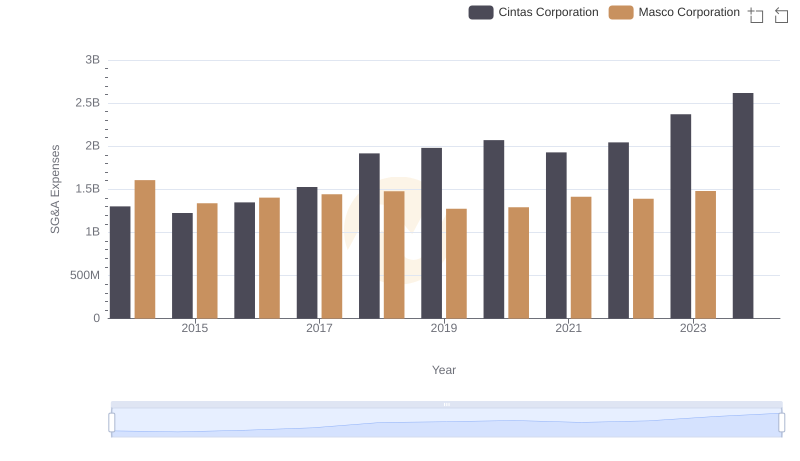

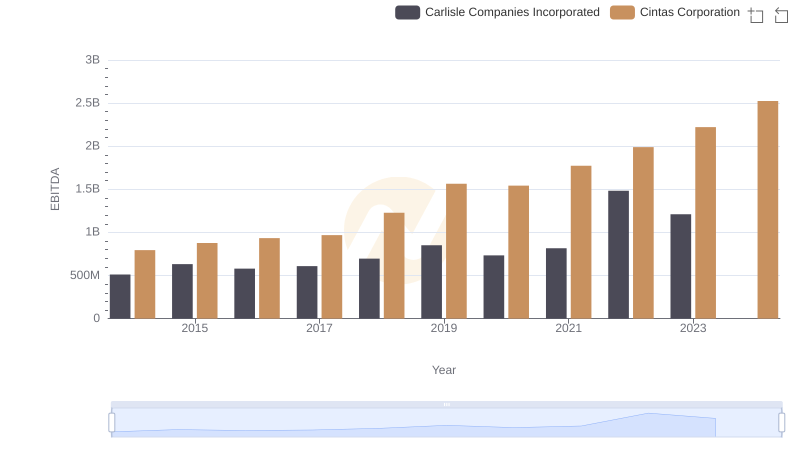

| __timestamp | Carlisle Companies Incorporated | Cintas Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 379000000 | 1302752000 |

| Thursday, January 1, 2015 | 461900000 | 1224930000 |

| Friday, January 1, 2016 | 532000000 | 1348122000 |

| Sunday, January 1, 2017 | 589400000 | 1527380000 |

| Monday, January 1, 2018 | 625400000 | 1916792000 |

| Tuesday, January 1, 2019 | 667100000 | 1980644000 |

| Wednesday, January 1, 2020 | 603200000 | 2071052000 |

| Friday, January 1, 2021 | 698200000 | 1929159000 |

| Saturday, January 1, 2022 | 811500000 | 2044876000 |

| Sunday, January 1, 2023 | 625200000 | 2370704000 |

| Monday, January 1, 2024 | 722800000 | 2617783000 |

Unlocking the unknown

In the competitive landscape of corporate America, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Cintas Corporation and Carlisle Companies Incorporated, two giants in their respective industries, have shown distinct strategies over the past decade. From 2014 to 2023, Cintas consistently reported higher SG&A expenses, peaking at approximately $2.62 billion in 2024. This represents a 100% increase from their 2014 figures. In contrast, Carlisle's SG&A expenses grew by about 65% over the same period, reaching a high of $811 million in 2022.

While Cintas's expenses are significantly higher, their growth trajectory suggests a strategic investment in scaling operations. Carlisle, on the other hand, appears to focus on cost containment, with a notable dip in 2023. This data provides a fascinating insight into how two industry leaders navigate financial management, each with its unique approach.

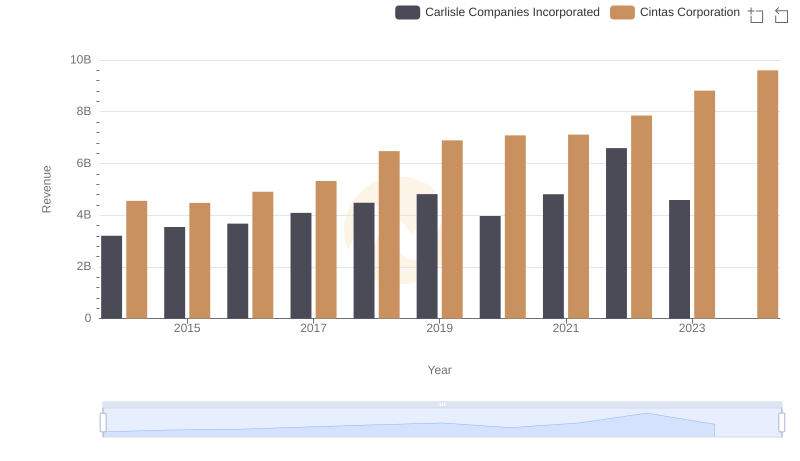

Cintas Corporation vs Carlisle Companies Incorporated: Annual Revenue Growth Compared

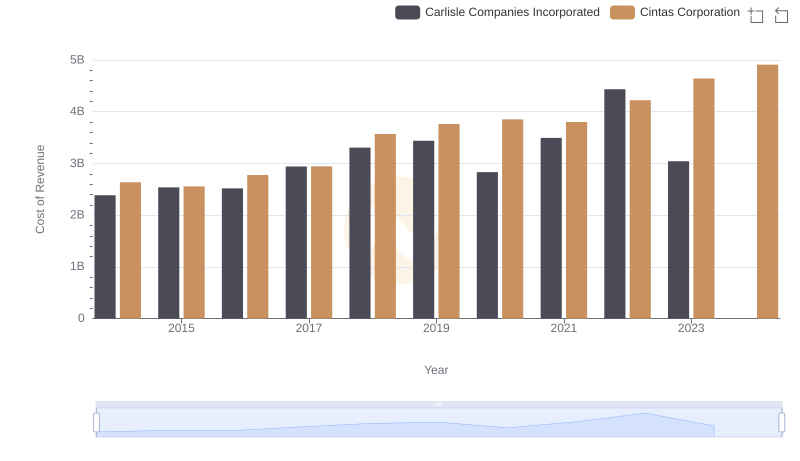

Cost of Revenue: Key Insights for Cintas Corporation and Carlisle Companies Incorporated

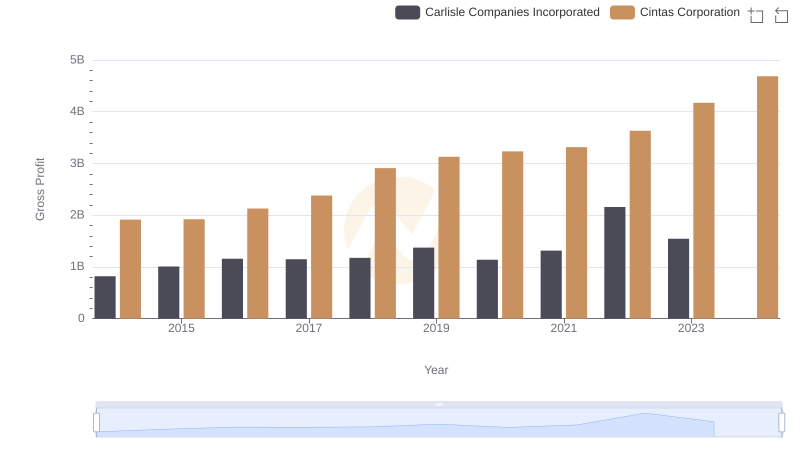

Gross Profit Comparison: Cintas Corporation and Carlisle Companies Incorporated Trends

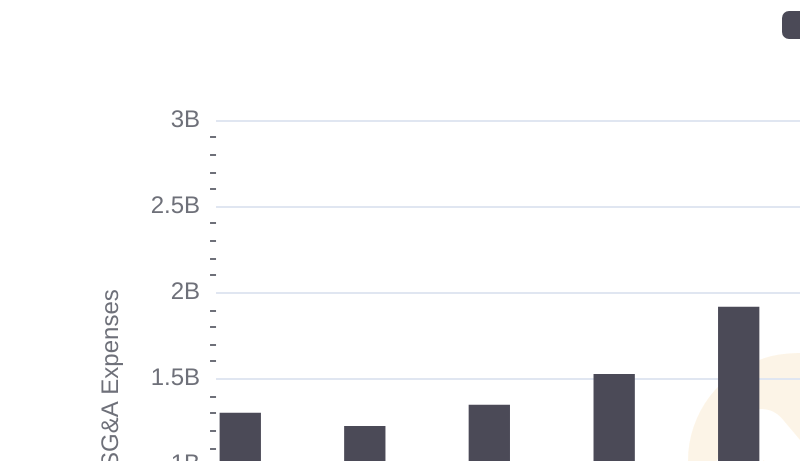

Cintas Corporation vs Masco Corporation: SG&A Expense Trends

Comparing SG&A Expenses: Cintas Corporation vs J.B. Hunt Transport Services, Inc. Trends and Insights

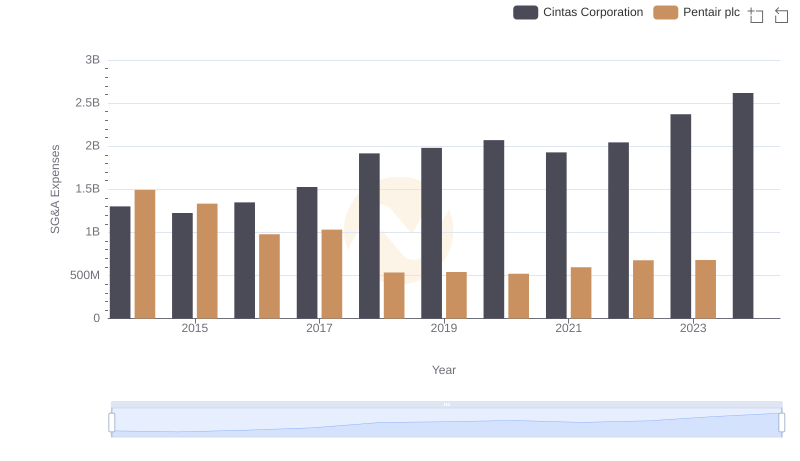

Breaking Down SG&A Expenses: Cintas Corporation vs Pentair plc

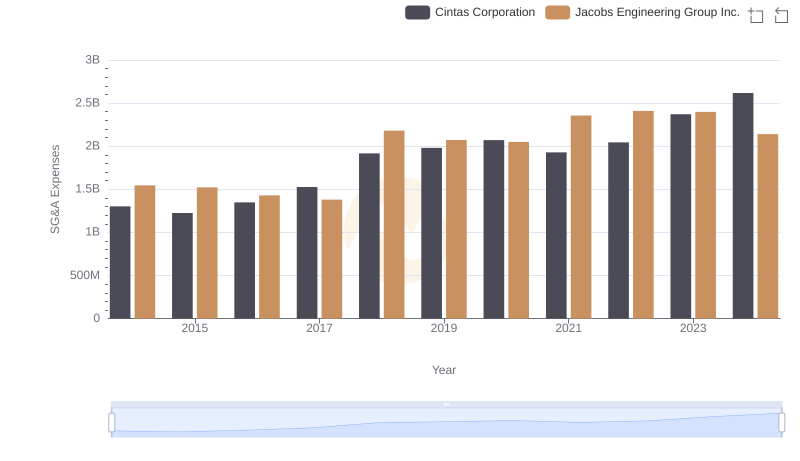

Cost Management Insights: SG&A Expenses for Cintas Corporation and Jacobs Engineering Group Inc.

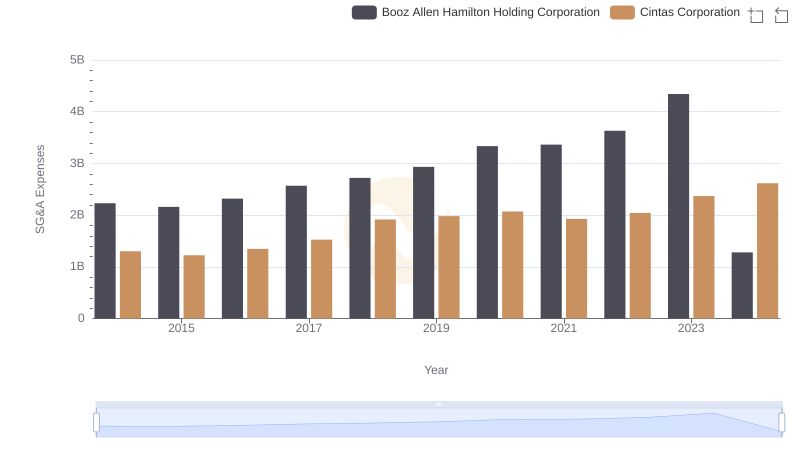

Cintas Corporation and Booz Allen Hamilton Holding Corporation: SG&A Spending Patterns Compared

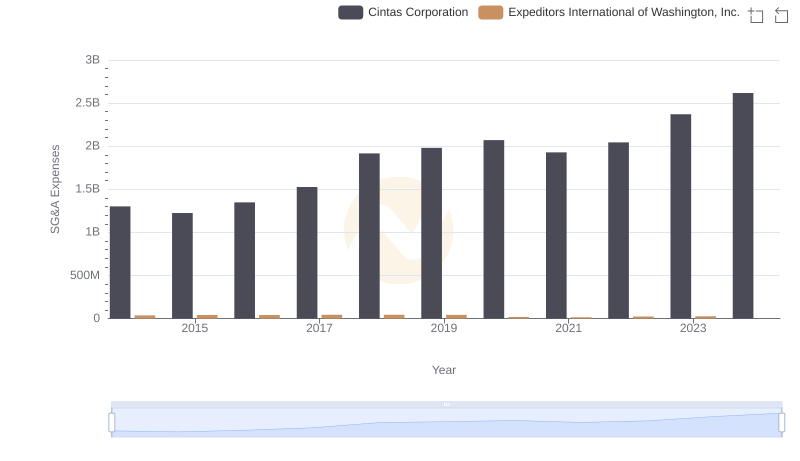

Operational Costs Compared: SG&A Analysis of Cintas Corporation and Expeditors International of Washington, Inc.

EBITDA Metrics Evaluated: Cintas Corporation vs Carlisle Companies Incorporated

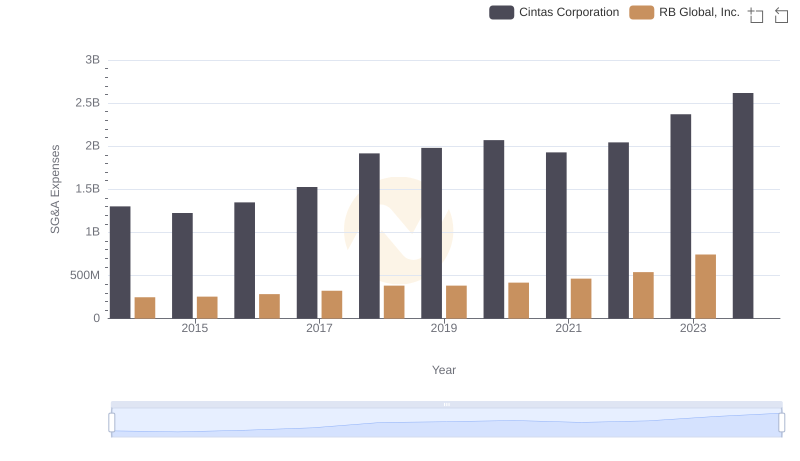

Cintas Corporation and RB Global, Inc.: SG&A Spending Patterns Compared

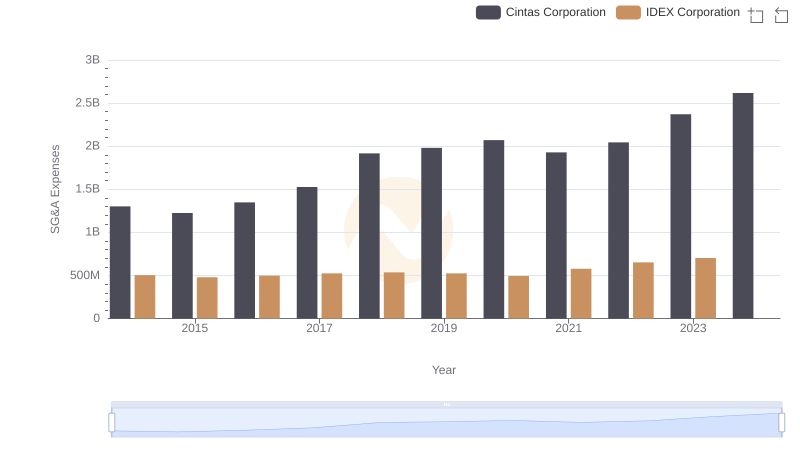

Operational Costs Compared: SG&A Analysis of Cintas Corporation and IDEX Corporation