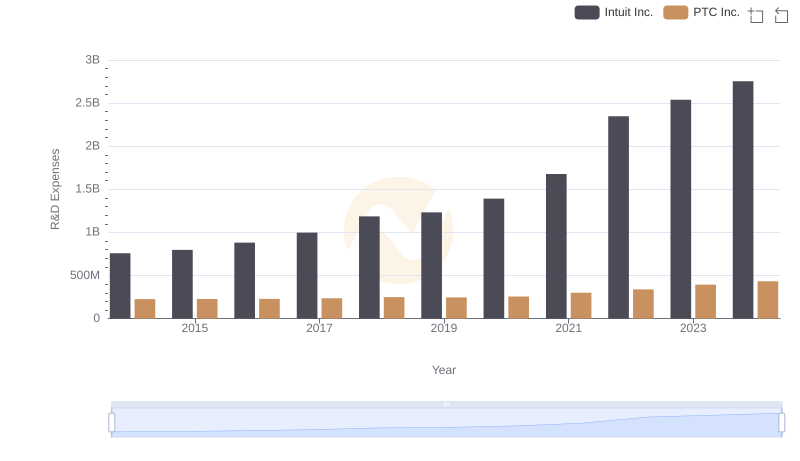

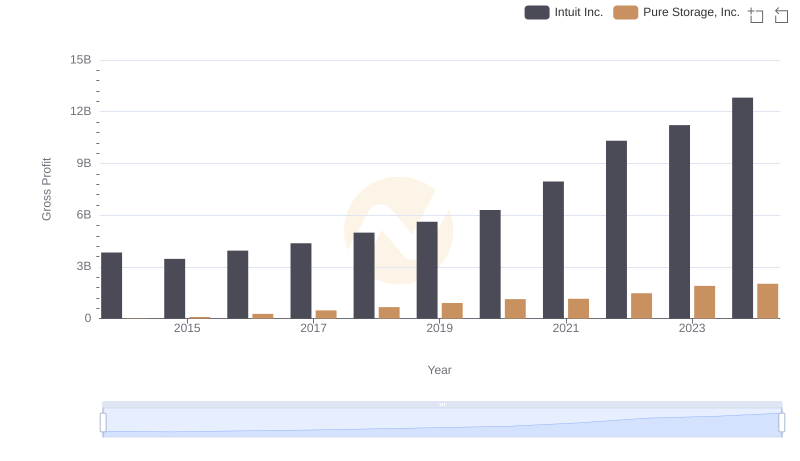

| __timestamp | Intuit Inc. | Pure Storage, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 758000000 | 36081000 |

| Thursday, January 1, 2015 | 798000000 | 92707000 |

| Friday, January 1, 2016 | 881000000 | 166645000 |

| Sunday, January 1, 2017 | 998000000 | 245817000 |

| Monday, January 1, 2018 | 1186000000 | 279196000 |

| Tuesday, January 1, 2019 | 1233000000 | 349936000 |

| Wednesday, January 1, 2020 | 1392000000 | 433662000 |

| Friday, January 1, 2021 | 1678000000 | 480467000 |

| Saturday, January 1, 2022 | 2347000000 | 581935000 |

| Sunday, January 1, 2023 | 2539000000 | 692528000 |

| Monday, January 1, 2024 | 2754000000 | 736764000 |

Cracking the code

In the ever-evolving tech landscape, research and development (R&D) spending is a critical indicator of a company's commitment to innovation. Over the past decade, Intuit Inc. and Pure Storage, Inc. have demonstrated contrasting trajectories in their R&D investments.

From 2014 to 2024, Intuit Inc. has consistently increased its R&D spending, growing by approximately 263%, from $758 million to $2.754 billion. This reflects Intuit's strategic focus on enhancing its financial software offerings. In contrast, Pure Storage, Inc., a leader in data storage solutions, has seen its R&D expenses rise by over 1,900%, from a modest $36 million to $737 million.

This stark difference highlights Intuit's established market position and Pure Storage's aggressive push to innovate and capture market share. As we look to the future, these investments will likely shape the competitive dynamics in their respective industries.

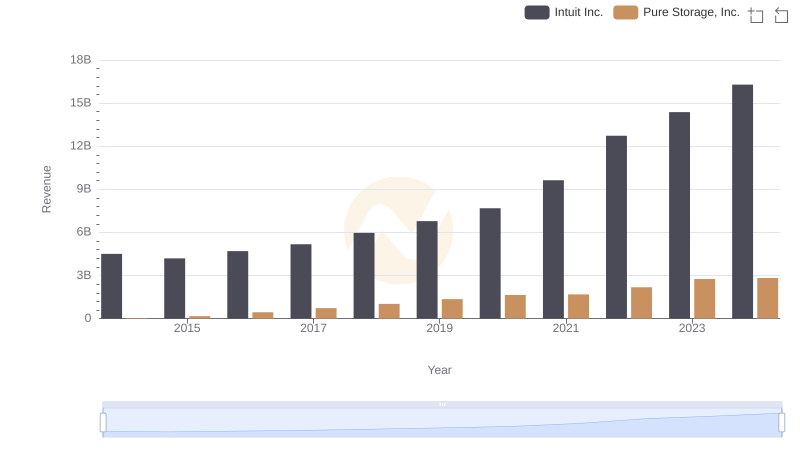

Intuit Inc. or Pure Storage, Inc.: Who Leads in Yearly Revenue?

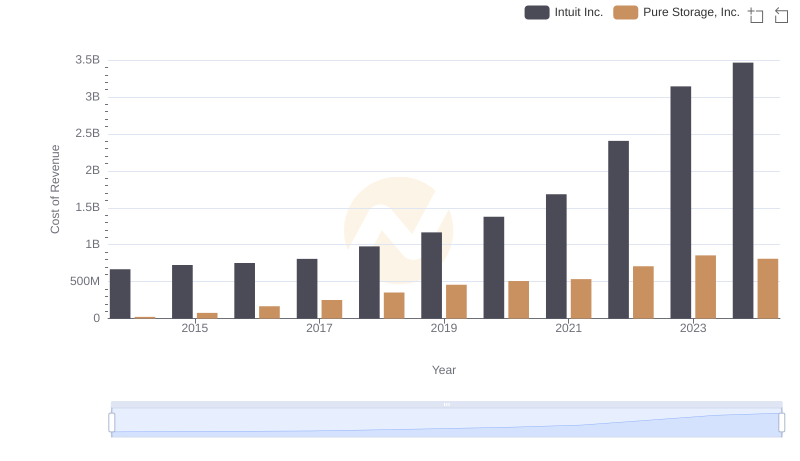

Analyzing Cost of Revenue: Intuit Inc. and Pure Storage, Inc.

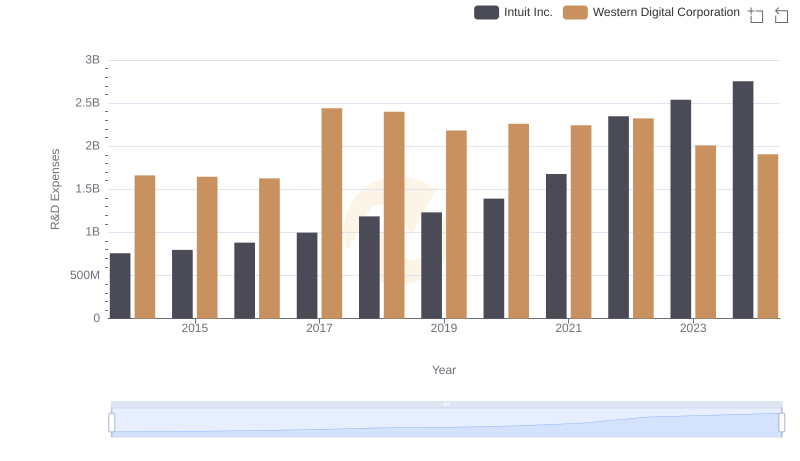

Who Prioritizes Innovation? R&D Spending Compared for Intuit Inc. and Western Digital Corporation

Who Prioritizes Innovation? R&D Spending Compared for Intuit Inc. and PTC Inc.

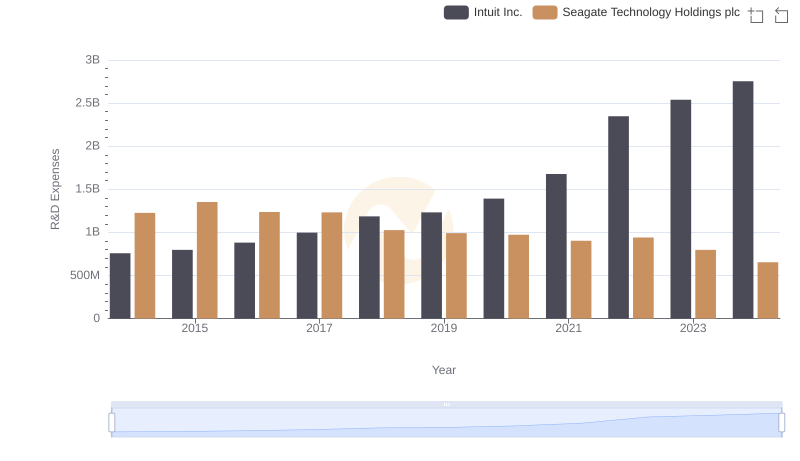

Research and Development Investment: Intuit Inc. vs Seagate Technology Holdings plc

Intuit Inc. vs Pure Storage, Inc.: A Gross Profit Performance Breakdown

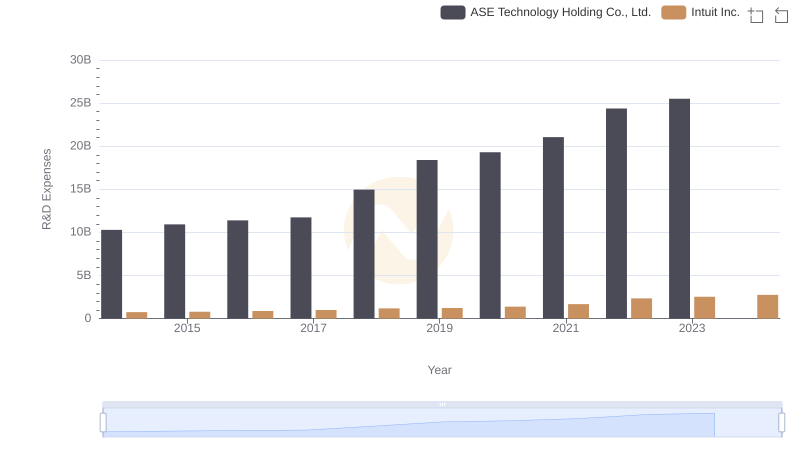

Intuit Inc. or ASE Technology Holding Co., Ltd.: Who Invests More in Innovation?

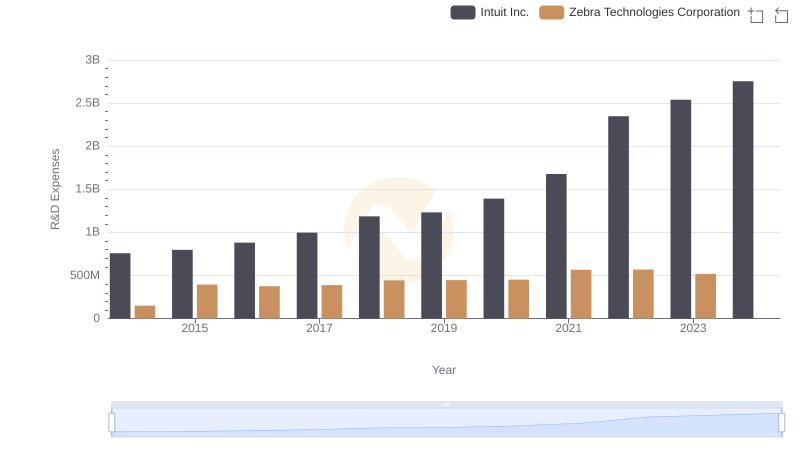

Intuit Inc. vs Zebra Technologies Corporation: Strategic Focus on R&D Spending

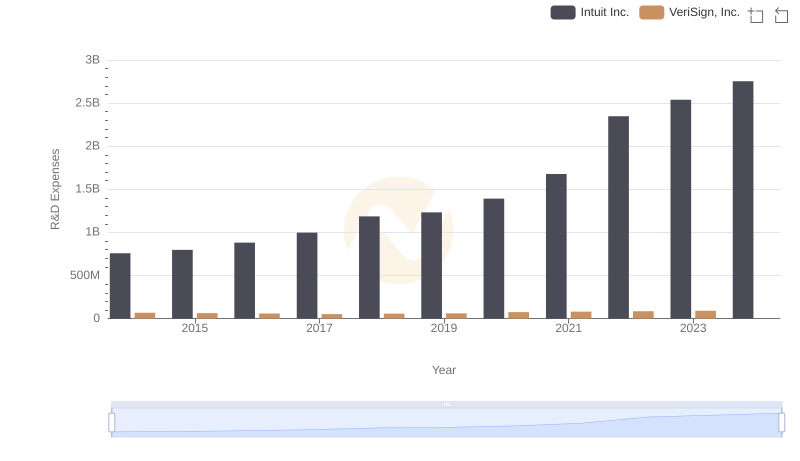

R&D Spending Showdown: Intuit Inc. vs VeriSign, Inc.

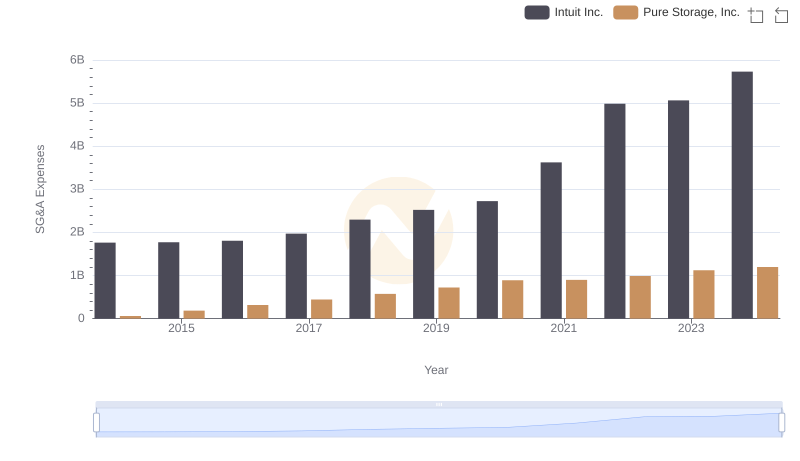

Comparing SG&A Expenses: Intuit Inc. vs Pure Storage, Inc. Trends and Insights