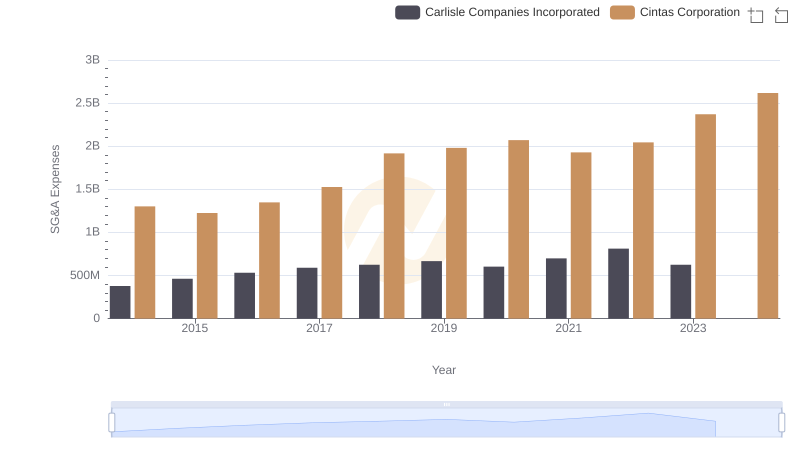

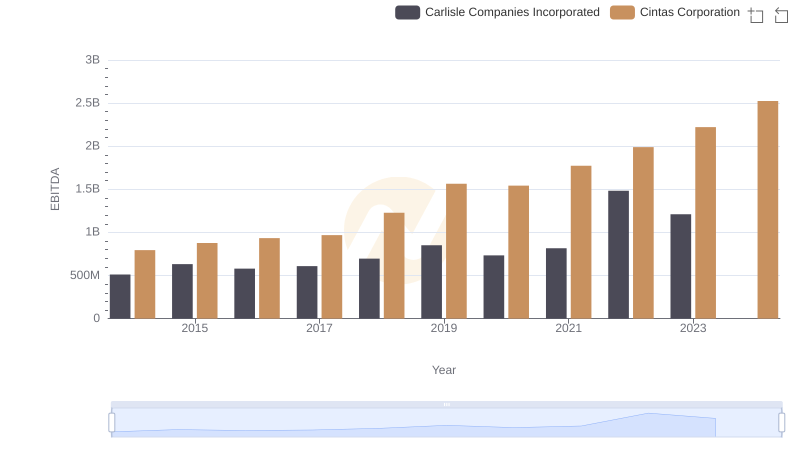

| __timestamp | Carlisle Companies Incorporated | Cintas Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 819500000 | 1914386000 |

| Thursday, January 1, 2015 | 1006700000 | 1921337000 |

| Friday, January 1, 2016 | 1157300000 | 2129870000 |

| Sunday, January 1, 2017 | 1148000000 | 2380295000 |

| Monday, January 1, 2018 | 1174700000 | 2908523000 |

| Tuesday, January 1, 2019 | 1371700000 | 3128588000 |

| Wednesday, January 1, 2020 | 1137400000 | 3233748000 |

| Friday, January 1, 2021 | 1314700000 | 3314651000 |

| Saturday, January 1, 2022 | 2157400000 | 3632246000 |

| Sunday, January 1, 2023 | 1544000000 | 4173368000 |

| Monday, January 1, 2024 | 1887700000 | 4686416000 |

Igniting the spark of knowledge

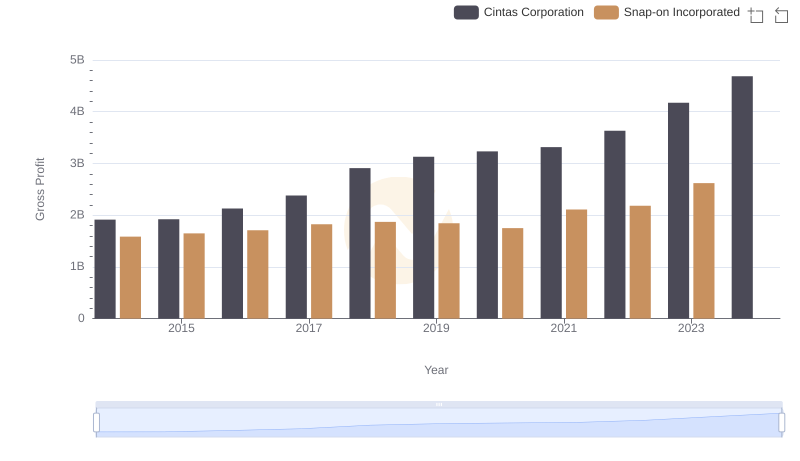

In the competitive landscape of industrial services, Cintas Corporation and Carlisle Companies Incorporated have been pivotal players. Over the past decade, Cintas has consistently outperformed Carlisle in terms of gross profit, showcasing a robust growth trajectory. From 2014 to 2023, Cintas's gross profit surged by approximately 118%, peaking at an impressive $4.17 billion in 2023. In contrast, Carlisle's growth was more modest, with a 88% increase, reaching $1.54 billion in the same year.

The data reveals a compelling narrative of strategic growth and market adaptation. Cintas's ability to nearly double its gross profit highlights its strategic prowess in expanding its market share and optimizing operations. Meanwhile, Carlisle's steady growth underscores its resilience and adaptability in a dynamic market. As we look to the future, these trends offer valuable insights into the evolving industrial landscape.

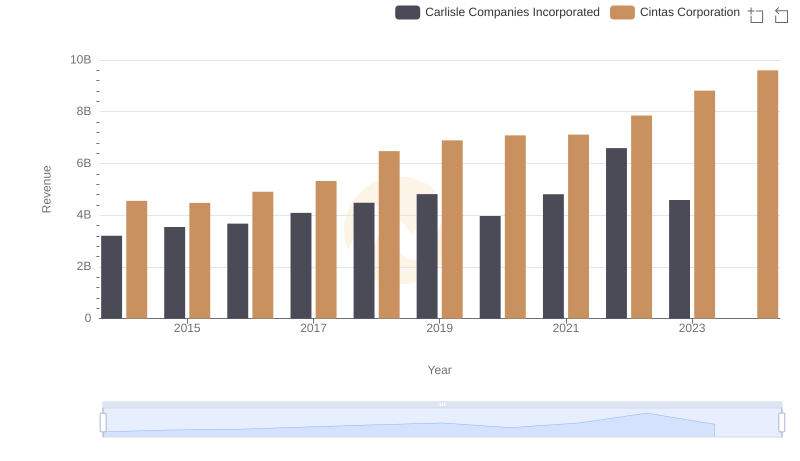

Cintas Corporation vs Carlisle Companies Incorporated: Annual Revenue Growth Compared

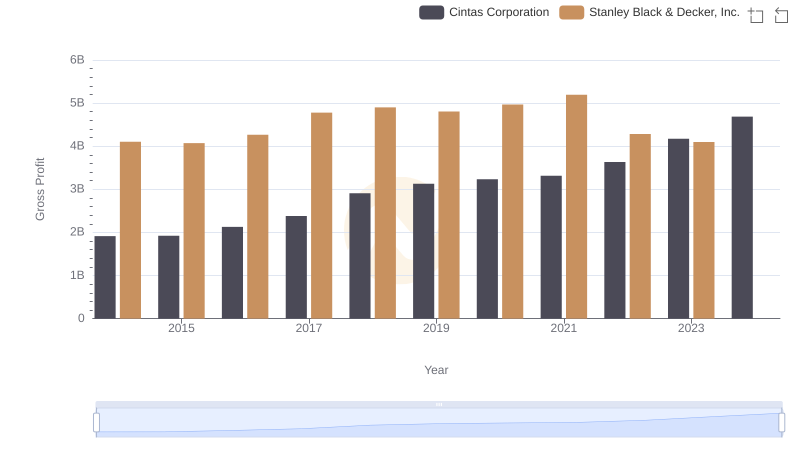

Key Insights on Gross Profit: Cintas Corporation vs Stanley Black & Decker, Inc.

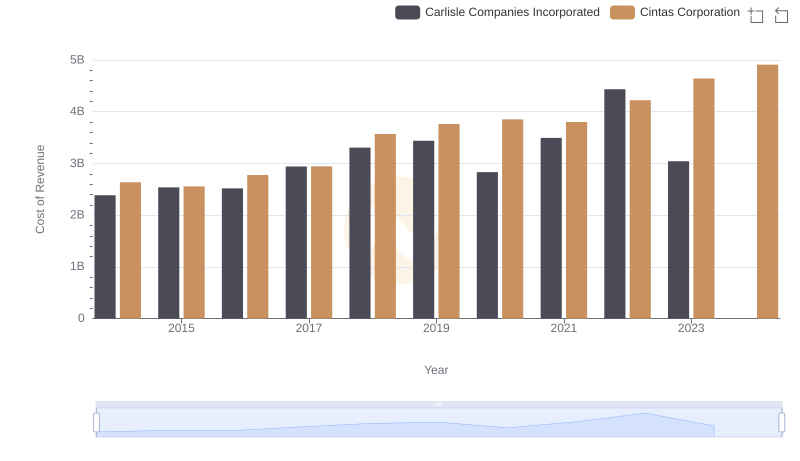

Cost of Revenue: Key Insights for Cintas Corporation and Carlisle Companies Incorporated

Gross Profit Trends Compared: Cintas Corporation vs Snap-on Incorporated

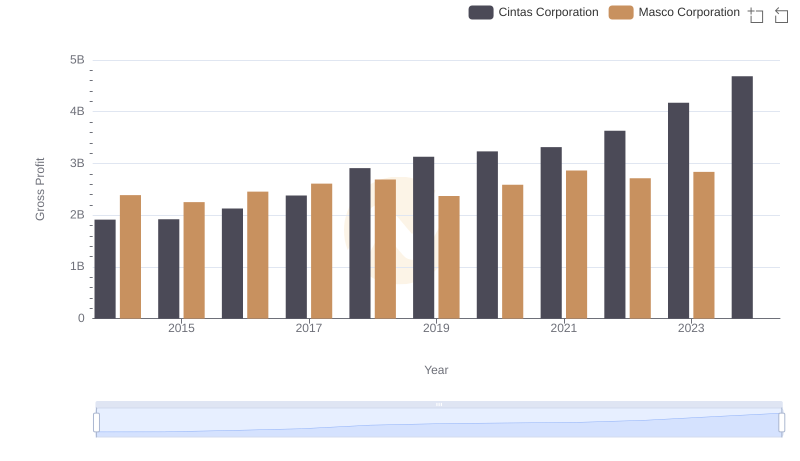

Gross Profit Analysis: Comparing Cintas Corporation and Masco Corporation

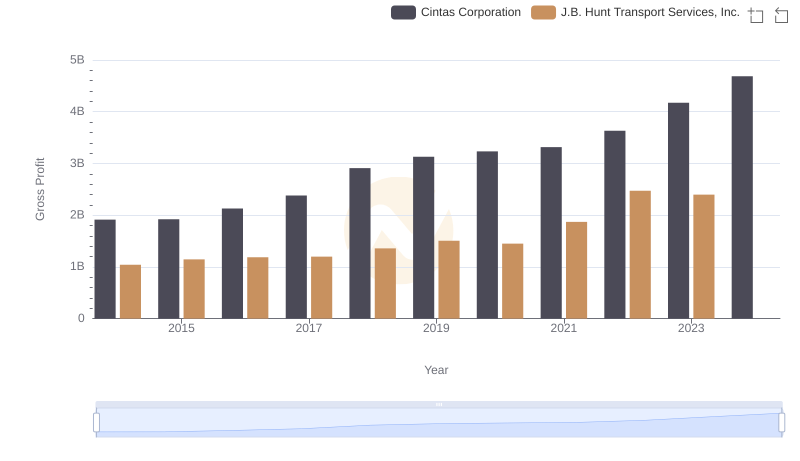

Cintas Corporation and J.B. Hunt Transport Services, Inc.: A Detailed Gross Profit Analysis

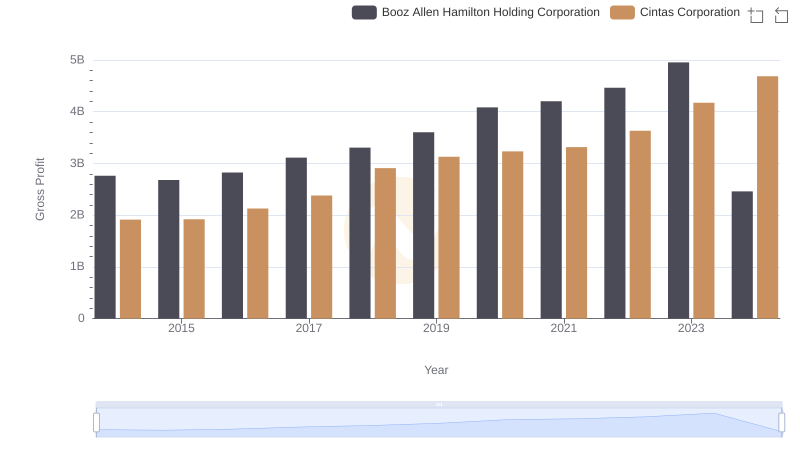

Cintas Corporation and Booz Allen Hamilton Holding Corporation: A Detailed Gross Profit Analysis

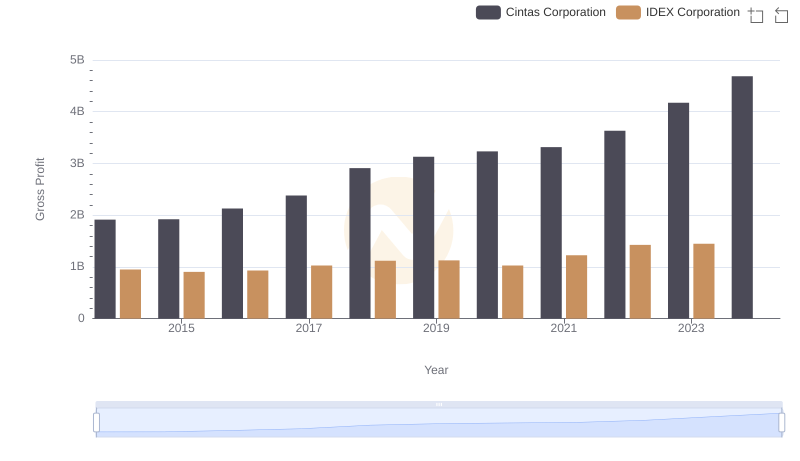

Gross Profit Trends Compared: Cintas Corporation vs IDEX Corporation

Who Optimizes SG&A Costs Better? Cintas Corporation or Carlisle Companies Incorporated

EBITDA Metrics Evaluated: Cintas Corporation vs Carlisle Companies Incorporated