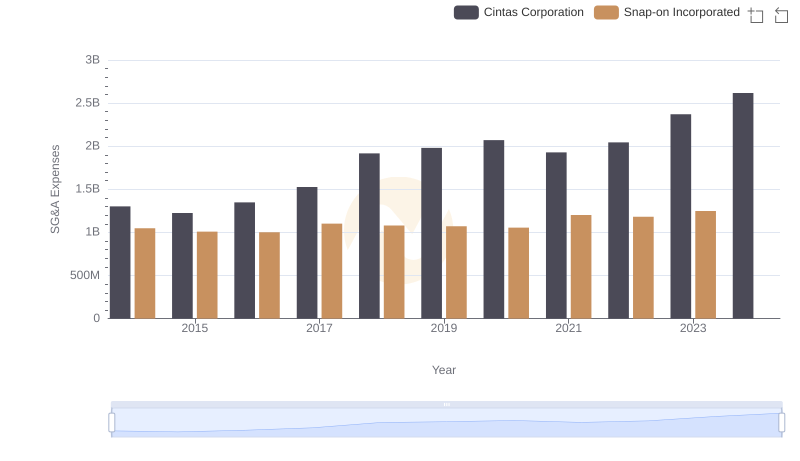

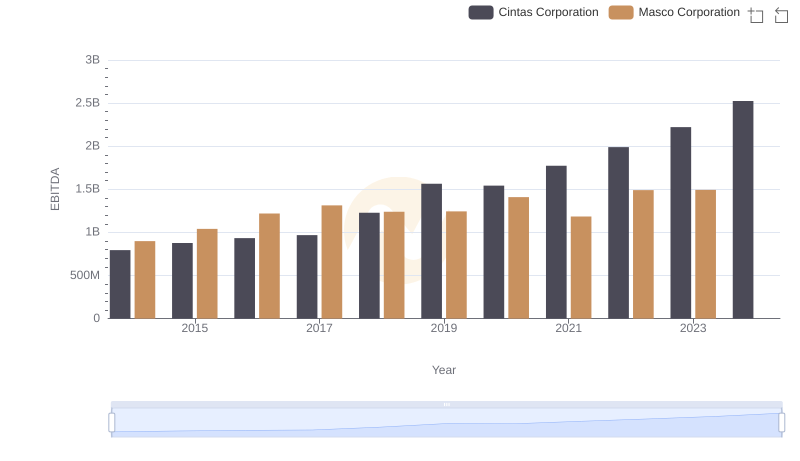

| __timestamp | Cintas Corporation | Masco Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1302752000 | 1607000000 |

| Thursday, January 1, 2015 | 1224930000 | 1339000000 |

| Friday, January 1, 2016 | 1348122000 | 1403000000 |

| Sunday, January 1, 2017 | 1527380000 | 1442000000 |

| Monday, January 1, 2018 | 1916792000 | 1478000000 |

| Tuesday, January 1, 2019 | 1980644000 | 1274000000 |

| Wednesday, January 1, 2020 | 2071052000 | 1292000000 |

| Friday, January 1, 2021 | 1929159000 | 1413000000 |

| Saturday, January 1, 2022 | 2044876000 | 1390000000 |

| Sunday, January 1, 2023 | 2370704000 | 1481000000 |

| Monday, January 1, 2024 | 2617783000 | 1468000000 |

Unveiling the hidden dimensions of data

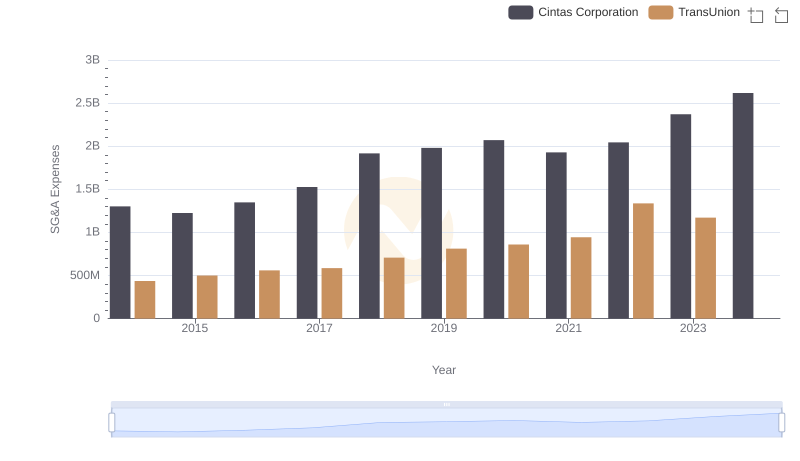

In the competitive landscape of corporate America, understanding the financial strategies of leading companies is crucial. Cintas Corporation and Masco Corporation, two giants in their respective industries, have shown distinct trends in their Selling, General, and Administrative (SG&A) expenses over the past decade.

From 2014 to 2023, Cintas Corporation's SG&A expenses have surged by approximately 101%, reflecting a strategic expansion and investment in operational efficiencies. In contrast, Masco Corporation's expenses have remained relatively stable, with a modest increase of about 5% over the same period. This divergence highlights Cintas's aggressive growth strategy compared to Masco's more conservative approach.

Interestingly, the data for 2024 shows a gap for Masco, indicating potential shifts or reporting delays. As these trends unfold, stakeholders and investors should keenly observe how these financial strategies impact market positioning and profitability.

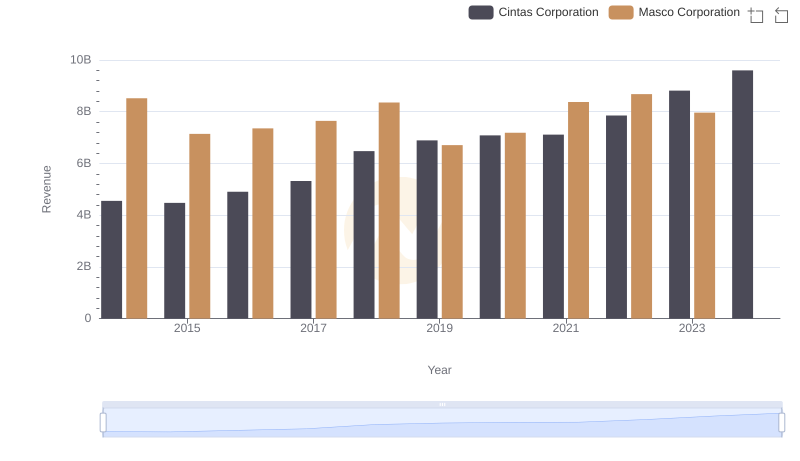

Who Generates More Revenue? Cintas Corporation or Masco Corporation

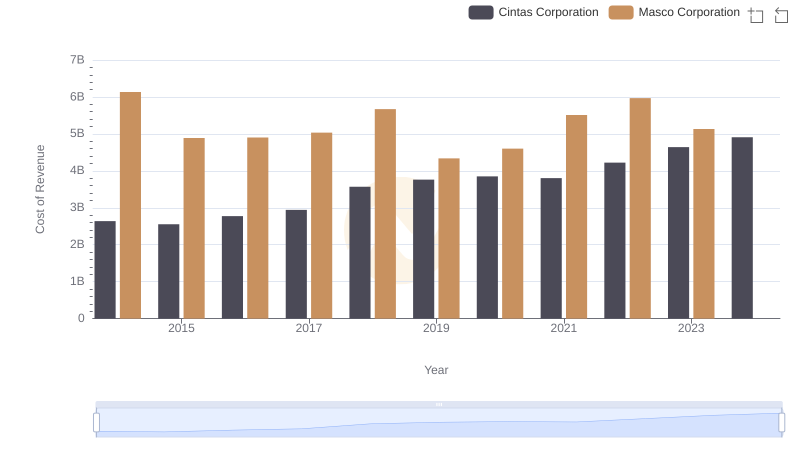

Comparing Cost of Revenue Efficiency: Cintas Corporation vs Masco Corporation

Who Optimizes SG&A Costs Better? Cintas Corporation or TransUnion

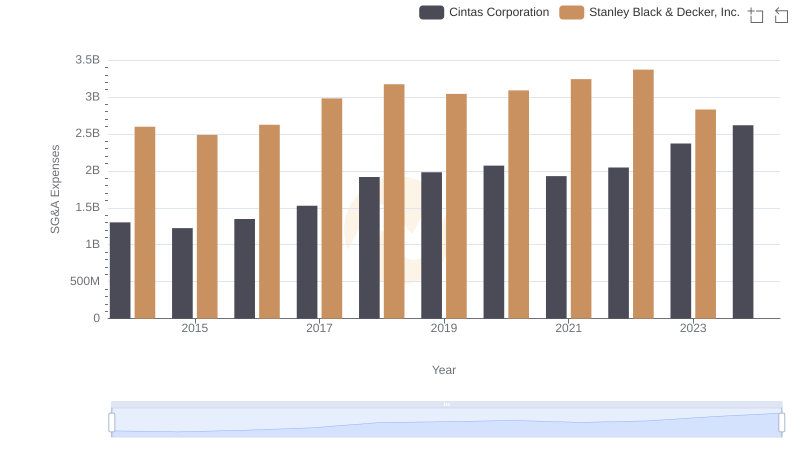

Operational Costs Compared: SG&A Analysis of Cintas Corporation and Stanley Black & Decker, Inc.

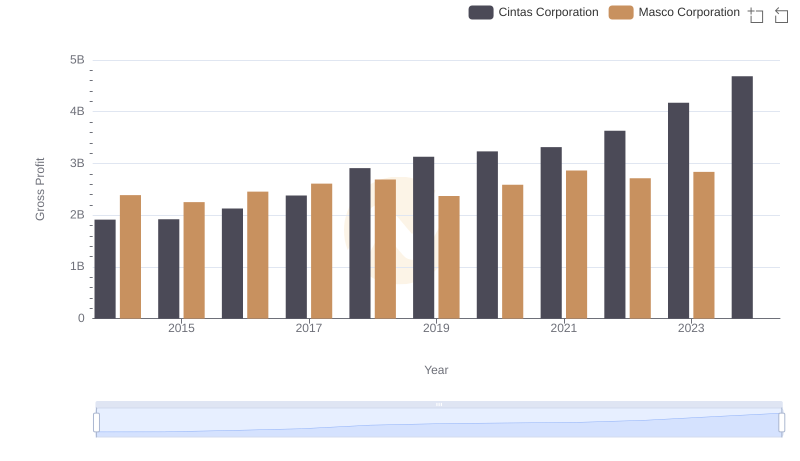

Gross Profit Analysis: Comparing Cintas Corporation and Masco Corporation

Selling, General, and Administrative Costs: Cintas Corporation vs Snap-on Incorporated

Comparing SG&A Expenses: Cintas Corporation vs J.B. Hunt Transport Services, Inc. Trends and Insights

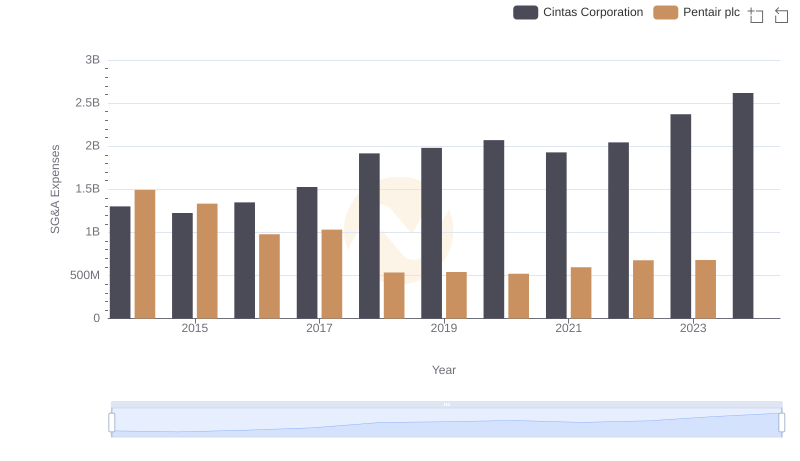

Breaking Down SG&A Expenses: Cintas Corporation vs Pentair plc

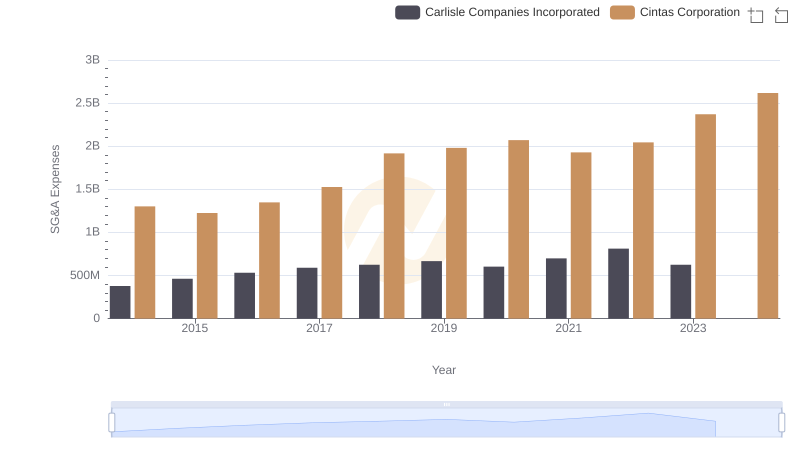

Who Optimizes SG&A Costs Better? Cintas Corporation or Carlisle Companies Incorporated

Cintas Corporation and Masco Corporation: A Detailed Examination of EBITDA Performance

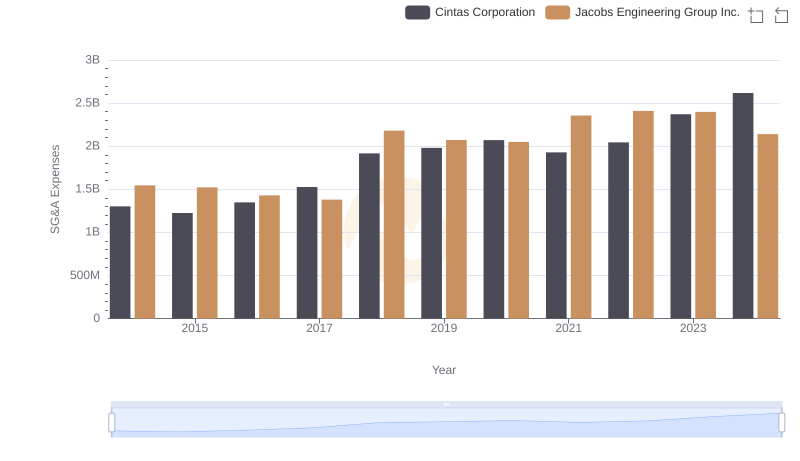

Cost Management Insights: SG&A Expenses for Cintas Corporation and Jacobs Engineering Group Inc.

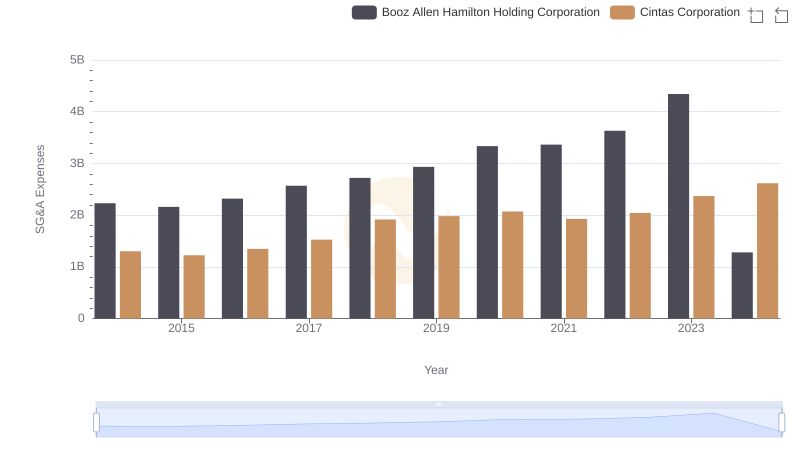

Cintas Corporation and Booz Allen Hamilton Holding Corporation: SG&A Spending Patterns Compared