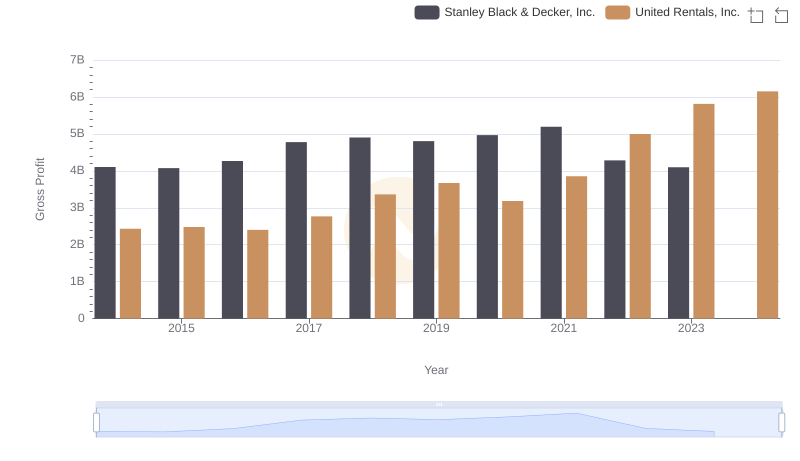

| __timestamp | Stanley Black & Decker, Inc. | United Rentals, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 4102700000 | 2432000000 |

| Thursday, January 1, 2015 | 4072000000 | 2480000000 |

| Friday, January 1, 2016 | 4267200000 | 2403000000 |

| Sunday, January 1, 2017 | 4778000000 | 2769000000 |

| Monday, January 1, 2018 | 4901900000 | 3364000000 |

| Tuesday, January 1, 2019 | 4805500000 | 3670000000 |

| Wednesday, January 1, 2020 | 4967900000 | 3183000000 |

| Friday, January 1, 2021 | 5194200000 | 3853000000 |

| Saturday, January 1, 2022 | 4284100000 | 4996000000 |

| Sunday, January 1, 2023 | 4098000000 | 5813000000 |

| Monday, January 1, 2024 | 4514400000 | 6150000000 |

Unleashing insights

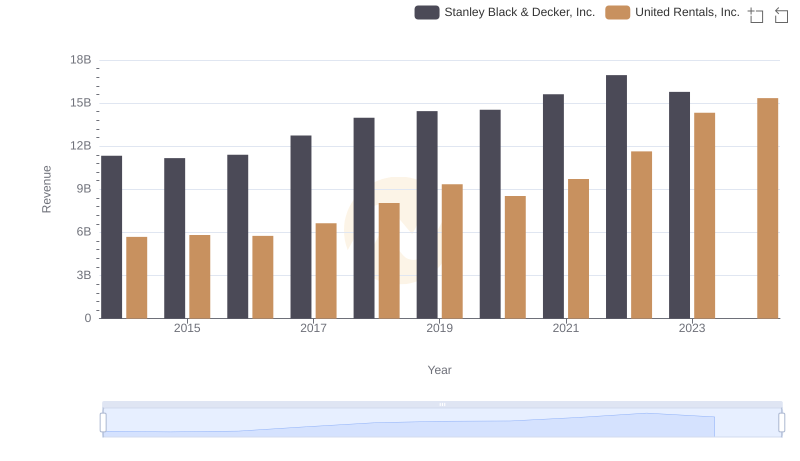

In the ever-evolving landscape of industrial equipment and tools, United Rentals, Inc. and Stanley Black & Decker, Inc. stand as titans. Over the past decade, these companies have showcased remarkable resilience and growth. From 2014 to 2023, Stanley Black & Decker's gross profit saw a steady climb, peaking in 2021 with a 27% increase from 2014. However, a slight dip in 2022 and 2023 suggests market challenges.

Conversely, United Rentals has demonstrated a robust upward trajectory, with a staggering 139% growth in gross profit from 2014 to 2023. This growth underscores their strategic market positioning and adaptability. Notably, 2023 marked a significant milestone for United Rentals, surpassing Stanley Black & Decker in gross profit for the first time. As we look to 2024, United Rentals continues its ascent, while Stanley Black & Decker's data remains elusive, hinting at potential shifts in the industry landscape.

Comparing Revenue Performance: United Rentals, Inc. or Stanley Black & Decker, Inc.?

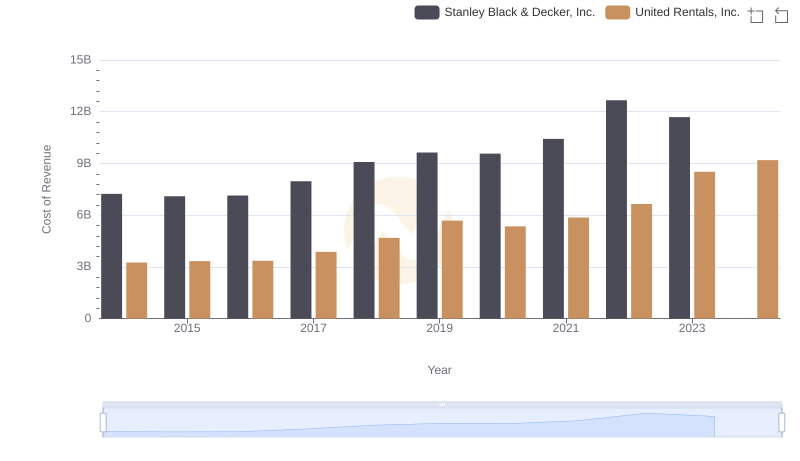

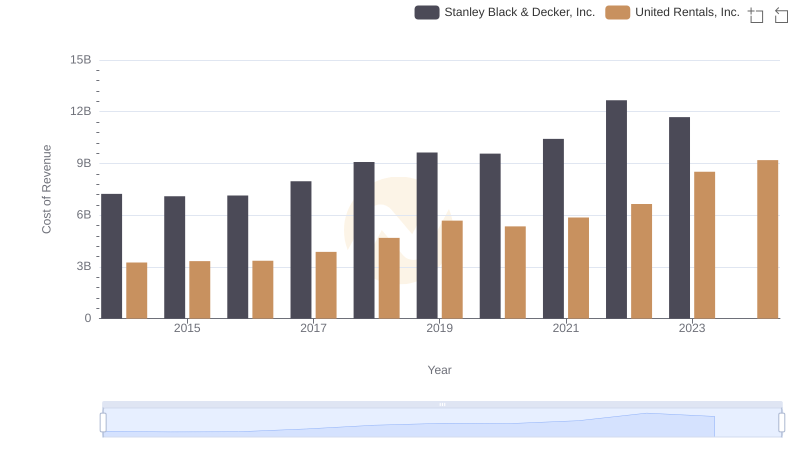

Cost of Revenue Comparison: United Rentals, Inc. vs Stanley Black & Decker, Inc.

Gross Profit Analysis: Comparing United Rentals, Inc. and Stanley Black & Decker, Inc.

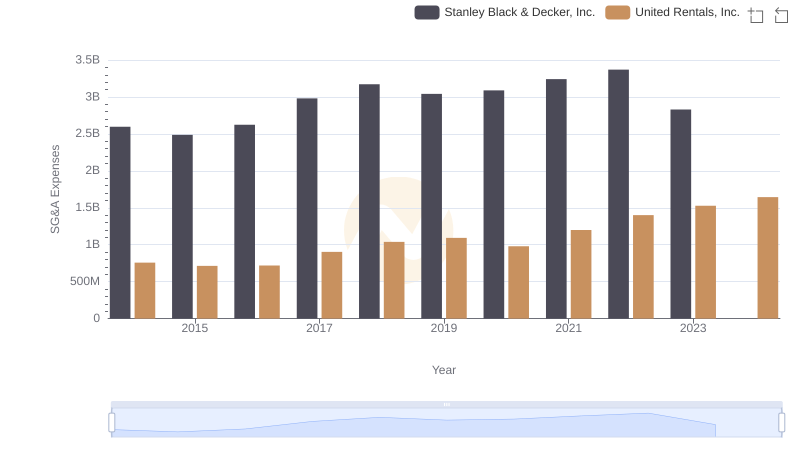

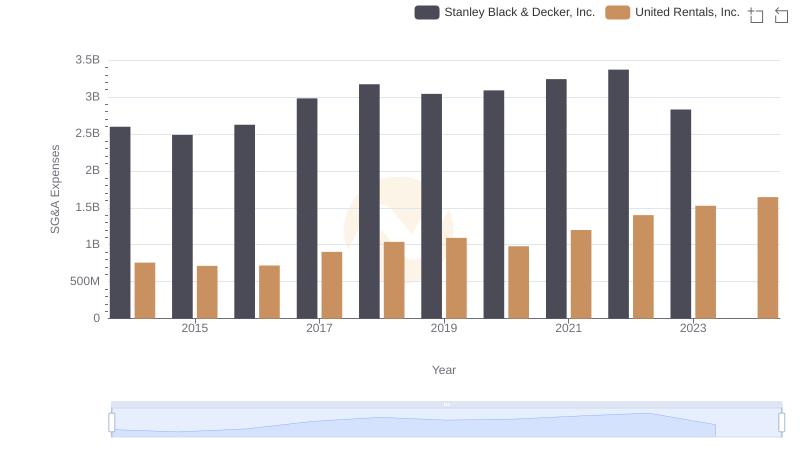

Selling, General, and Administrative Costs: United Rentals, Inc. vs Stanley Black & Decker, Inc.

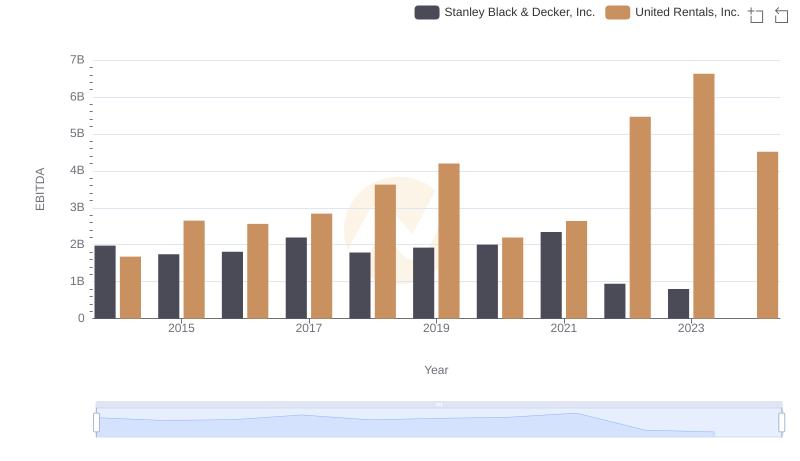

A Side-by-Side Analysis of EBITDA: United Rentals, Inc. and Stanley Black & Decker, Inc.

Breaking Down Revenue Trends: United Rentals, Inc. vs Stanley Black & Decker, Inc.

Comparing Cost of Revenue Efficiency: United Rentals, Inc. vs Stanley Black & Decker, Inc.

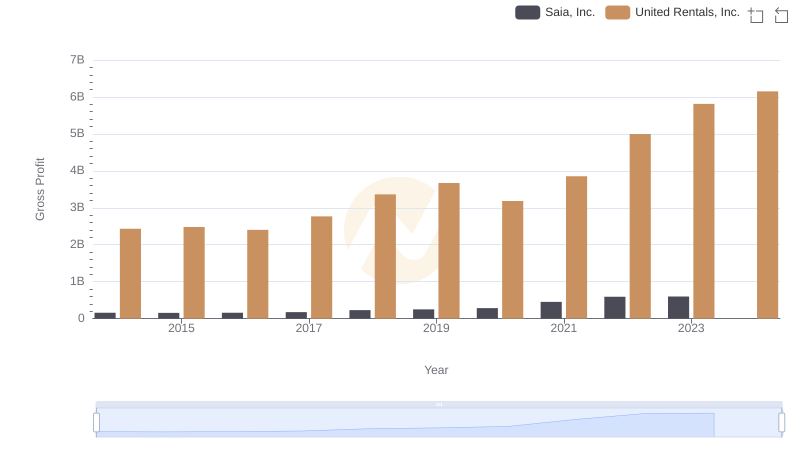

Gross Profit Comparison: United Rentals, Inc. and Saia, Inc. Trends

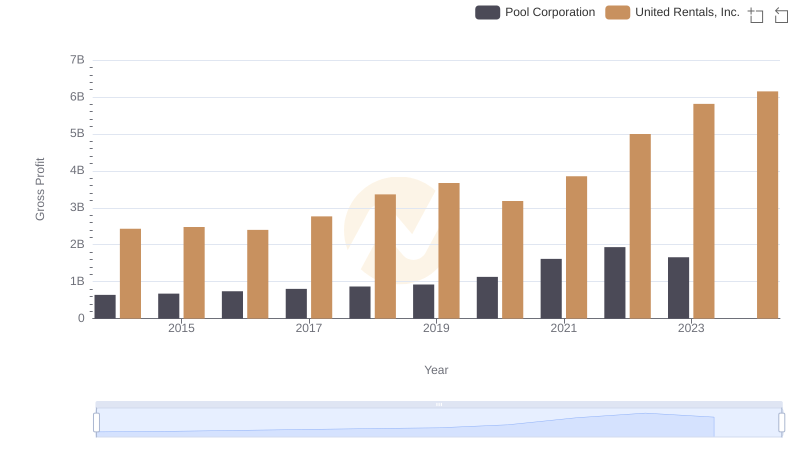

United Rentals, Inc. vs Pool Corporation: A Gross Profit Performance Breakdown

Gross Profit Comparison: United Rentals, Inc. and U-Haul Holding Company Trends

Cost Management Insights: SG&A Expenses for United Rentals, Inc. and Stanley Black & Decker, Inc.

Comprehensive EBITDA Comparison: United Rentals, Inc. vs Stanley Black & Decker, Inc.