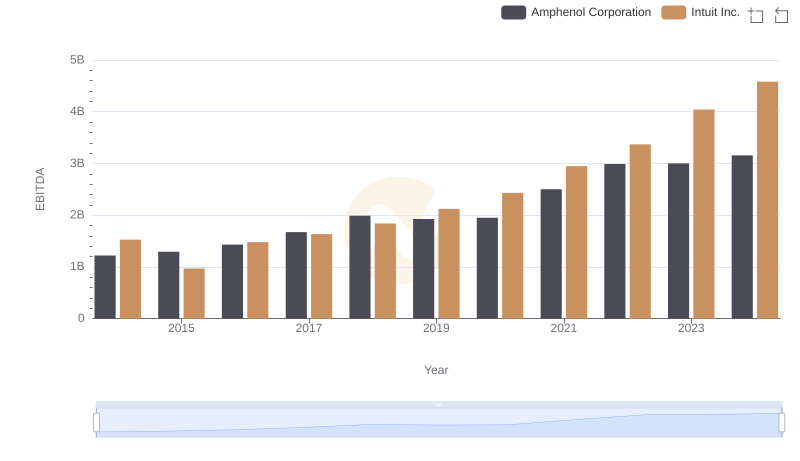

| __timestamp | Amphenol Corporation | Intuit Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 645100000 | 1762000000 |

| Thursday, January 1, 2015 | 669100000 | 1771000000 |

| Friday, January 1, 2016 | 798200000 | 1807000000 |

| Sunday, January 1, 2017 | 878300000 | 1973000000 |

| Monday, January 1, 2018 | 959500000 | 2298000000 |

| Tuesday, January 1, 2019 | 971400000 | 2524000000 |

| Wednesday, January 1, 2020 | 1014200000 | 2727000000 |

| Friday, January 1, 2021 | 1226300000 | 3626000000 |

| Saturday, January 1, 2022 | 1420900000 | 4986000000 |

| Sunday, January 1, 2023 | 1489900000 | 5062000000 |

| Monday, January 1, 2024 | 1855400000 | 5730000000 |

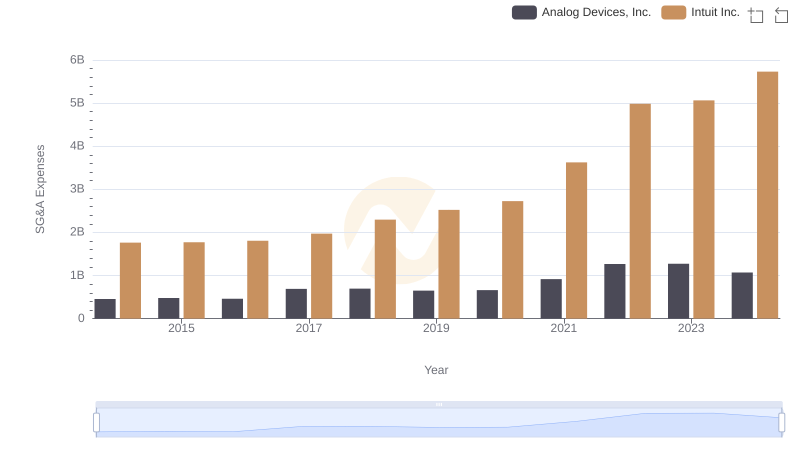

Data in motion

In the competitive landscape of corporate America, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. This analysis pits Intuit Inc. against Amphenol Corporation, two industry leaders, in their quest to optimize these costs over the past decade.

From 2014 to 2024, Intuit Inc. has seen its SG&A expenses grow by approximately 225%, reaching a peak in 2024. In contrast, Amphenol Corporation's expenses increased by about 188% during the same period. Despite Intuit's higher absolute expenses, Amphenol's more modest growth rate suggests a tighter rein on cost management.

The data reveals a consistent upward trend for both companies, with Intuit's expenses consistently outpacing Amphenol's. This could indicate a more aggressive growth strategy or higher operational costs. As businesses navigate economic uncertainties, effective SG&A management remains a key differentiator in maintaining competitive advantage.

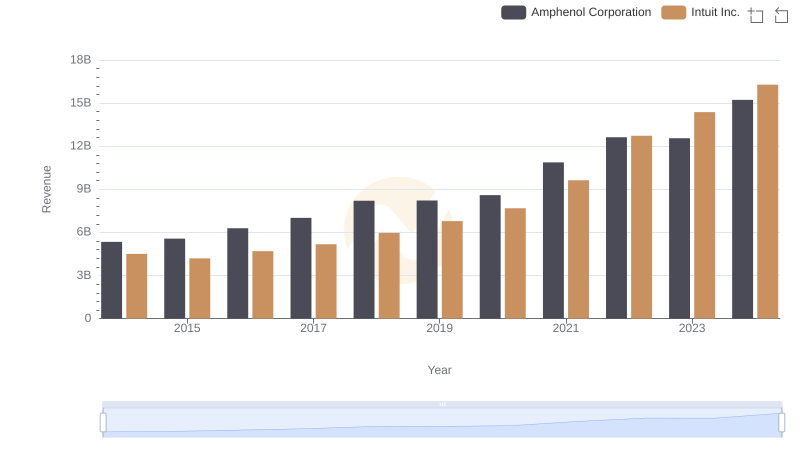

Revenue Insights: Intuit Inc. and Amphenol Corporation Performance Compared

Who Optimizes SG&A Costs Better? Intuit Inc. or Analog Devices, Inc.

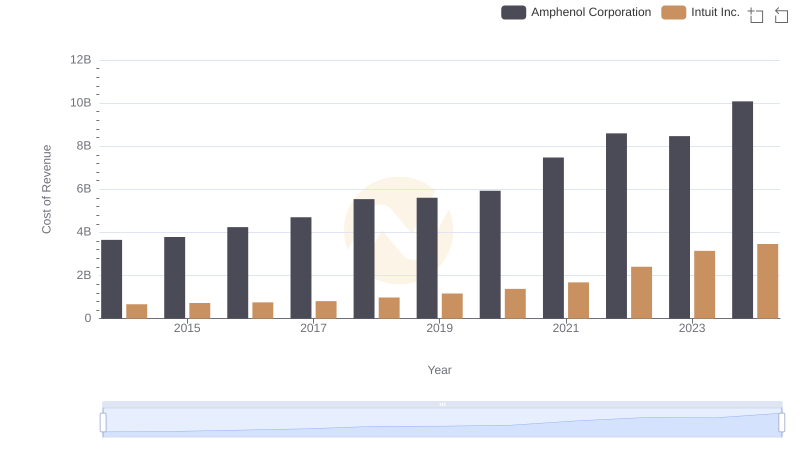

Analyzing Cost of Revenue: Intuit Inc. and Amphenol Corporation

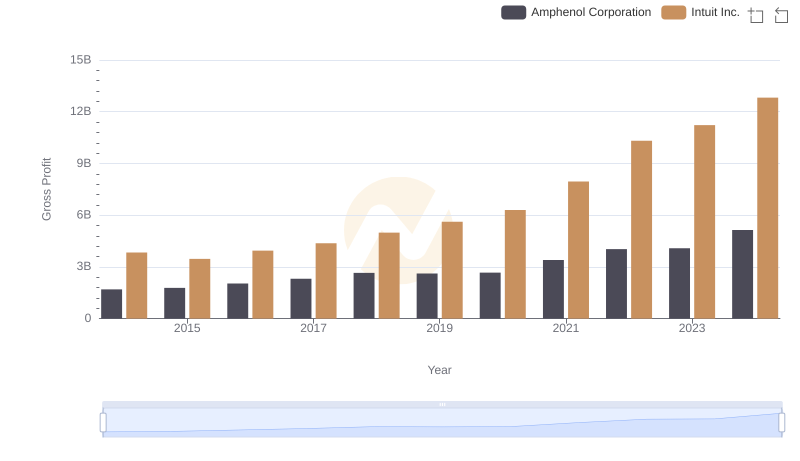

Gross Profit Analysis: Comparing Intuit Inc. and Amphenol Corporation

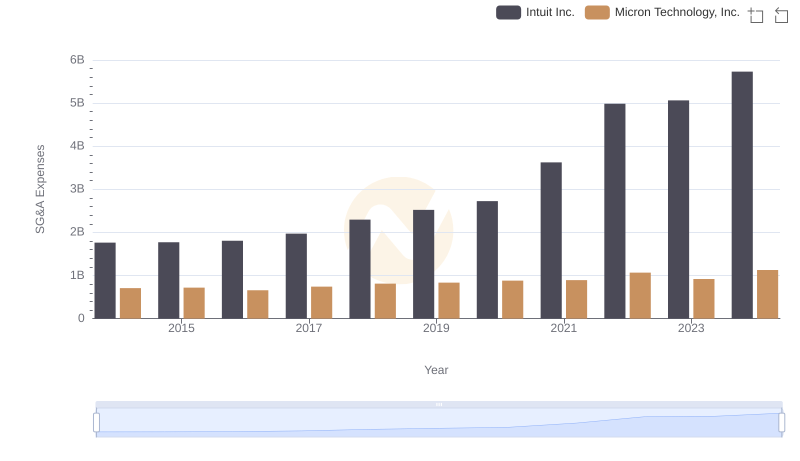

Who Optimizes SG&A Costs Better? Intuit Inc. or Micron Technology, Inc.

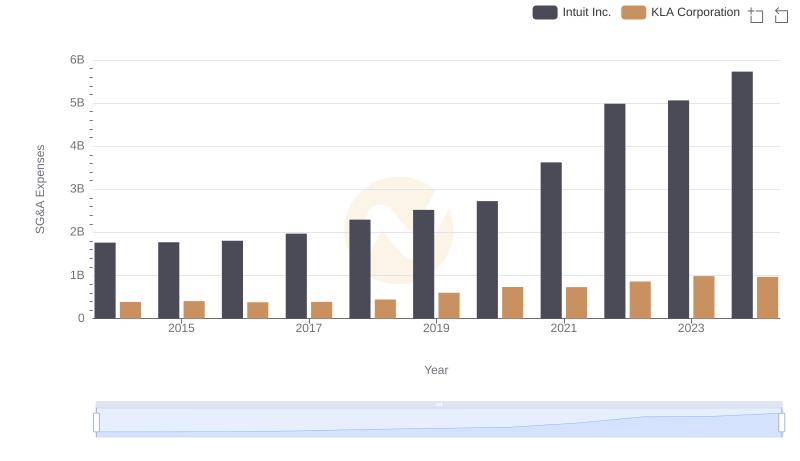

Intuit Inc. and KLA Corporation: SG&A Spending Patterns Compared

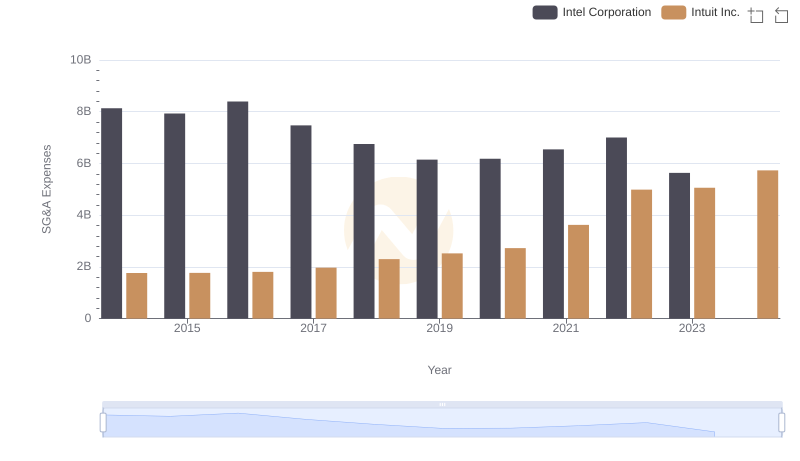

Intuit Inc. and Intel Corporation: SG&A Spending Patterns Compared

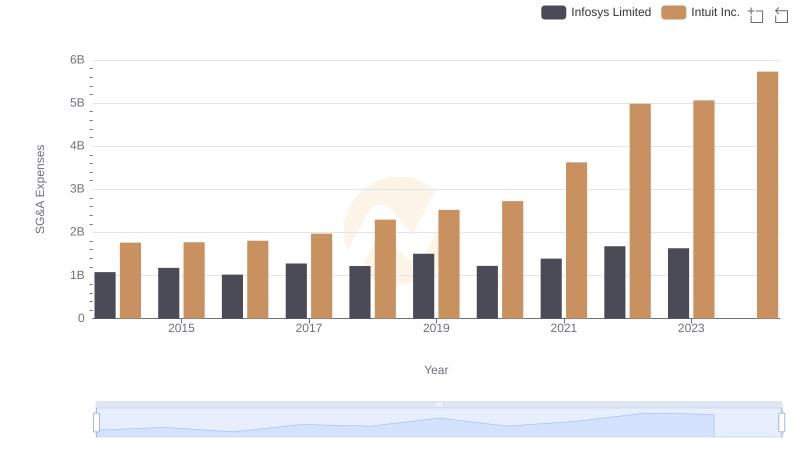

Intuit Inc. and Infosys Limited: SG&A Spending Patterns Compared

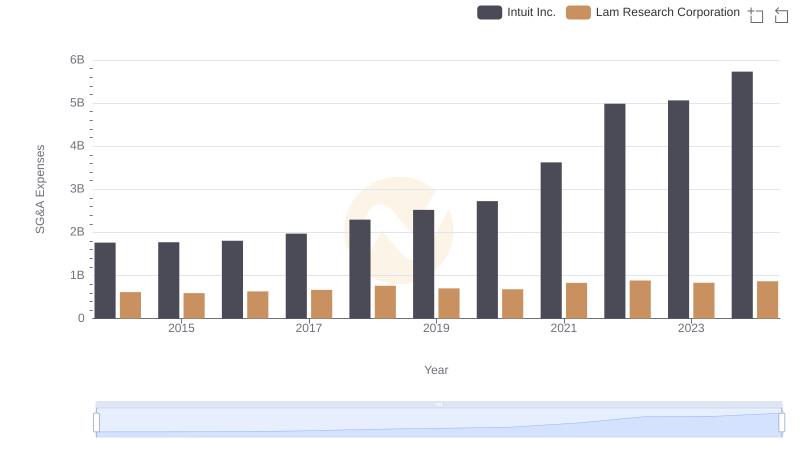

Comparing SG&A Expenses: Intuit Inc. vs Lam Research Corporation Trends and Insights

A Side-by-Side Analysis of EBITDA: Intuit Inc. and Amphenol Corporation

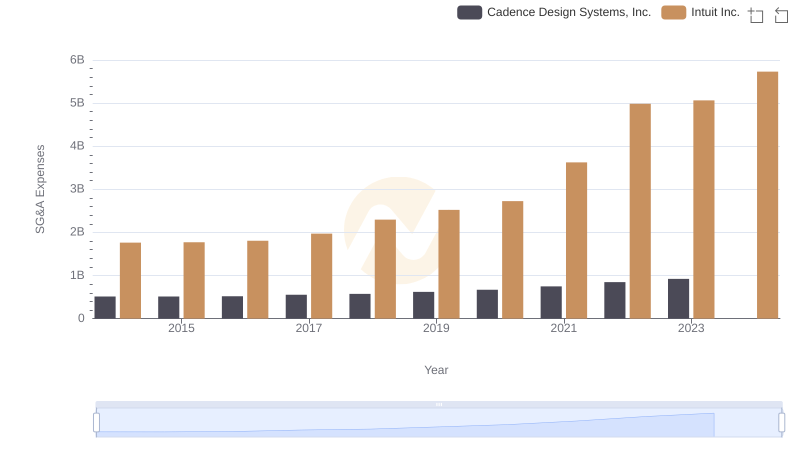

Operational Costs Compared: SG&A Analysis of Intuit Inc. and Cadence Design Systems, Inc.

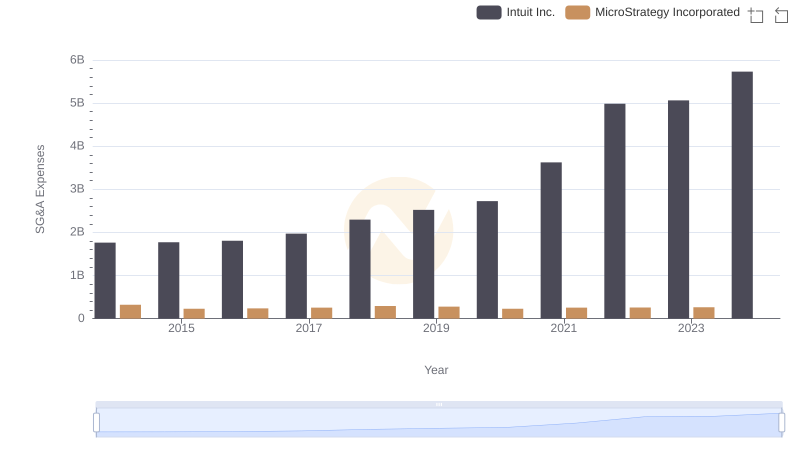

Intuit Inc. and MicroStrategy Incorporated: SG&A Spending Patterns Compared