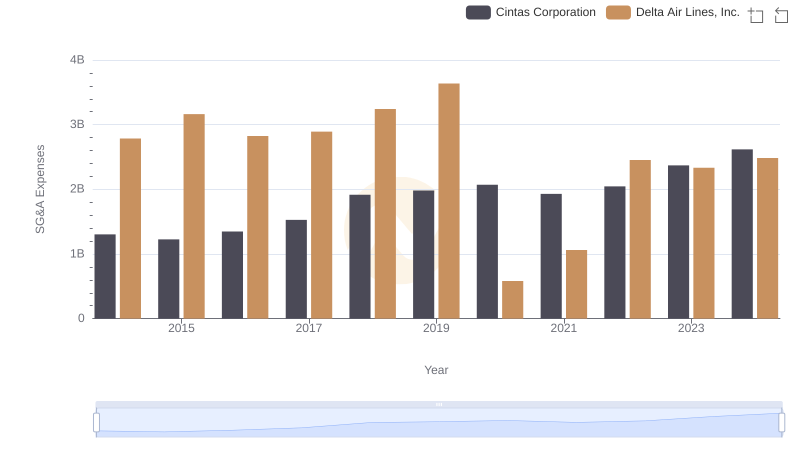

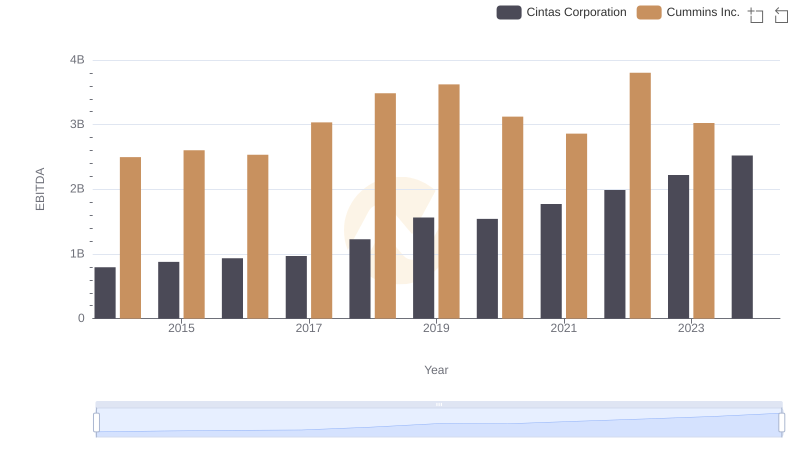

| __timestamp | Cintas Corporation | Cummins Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1302752000 | 2095000000 |

| Thursday, January 1, 2015 | 1224930000 | 2092000000 |

| Friday, January 1, 2016 | 1348122000 | 2046000000 |

| Sunday, January 1, 2017 | 1527380000 | 2390000000 |

| Monday, January 1, 2018 | 1916792000 | 2437000000 |

| Tuesday, January 1, 2019 | 1980644000 | 2454000000 |

| Wednesday, January 1, 2020 | 2071052000 | 2125000000 |

| Friday, January 1, 2021 | 1929159000 | 2374000000 |

| Saturday, January 1, 2022 | 2044876000 | 2687000000 |

| Sunday, January 1, 2023 | 2370704000 | 3208000000 |

| Monday, January 1, 2024 | 2617783000 | 3275000000 |

Data in motion

In the ever-evolving landscape of corporate finance, understanding the nuances of Selling, General, and Administrative (SG&A) expenses is crucial. Over the past decade, Cintas Corporation and Cummins Inc. have demonstrated distinct trajectories in their SG&A expenditures. From 2014 to 2023, Cintas Corporation's SG&A expenses surged by approximately 101%, reflecting strategic investments in growth and operational efficiency. In contrast, Cummins Inc. experienced a 53% increase over the same period, indicating a more conservative approach.

Notably, 2023 marked a significant year for Cummins Inc., with SG&A expenses peaking at 3.2 billion, a 19% rise from the previous year. Meanwhile, Cintas Corporation's expenses reached 2.4 billion, showcasing a steady upward trend. The data for 2024 remains incomplete, offering a tantalizing glimpse into future financial strategies. This analysis underscores the importance of SG&A management in shaping corporate success.

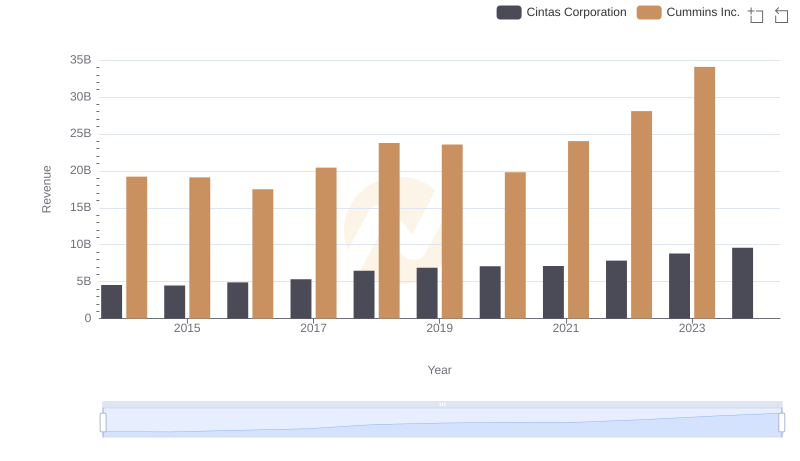

Comparing Revenue Performance: Cintas Corporation or Cummins Inc.?

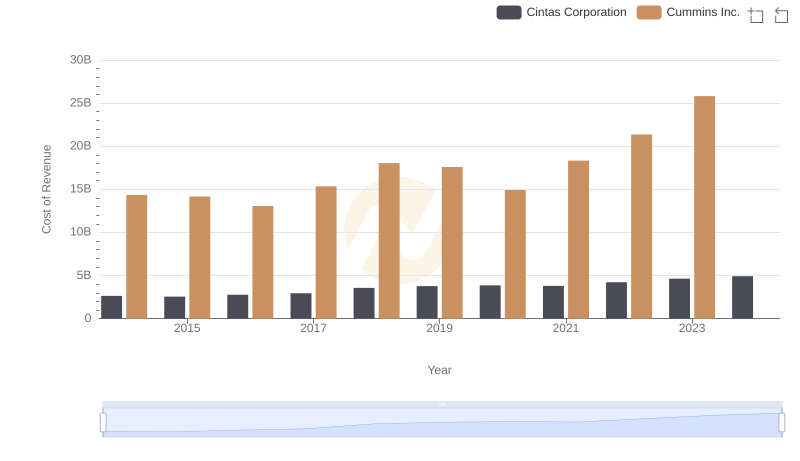

Cost Insights: Breaking Down Cintas Corporation and Cummins Inc.'s Expenses

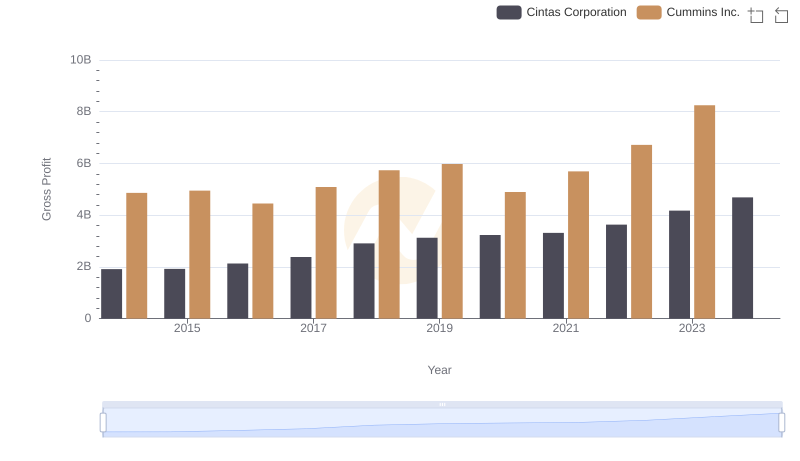

Gross Profit Trends Compared: Cintas Corporation vs Cummins Inc.

Cost Management Insights: SG&A Expenses for Cintas Corporation and Delta Air Lines, Inc.

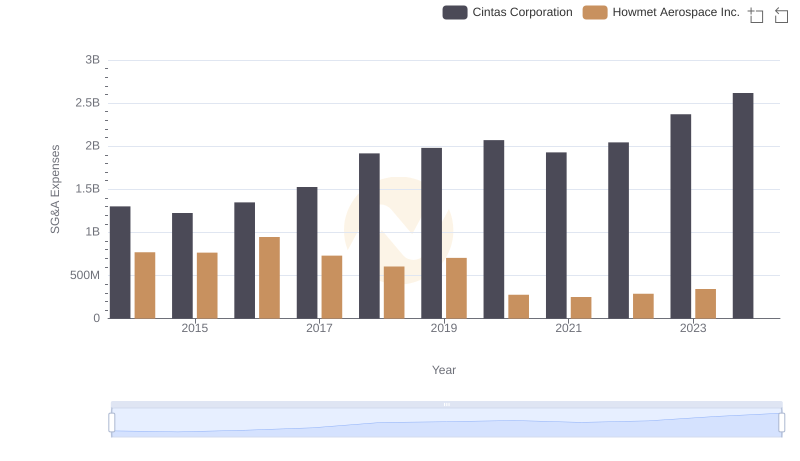

Who Optimizes SG&A Costs Better? Cintas Corporation or Howmet Aerospace Inc.

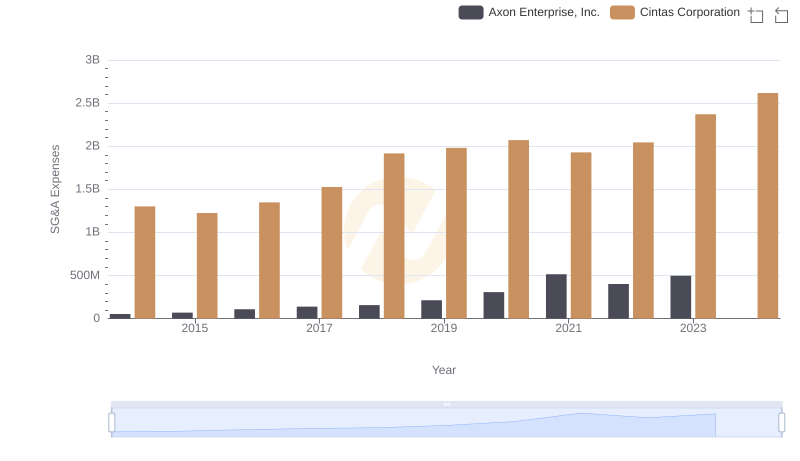

Cintas Corporation and Axon Enterprise, Inc.: SG&A Spending Patterns Compared

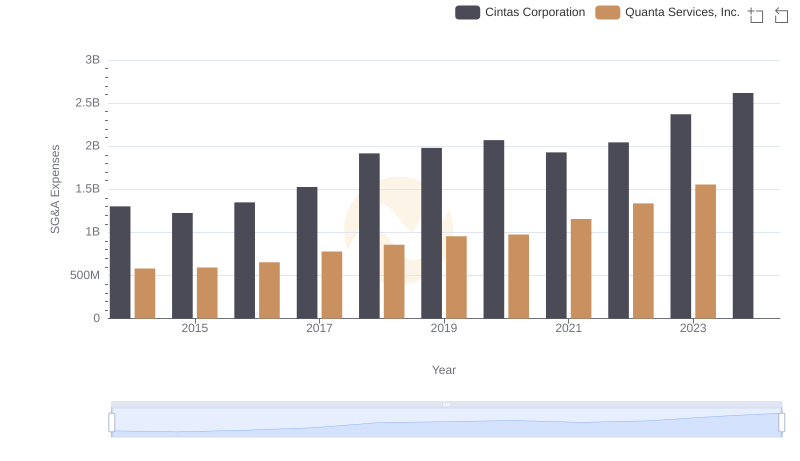

Who Optimizes SG&A Costs Better? Cintas Corporation or Quanta Services, Inc.

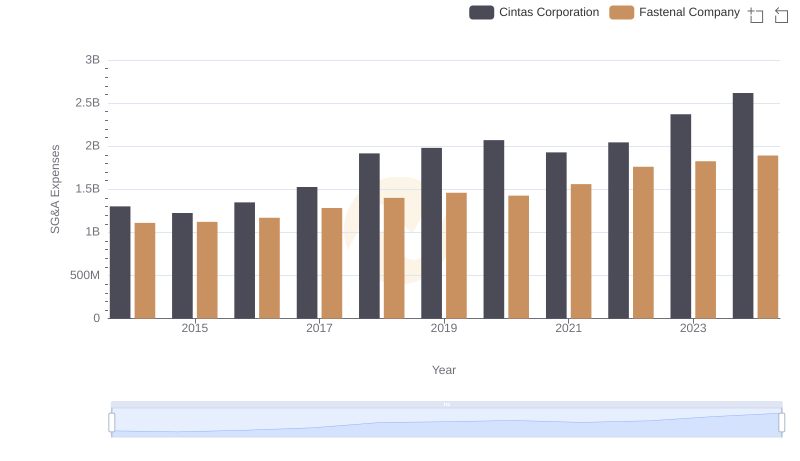

Cintas Corporation vs Fastenal Company: SG&A Expense Trends

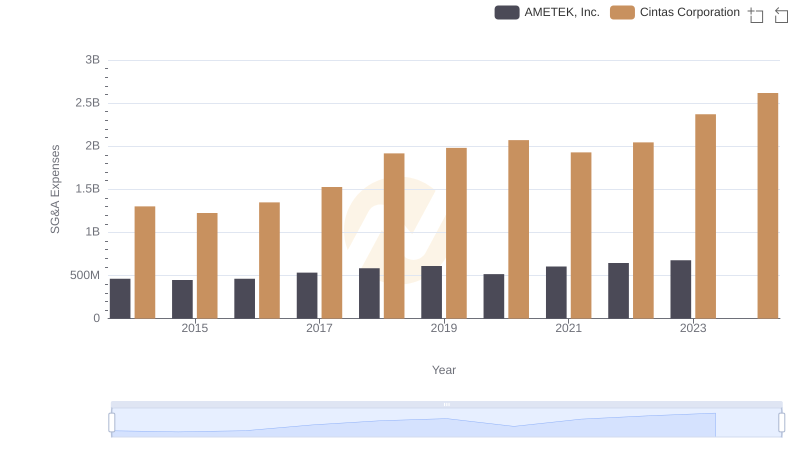

Cintas Corporation vs AMETEK, Inc.: SG&A Expense Trends

EBITDA Analysis: Evaluating Cintas Corporation Against Cummins Inc.

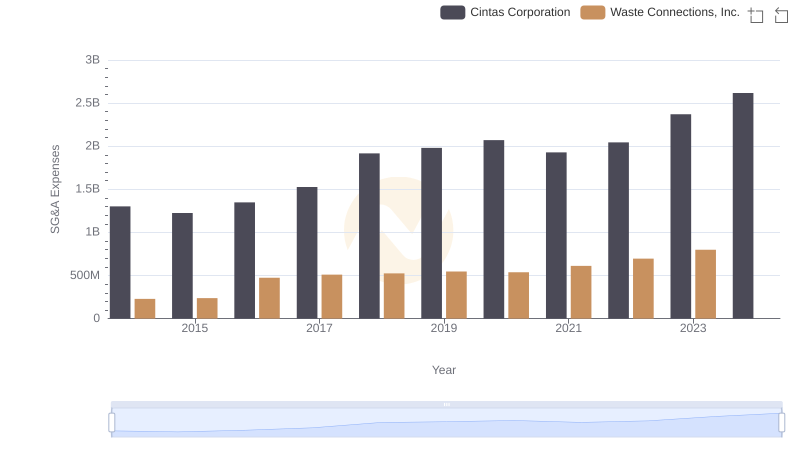

SG&A Efficiency Analysis: Comparing Cintas Corporation and Waste Connections, Inc.

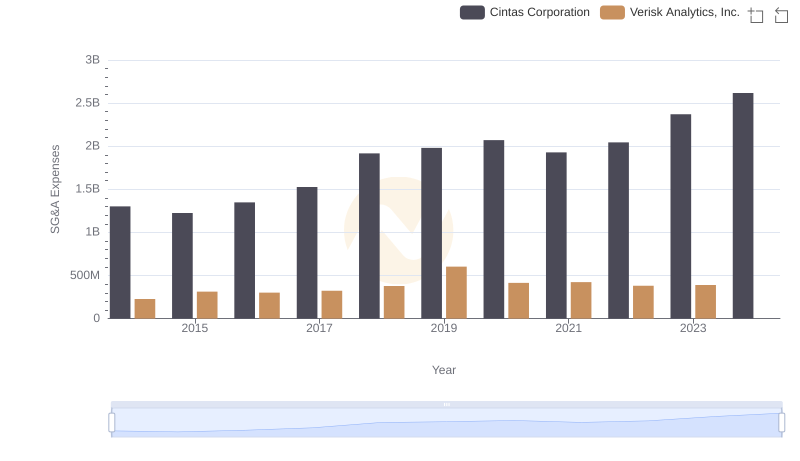

Cintas Corporation vs Verisk Analytics, Inc.: SG&A Expense Trends