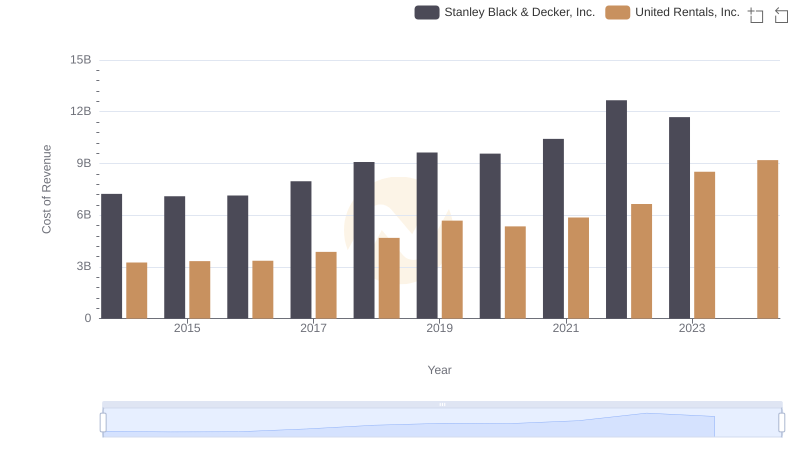

| __timestamp | Stanley Black & Decker, Inc. | United Rentals, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1975400000 | 1678000000 |

| Thursday, January 1, 2015 | 1741900000 | 2653000000 |

| Friday, January 1, 2016 | 1810200000 | 2566000000 |

| Sunday, January 1, 2017 | 2196000000 | 2843000000 |

| Monday, January 1, 2018 | 1791200000 | 3628000000 |

| Tuesday, January 1, 2019 | 1920600000 | 4200000000 |

| Wednesday, January 1, 2020 | 2004200000 | 2195000000 |

| Friday, January 1, 2021 | 2345500000 | 2642000000 |

| Saturday, January 1, 2022 | 942800000 | 5464000000 |

| Sunday, January 1, 2023 | 802700000 | 6627000000 |

| Monday, January 1, 2024 | 286300000 | 4516000000 |

Igniting the spark of knowledge

In the ever-evolving landscape of industrial giants, United Rentals, Inc. and Stanley Black & Decker, Inc. have been pivotal players. Over the past decade, United Rentals has consistently outperformed Stanley Black & Decker in terms of EBITDA, showcasing a robust growth trajectory. From 2014 to 2023, United Rentals' EBITDA surged by nearly 295%, peaking in 2023, while Stanley Black & Decker experienced a more modest growth of around 19% during the same period.

The year 2022 marked a significant divergence, with United Rentals achieving an EBITDA of approximately 5.5 billion, a stark contrast to Stanley Black & Decker's 942 million. This trend continued into 2023, highlighting United Rentals' strategic prowess in capitalizing on market opportunities. However, the data for 2024 remains incomplete, leaving room for speculation on future dynamics. As these industrial titans continue to navigate economic challenges, their financial strategies will be crucial in shaping their competitive edge.

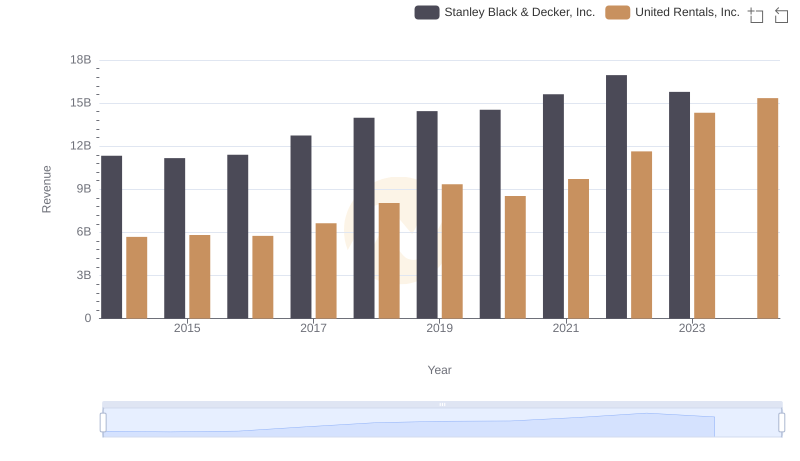

Comparing Revenue Performance: United Rentals, Inc. or Stanley Black & Decker, Inc.?

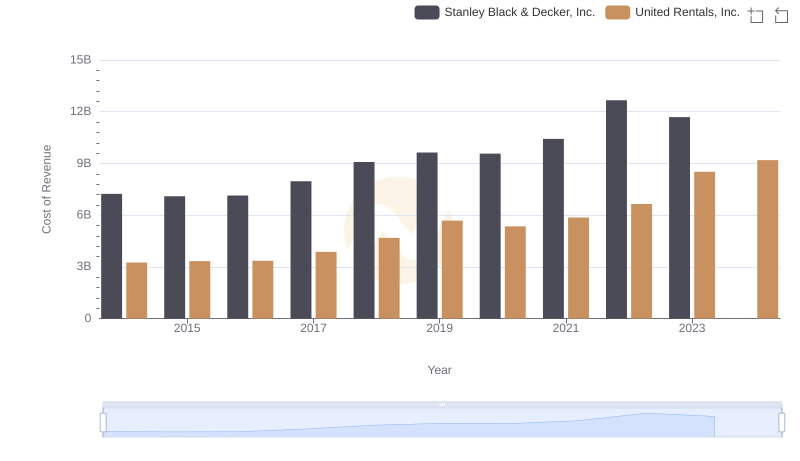

Cost of Revenue Comparison: United Rentals, Inc. vs Stanley Black & Decker, Inc.

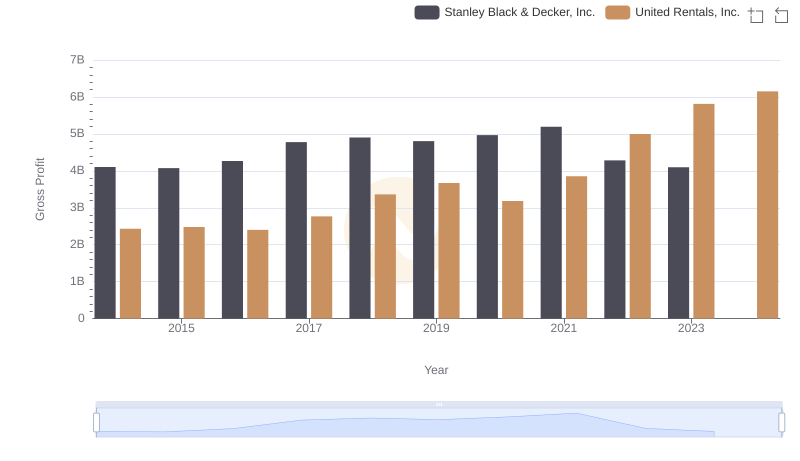

Gross Profit Analysis: Comparing United Rentals, Inc. and Stanley Black & Decker, Inc.

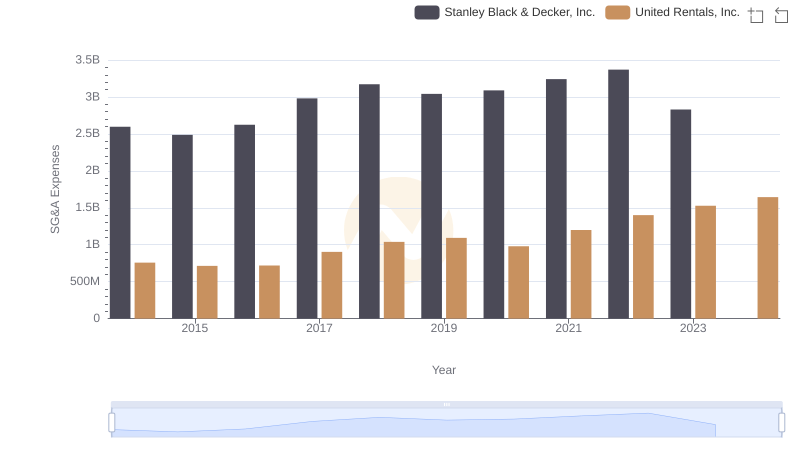

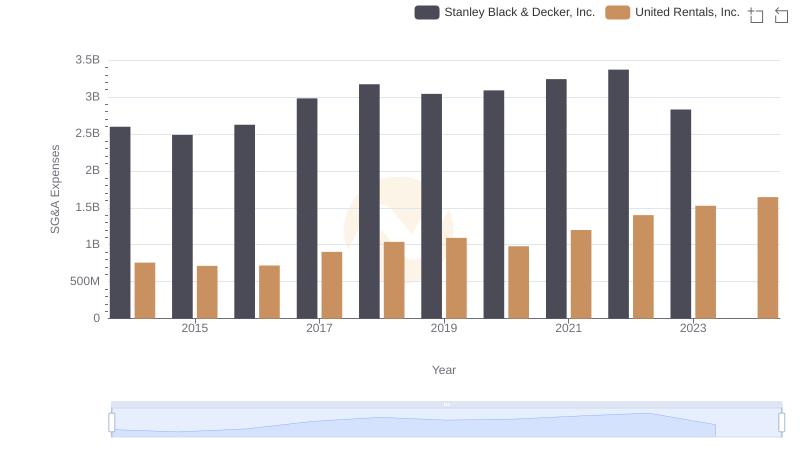

Selling, General, and Administrative Costs: United Rentals, Inc. vs Stanley Black & Decker, Inc.

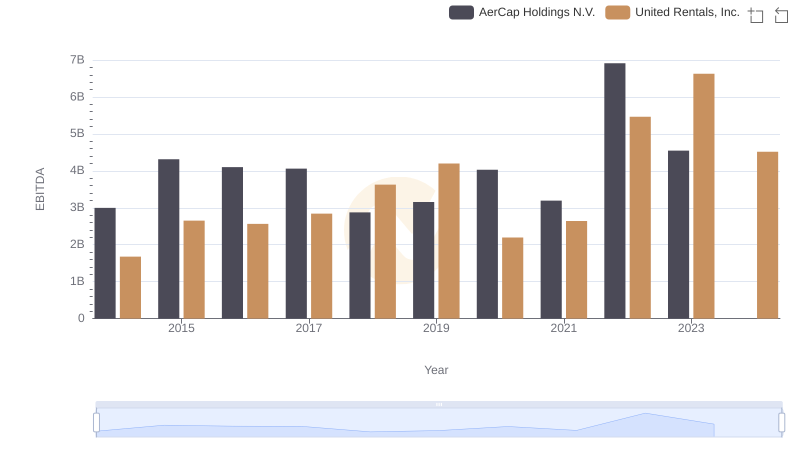

Comparative EBITDA Analysis: United Rentals, Inc. vs AerCap Holdings N.V.

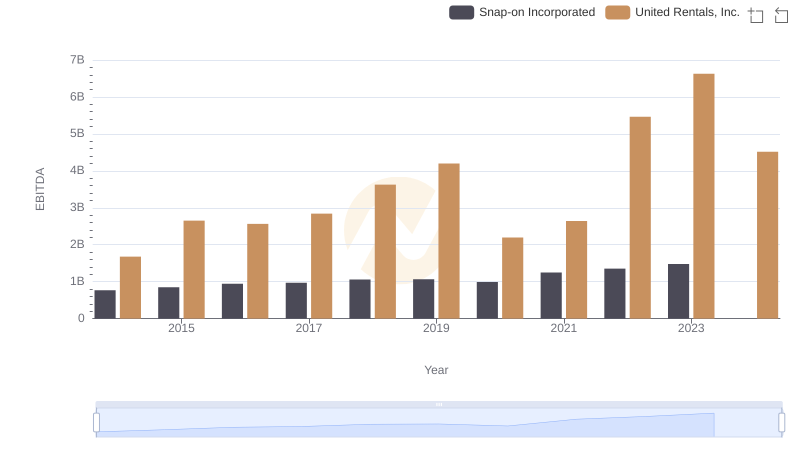

Comparative EBITDA Analysis: United Rentals, Inc. vs Snap-on Incorporated

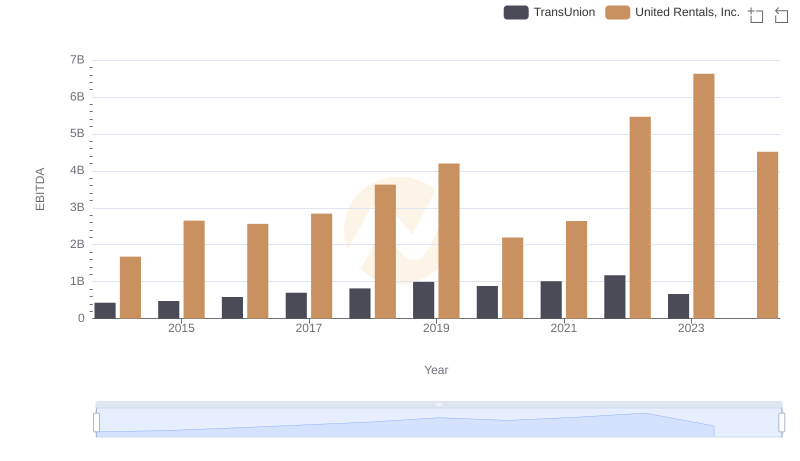

EBITDA Performance Review: United Rentals, Inc. vs TransUnion

Breaking Down Revenue Trends: United Rentals, Inc. vs Stanley Black & Decker, Inc.

Comparing Cost of Revenue Efficiency: United Rentals, Inc. vs Stanley Black & Decker, Inc.

United Rentals, Inc. and Stanley Black & Decker, Inc.: A Detailed Gross Profit Analysis

Cost Management Insights: SG&A Expenses for United Rentals, Inc. and Stanley Black & Decker, Inc.

Comprehensive EBITDA Comparison: United Rentals, Inc. vs Stanley Black & Decker, Inc.