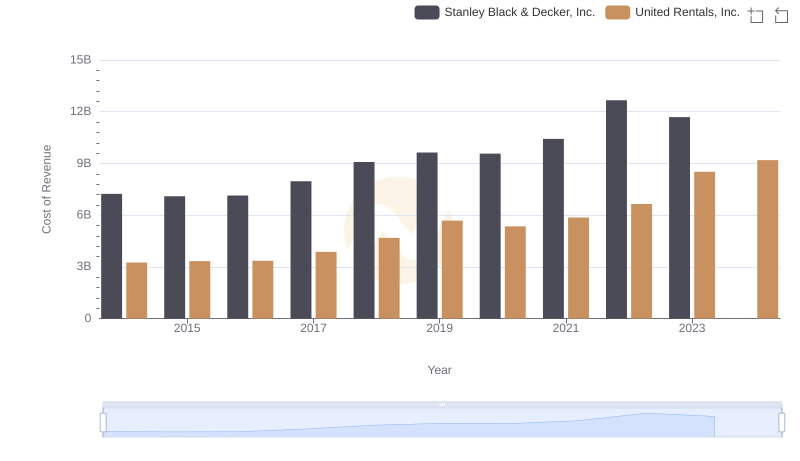

| __timestamp | Stanley Black & Decker, Inc. | United Rentals, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 11338600000 | 5685000000 |

| Thursday, January 1, 2015 | 11171800000 | 5817000000 |

| Friday, January 1, 2016 | 11406900000 | 5762000000 |

| Sunday, January 1, 2017 | 12747200000 | 6641000000 |

| Monday, January 1, 2018 | 13982400000 | 8047000000 |

| Tuesday, January 1, 2019 | 14442200000 | 9351000000 |

| Wednesday, January 1, 2020 | 14534600000 | 8530000000 |

| Friday, January 1, 2021 | 15617200000 | 9716000000 |

| Saturday, January 1, 2022 | 16947400000 | 11642000000 |

| Sunday, January 1, 2023 | 15781100000 | 14332000000 |

| Monday, January 1, 2024 | 15365700000 | 15345000000 |

Igniting the spark of knowledge

In the ever-evolving landscape of industrial equipment and tools, United Rentals, Inc. and Stanley Black & Decker, Inc. have emerged as formidable players. Over the past decade, these companies have showcased distinct revenue trajectories, reflecting their strategic maneuvers and market dynamics.

From 2014 to 2023, Stanley Black & Decker consistently outperformed United Rentals in revenue, peaking in 2022 with a 50% higher revenue than United Rentals. However, United Rentals has shown remarkable growth, nearly tripling its revenue from 2014 to 2023, closing the gap significantly. By 2023, United Rentals' revenue surged to 91% of Stanley Black & Decker's, highlighting its aggressive expansion and market penetration.

As we look to the future, the missing data for 2024 leaves us anticipating whether United Rentals will continue its upward trajectory or if Stanley Black & Decker will maintain its lead.

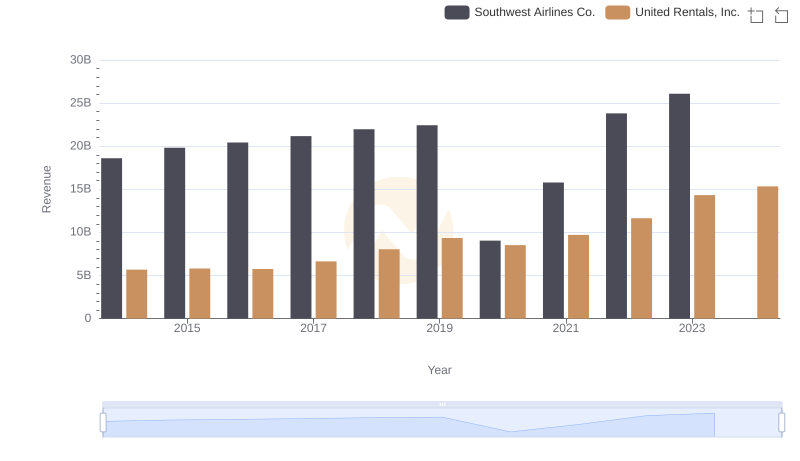

Comparing Revenue Performance: United Rentals, Inc. or Southwest Airlines Co.?

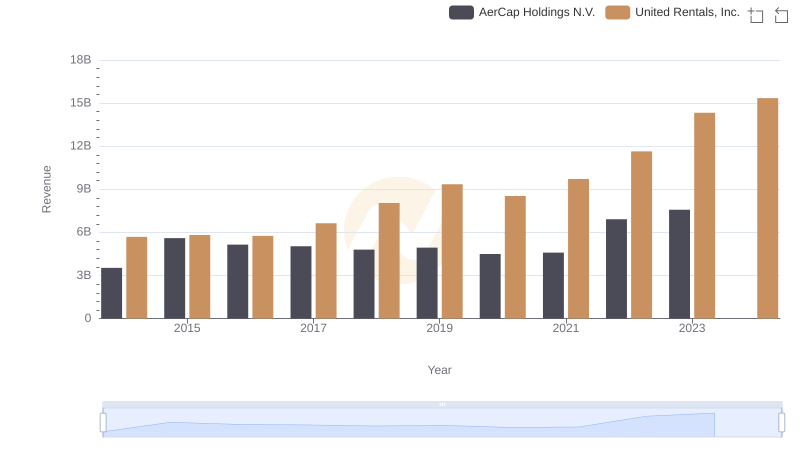

United Rentals, Inc. vs AerCap Holdings N.V.: Annual Revenue Growth Compared

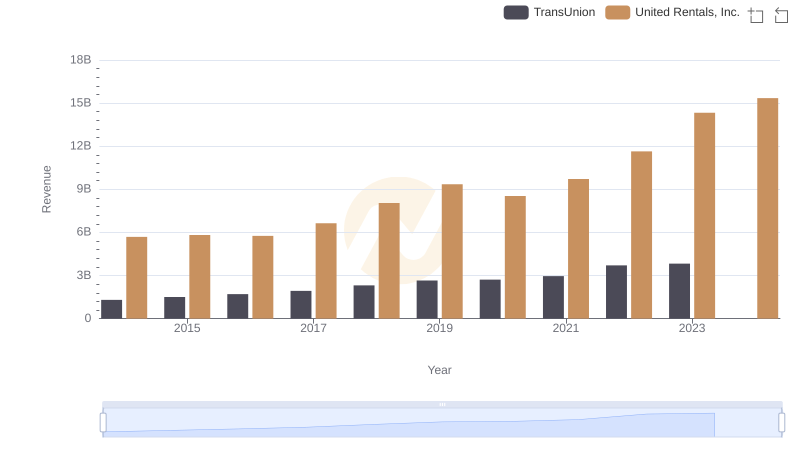

Comparing Revenue Performance: United Rentals, Inc. or TransUnion?

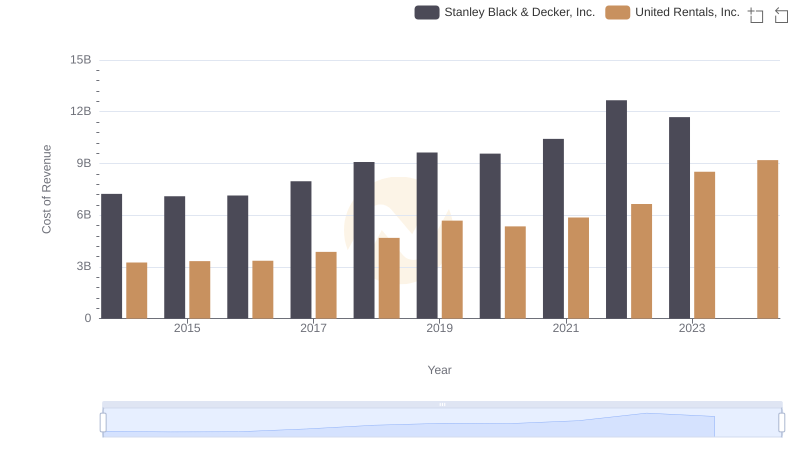

Cost of Revenue Comparison: United Rentals, Inc. vs Stanley Black & Decker, Inc.

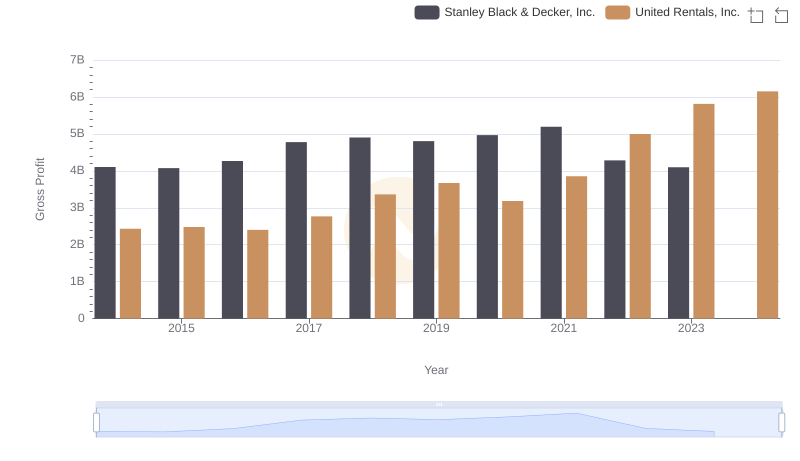

Gross Profit Analysis: Comparing United Rentals, Inc. and Stanley Black & Decker, Inc.

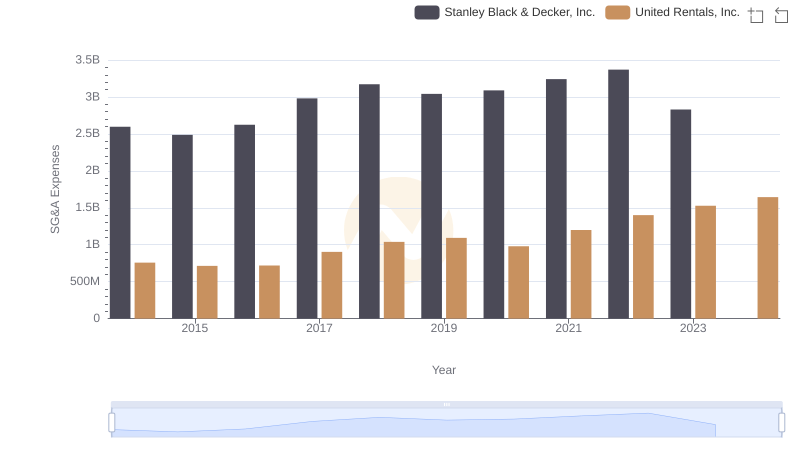

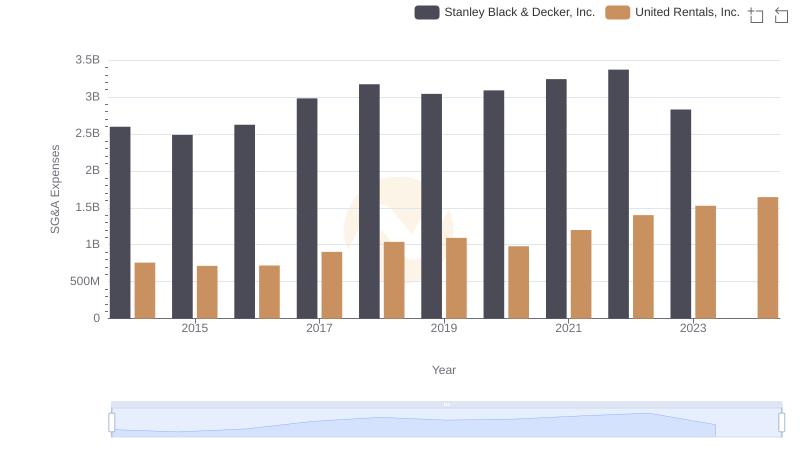

Selling, General, and Administrative Costs: United Rentals, Inc. vs Stanley Black & Decker, Inc.

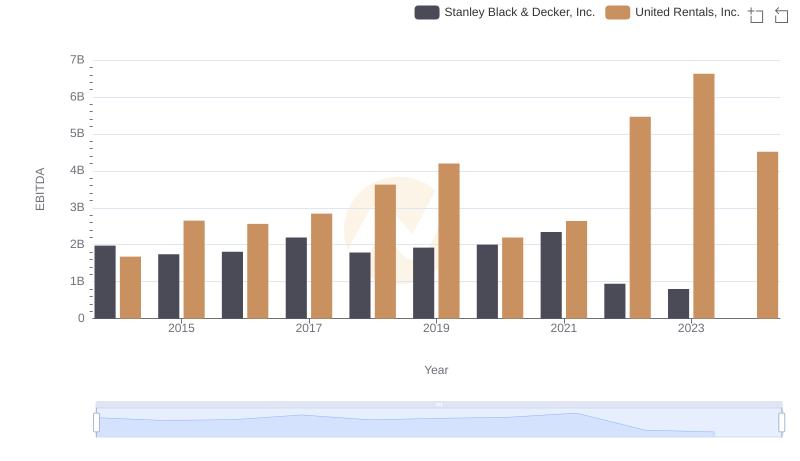

A Side-by-Side Analysis of EBITDA: United Rentals, Inc. and Stanley Black & Decker, Inc.

Breaking Down Revenue Trends: United Rentals, Inc. vs Stanley Black & Decker, Inc.

Comparing Cost of Revenue Efficiency: United Rentals, Inc. vs Stanley Black & Decker, Inc.

United Rentals, Inc. and Stanley Black & Decker, Inc.: A Detailed Gross Profit Analysis

Cost Management Insights: SG&A Expenses for United Rentals, Inc. and Stanley Black & Decker, Inc.

Comprehensive EBITDA Comparison: United Rentals, Inc. vs Stanley Black & Decker, Inc.