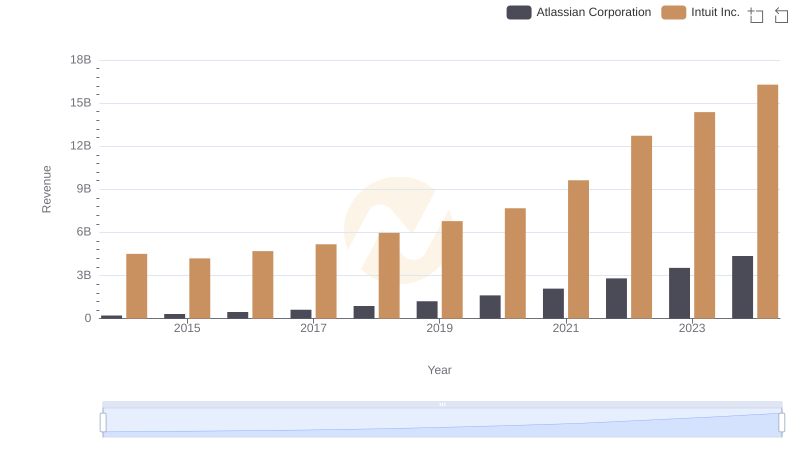

| __timestamp | Atlassian Corporation | Intuit Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 177123000 | 3838000000 |

| Thursday, January 1, 2015 | 266589000 | 3467000000 |

| Friday, January 1, 2016 | 381275000 | 3942000000 |

| Sunday, January 1, 2017 | 500775000 | 4368000000 |

| Monday, January 1, 2018 | 701260000 | 4987000000 |

| Tuesday, January 1, 2019 | 999842000 | 5617000000 |

| Wednesday, January 1, 2020 | 1345366000 | 6301000000 |

| Friday, January 1, 2021 | 1753111000 | 7950000000 |

| Saturday, January 1, 2022 | 2337175000 | 10320000000 |

| Sunday, January 1, 2023 | 2900882000 | 11225000000 |

| Monday, January 1, 2024 | 3555108000 | 12820000000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of financial technology and software services, Intuit Inc. and Atlassian Corporation have emerged as key players. Over the past decade, from 2014 to 2024, these companies have demonstrated remarkable growth in gross profit, reflecting their strategic prowess and market adaptability.

Intuit Inc., a leader in financial software, has seen its gross profit soar by approximately 234%, from $3.8 billion in 2014 to an impressive $12.8 billion in 2024. This growth underscores Intuit's ability to innovate and capture market share in a competitive industry.

Meanwhile, Atlassian Corporation, known for its collaboration and productivity software, has experienced a staggering 1,900% increase in gross profit, rising from $177 million in 2014 to $3.6 billion in 2024. This exponential growth highlights Atlassian's successful expansion and product diversification.

Both companies exemplify the dynamic nature of the tech industry, where strategic innovation and market responsiveness are key to sustained success.

Who Generates More Revenue? Intuit Inc. or Atlassian Corporation

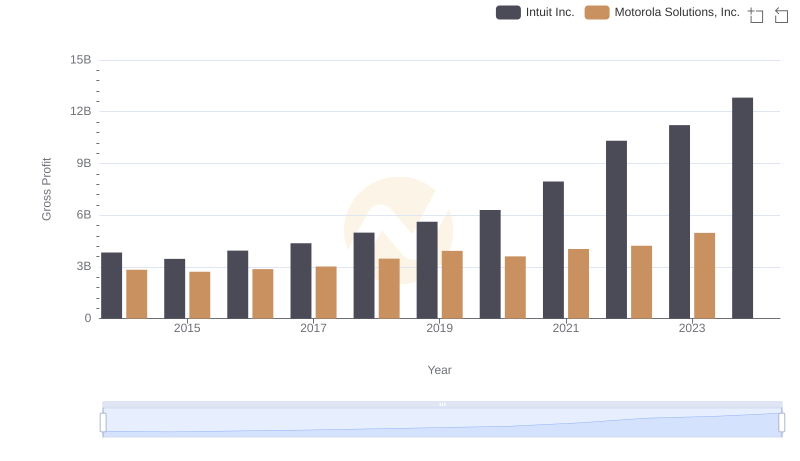

Intuit Inc. and Motorola Solutions, Inc.: A Detailed Gross Profit Analysis

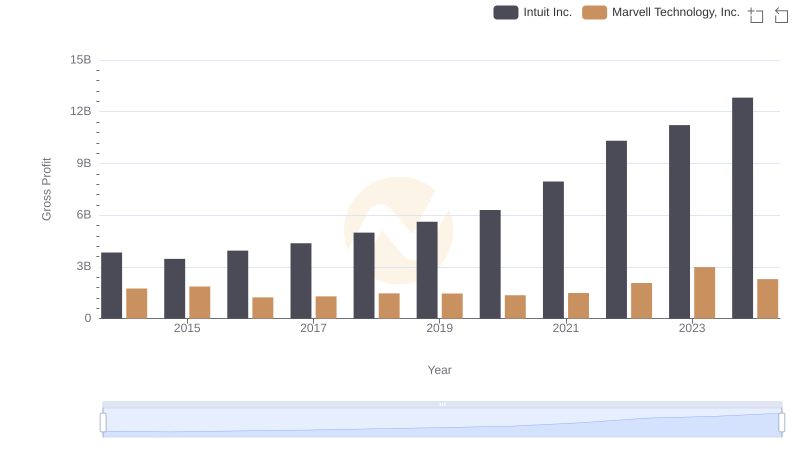

Gross Profit Analysis: Comparing Intuit Inc. and Marvell Technology, Inc.

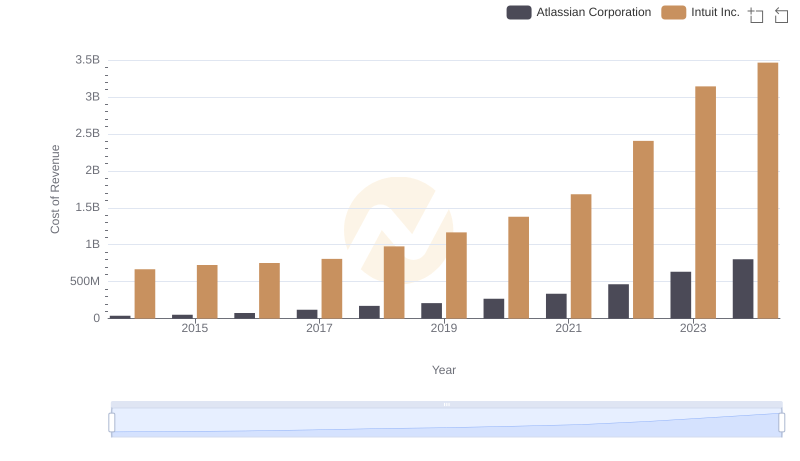

Analyzing Cost of Revenue: Intuit Inc. and Atlassian Corporation

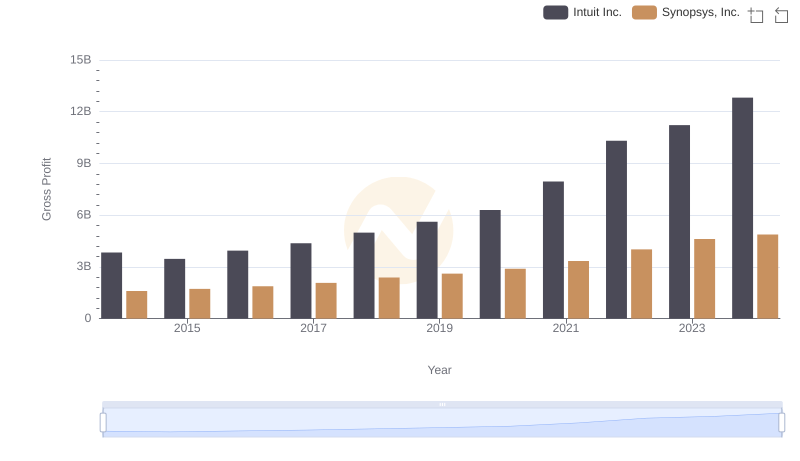

Intuit Inc. and Synopsys, Inc.: A Detailed Gross Profit Analysis

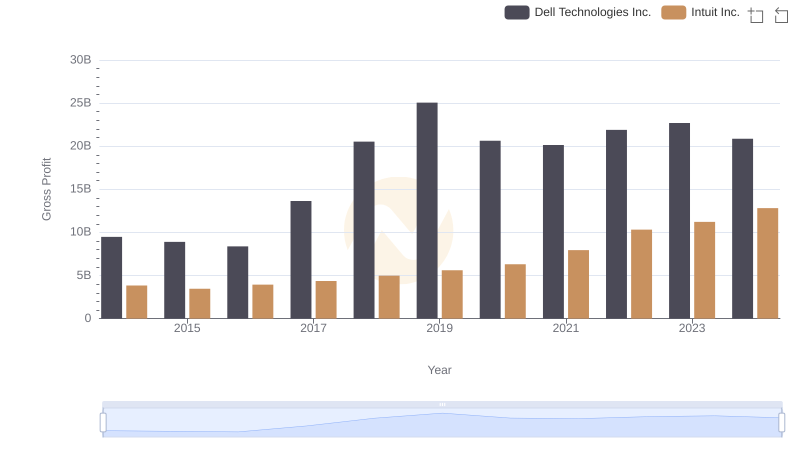

Intuit Inc. and Dell Technologies Inc.: A Detailed Gross Profit Analysis

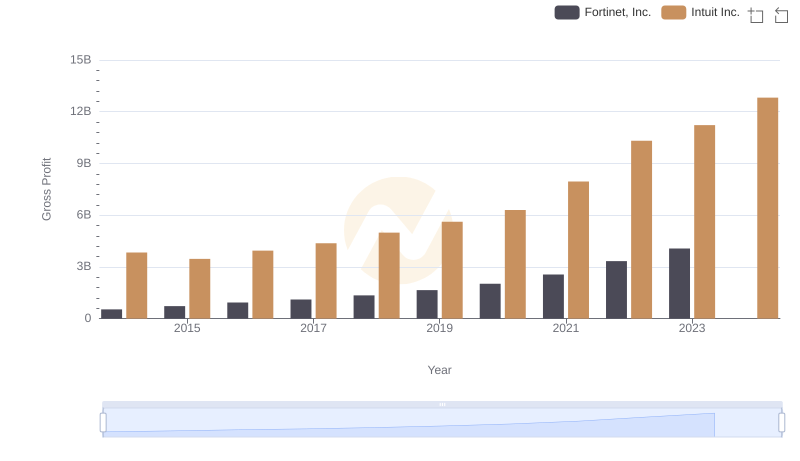

Intuit Inc. vs Fortinet, Inc.: A Gross Profit Performance Breakdown

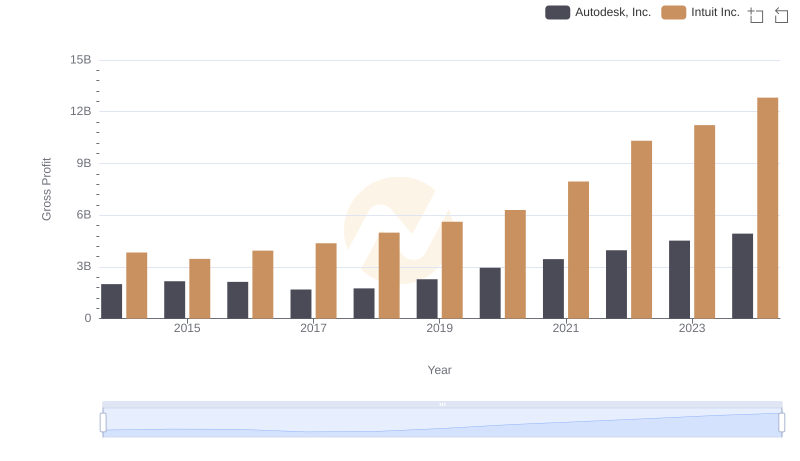

Key Insights on Gross Profit: Intuit Inc. vs Autodesk, Inc.

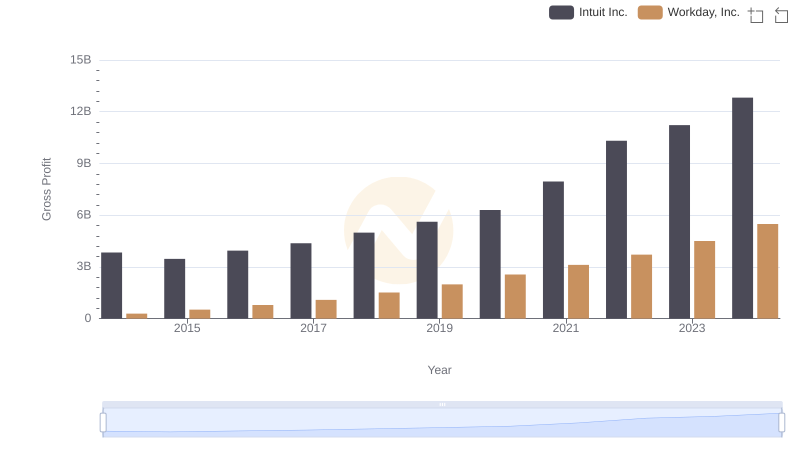

Gross Profit Comparison: Intuit Inc. and Workday, Inc. Trends

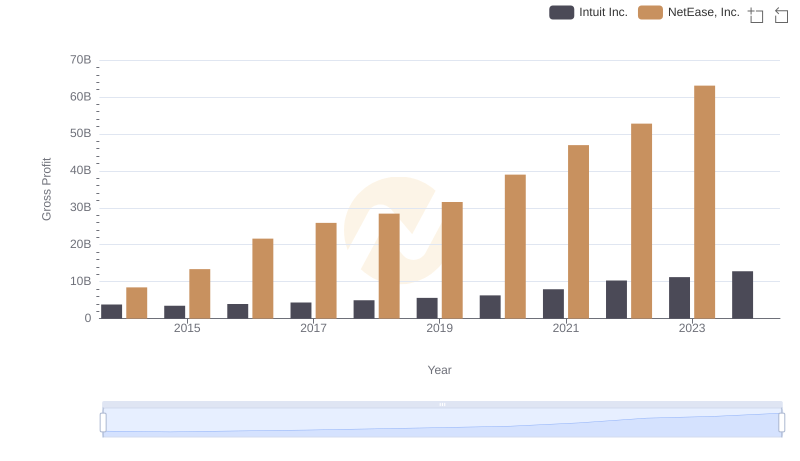

Who Generates Higher Gross Profit? Intuit Inc. or NetEase, Inc.

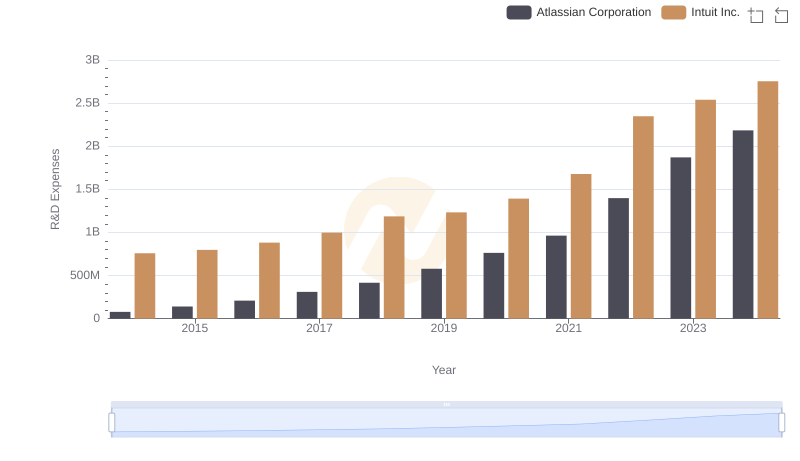

R&D Insights: How Intuit Inc. and Atlassian Corporation Allocate Funds

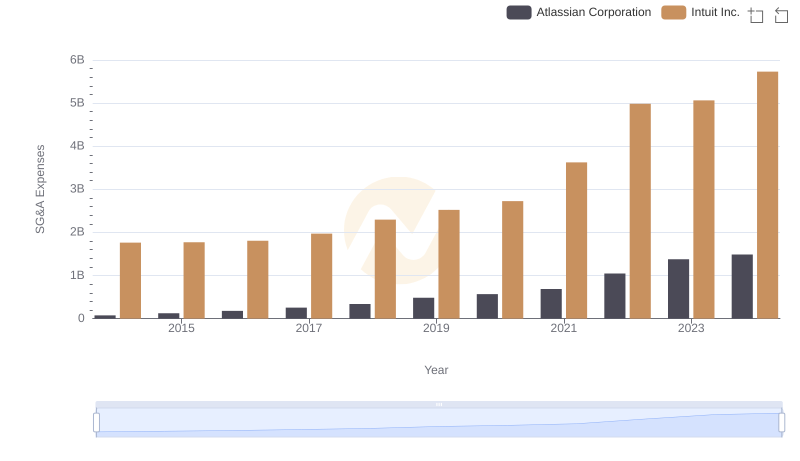

Who Optimizes SG&A Costs Better? Intuit Inc. or Atlassian Corporation