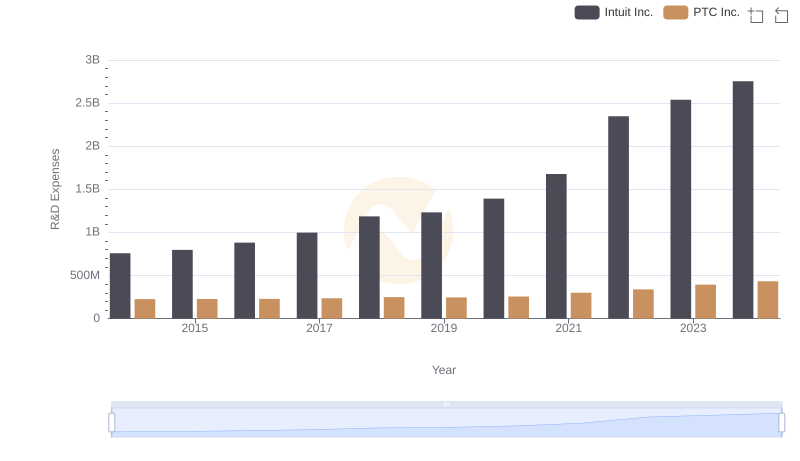

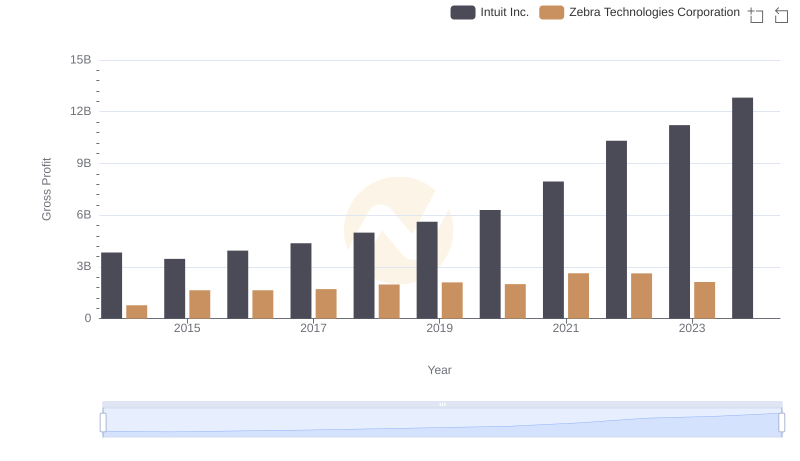

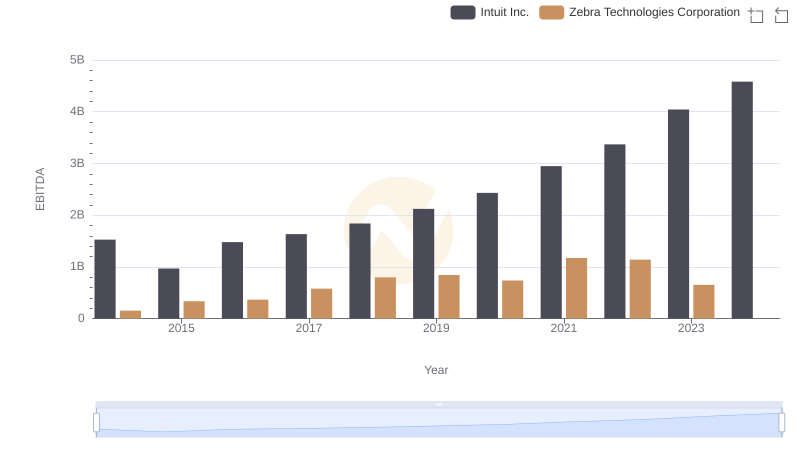

| __timestamp | Intuit Inc. | Zebra Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 758000000 | 151103000 |

| Thursday, January 1, 2015 | 798000000 | 394111000 |

| Friday, January 1, 2016 | 881000000 | 376000000 |

| Sunday, January 1, 2017 | 998000000 | 389000000 |

| Monday, January 1, 2018 | 1186000000 | 444000000 |

| Tuesday, January 1, 2019 | 1233000000 | 447000000 |

| Wednesday, January 1, 2020 | 1392000000 | 453000000 |

| Friday, January 1, 2021 | 1678000000 | 567000000 |

| Saturday, January 1, 2022 | 2347000000 | 570000000 |

| Sunday, January 1, 2023 | 2539000000 | 519000000 |

| Monday, January 1, 2024 | 2754000000 | 563000000 |

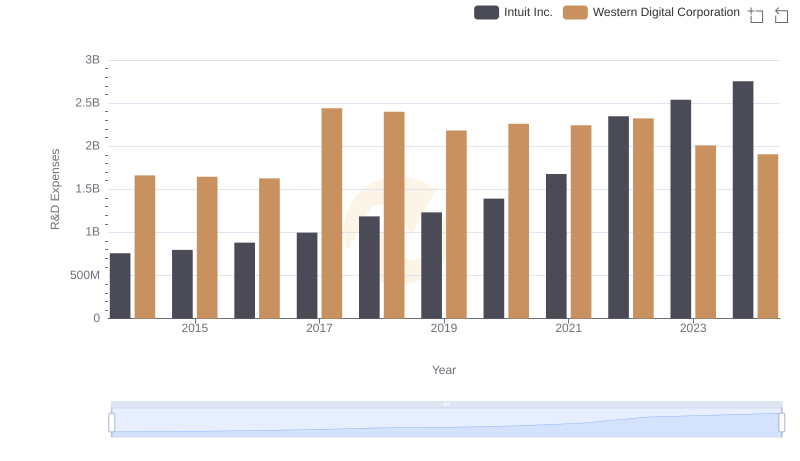

Unleashing insights

In the ever-evolving tech landscape, strategic investment in research and development (R&D) is crucial for maintaining a competitive edge. Over the past decade, Intuit Inc. has significantly ramped up its R&D spending, showcasing a remarkable growth of over 260% from 2014 to 2023. This strategic focus has positioned Intuit as a leader in innovation, with its R&D expenses peaking at approximately $2.75 billion in 2024.

Conversely, Zebra Technologies Corporation has maintained a steady yet modest increase in its R&D investments, with a 243% rise from 2014 to 2022. However, data for 2024 is currently unavailable, indicating potential shifts in strategy or reporting.

This comparative analysis highlights the divergent paths these companies have taken in their quest for innovation, with Intuit's aggressive R&D strategy potentially setting new industry benchmarks.

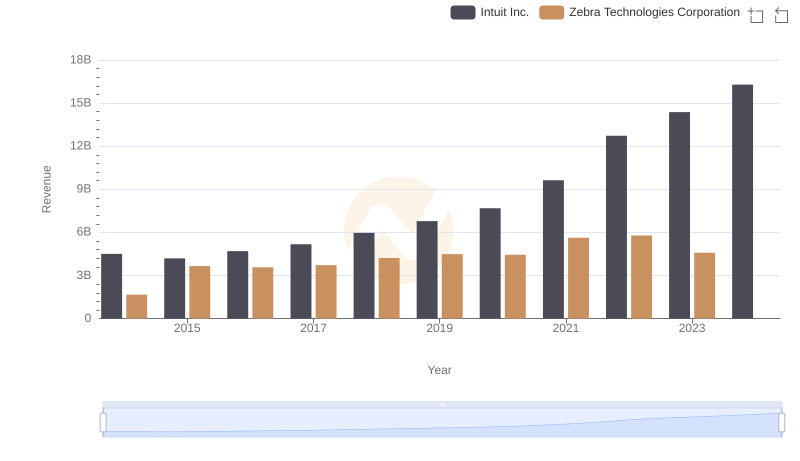

Intuit Inc. vs Zebra Technologies Corporation: Examining Key Revenue Metrics

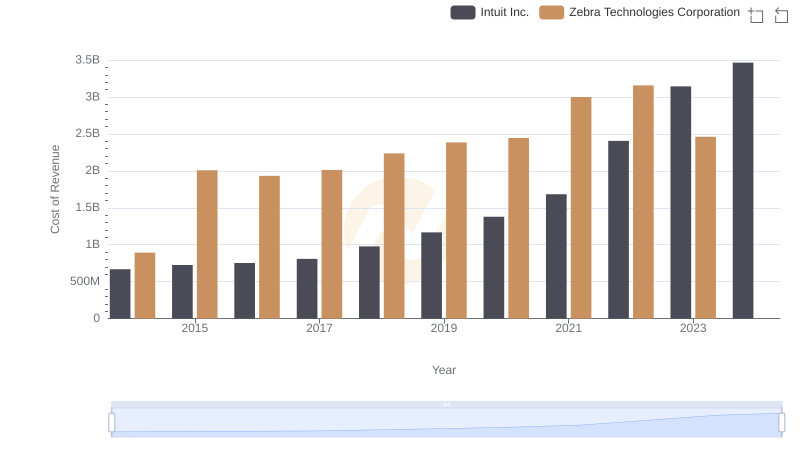

Cost of Revenue: Key Insights for Intuit Inc. and Zebra Technologies Corporation

Who Prioritizes Innovation? R&D Spending Compared for Intuit Inc. and Western Digital Corporation

Who Prioritizes Innovation? R&D Spending Compared for Intuit Inc. and PTC Inc.

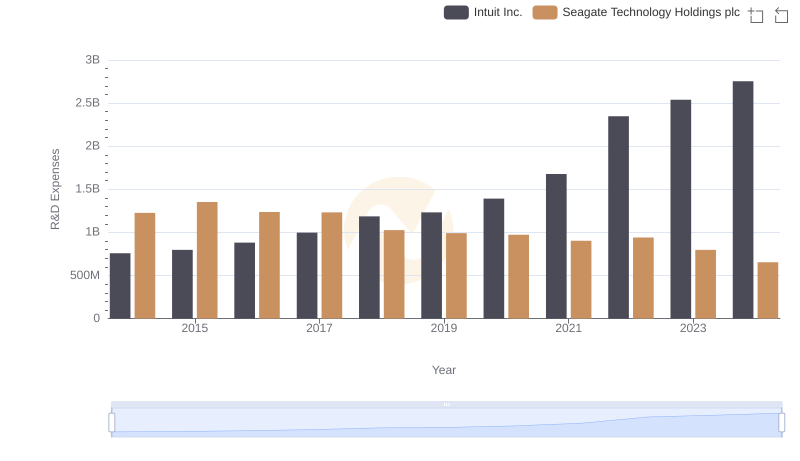

Research and Development Investment: Intuit Inc. vs Seagate Technology Holdings plc

Who Generates Higher Gross Profit? Intuit Inc. or Zebra Technologies Corporation

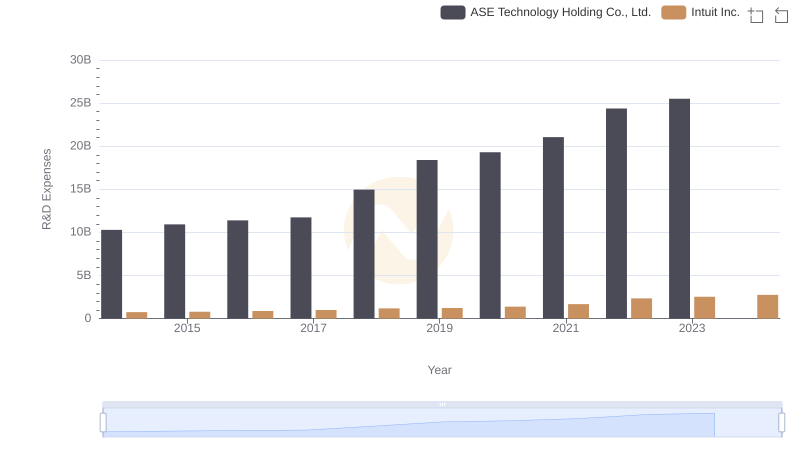

Intuit Inc. or ASE Technology Holding Co., Ltd.: Who Invests More in Innovation?

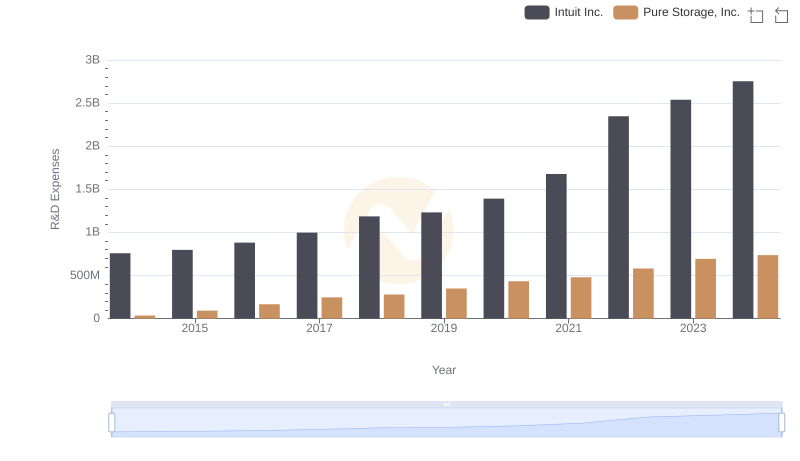

R&D Spending Showdown: Intuit Inc. vs Pure Storage, Inc.

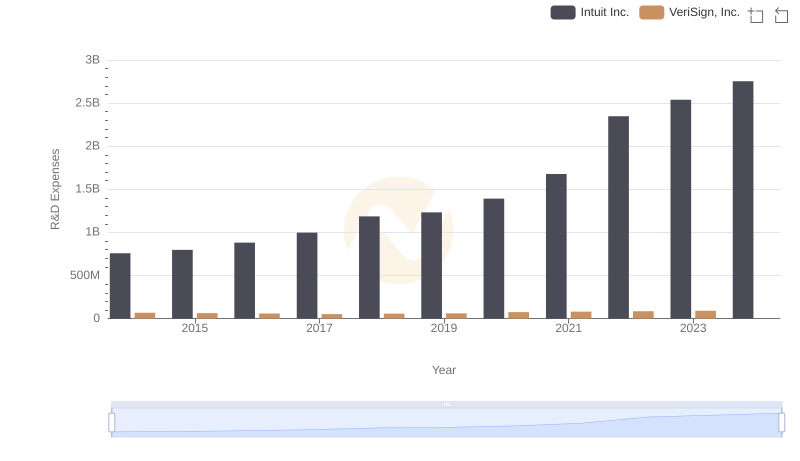

R&D Spending Showdown: Intuit Inc. vs VeriSign, Inc.

Operational Costs Compared: SG&A Analysis of Intuit Inc. and Zebra Technologies Corporation

EBITDA Analysis: Evaluating Intuit Inc. Against Zebra Technologies Corporation