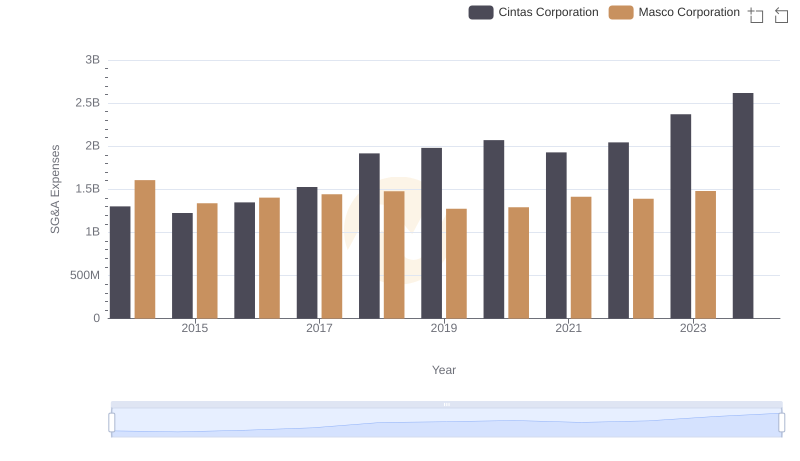

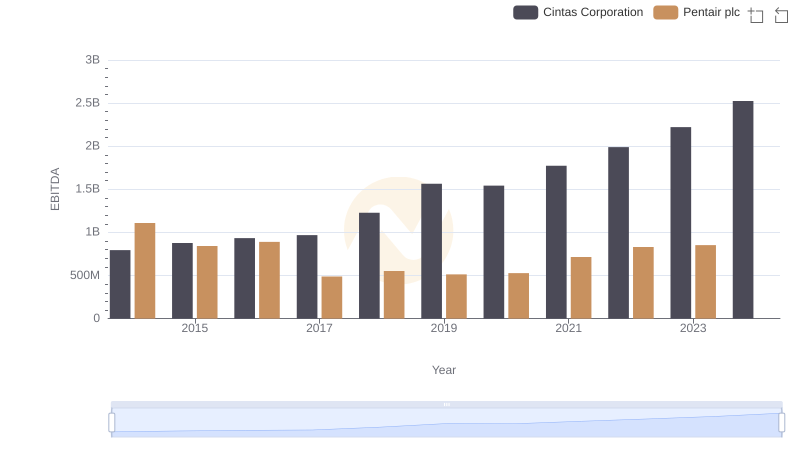

| __timestamp | Cintas Corporation | Pentair plc |

|---|---|---|

| Wednesday, January 1, 2014 | 1302752000 | 1493800000 |

| Thursday, January 1, 2015 | 1224930000 | 1334300000 |

| Friday, January 1, 2016 | 1348122000 | 979300000 |

| Sunday, January 1, 2017 | 1527380000 | 1032500000 |

| Monday, January 1, 2018 | 1916792000 | 534300000 |

| Tuesday, January 1, 2019 | 1980644000 | 540100000 |

| Wednesday, January 1, 2020 | 2071052000 | 520500000 |

| Friday, January 1, 2021 | 1929159000 | 596400000 |

| Saturday, January 1, 2022 | 2044876000 | 677100000 |

| Sunday, January 1, 2023 | 2370704000 | 680200000 |

| Monday, January 1, 2024 | 2617783000 | 701400000 |

Igniting the spark of knowledge

In the ever-evolving landscape of corporate finance, understanding the nuances of Selling, General, and Administrative (SG&A) expenses is crucial. Over the past decade, Cintas Corporation and Pentair plc have showcased contrasting trajectories in their SG&A expenditures. From 2014 to 2023, Cintas Corporation's SG&A expenses surged by approximately 101%, reflecting its strategic investments and expansion efforts. In contrast, Pentair plc experienced a decline of around 54% in the same period, indicating a shift towards cost optimization and efficiency.

Cintas consistently increased its SG&A spending, peaking in 2024, while Pentair's expenses dwindled, with data missing for 2024. This divergence highlights differing corporate strategies: Cintas's aggressive growth versus Pentair's streamlined operations. As businesses navigate the complexities of the modern market, these insights into SG&A trends offer valuable lessons in balancing growth and efficiency.

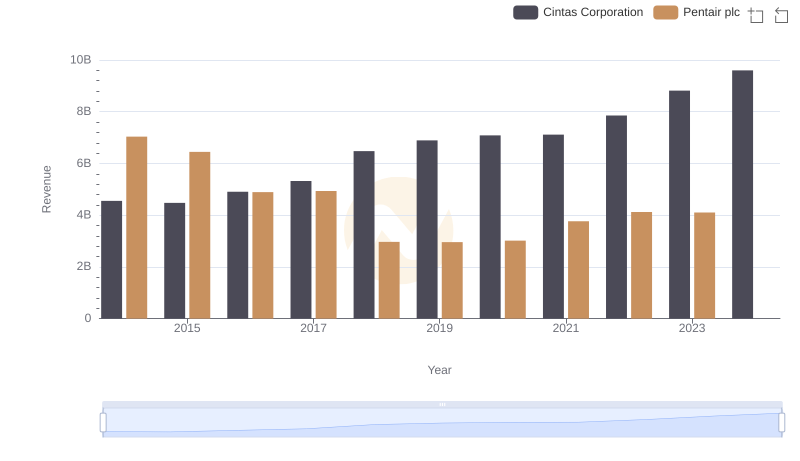

Annual Revenue Comparison: Cintas Corporation vs Pentair plc

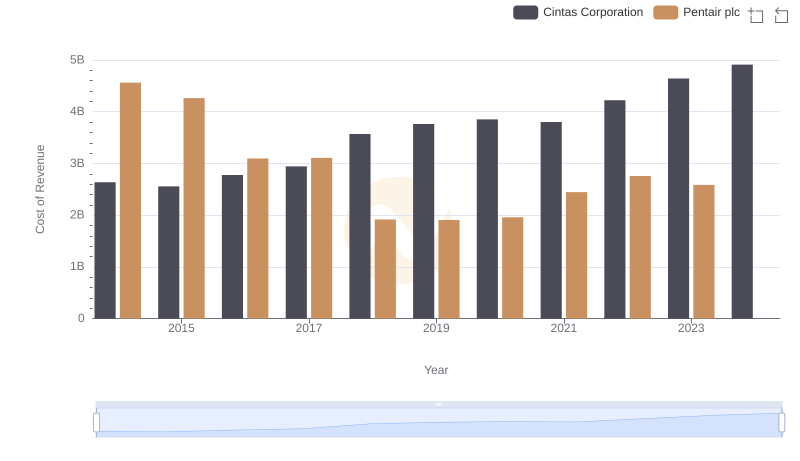

Cost of Revenue Comparison: Cintas Corporation vs Pentair plc

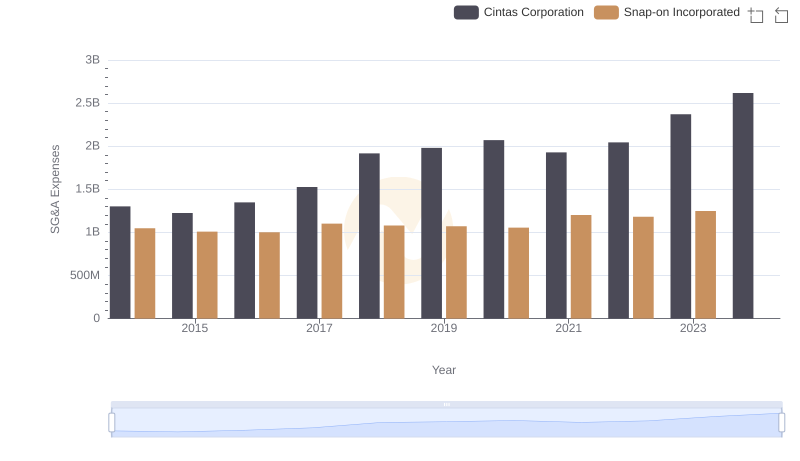

Selling, General, and Administrative Costs: Cintas Corporation vs Snap-on Incorporated

Cintas Corporation vs Masco Corporation: SG&A Expense Trends

Comparing SG&A Expenses: Cintas Corporation vs J.B. Hunt Transport Services, Inc. Trends and Insights

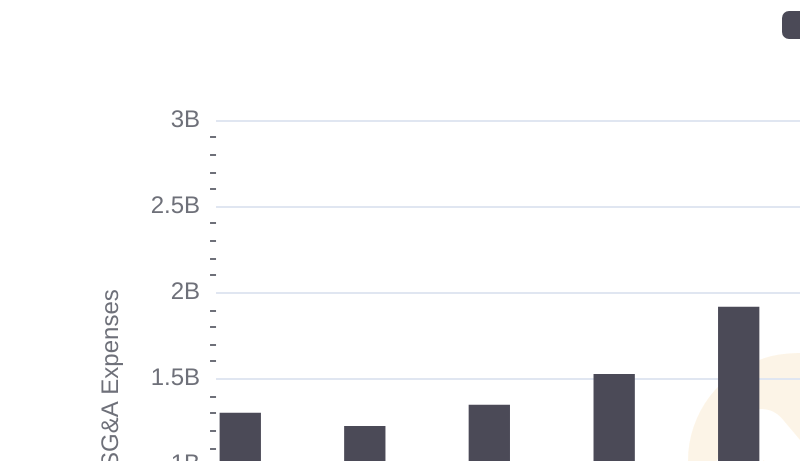

Who Optimizes SG&A Costs Better? Cintas Corporation or Carlisle Companies Incorporated

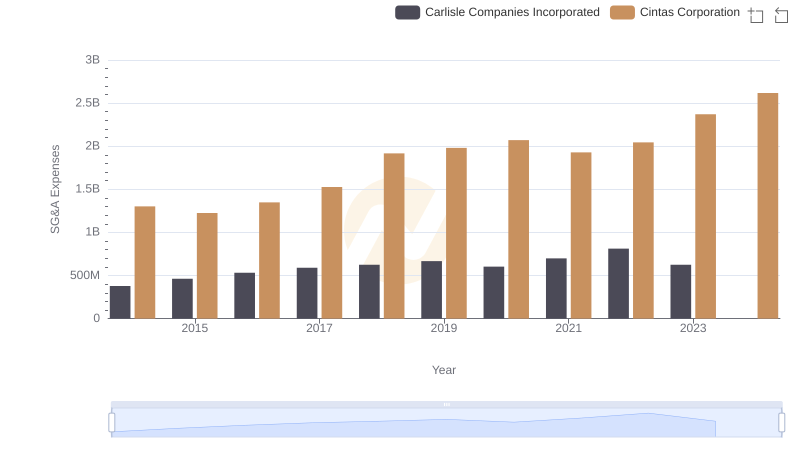

Cost Management Insights: SG&A Expenses for Cintas Corporation and Jacobs Engineering Group Inc.

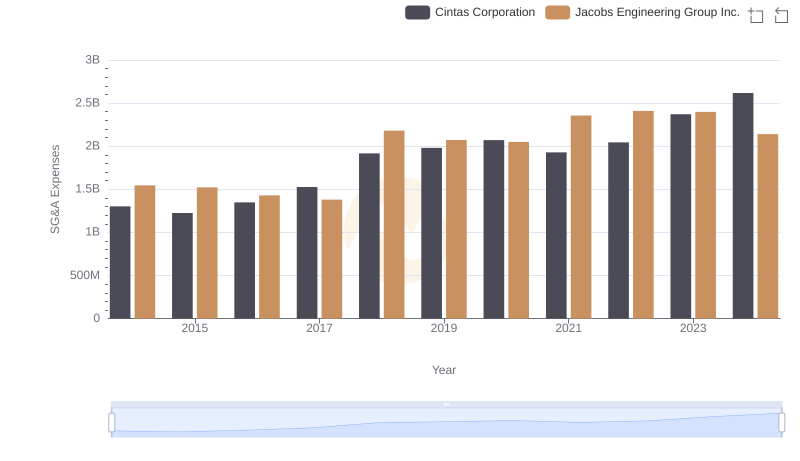

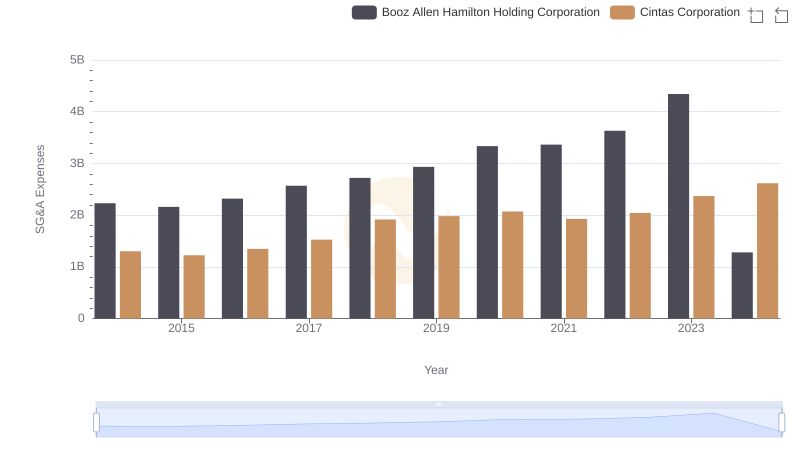

Cintas Corporation and Booz Allen Hamilton Holding Corporation: SG&A Spending Patterns Compared

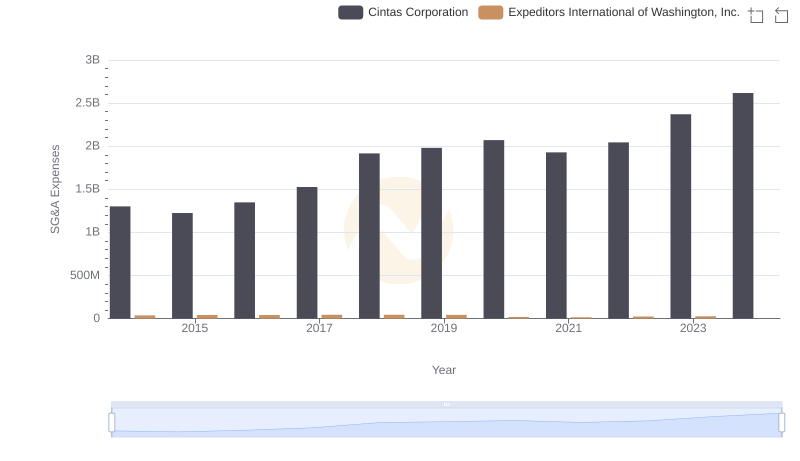

Operational Costs Compared: SG&A Analysis of Cintas Corporation and Expeditors International of Washington, Inc.

Professional EBITDA Benchmarking: Cintas Corporation vs Pentair plc

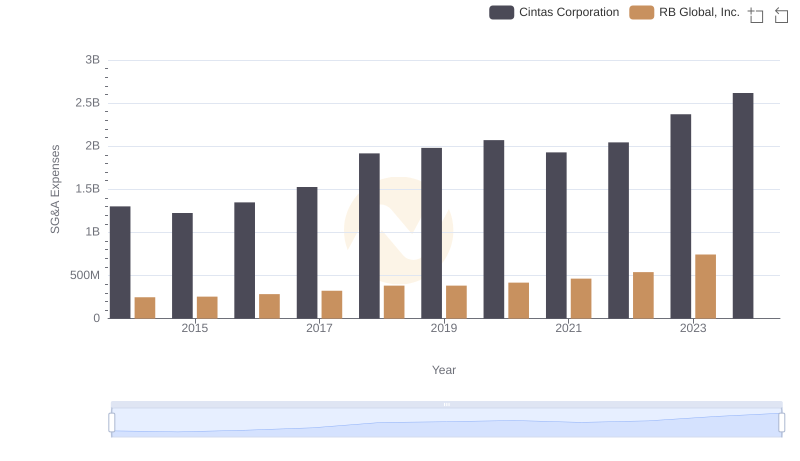

Cintas Corporation and RB Global, Inc.: SG&A Spending Patterns Compared