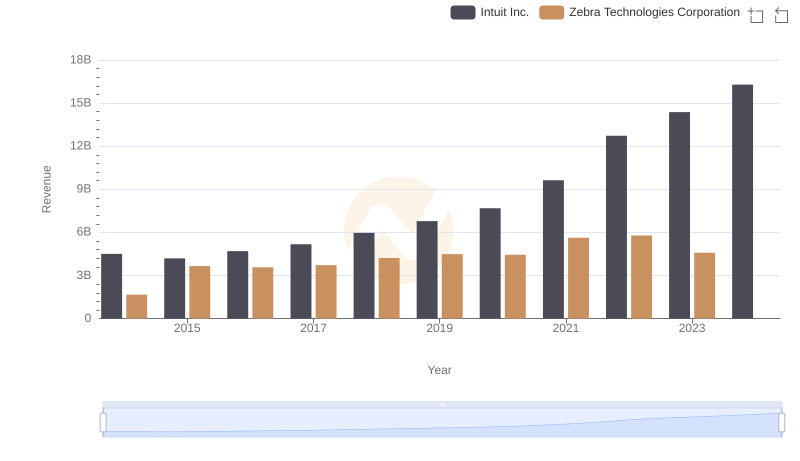

| __timestamp | Intuit Inc. | Zebra Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 668000000 | 892547000 |

| Thursday, January 1, 2015 | 725000000 | 2007739000 |

| Friday, January 1, 2016 | 752000000 | 1932000000 |

| Sunday, January 1, 2017 | 809000000 | 2012000000 |

| Monday, January 1, 2018 | 977000000 | 2237000000 |

| Tuesday, January 1, 2019 | 1167000000 | 2385000000 |

| Wednesday, January 1, 2020 | 1378000000 | 2445000000 |

| Friday, January 1, 2021 | 1683000000 | 2999000000 |

| Saturday, January 1, 2022 | 2406000000 | 3157000000 |

| Sunday, January 1, 2023 | 3143000000 | 2461000000 |

| Monday, January 1, 2024 | 3465000000 | 2568000000 |

Infusing magic into the data realm

In the ever-evolving landscape of technology, understanding cost structures is crucial. From 2014 to 2023, Intuit Inc. and Zebra Technologies Corporation have shown distinct trajectories in their cost of revenue. Intuit Inc. has seen a remarkable increase, with costs rising by over 400% from 2014 to 2023. This growth reflects Intuit's expanding operations and market reach. In contrast, Zebra Technologies experienced a more stable trend, peaking in 2022 with a 254% increase from 2014, before a slight dip in 2023. This stability suggests a mature cost management strategy. Notably, data for Zebra Technologies in 2024 is missing, indicating potential reporting delays or strategic shifts. These insights highlight the dynamic nature of cost management in tech companies, offering a window into their operational strategies and market positioning.

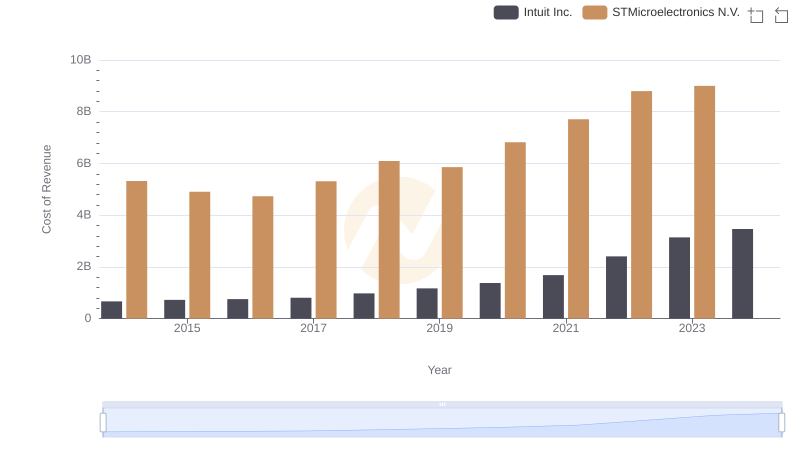

Cost Insights: Breaking Down Intuit Inc. and STMicroelectronics N.V.'s Expenses

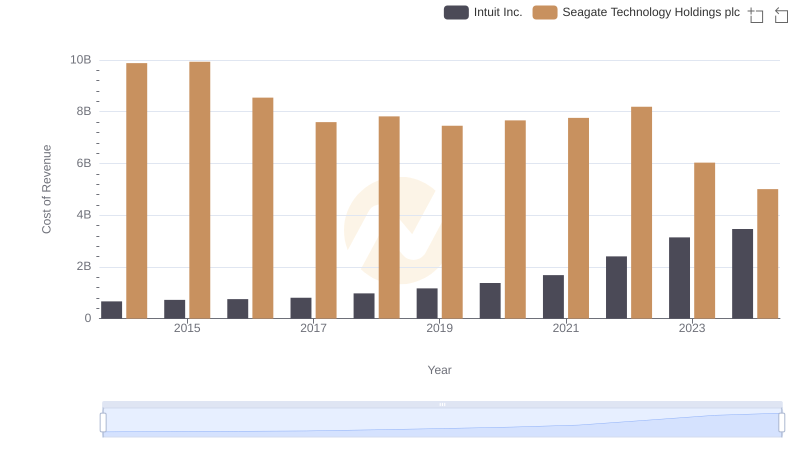

Cost Insights: Breaking Down Intuit Inc. and Seagate Technology Holdings plc's Expenses

Intuit Inc. vs Zebra Technologies Corporation: Examining Key Revenue Metrics

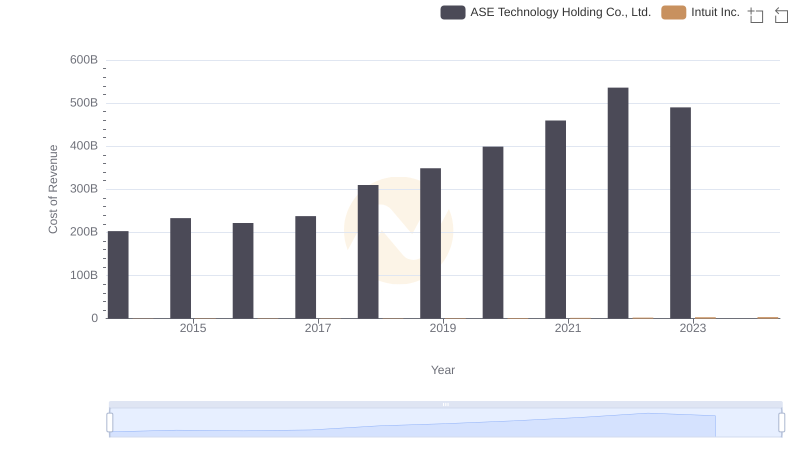

Cost of Revenue Comparison: Intuit Inc. vs ASE Technology Holding Co., Ltd.

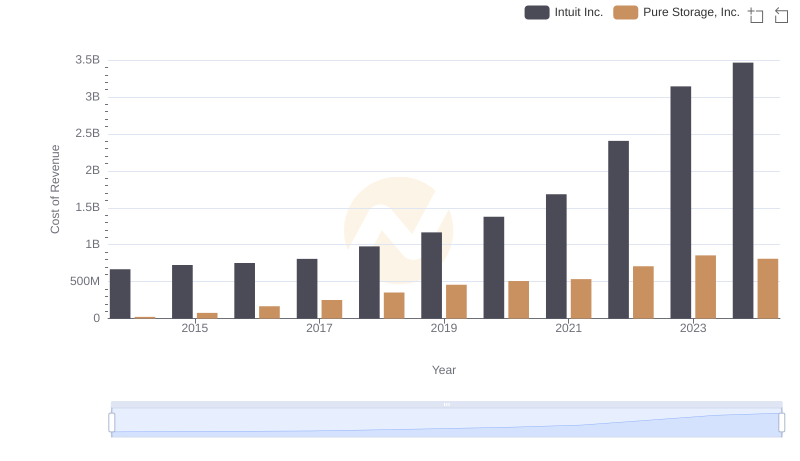

Analyzing Cost of Revenue: Intuit Inc. and Pure Storage, Inc.

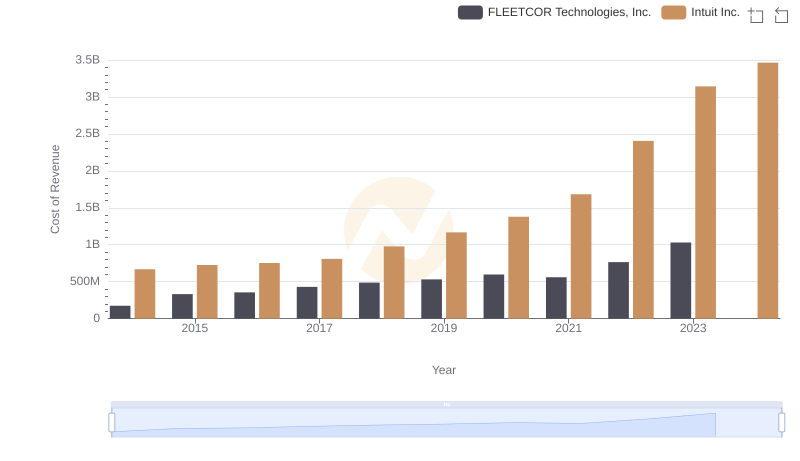

Comparing Cost of Revenue Efficiency: Intuit Inc. vs FLEETCOR Technologies, Inc.

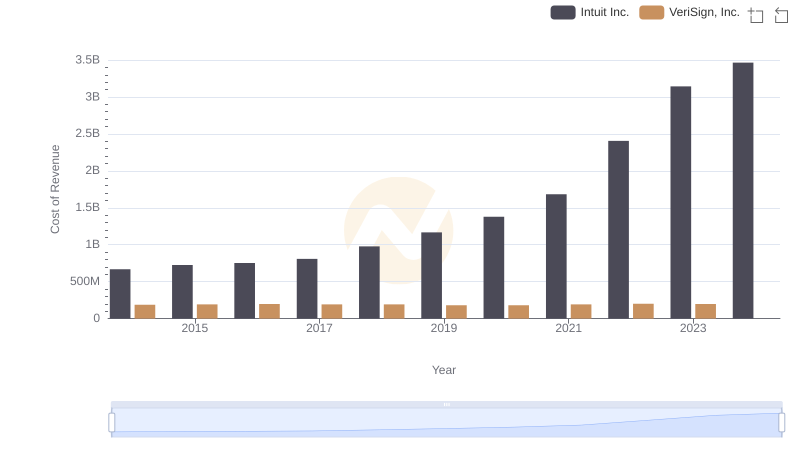

Comparing Cost of Revenue Efficiency: Intuit Inc. vs VeriSign, Inc.

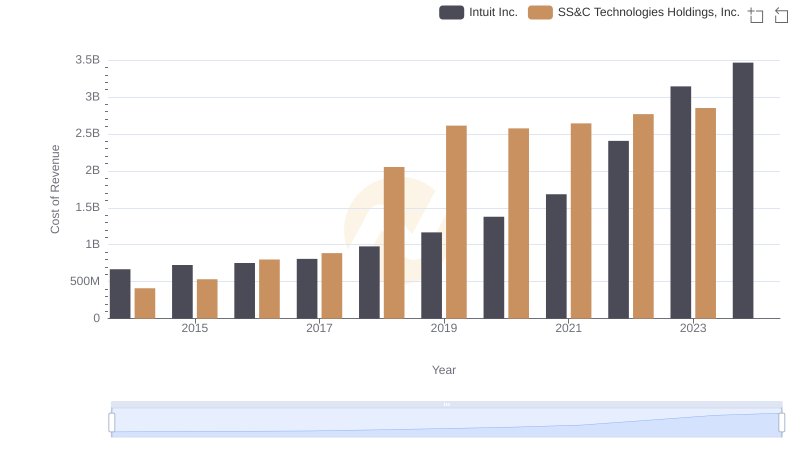

Cost of Revenue Trends: Intuit Inc. vs SS&C Technologies Holdings, Inc.

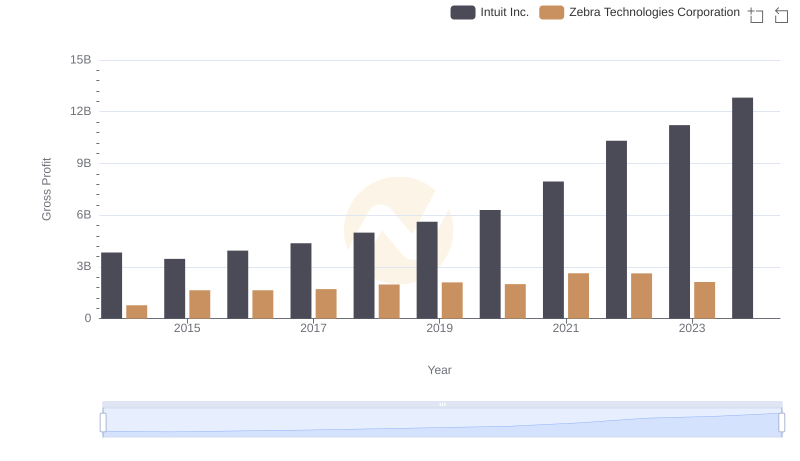

Who Generates Higher Gross Profit? Intuit Inc. or Zebra Technologies Corporation

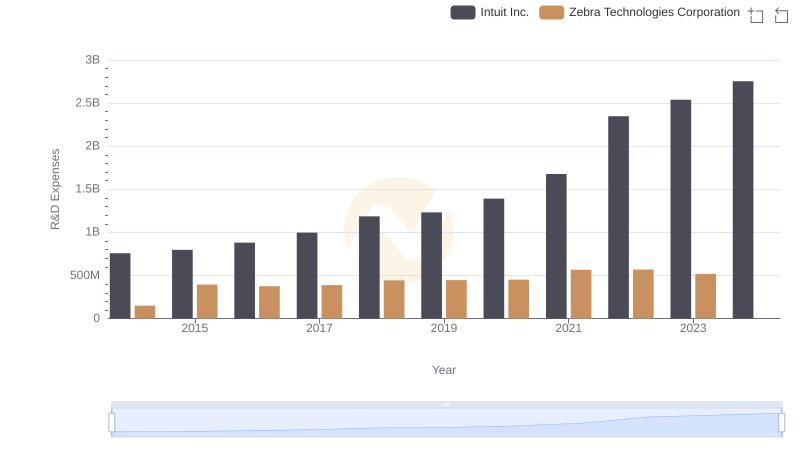

Intuit Inc. vs Zebra Technologies Corporation: Strategic Focus on R&D Spending

Operational Costs Compared: SG&A Analysis of Intuit Inc. and Zebra Technologies Corporation

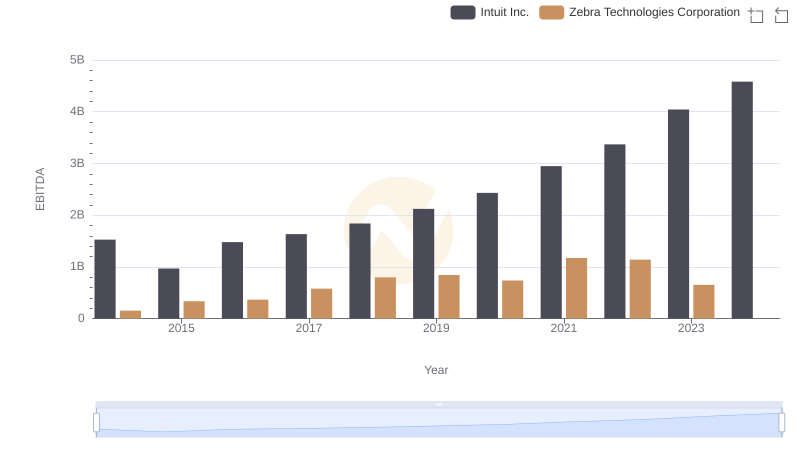

EBITDA Analysis: Evaluating Intuit Inc. Against Zebra Technologies Corporation