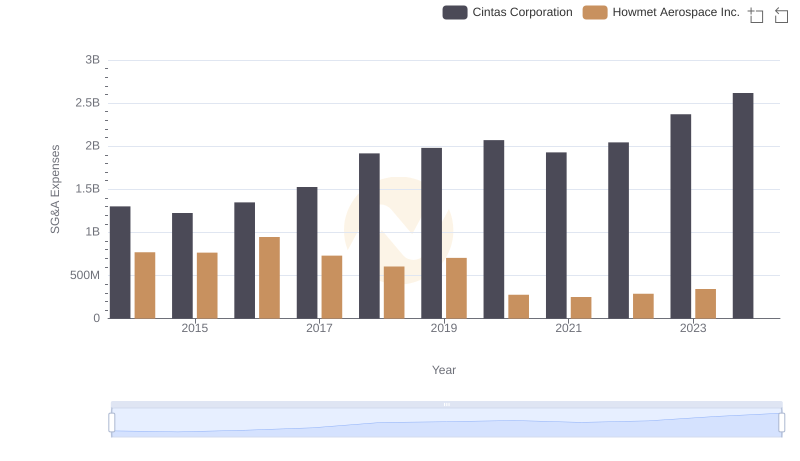

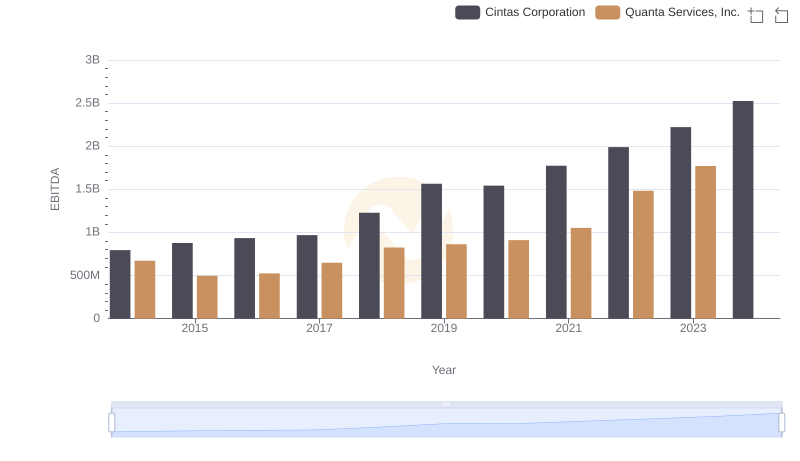

| __timestamp | Cintas Corporation | Quanta Services, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1302752000 | 580730000 |

| Thursday, January 1, 2015 | 1224930000 | 592863000 |

| Friday, January 1, 2016 | 1348122000 | 653338000 |

| Sunday, January 1, 2017 | 1527380000 | 777920000 |

| Monday, January 1, 2018 | 1916792000 | 857574000 |

| Tuesday, January 1, 2019 | 1980644000 | 955991000 |

| Wednesday, January 1, 2020 | 2071052000 | 975074000 |

| Friday, January 1, 2021 | 1929159000 | 1155956000 |

| Saturday, January 1, 2022 | 2044876000 | 1336711000 |

| Sunday, January 1, 2023 | 2370704000 | 1555137000 |

| Monday, January 1, 2024 | 2617783000 |

Unleashing the power of data

In the competitive landscape of corporate America, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Cintas Corporation and Quanta Services, Inc. have been at the forefront of this financial balancing act since 2014. Over the past decade, Cintas has consistently outpaced Quanta in SG&A optimization, with expenses growing by approximately 101% compared to Quanta's 168% increase. Notably, Cintas's SG&A expenses peaked in 2024, while Quanta's data for the same year remains unavailable, highlighting potential reporting gaps. This trend underscores Cintas's strategic focus on cost efficiency, a critical factor in maintaining its competitive edge. As businesses navigate economic uncertainties, the ability to control SG&A costs will remain a key differentiator in the market.

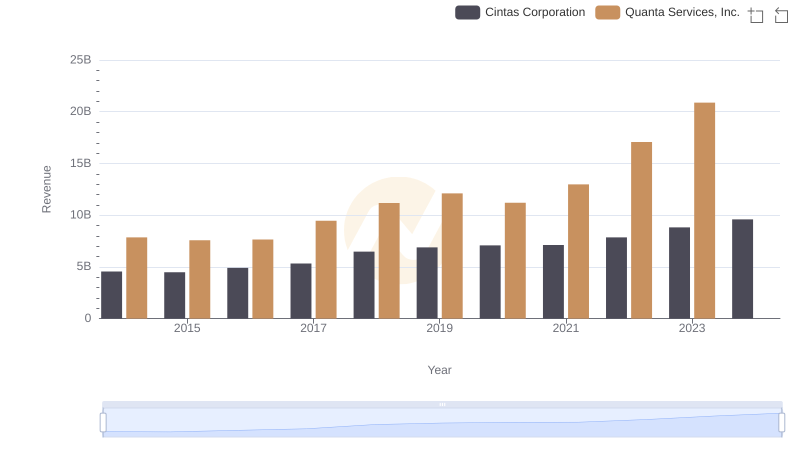

Who Generates More Revenue? Cintas Corporation or Quanta Services, Inc.

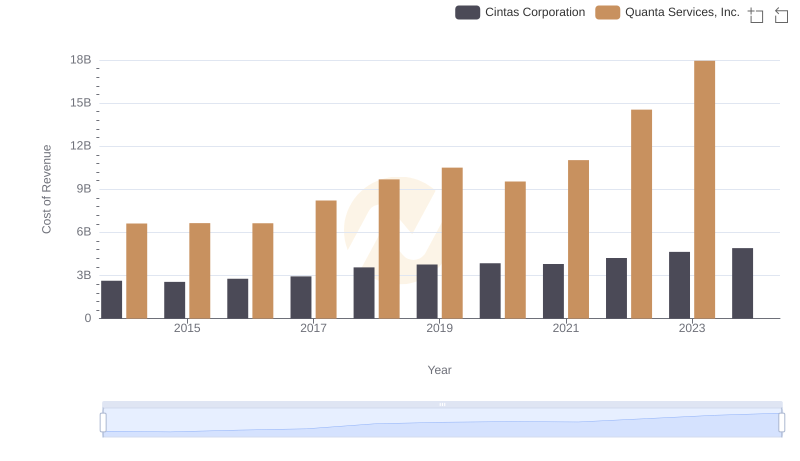

Analyzing Cost of Revenue: Cintas Corporation and Quanta Services, Inc.

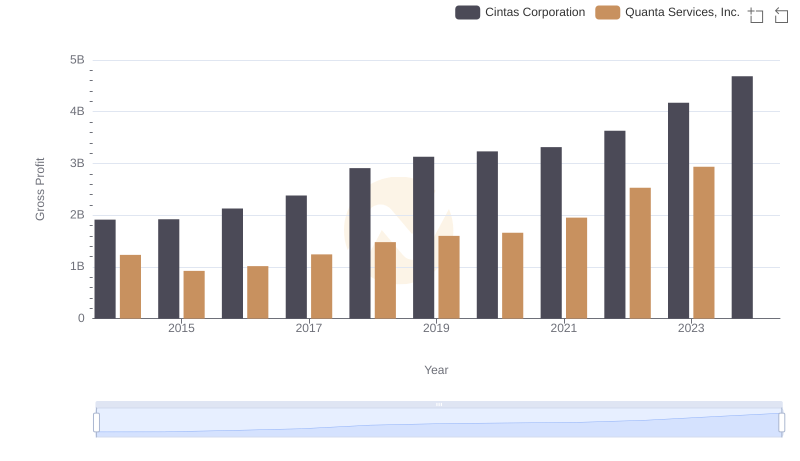

Gross Profit Comparison: Cintas Corporation and Quanta Services, Inc. Trends

Who Optimizes SG&A Costs Better? Cintas Corporation or Howmet Aerospace Inc.

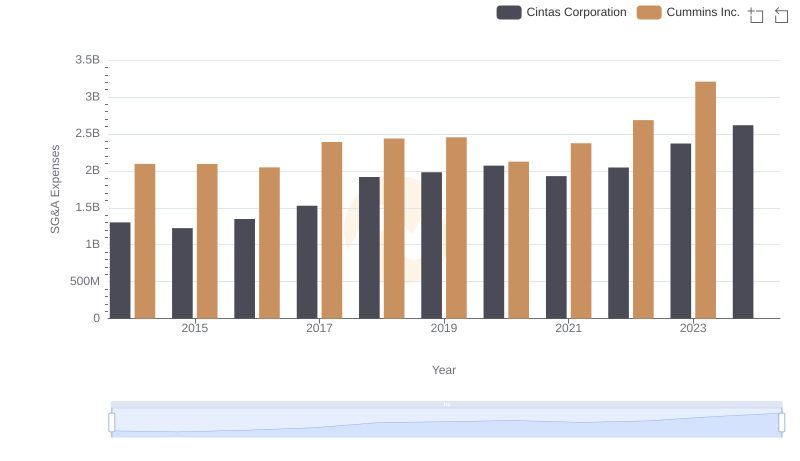

Breaking Down SG&A Expenses: Cintas Corporation vs Cummins Inc.

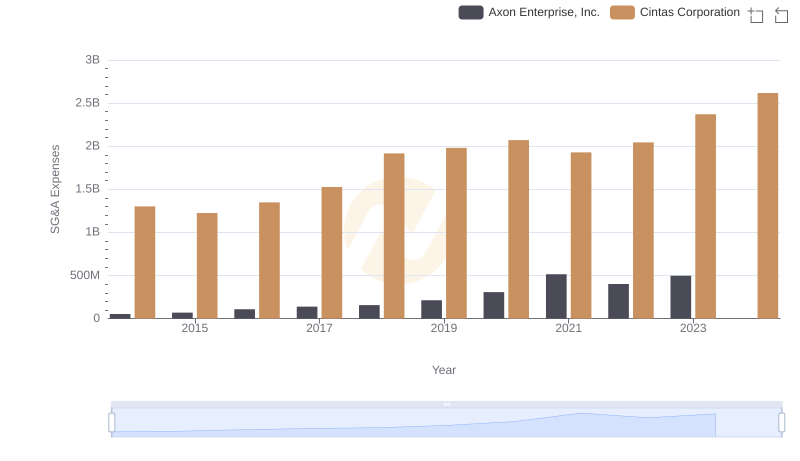

Cintas Corporation and Axon Enterprise, Inc.: SG&A Spending Patterns Compared

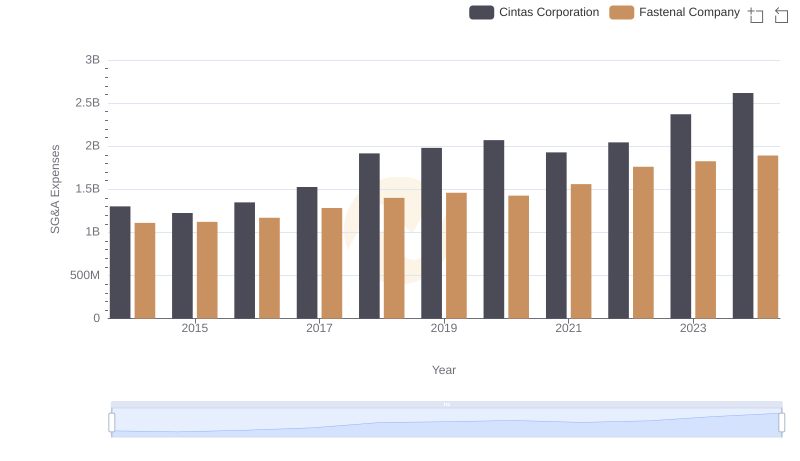

Cintas Corporation vs Fastenal Company: SG&A Expense Trends

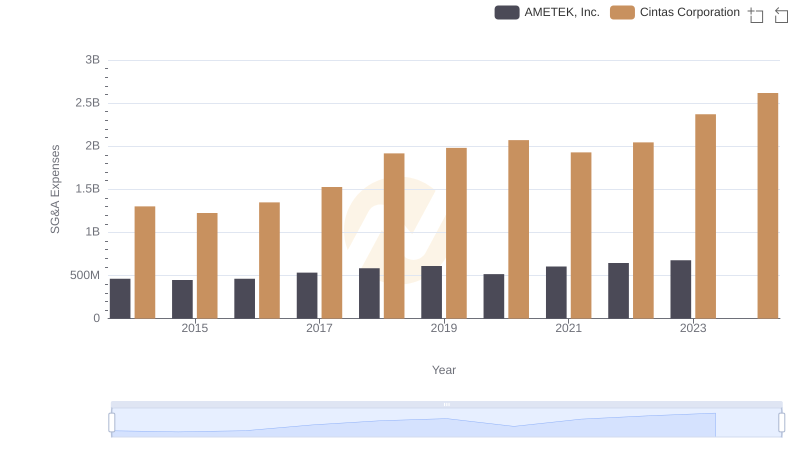

Cintas Corporation vs AMETEK, Inc.: SG&A Expense Trends

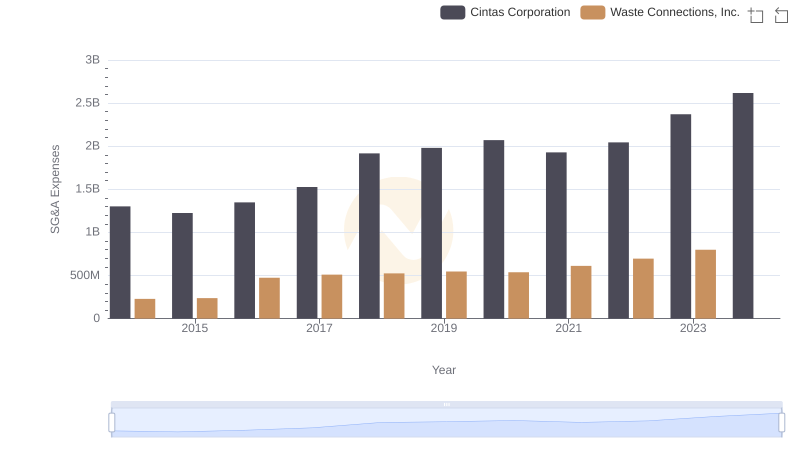

SG&A Efficiency Analysis: Comparing Cintas Corporation and Waste Connections, Inc.

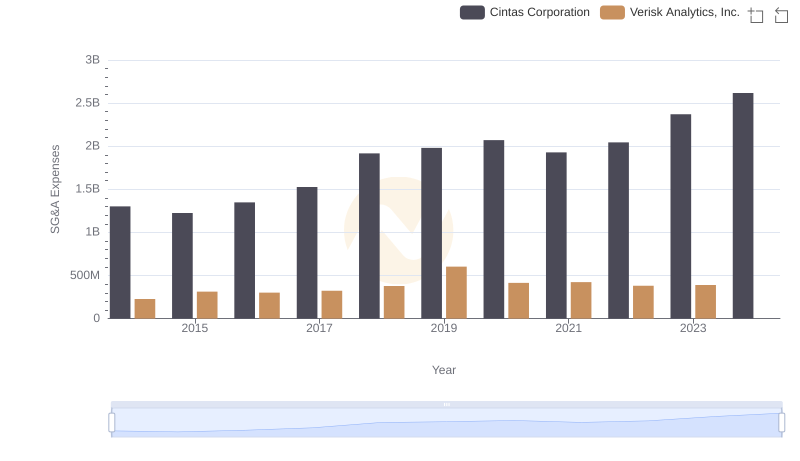

Cintas Corporation vs Verisk Analytics, Inc.: SG&A Expense Trends

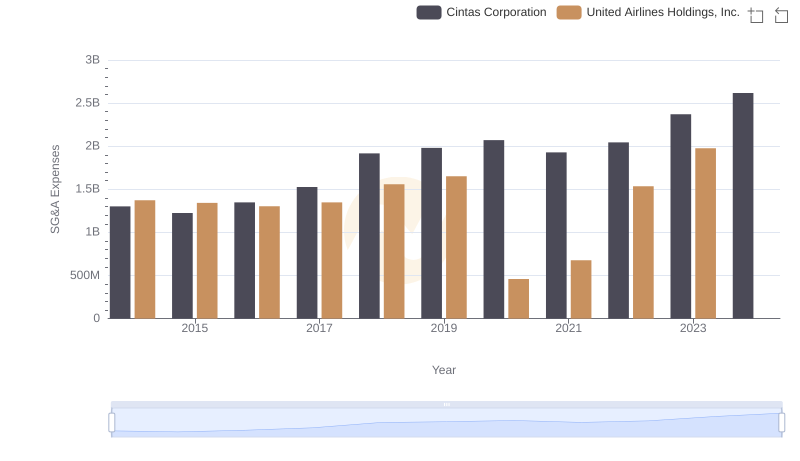

SG&A Efficiency Analysis: Comparing Cintas Corporation and United Airlines Holdings, Inc.

Comparative EBITDA Analysis: Cintas Corporation vs Quanta Services, Inc.