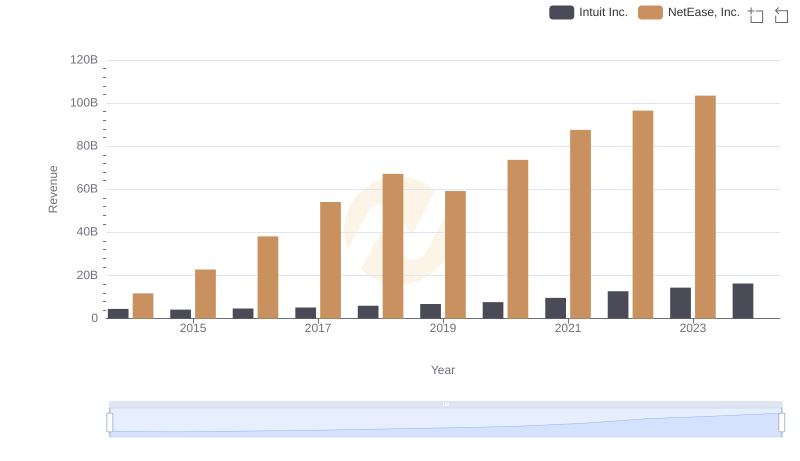

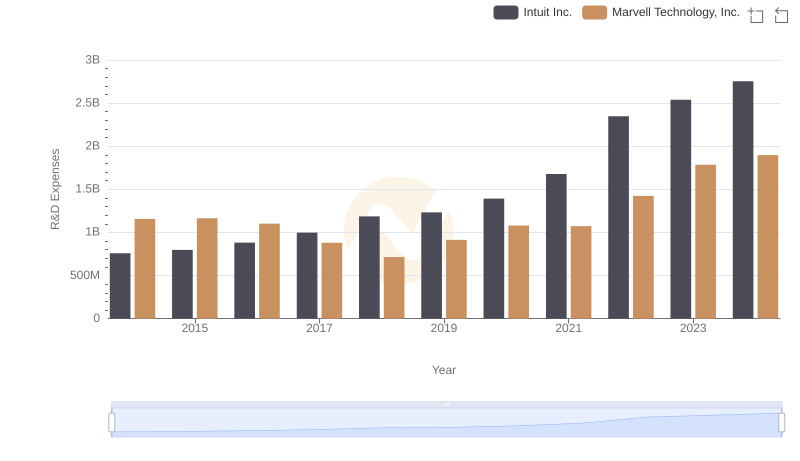

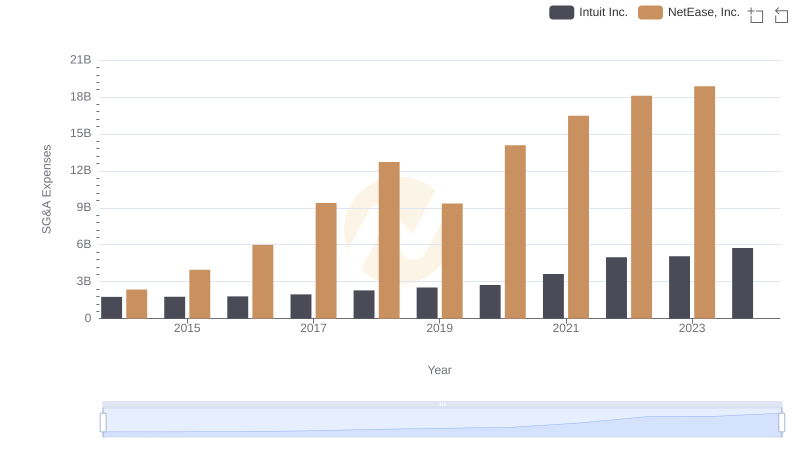

| __timestamp | Intuit Inc. | NetEase, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 758000000 | 1323498000 |

| Thursday, January 1, 2015 | 798000000 | 2158888000 |

| Friday, January 1, 2016 | 881000000 | 3046979000 |

| Sunday, January 1, 2017 | 998000000 | 4371428000 |

| Monday, January 1, 2018 | 1186000000 | 7792550000 |

| Tuesday, January 1, 2019 | 1233000000 | 8413224000 |

| Wednesday, January 1, 2020 | 1392000000 | 10369382000 |

| Friday, January 1, 2021 | 1678000000 | 14075991000 |

| Saturday, January 1, 2022 | 2347000000 | 15039014000 |

| Sunday, January 1, 2023 | 2539000000 | 16484910000 |

| Monday, January 1, 2024 | 2754000000 |

Igniting the spark of knowledge

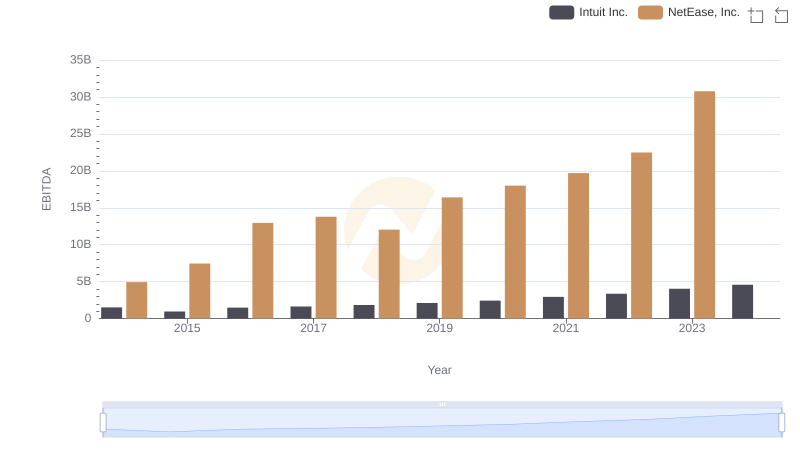

In the ever-evolving landscape of technology, research and development (R&D) investments are pivotal for companies aiming to stay ahead. Over the past decade, Intuit Inc. and NetEase, Inc. have demonstrated contrasting trajectories in their R&D spending. From 2014 to 2023, Intuit's R&D expenses surged by over 260%, reflecting its commitment to innovation in financial software. In contrast, NetEase, a titan in the gaming and internet services sector, saw its R&D investment grow by approximately 1,145% until 2023, underscoring its aggressive expansion strategy.

While Intuit's steady increase highlights a consistent focus on enhancing its product offerings, NetEase's exponential growth in R&D spending signals its ambition to diversify and dominate new markets. However, data for 2024 is missing for NetEase, leaving a gap in understanding its future direction. This comparison offers a fascinating glimpse into how two industry leaders prioritize innovation to maintain their competitive edge.

Breaking Down Revenue Trends: Intuit Inc. vs NetEase, Inc.

Research and Development Expenses Breakdown: Intuit Inc. vs Marvell Technology, Inc.

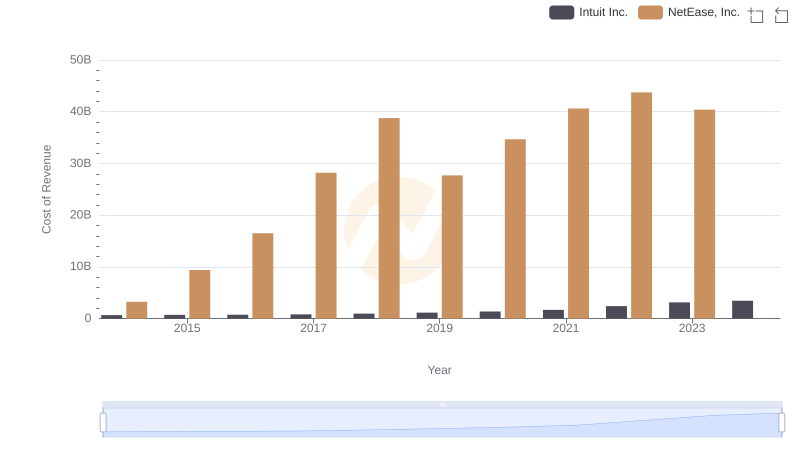

Cost of Revenue: Key Insights for Intuit Inc. and NetEase, Inc.

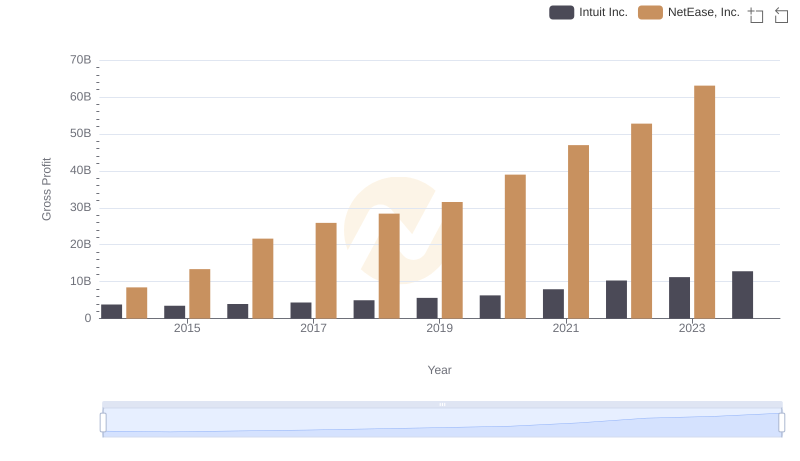

Who Generates Higher Gross Profit? Intuit Inc. or NetEase, Inc.

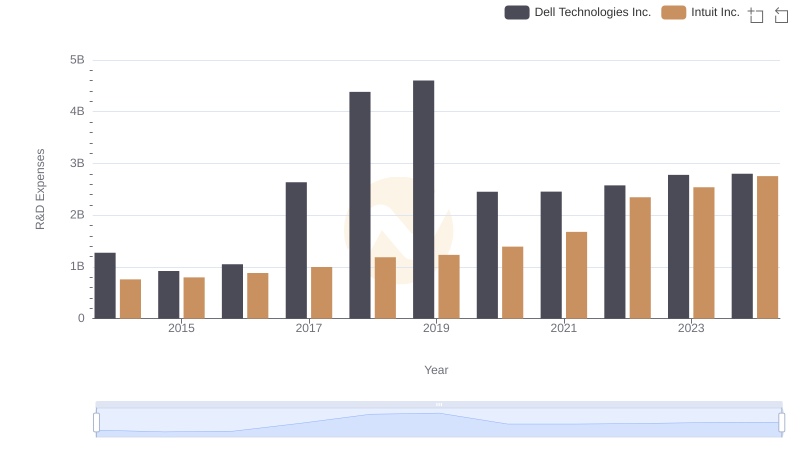

Intuit Inc. vs Dell Technologies Inc.: Strategic Focus on R&D Spending

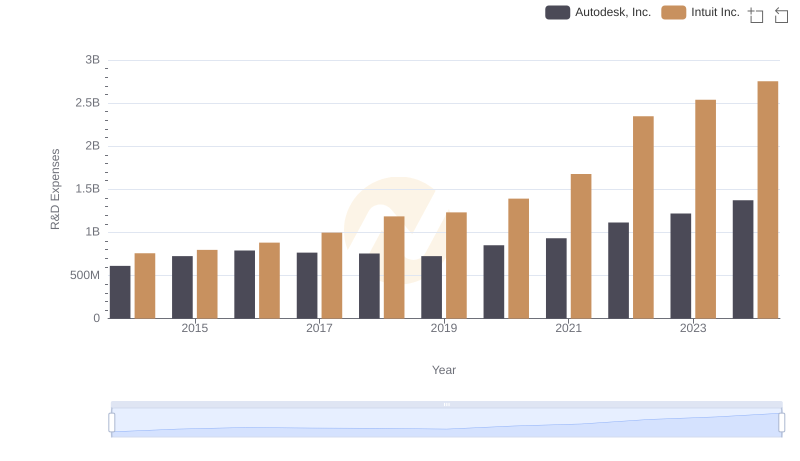

Research and Development Investment: Intuit Inc. vs Autodesk, Inc.

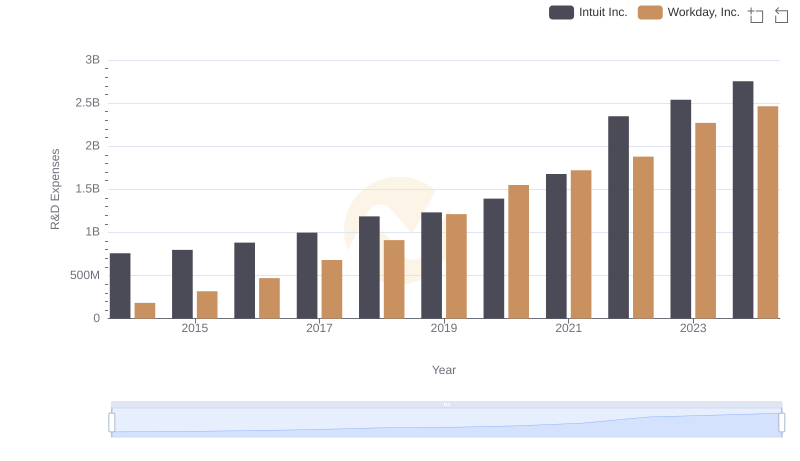

Research and Development Expenses Breakdown: Intuit Inc. vs Workday, Inc.

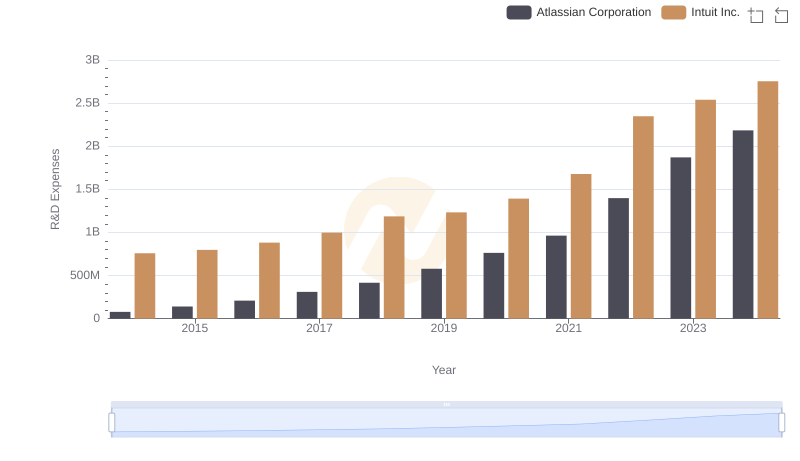

R&D Insights: How Intuit Inc. and Atlassian Corporation Allocate Funds

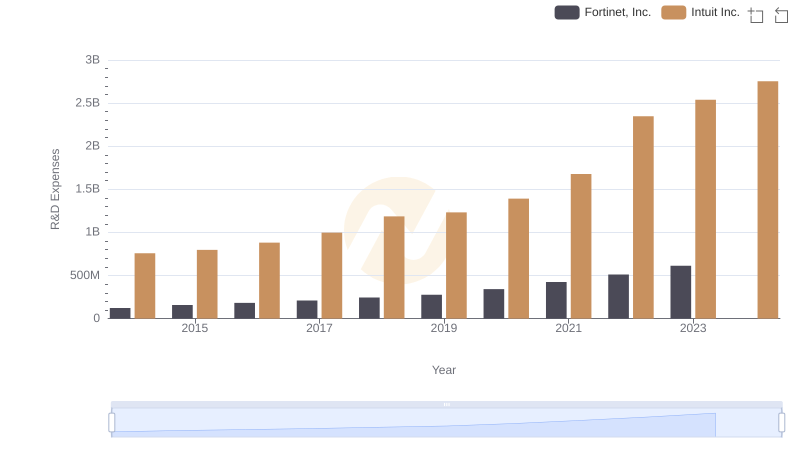

Intuit Inc. vs Fortinet, Inc.: Strategic Focus on R&D Spending

Breaking Down SG&A Expenses: Intuit Inc. vs NetEase, Inc.

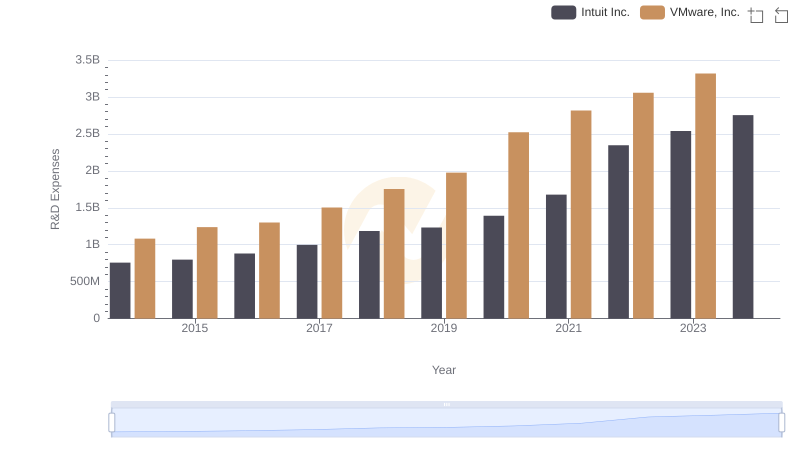

Intuit Inc. or VMware, Inc.: Who Invests More in Innovation?

EBITDA Performance Review: Intuit Inc. vs NetEase, Inc.