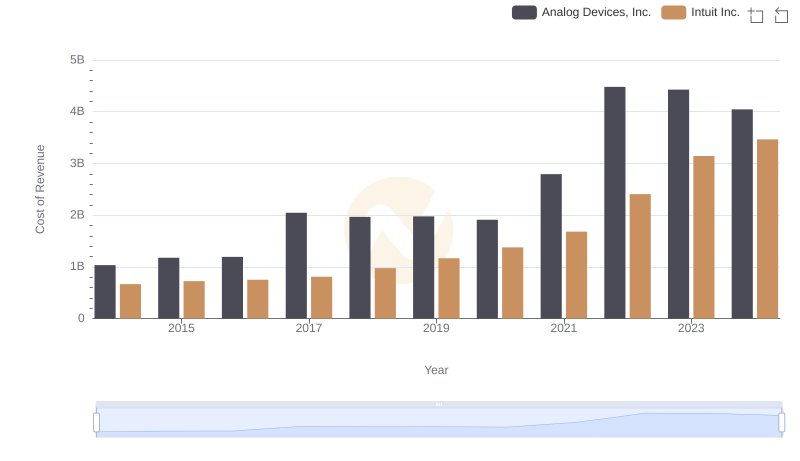

Cost Insights: Breaking Down Intuit Inc. and Analog Devices, Inc.'s Expenses

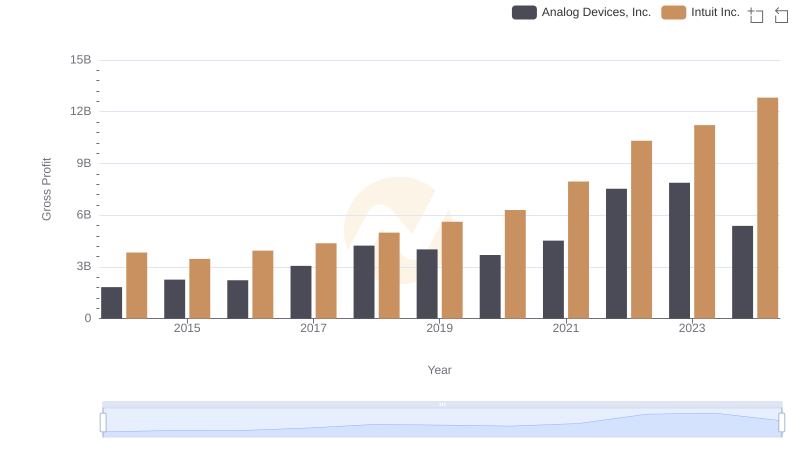

Who Generates Higher Gross Profit? Intuit Inc. or Analog Devices, Inc.

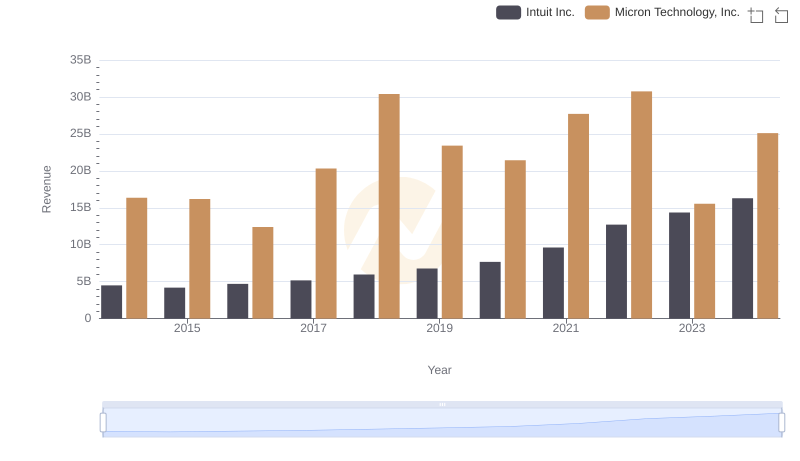

Breaking Down Revenue Trends: Intuit Inc. vs Micron Technology, Inc.

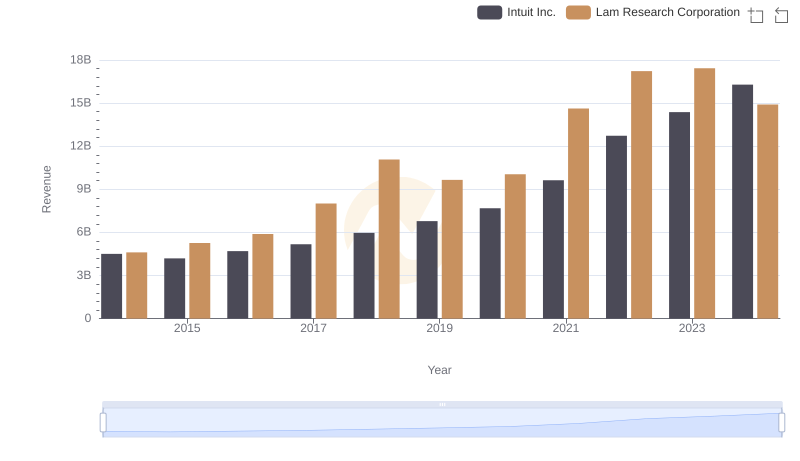

Revenue Insights: Intuit Inc. and Lam Research Corporation Performance Compared

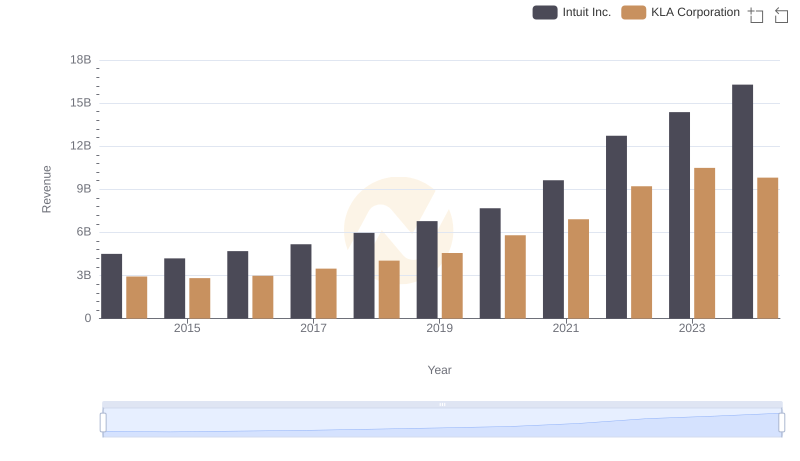

Revenue Showdown: Intuit Inc. vs KLA Corporation

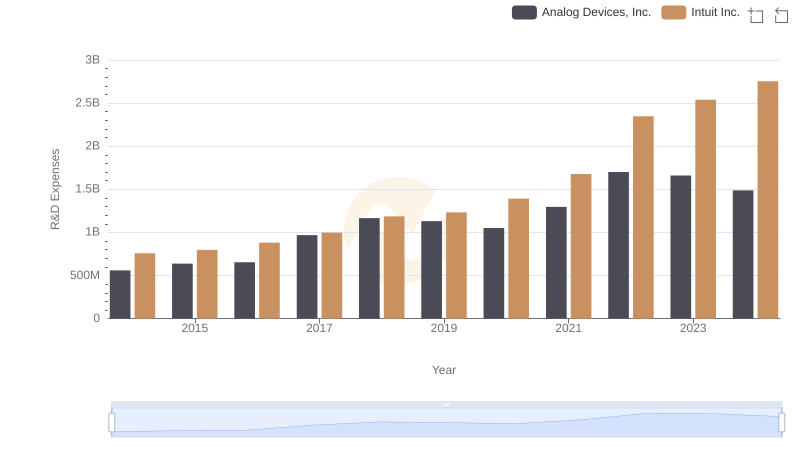

Research and Development Investment: Intuit Inc. vs Analog Devices, Inc.

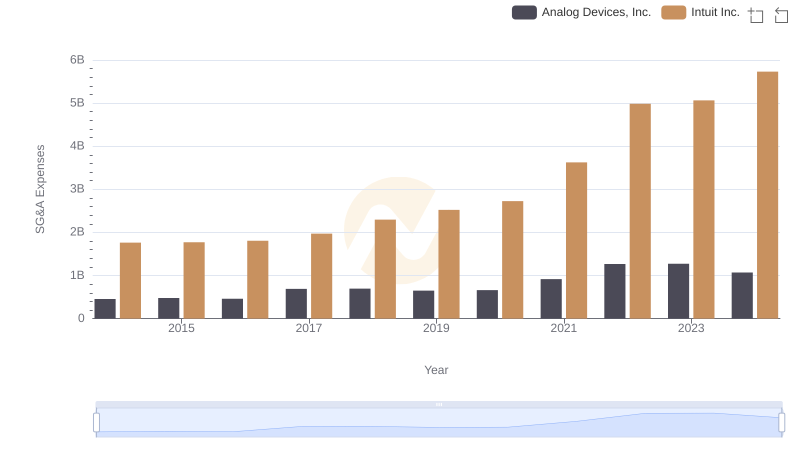

Who Optimizes SG&A Costs Better? Intuit Inc. or Analog Devices, Inc.

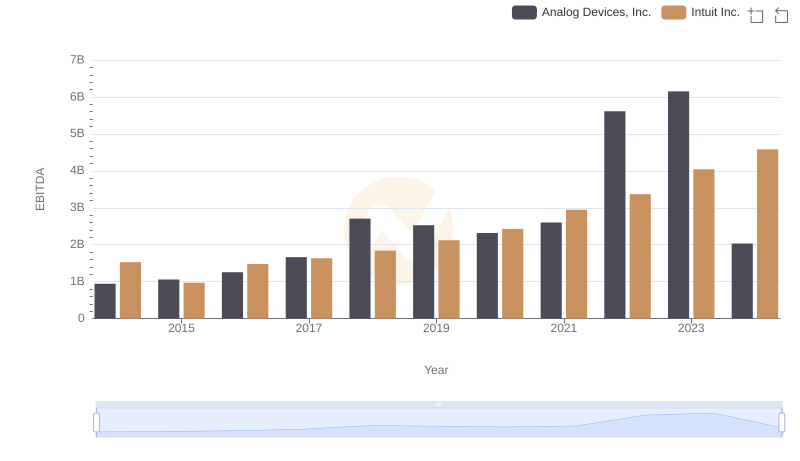

A Side-by-Side Analysis of EBITDA: Intuit Inc. and Analog Devices, Inc.