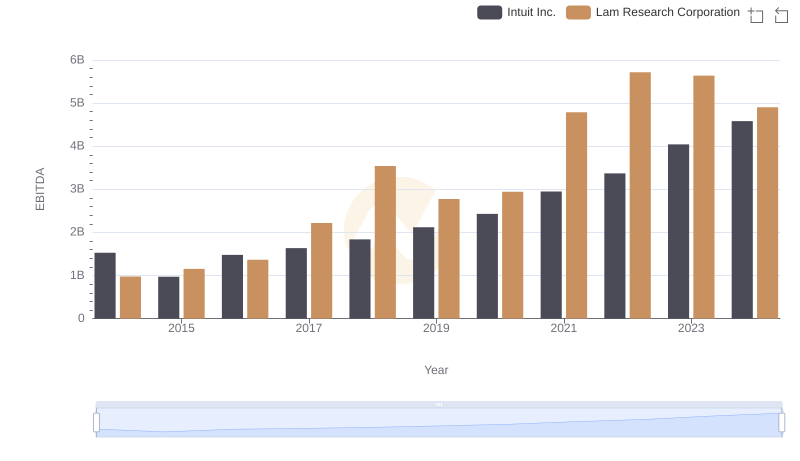

| __timestamp | Intuit Inc. | Lam Research Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1762000000 | 613341000 |

| Thursday, January 1, 2015 | 1771000000 | 591611000 |

| Friday, January 1, 2016 | 1807000000 | 630954000 |

| Sunday, January 1, 2017 | 1973000000 | 667485000 |

| Monday, January 1, 2018 | 2298000000 | 762219000 |

| Tuesday, January 1, 2019 | 2524000000 | 702407000 |

| Wednesday, January 1, 2020 | 2727000000 | 682479000 |

| Friday, January 1, 2021 | 3626000000 | 829875000 |

| Saturday, January 1, 2022 | 4986000000 | 885737000 |

| Sunday, January 1, 2023 | 5062000000 | 832753000 |

| Monday, January 1, 2024 | 5730000000 | 868247000 |

Cracking the code

In the ever-evolving landscape of corporate finance, understanding the trends in Selling, General, and Administrative (SG&A) expenses can offer profound insights into a company's operational efficiency. Over the past decade, Intuit Inc. and Lam Research Corporation have showcased contrasting trajectories in their SG&A expenditures. From 2014 to 2024, Intuit's SG&A expenses surged by over 225%, reflecting its aggressive growth strategy and investment in innovation. In contrast, Lam Research's expenses grew by a modest 42%, indicating a more conservative approach. This divergence highlights the distinct strategic priorities of these industry leaders. Intuit's focus on expanding its market presence is evident, while Lam Research maintains a steady course, optimizing its operational costs. As we delve into these financial narratives, it becomes clear that SG&A trends are not just numbers; they are stories of ambition, strategy, and market positioning.

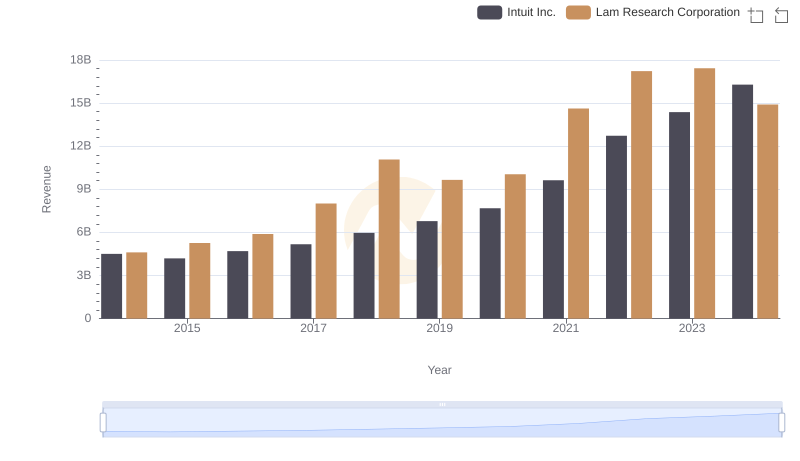

Revenue Insights: Intuit Inc. and Lam Research Corporation Performance Compared

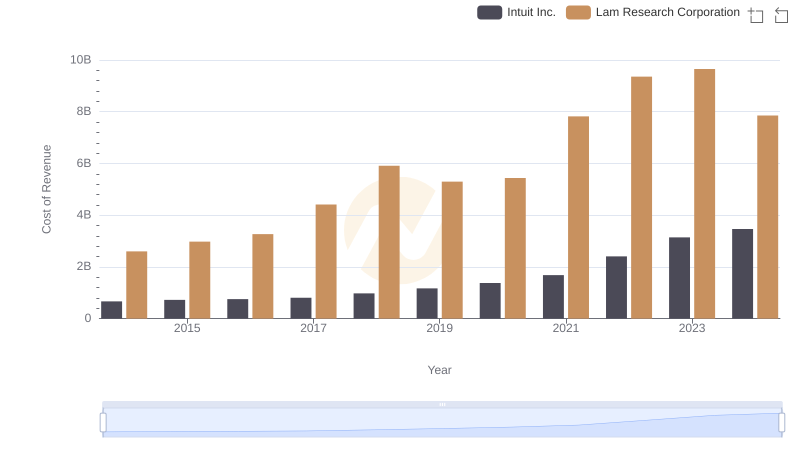

Analyzing Cost of Revenue: Intuit Inc. and Lam Research Corporation

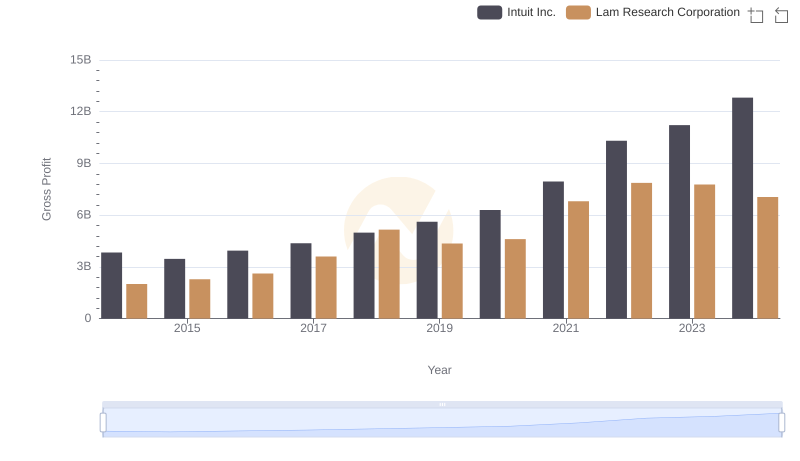

Gross Profit Comparison: Intuit Inc. and Lam Research Corporation Trends

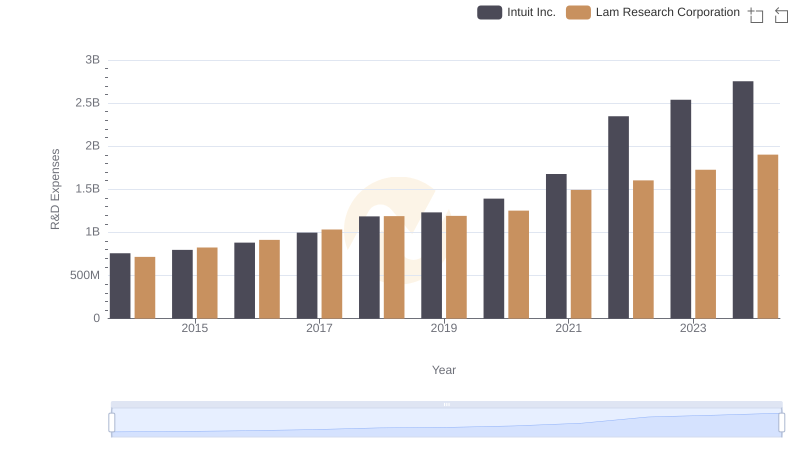

Analyzing R&D Budgets: Intuit Inc. vs Lam Research Corporation

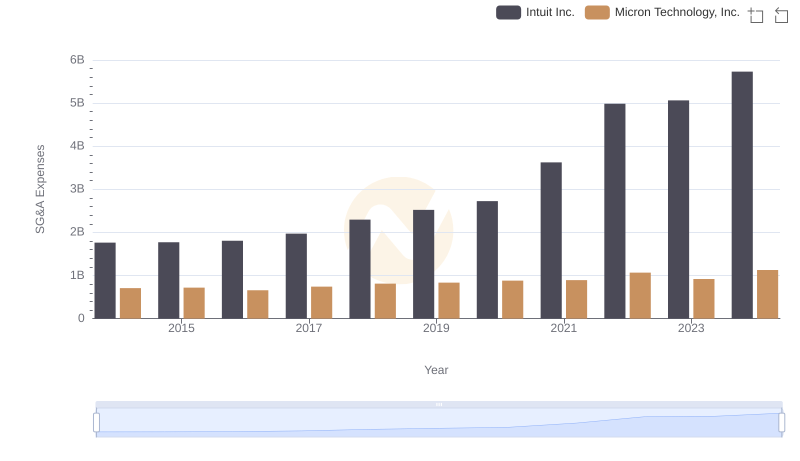

Who Optimizes SG&A Costs Better? Intuit Inc. or Micron Technology, Inc.

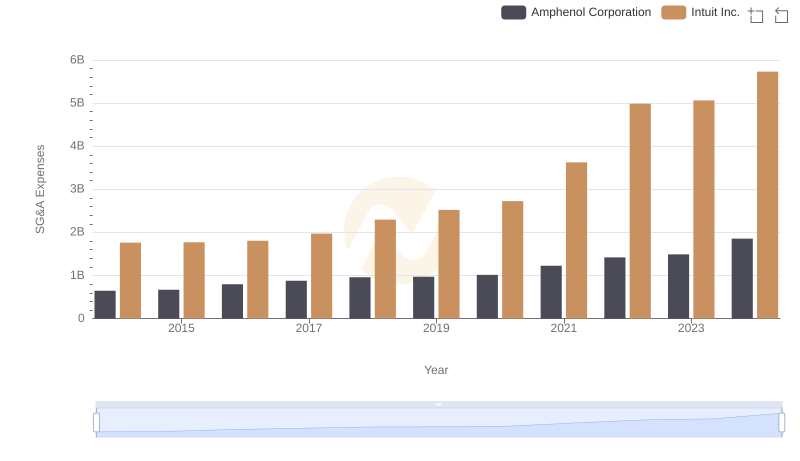

Who Optimizes SG&A Costs Better? Intuit Inc. or Amphenol Corporation

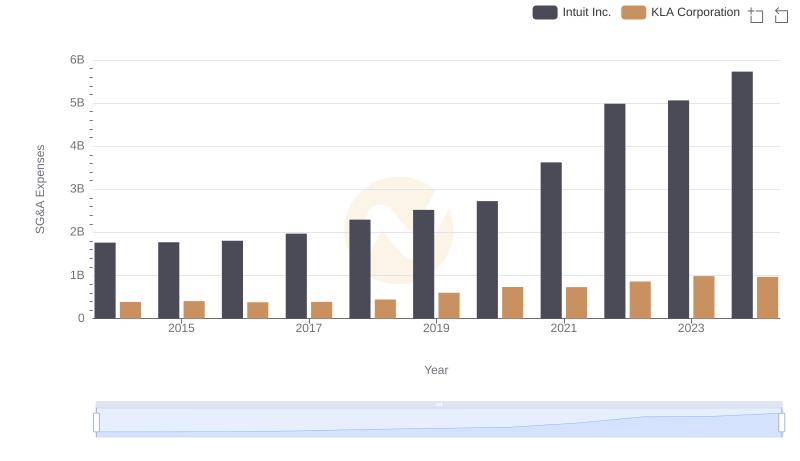

Intuit Inc. and KLA Corporation: SG&A Spending Patterns Compared

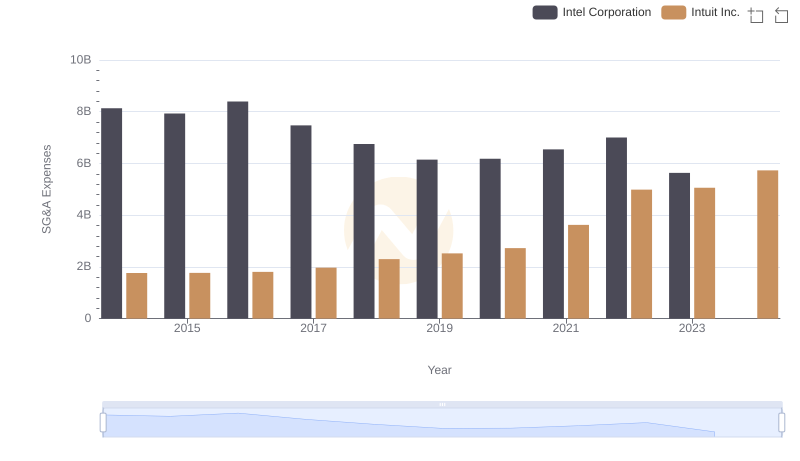

Intuit Inc. and Intel Corporation: SG&A Spending Patterns Compared

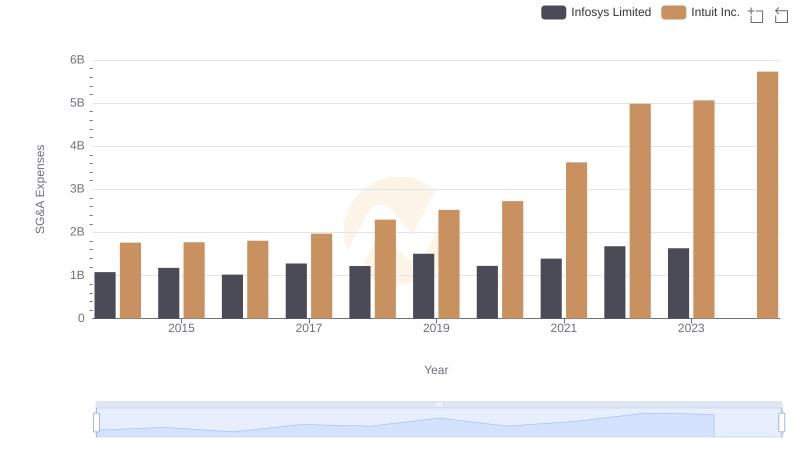

Intuit Inc. and Infosys Limited: SG&A Spending Patterns Compared

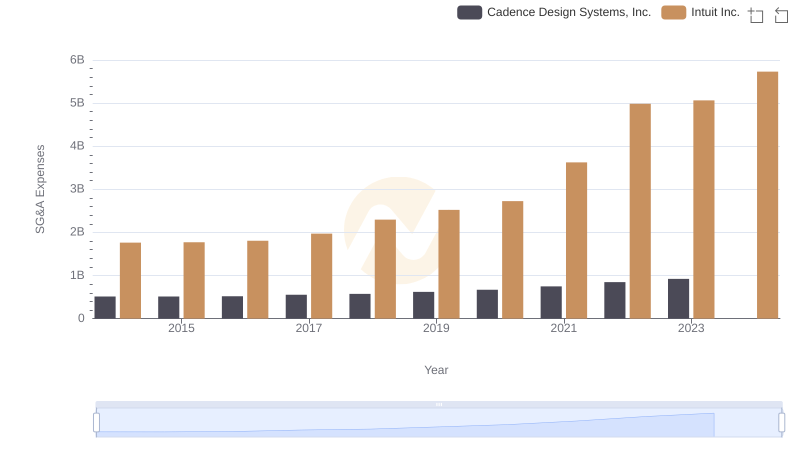

Operational Costs Compared: SG&A Analysis of Intuit Inc. and Cadence Design Systems, Inc.

Intuit Inc. and Lam Research Corporation: A Detailed Examination of EBITDA Performance

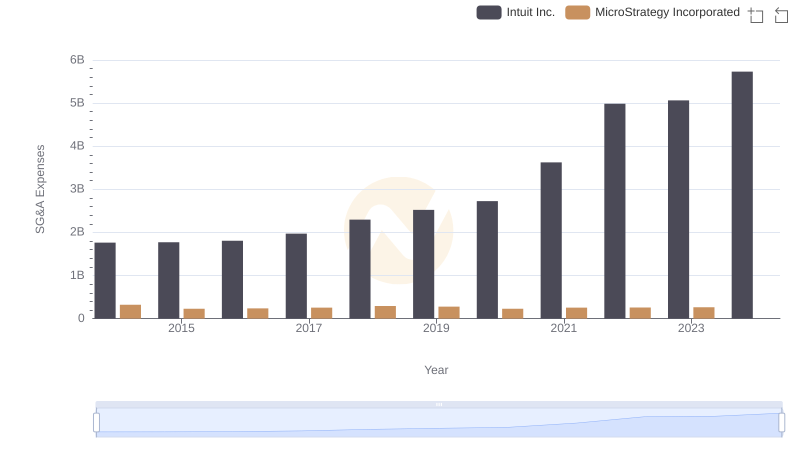

Intuit Inc. and MicroStrategy Incorporated: SG&A Spending Patterns Compared