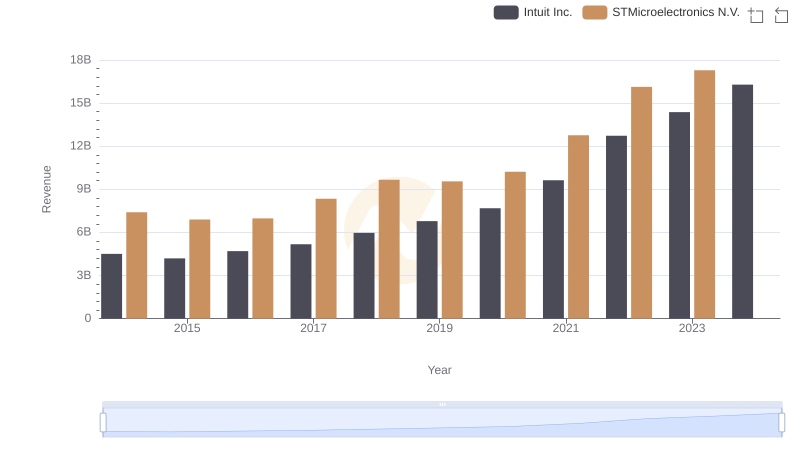

| __timestamp | Intuit Inc. | STMicroelectronics N.V. |

|---|---|---|

| Wednesday, January 1, 2014 | 3838000000 | 2083000000 |

| Thursday, January 1, 2015 | 3467000000 | 1990000000 |

| Friday, January 1, 2016 | 3942000000 | 2242000000 |

| Sunday, January 1, 2017 | 4368000000 | 3034000000 |

| Monday, January 1, 2018 | 4987000000 | 3568000000 |

| Tuesday, January 1, 2019 | 5617000000 | 3696000000 |

| Wednesday, January 1, 2020 | 6301000000 | 3400000000 |

| Friday, January 1, 2021 | 7950000000 | 5053000000 |

| Saturday, January 1, 2022 | 10320000000 | 7331000000 |

| Sunday, January 1, 2023 | 11225000000 | 8287000000 |

| Monday, January 1, 2024 | 12820000000 |

Unleashing the power of data

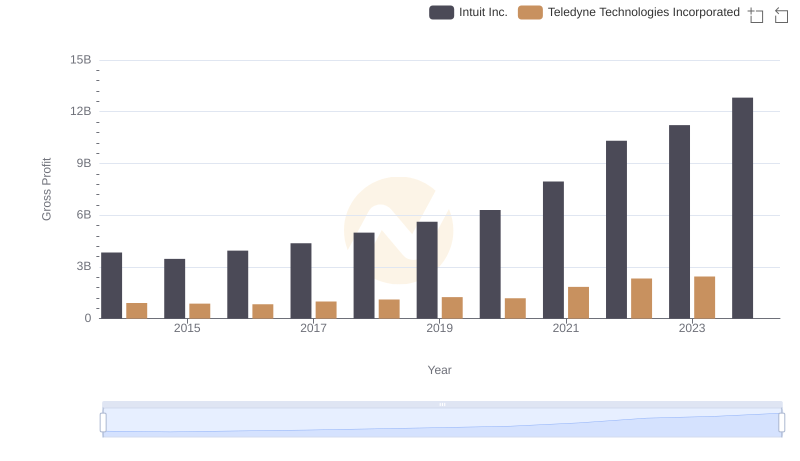

In the ever-evolving landscape of technology, Intuit Inc. and STMicroelectronics N.V. have demonstrated remarkable growth in gross profit over the past decade. From 2014 to 2023, Intuit Inc. has seen its gross profit soar by approximately 192%, reflecting its robust business model and strategic innovations. Meanwhile, STMicroelectronics N.V. has experienced a commendable 298% increase, showcasing its resilience and adaptability in the semiconductor industry.

While 2024 data for STMicroelectronics is missing, the trends suggest continued growth for both companies, making them key players to watch in their respective sectors.

Breaking Down Revenue Trends: Intuit Inc. vs STMicroelectronics N.V.

Intuit Inc. vs Teledyne Technologies Incorporated: A Gross Profit Performance Breakdown

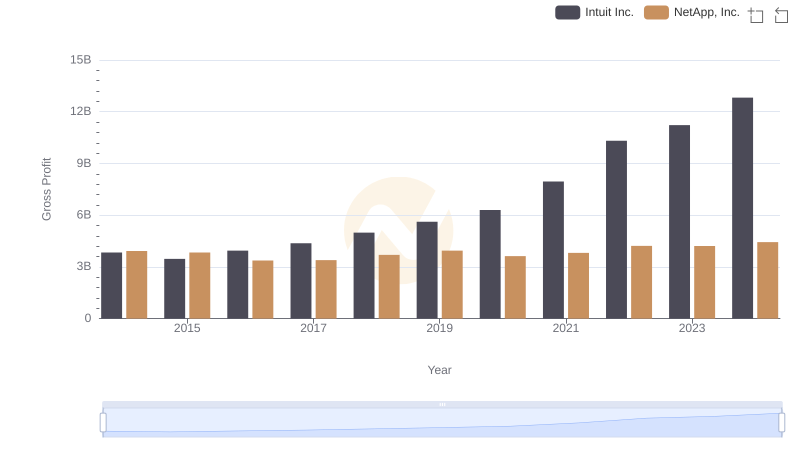

Gross Profit Trends Compared: Intuit Inc. vs NetApp, Inc.

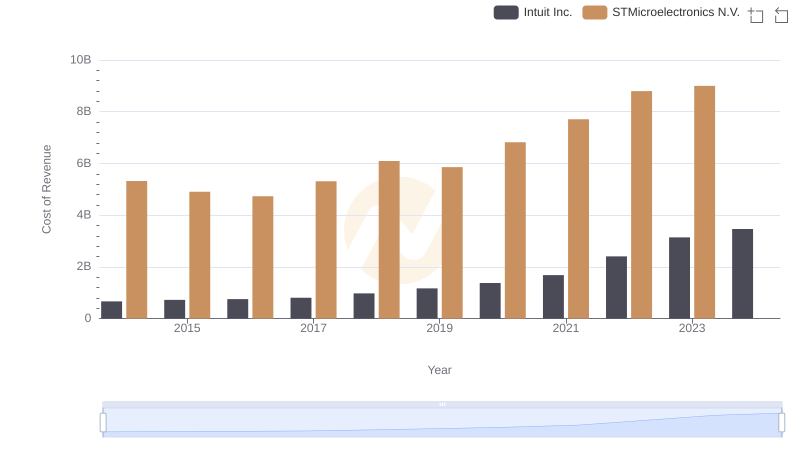

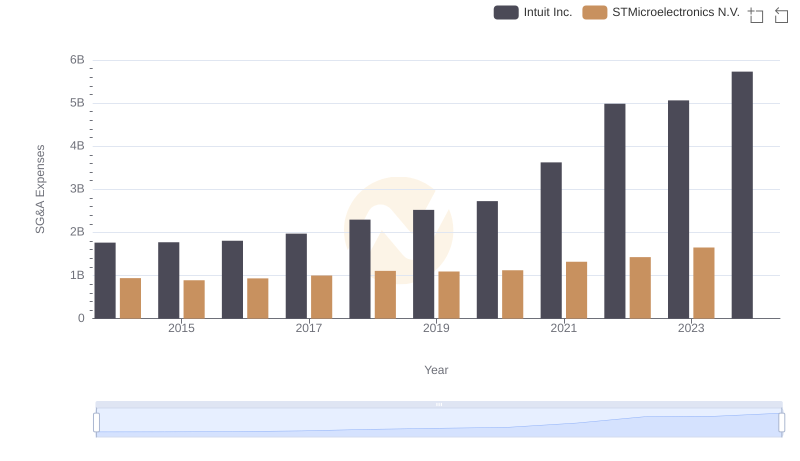

Cost Insights: Breaking Down Intuit Inc. and STMicroelectronics N.V.'s Expenses

Intuit Inc. vs ON Semiconductor Corporation: A Gross Profit Performance Breakdown

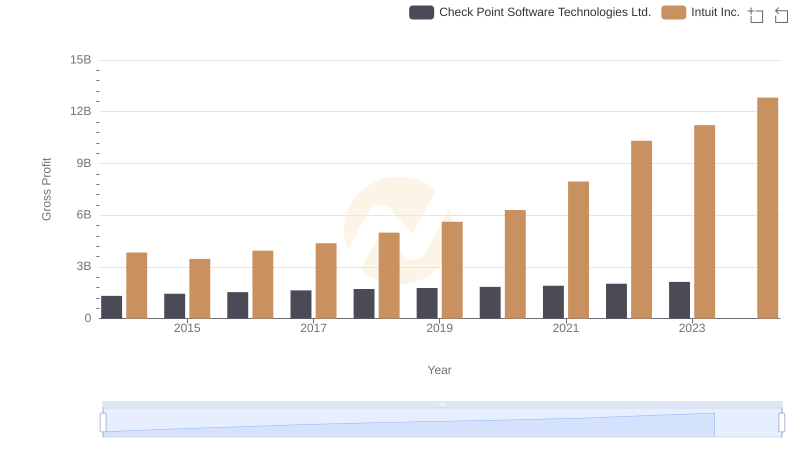

Who Generates Higher Gross Profit? Intuit Inc. or Check Point Software Technologies Ltd.

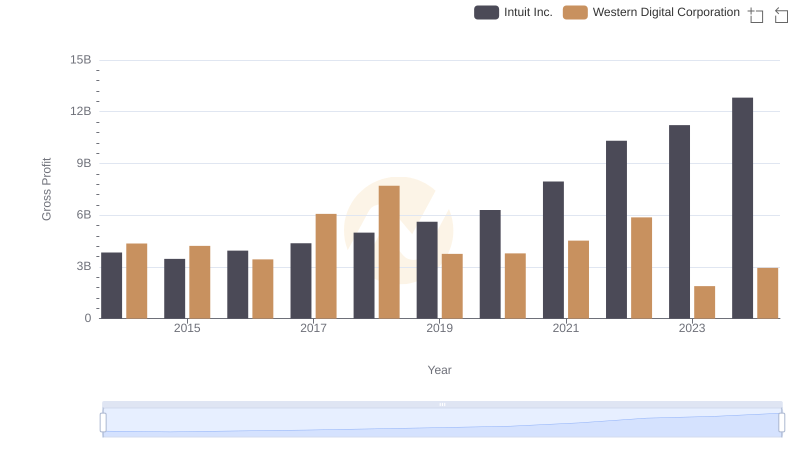

Intuit Inc. and Western Digital Corporation: A Detailed Gross Profit Analysis

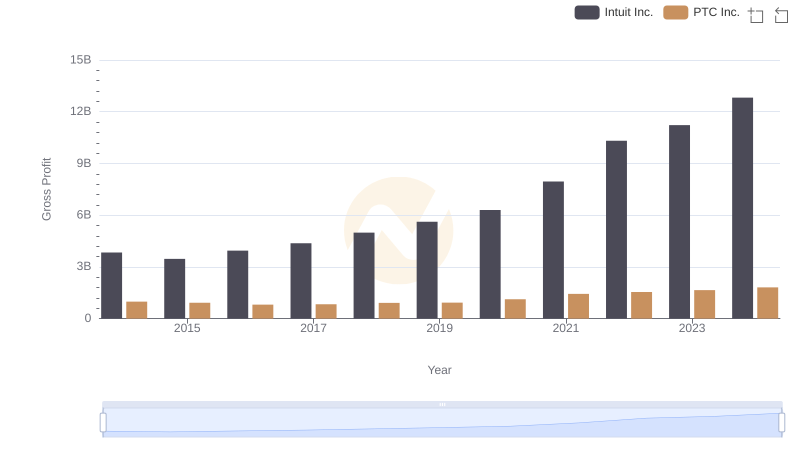

Gross Profit Analysis: Comparing Intuit Inc. and PTC Inc.

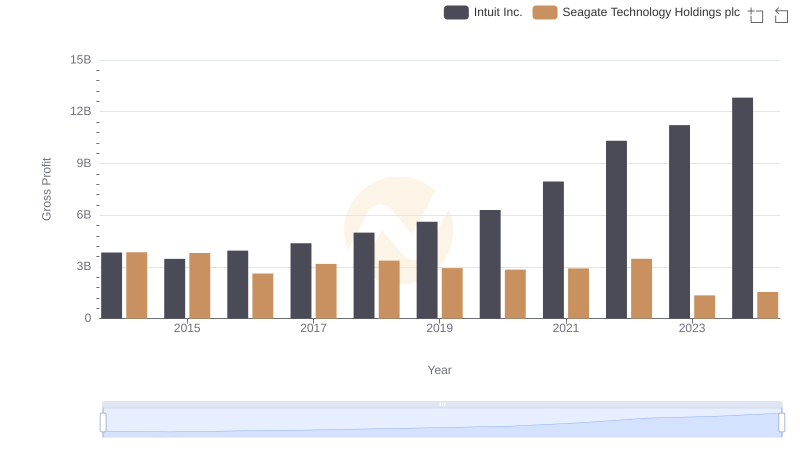

Gross Profit Analysis: Comparing Intuit Inc. and Seagate Technology Holdings plc

Cost Management Insights: SG&A Expenses for Intuit Inc. and STMicroelectronics N.V.

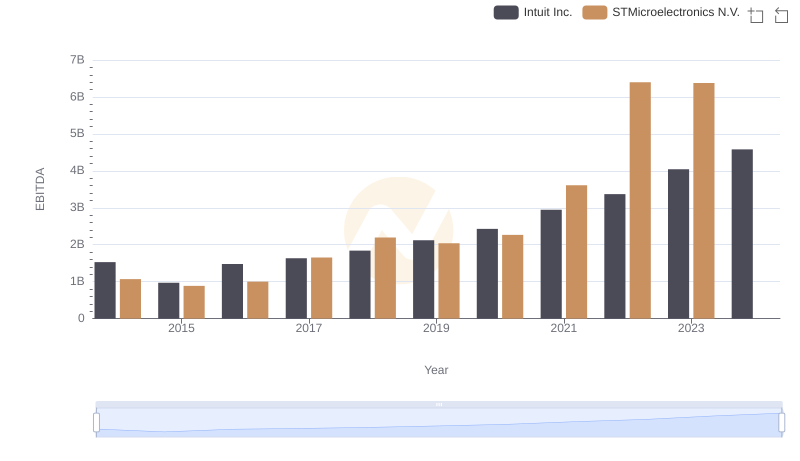

EBITDA Analysis: Evaluating Intuit Inc. Against STMicroelectronics N.V.