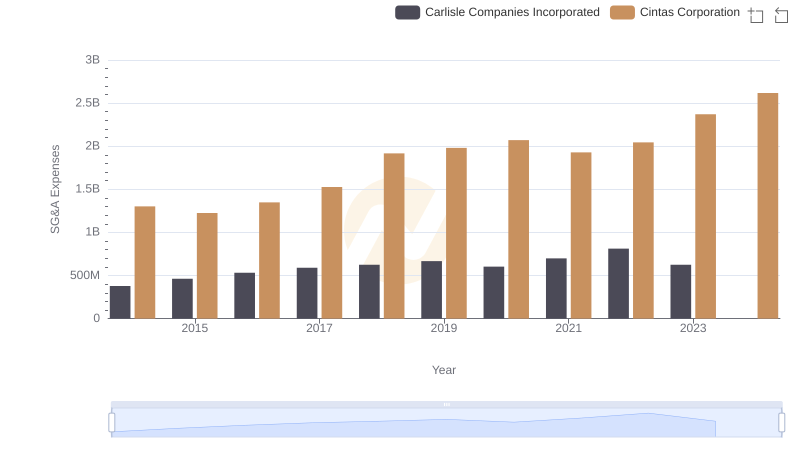

| __timestamp | Cintas Corporation | Jacobs Engineering Group Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1302752000 | 1545716000 |

| Thursday, January 1, 2015 | 1224930000 | 1522811000 |

| Friday, January 1, 2016 | 1348122000 | 1429233000 |

| Sunday, January 1, 2017 | 1527380000 | 1379983000 |

| Monday, January 1, 2018 | 1916792000 | 2180399000 |

| Tuesday, January 1, 2019 | 1980644000 | 2072177000 |

| Wednesday, January 1, 2020 | 2071052000 | 2050695000 |

| Friday, January 1, 2021 | 1929159000 | 2355683000 |

| Saturday, January 1, 2022 | 2044876000 | 2409190000 |

| Sunday, January 1, 2023 | 2370704000 | 2398078000 |

| Monday, January 1, 2024 | 2617783000 | 2140320000 |

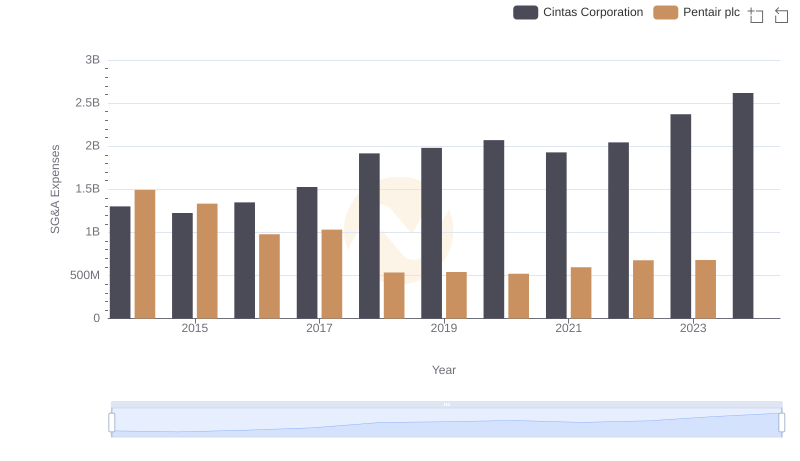

Unveiling the hidden dimensions of data

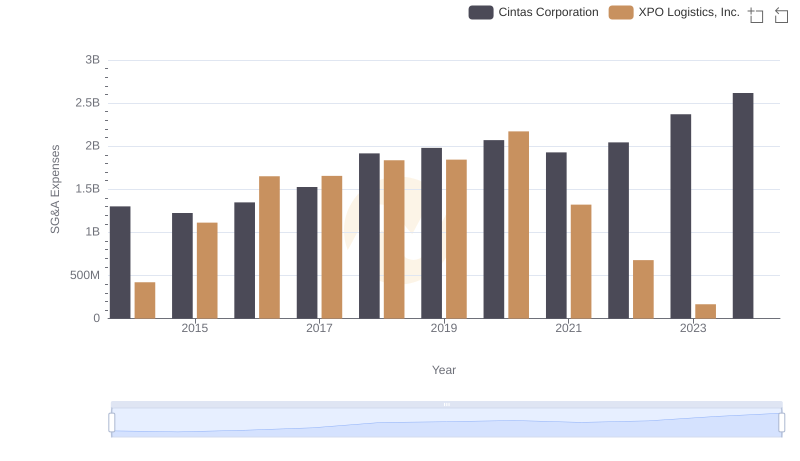

In the ever-evolving landscape of corporate finance, effective cost management is pivotal. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of two industry titans: Cintas Corporation and Jacobs Engineering Group Inc., from 2014 to 2024. Over this decade, Cintas Corporation's SG&A expenses surged by approximately 101%, reflecting strategic investments and expansion efforts. Meanwhile, Jacobs Engineering Group Inc. experienced a more modest increase of around 39%, indicating a steady approach to cost management.

These insights offer a window into the strategic priorities and operational efficiencies of these corporations, providing valuable lessons in financial stewardship.

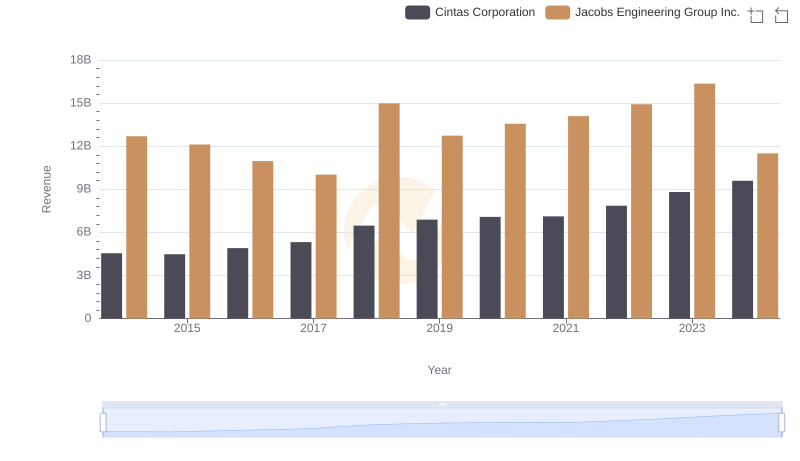

Comparing Revenue Performance: Cintas Corporation or Jacobs Engineering Group Inc.?

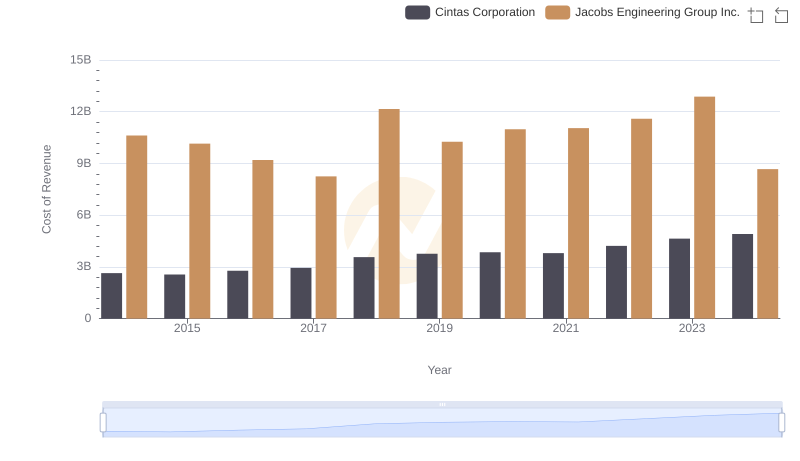

Cintas Corporation vs Jacobs Engineering Group Inc.: Efficiency in Cost of Revenue Explored

Breaking Down SG&A Expenses: Cintas Corporation vs Pentair plc

Who Optimizes SG&A Costs Better? Cintas Corporation or Carlisle Companies Incorporated

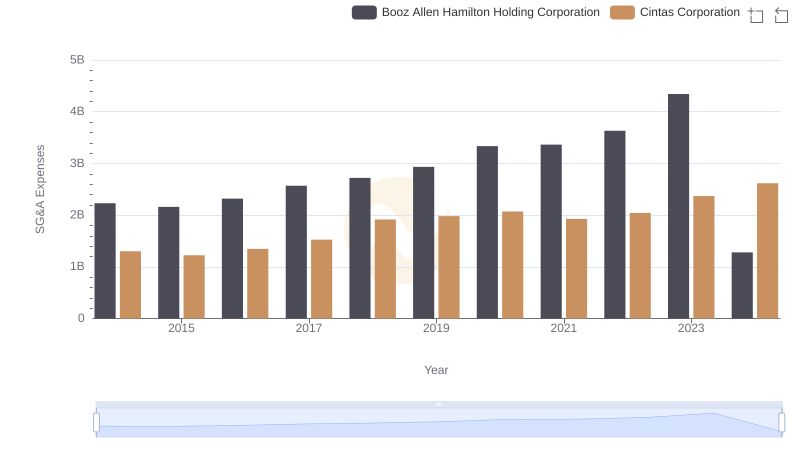

Cintas Corporation and Booz Allen Hamilton Holding Corporation: SG&A Spending Patterns Compared

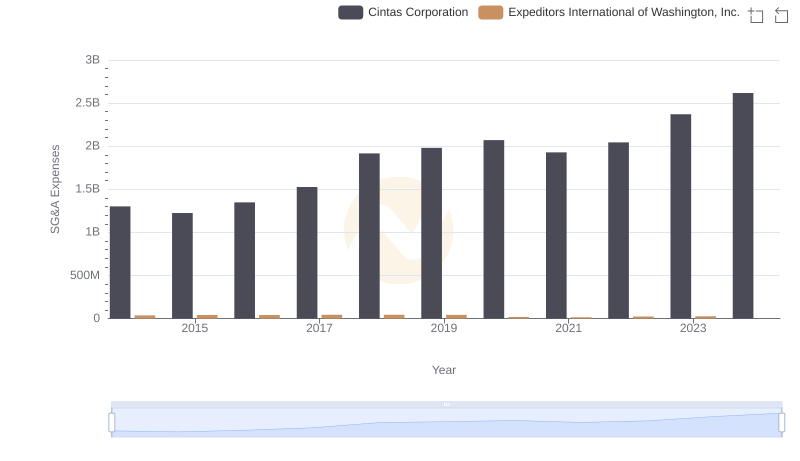

Operational Costs Compared: SG&A Analysis of Cintas Corporation and Expeditors International of Washington, Inc.

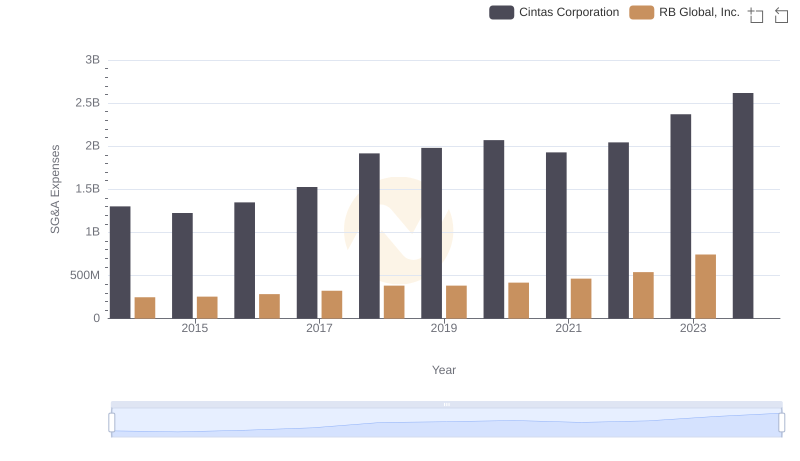

Cintas Corporation and RB Global, Inc.: SG&A Spending Patterns Compared

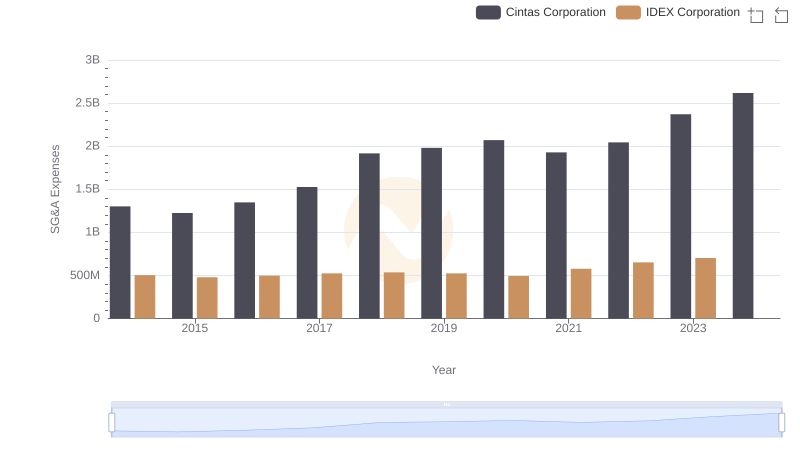

Operational Costs Compared: SG&A Analysis of Cintas Corporation and IDEX Corporation

SG&A Efficiency Analysis: Comparing Cintas Corporation and XPO Logistics, Inc.