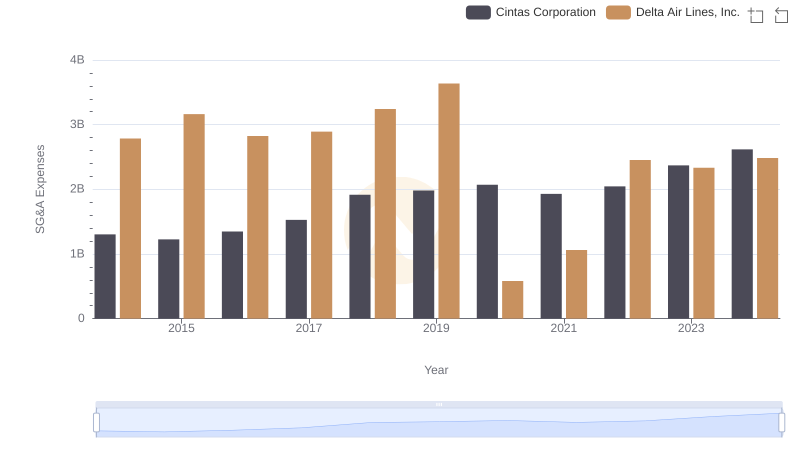

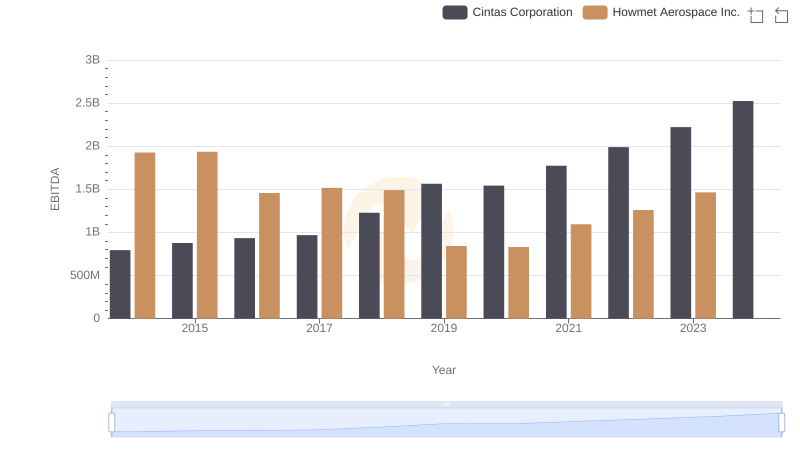

| __timestamp | Cintas Corporation | Howmet Aerospace Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1302752000 | 770000000 |

| Thursday, January 1, 2015 | 1224930000 | 765000000 |

| Friday, January 1, 2016 | 1348122000 | 947000000 |

| Sunday, January 1, 2017 | 1527380000 | 731000000 |

| Monday, January 1, 2018 | 1916792000 | 604000000 |

| Tuesday, January 1, 2019 | 1980644000 | 704000000 |

| Wednesday, January 1, 2020 | 2071052000 | 277000000 |

| Friday, January 1, 2021 | 1929159000 | 251000000 |

| Saturday, January 1, 2022 | 2044876000 | 288000000 |

| Sunday, January 1, 2023 | 2370704000 | 343000000 |

| Monday, January 1, 2024 | 2617783000 | 362000000 |

In pursuit of knowledge

In the competitive landscape of corporate America, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Cintas Corporation and Howmet Aerospace Inc. have been at the forefront of this financial balancing act since 2014. Over the past decade, Cintas has consistently outpaced Howmet in SG&A spending, with a notable increase of approximately 100% from 2014 to 2023. In contrast, Howmet's SG&A expenses have seen a decline, dropping by nearly 55% over the same period. This divergence highlights Cintas's aggressive growth strategy, while Howmet appears to be optimizing its operations more conservatively. The data for 2024 is incomplete, but the trend suggests Cintas's expenses continue to rise. This analysis provides a fascinating glimpse into how two industry leaders manage their operational costs, offering valuable insights for investors and business strategists alike.

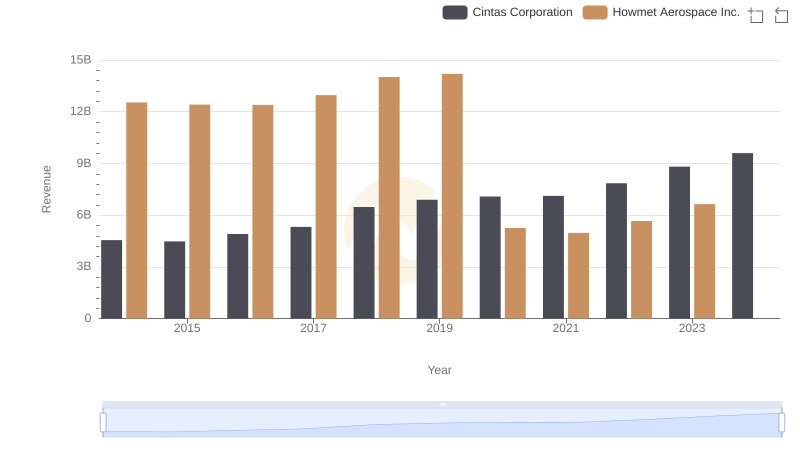

Cintas Corporation vs Howmet Aerospace Inc.: Examining Key Revenue Metrics

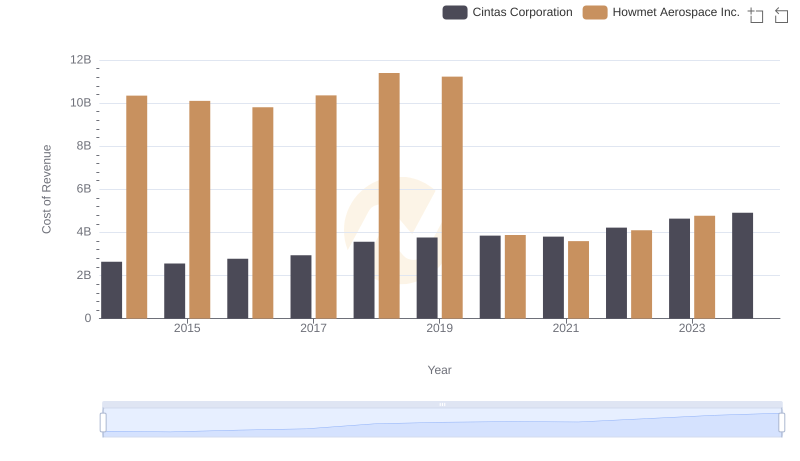

Cost of Revenue Comparison: Cintas Corporation vs Howmet Aerospace Inc.

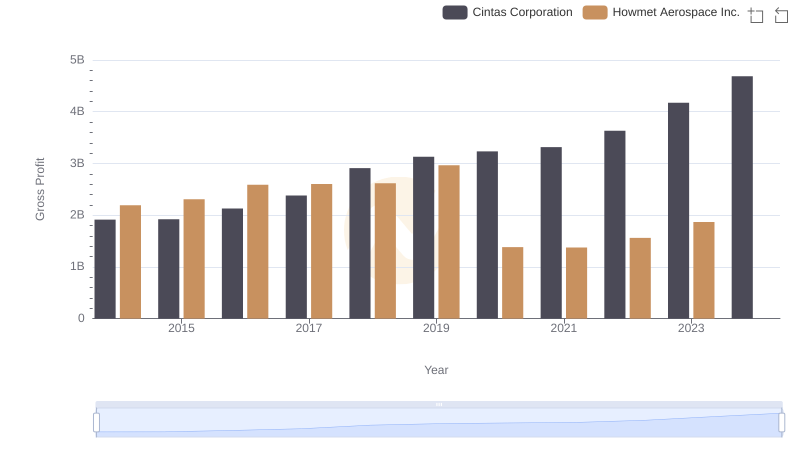

Who Generates Higher Gross Profit? Cintas Corporation or Howmet Aerospace Inc.

Cost Management Insights: SG&A Expenses for Cintas Corporation and Delta Air Lines, Inc.

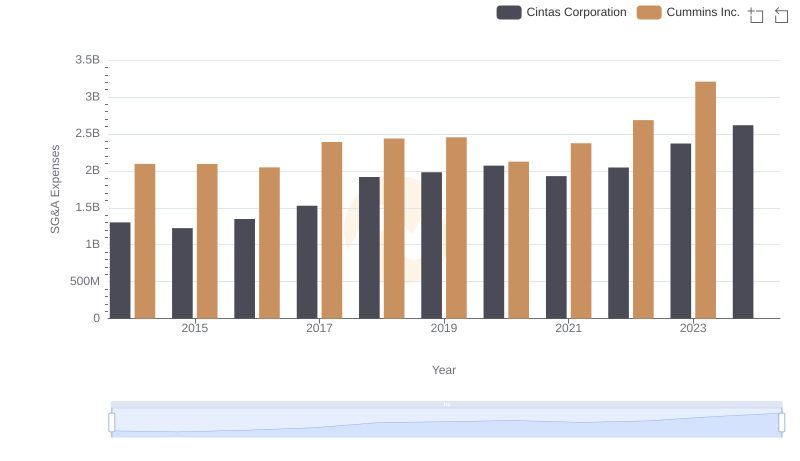

Breaking Down SG&A Expenses: Cintas Corporation vs Cummins Inc.

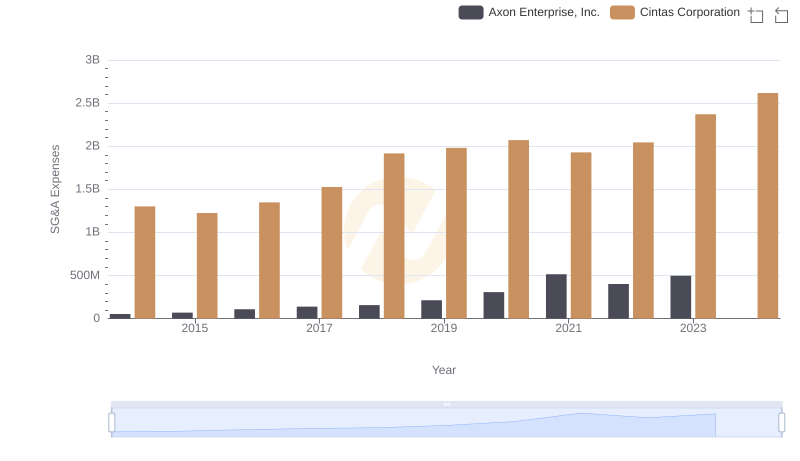

Cintas Corporation and Axon Enterprise, Inc.: SG&A Spending Patterns Compared

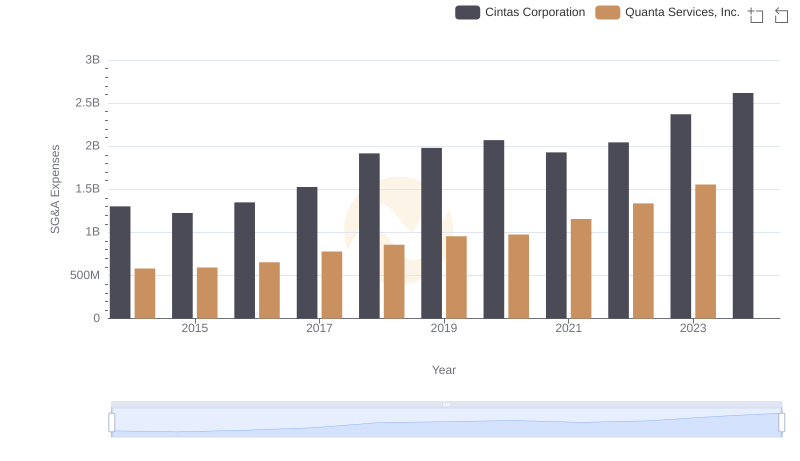

Who Optimizes SG&A Costs Better? Cintas Corporation or Quanta Services, Inc.

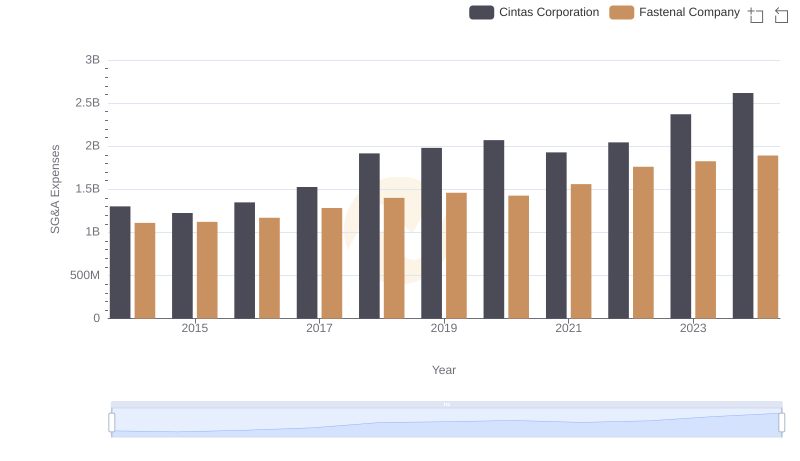

Cintas Corporation vs Fastenal Company: SG&A Expense Trends

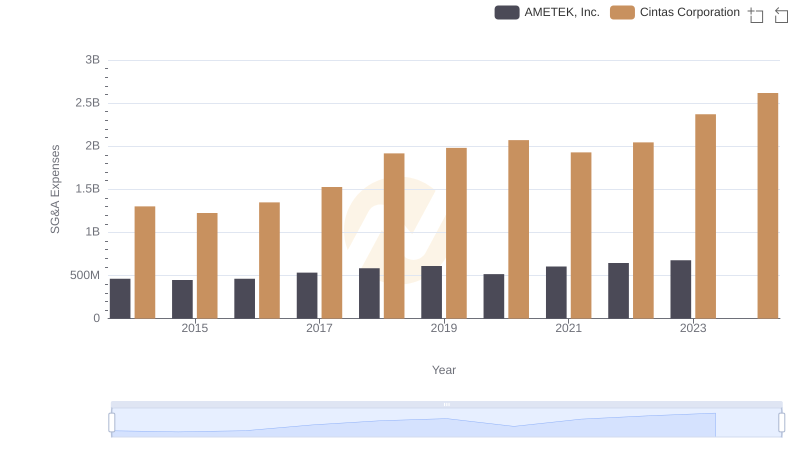

Cintas Corporation vs AMETEK, Inc.: SG&A Expense Trends

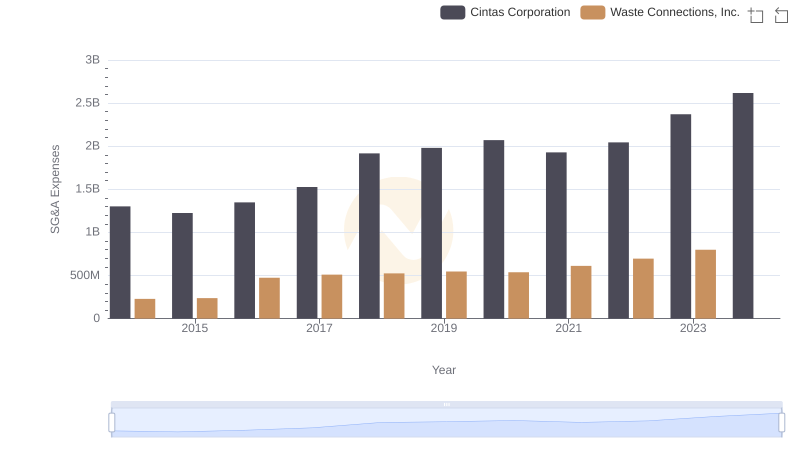

SG&A Efficiency Analysis: Comparing Cintas Corporation and Waste Connections, Inc.

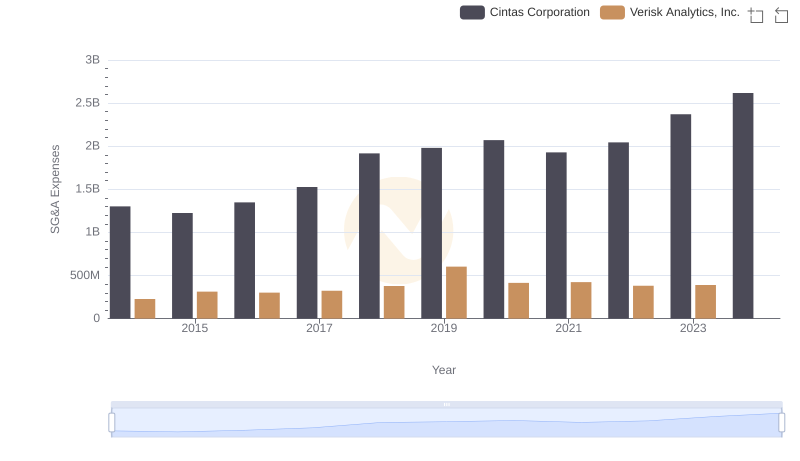

Cintas Corporation vs Verisk Analytics, Inc.: SG&A Expense Trends

Professional EBITDA Benchmarking: Cintas Corporation vs Howmet Aerospace Inc.