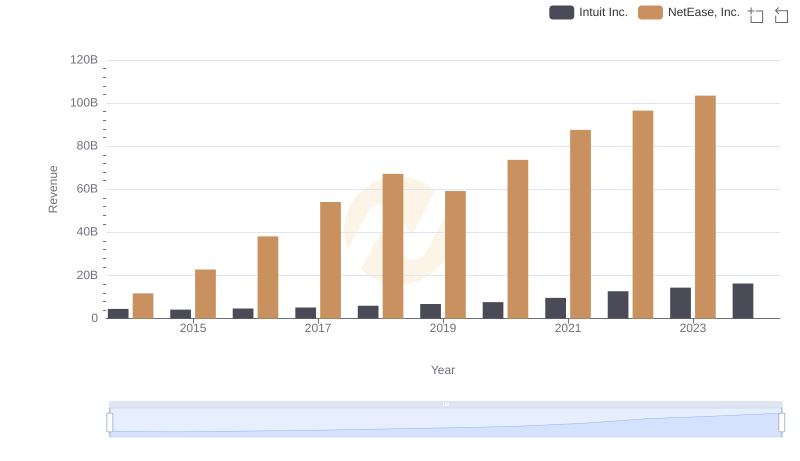

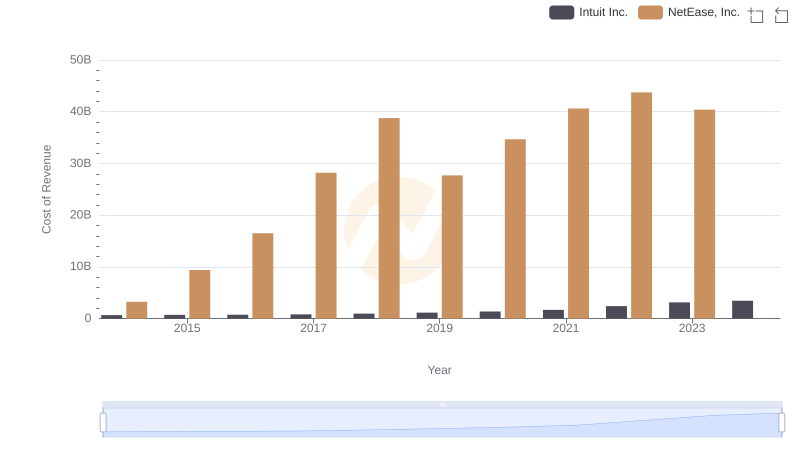

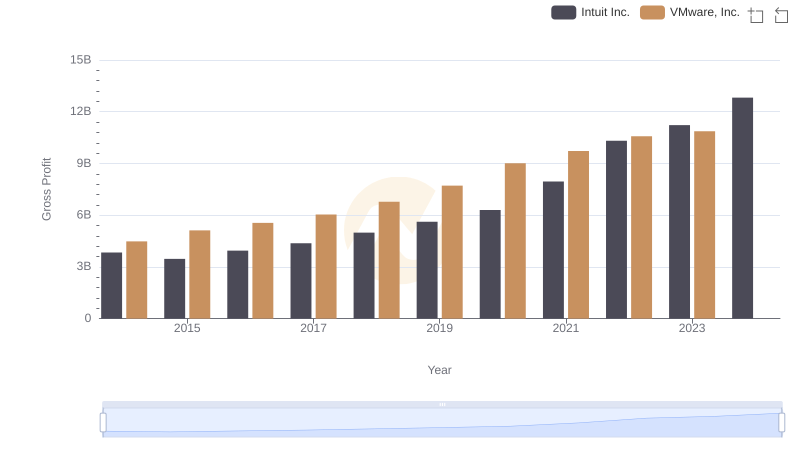

| __timestamp | Intuit Inc. | NetEase, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 3838000000 | 8451290000 |

| Thursday, January 1, 2015 | 3467000000 | 13403635000 |

| Friday, January 1, 2016 | 3942000000 | 21663812000 |

| Sunday, January 1, 2017 | 4368000000 | 25912693000 |

| Monday, January 1, 2018 | 4987000000 | 28403496000 |

| Tuesday, January 1, 2019 | 5617000000 | 31555300000 |

| Wednesday, January 1, 2020 | 6301000000 | 38983402000 |

| Friday, January 1, 2021 | 7950000000 | 46970801000 |

| Saturday, January 1, 2022 | 10320000000 | 52766126000 |

| Sunday, January 1, 2023 | 11225000000 | 63063394000 |

| Monday, January 1, 2024 | 12820000000 |

Cracking the code

In the ever-evolving landscape of global business, understanding which companies lead in profitability is crucial. From 2014 to 2023, NetEase, Inc. consistently outperformed Intuit Inc. in terms of gross profit. NetEase's gross profit surged by approximately 646% over this period, peaking in 2023. In contrast, Intuit Inc. saw a more modest growth of around 234%, reaching its highest in 2024.

NetEase's dominance is evident, with its gross profit in 2023 being nearly six times that of Intuit's. However, Intuit's steady growth trajectory cannot be overlooked, as it reflects a robust business model. The data for 2024 is incomplete for NetEase, leaving room for speculation on whether this trend will continue. This comparison highlights the dynamic nature of the tech industry and the varying strategies companies employ to achieve financial success.

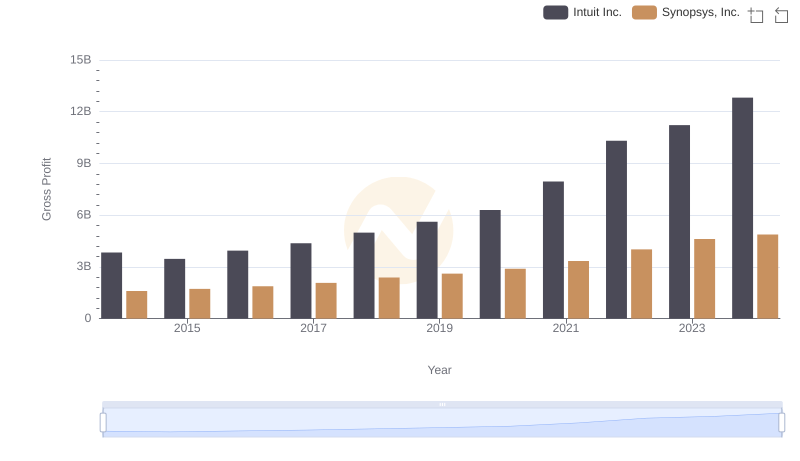

Intuit Inc. and Synopsys, Inc.: A Detailed Gross Profit Analysis

Breaking Down Revenue Trends: Intuit Inc. vs NetEase, Inc.

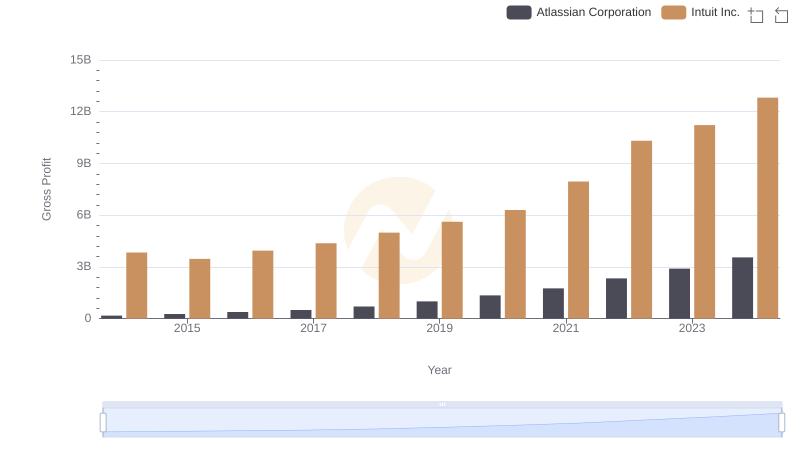

Gross Profit Analysis: Comparing Intuit Inc. and Atlassian Corporation

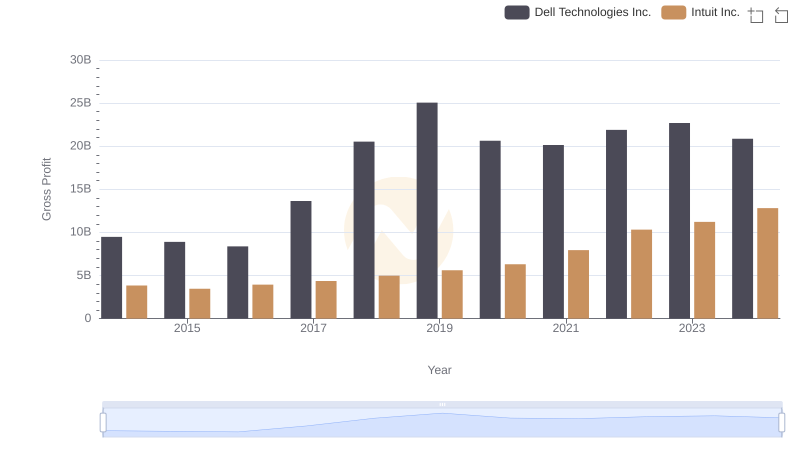

Intuit Inc. and Dell Technologies Inc.: A Detailed Gross Profit Analysis

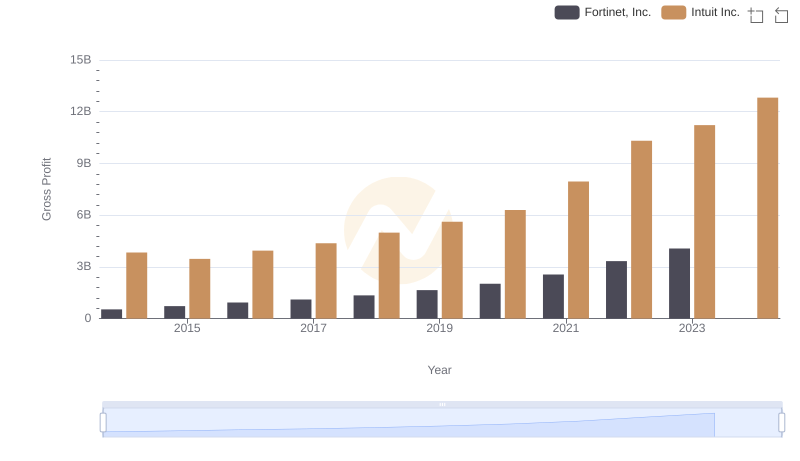

Intuit Inc. vs Fortinet, Inc.: A Gross Profit Performance Breakdown

Cost of Revenue: Key Insights for Intuit Inc. and NetEase, Inc.

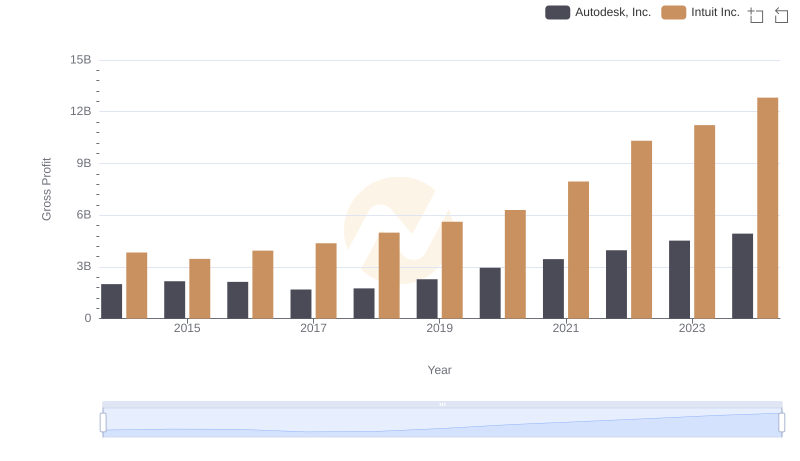

Key Insights on Gross Profit: Intuit Inc. vs Autodesk, Inc.

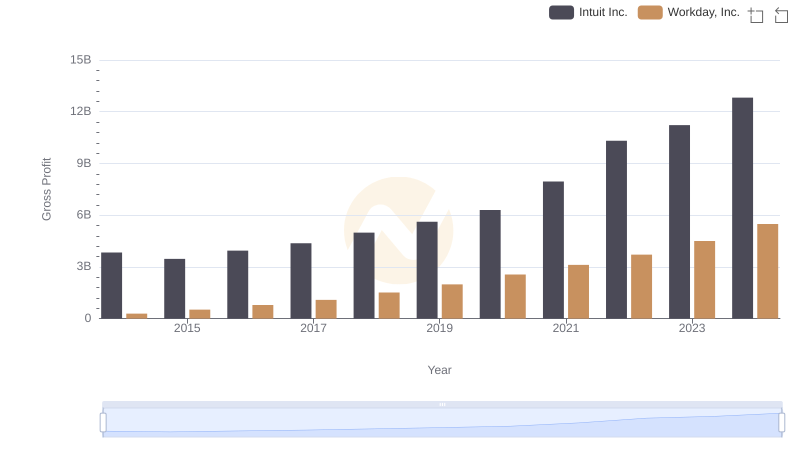

Gross Profit Comparison: Intuit Inc. and Workday, Inc. Trends

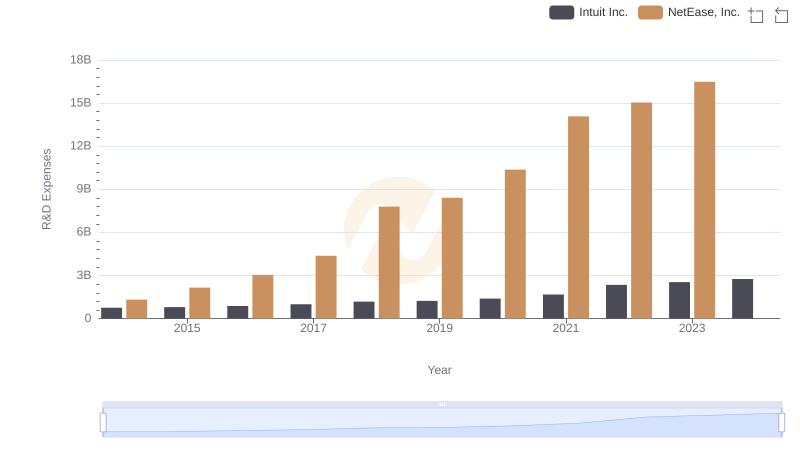

Research and Development Investment: Intuit Inc. vs NetEase, Inc.

Intuit Inc. and VMware, Inc.: A Detailed Gross Profit Analysis

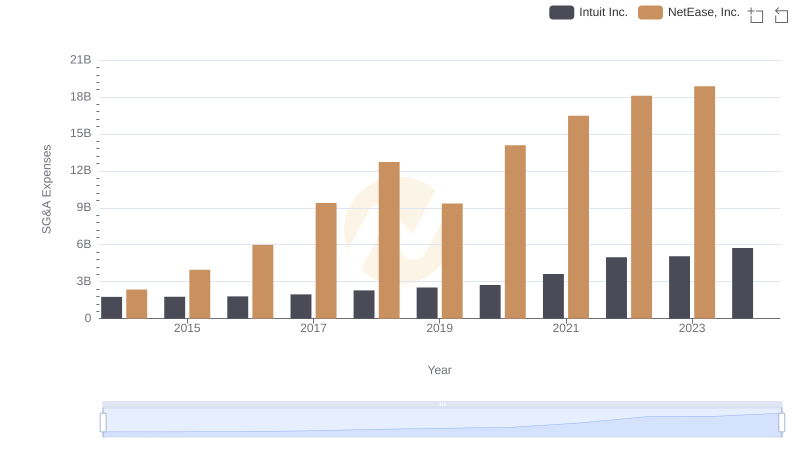

Breaking Down SG&A Expenses: Intuit Inc. vs NetEase, Inc.

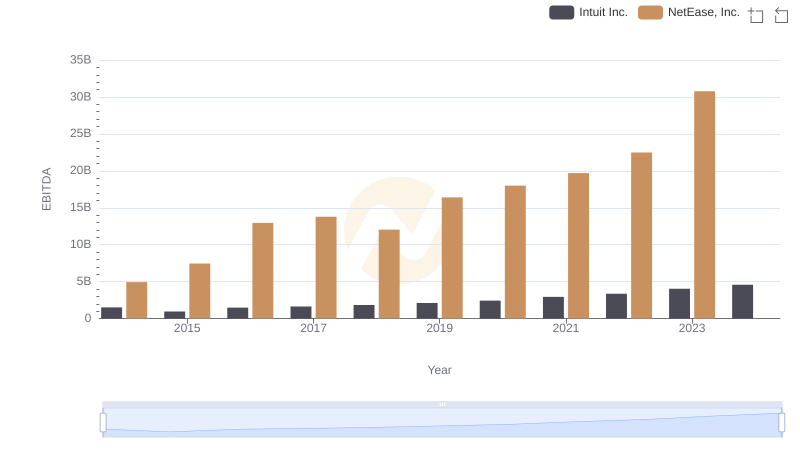

EBITDA Performance Review: Intuit Inc. vs NetEase, Inc.