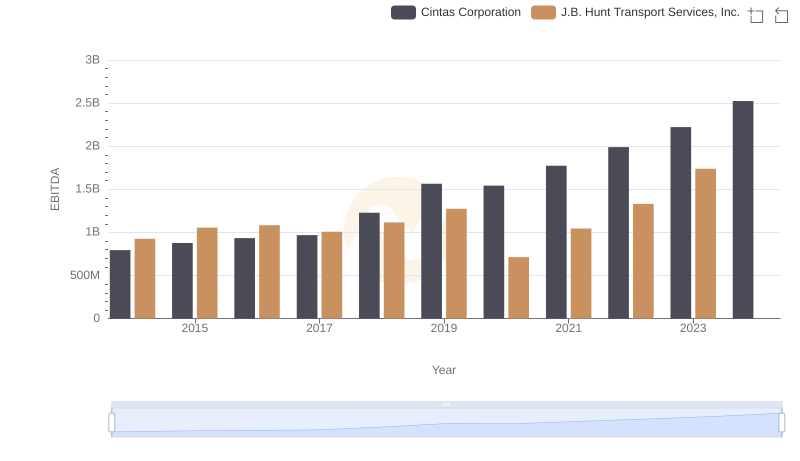

| __timestamp | Cintas Corporation | J.B. Hunt Transport Services, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1302752000 | 152469000 |

| Thursday, January 1, 2015 | 1224930000 | 166799000 |

| Friday, January 1, 2016 | 1348122000 | 185436000 |

| Sunday, January 1, 2017 | 1527380000 | 273440000 |

| Monday, January 1, 2018 | 1916792000 | 323587000 |

| Tuesday, January 1, 2019 | 1980644000 | 383981000 |

| Wednesday, January 1, 2020 | 2071052000 | 348076000 |

| Friday, January 1, 2021 | 1929159000 | 395533000 |

| Saturday, January 1, 2022 | 2044876000 | 570191000 |

| Sunday, January 1, 2023 | 2370704000 | 590242000 |

| Monday, January 1, 2024 | 2617783000 |

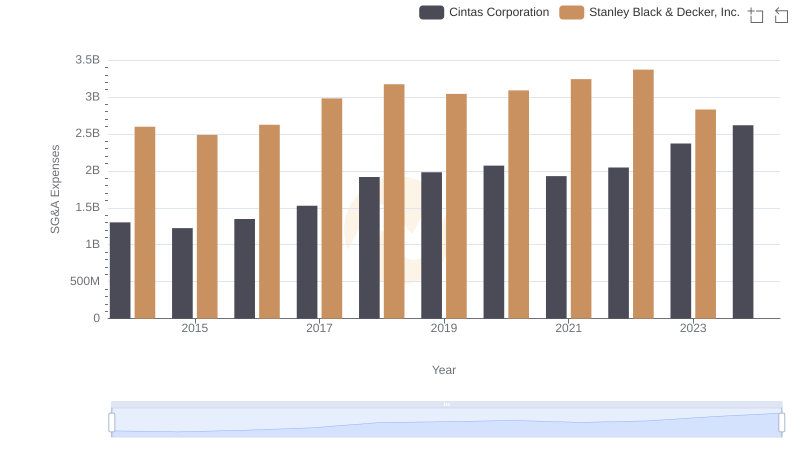

In pursuit of knowledge

In the world of corporate finance, Selling, General, and Administrative (SG&A) expenses are a critical measure of a company's operational efficiency. Over the past decade, Cintas Corporation and J.B. Hunt Transport Services, Inc. have showcased contrasting trends in their SG&A expenses. From 2014 to 2023, Cintas Corporation's SG&A expenses surged by approximately 101%, reflecting its aggressive growth strategy and expansion efforts. In contrast, J.B. Hunt's expenses grew by about 287% during the same period, indicating a significant investment in scaling operations.

While Cintas consistently reported higher SG&A expenses, J.B. Hunt's rapid increase highlights its strategic focus on enhancing service capabilities. Notably, data for 2024 is incomplete, suggesting a need for cautious interpretation. This analysis offers a window into the financial strategies of two industry leaders, providing valuable insights for investors and analysts alike.

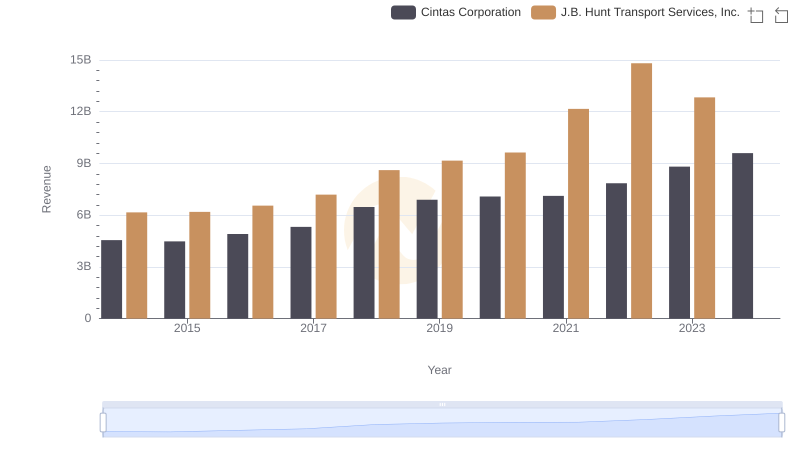

Cintas Corporation and J.B. Hunt Transport Services, Inc.: A Comprehensive Revenue Analysis

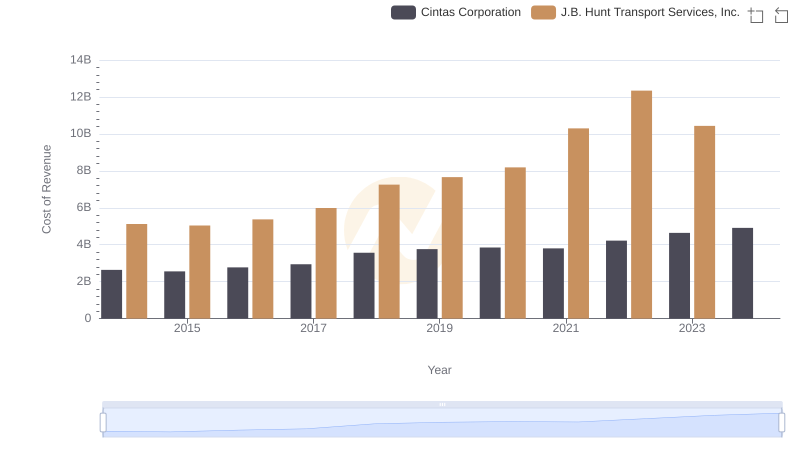

Cintas Corporation vs J.B. Hunt Transport Services, Inc.: Efficiency in Cost of Revenue Explored

Operational Costs Compared: SG&A Analysis of Cintas Corporation and Stanley Black & Decker, Inc.

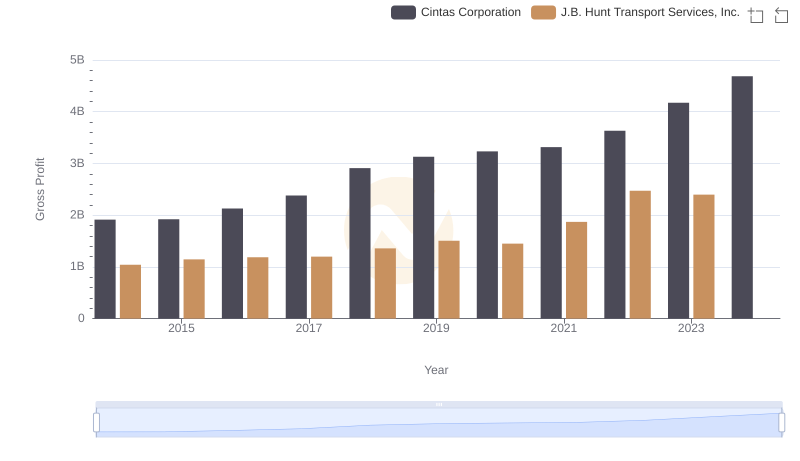

Cintas Corporation and J.B. Hunt Transport Services, Inc.: A Detailed Gross Profit Analysis

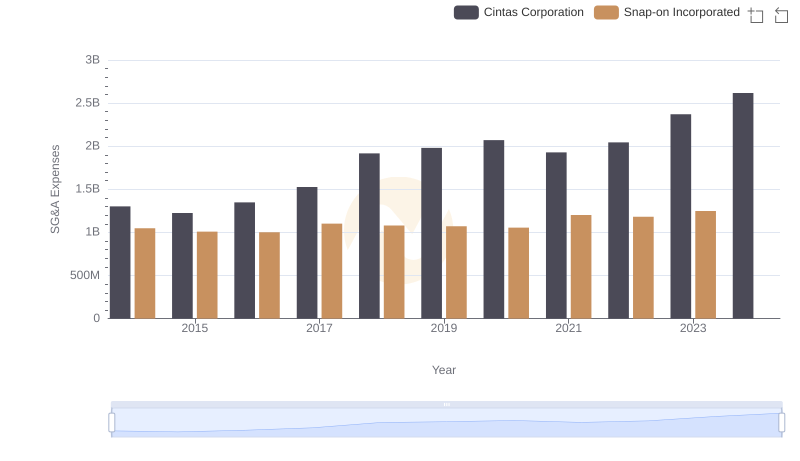

Selling, General, and Administrative Costs: Cintas Corporation vs Snap-on Incorporated

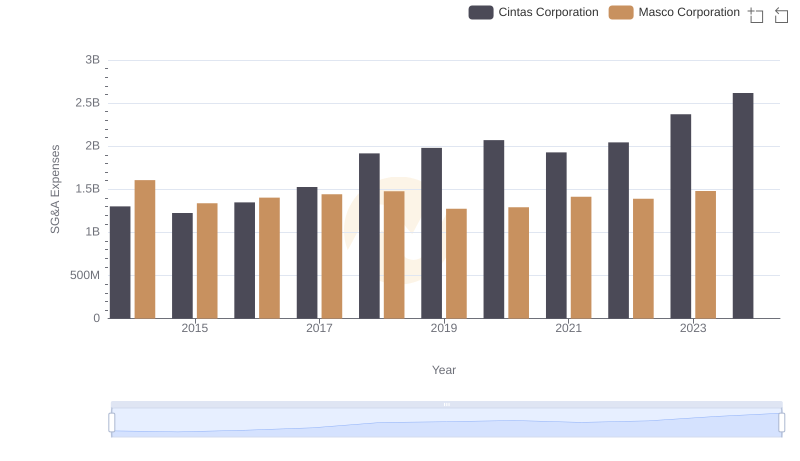

Cintas Corporation vs Masco Corporation: SG&A Expense Trends

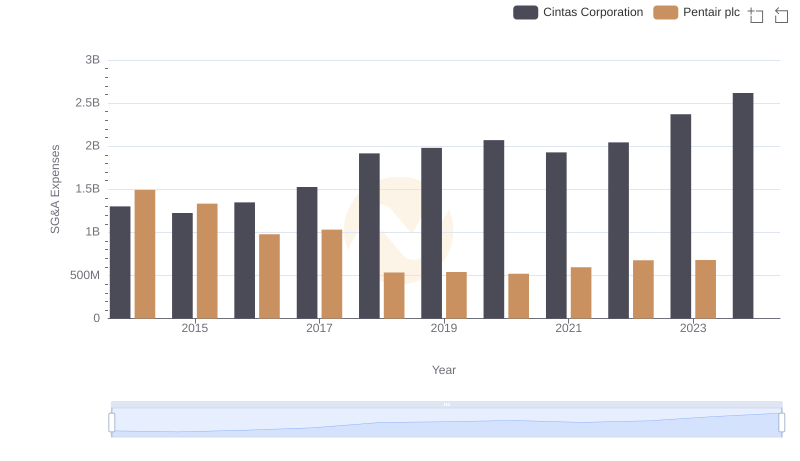

Breaking Down SG&A Expenses: Cintas Corporation vs Pentair plc

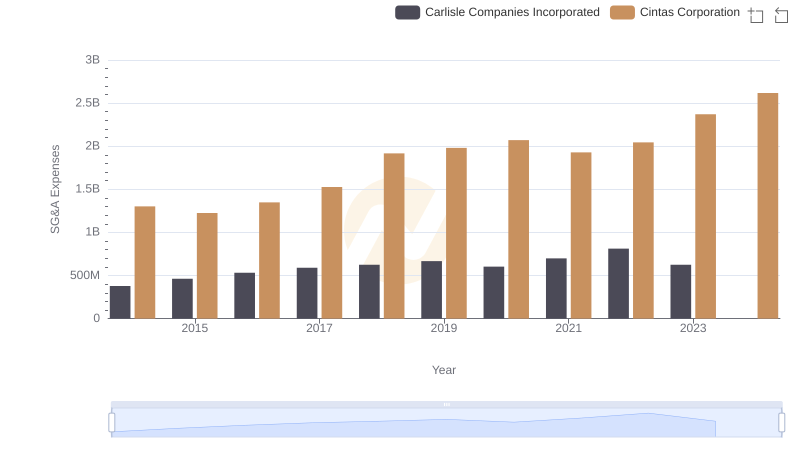

Who Optimizes SG&A Costs Better? Cintas Corporation or Carlisle Companies Incorporated

Comparative EBITDA Analysis: Cintas Corporation vs J.B. Hunt Transport Services, Inc.

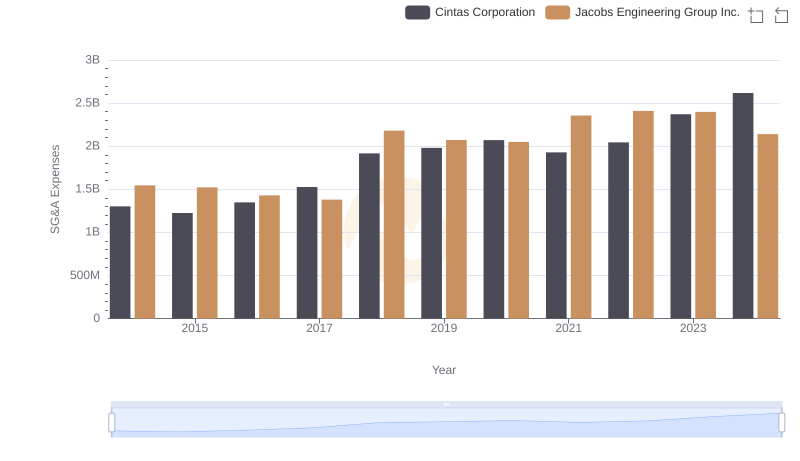

Cost Management Insights: SG&A Expenses for Cintas Corporation and Jacobs Engineering Group Inc.

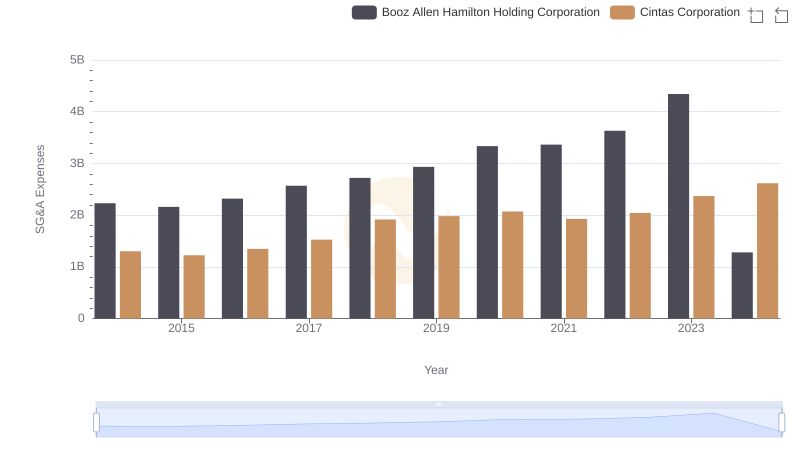

Cintas Corporation and Booz Allen Hamilton Holding Corporation: SG&A Spending Patterns Compared

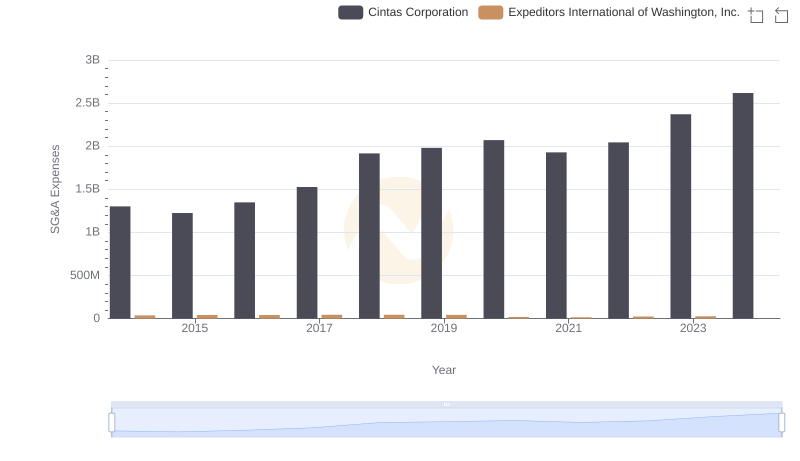

Operational Costs Compared: SG&A Analysis of Cintas Corporation and Expeditors International of Washington, Inc.