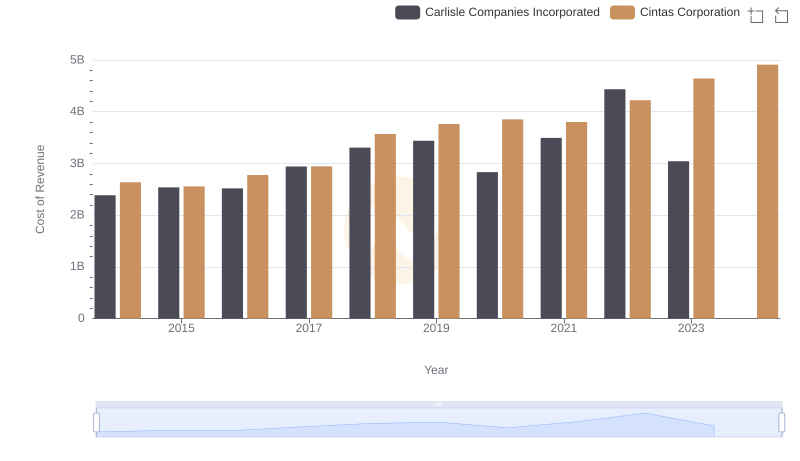

| __timestamp | Carlisle Companies Incorporated | Cintas Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 3204000000 | 4551812000 |

| Thursday, January 1, 2015 | 3543200000 | 4476886000 |

| Friday, January 1, 2016 | 3675400000 | 4905458000 |

| Sunday, January 1, 2017 | 4089900000 | 5323381000 |

| Monday, January 1, 2018 | 4479500000 | 6476632000 |

| Tuesday, January 1, 2019 | 4811600000 | 6892303000 |

| Wednesday, January 1, 2020 | 3969900000 | 7085120000 |

| Friday, January 1, 2021 | 4810300000 | 7116340000 |

| Saturday, January 1, 2022 | 6591900000 | 7854459000 |

| Sunday, January 1, 2023 | 4586900000 | 8815769000 |

| Monday, January 1, 2024 | 5003600000 | 9596615000 |

Infusing magic into the data realm

In the competitive landscape of industrial services, Cintas Corporation and Carlisle Companies Incorporated have been vying for dominance. Over the past decade, Cintas has consistently outpaced Carlisle in revenue growth. From 2014 to 2023, Cintas saw its revenue soar by approximately 94%, while Carlisle experienced a more modest increase of around 43%. Notably, Cintas achieved a remarkable 20% growth from 2022 to 2023, reaching nearly $8.8 billion. In contrast, Carlisle's revenue dipped by 30% in the same period, highlighting the volatility in its financial performance.

The data reveals a compelling narrative of resilience and strategic prowess by Cintas, as it navigates the challenges of the industrial sector. As we look to the future, the question remains: Can Carlisle close the gap, or will Cintas continue to lead the charge?

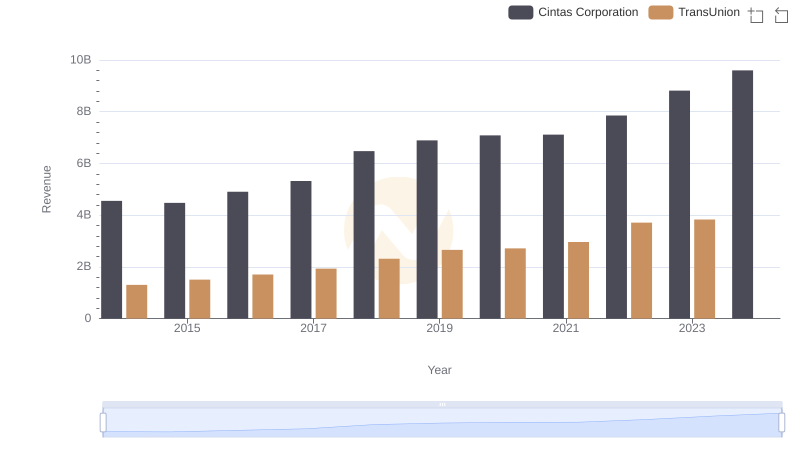

Cintas Corporation or TransUnion: Who Leads in Yearly Revenue?

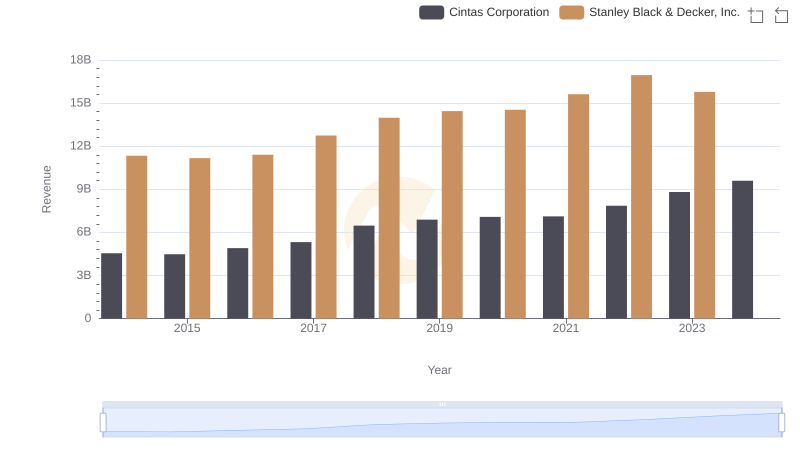

Cintas Corporation or Stanley Black & Decker, Inc.: Who Leads in Yearly Revenue?

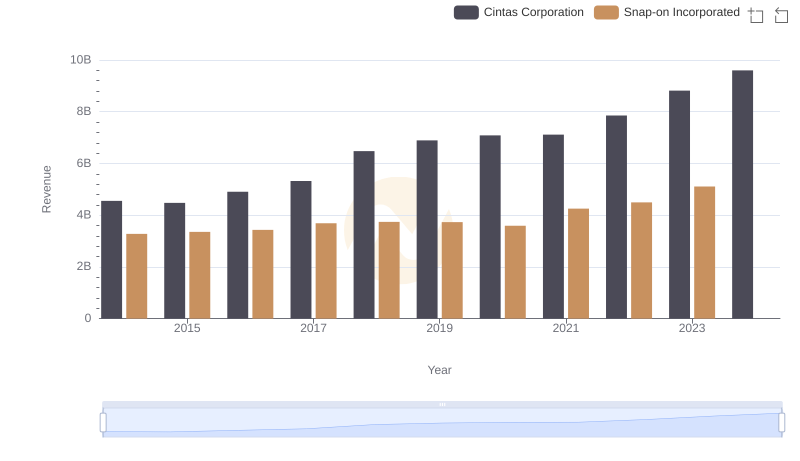

Comparing Revenue Performance: Cintas Corporation or Snap-on Incorporated?

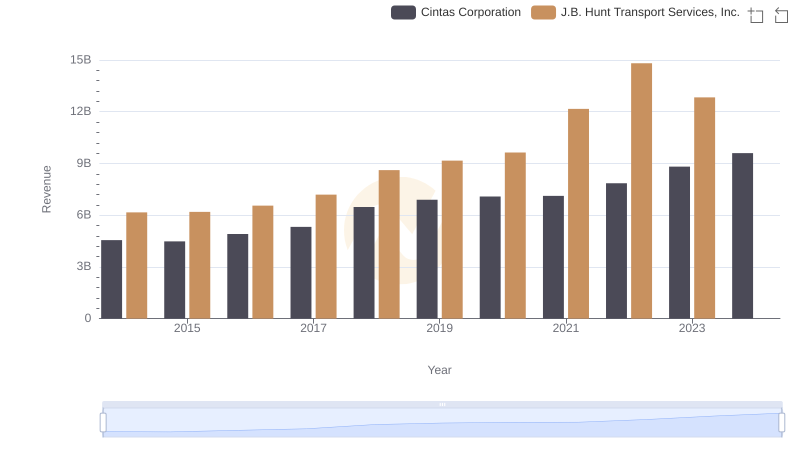

Cintas Corporation and J.B. Hunt Transport Services, Inc.: A Comprehensive Revenue Analysis

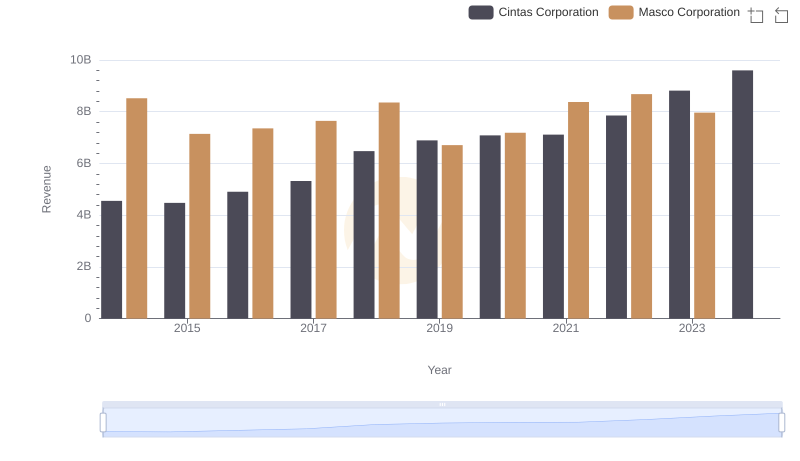

Who Generates More Revenue? Cintas Corporation or Masco Corporation

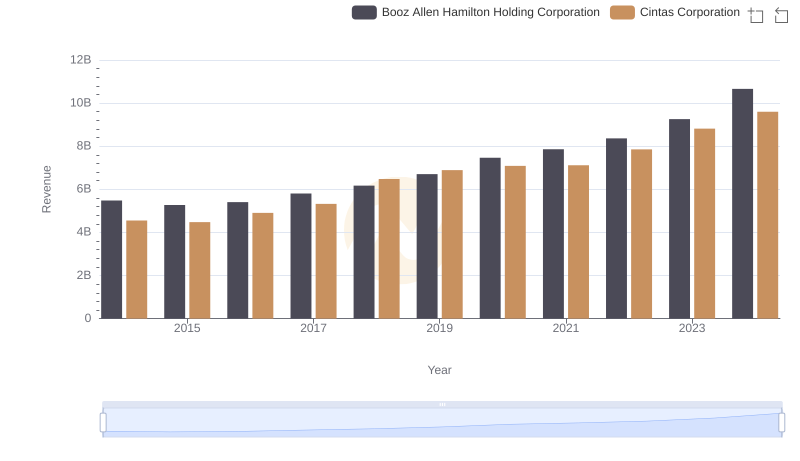

Cintas Corporation vs Booz Allen Hamilton Holding Corporation: Examining Key Revenue Metrics

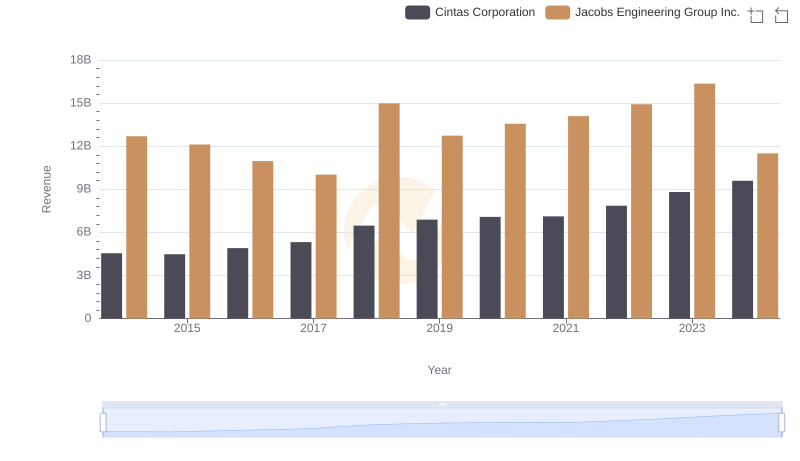

Comparing Revenue Performance: Cintas Corporation or Jacobs Engineering Group Inc.?

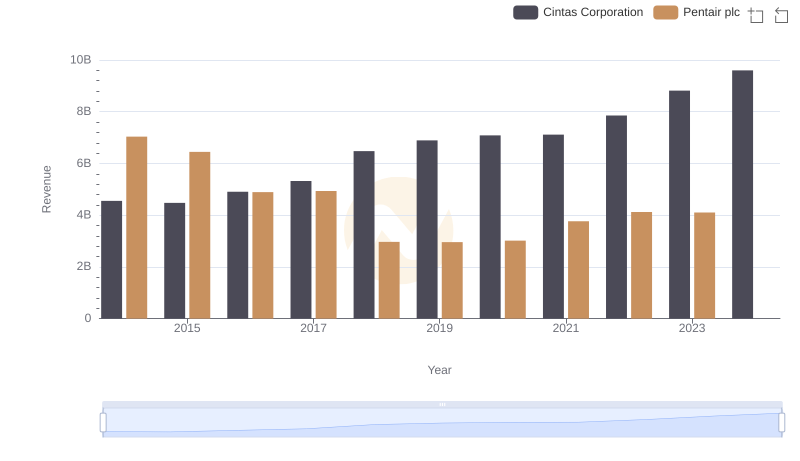

Annual Revenue Comparison: Cintas Corporation vs Pentair plc

Cost of Revenue: Key Insights for Cintas Corporation and Carlisle Companies Incorporated

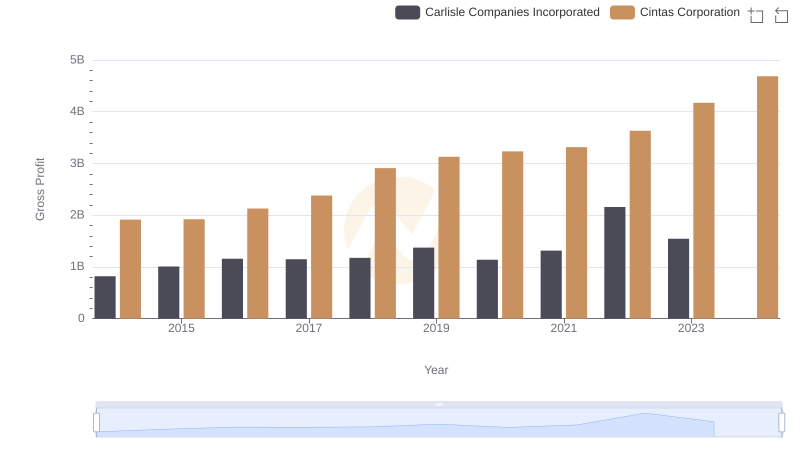

Gross Profit Comparison: Cintas Corporation and Carlisle Companies Incorporated Trends

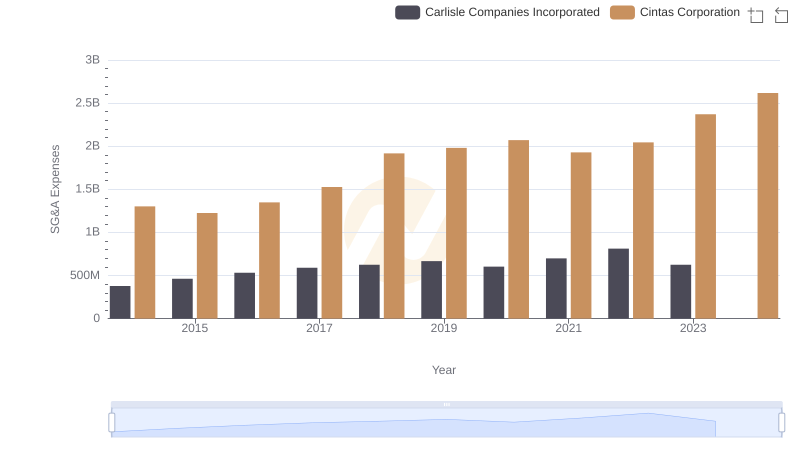

Who Optimizes SG&A Costs Better? Cintas Corporation or Carlisle Companies Incorporated

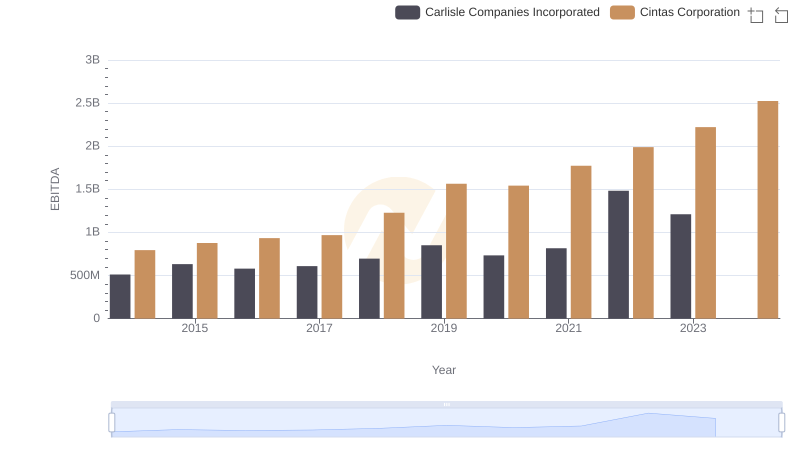

EBITDA Metrics Evaluated: Cintas Corporation vs Carlisle Companies Incorporated